- feature

- INDIVIDUALS

The kiddie tax and unearned income from scholarships

Please note: This item is from our archives and was published in 2019. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Average tax refund rises 11%; total filings decline

Prop. regs. issued on new qualified tips deduction

IRS releases FAQs on qualified overtime pay deduction under H.R. 1

TOPICS

EXECUTIVE | |

|

Every fall, students all over the country set off to attend various colleges and universities. With the rising cost of higher education, many of these students are looking forward to receiving some form of scholarships to pay a portion or, in some cases, all of their tuition. This article reviews how some of these scholarships might be considered taxable income to the student. With the law known as the Tax Cuts and Jobs Act (TCJA) signed into law in 2017, this income, which is subject to the “kiddie tax” rules, is taxed at estate and trust tax rates, which can quickly climb to as much as 37%.1

Taxable scholarships

In many cases, scholarships are not taxable. In fact, most students do not need to fear paying any tax on scholarships and fellowship grants because they are excluded from gross income under Sec. 117 as long as they are used for qualified tuition and related expenses,2 have not been earmarked for other purposes,3 and go to a student who is a candidate for a degree4 at a qualified educational organization.5 Qualified tuition and related expenses in this case include required tuition, fees, books, supplies, and equipment.6

An expense that most people commonly assume to be included in the qualified tuition and related expenses list is room and board, but it is not. Any scholarship or fellowship grant that is used to pay for room and board, or something else that is not considered qualified tuition or a related expense, is taxable. In addition, a scholarship may also be taxable when the scholarship is earmarked for a nonqualifying purpose such as room and board or travel.7 In these situations, the amount of the earmark is taxable.

Not all payments made to a student or the school he or she is attending for qualified tuition or related expenses meet the requirements to be classified as a scholarship for purposes of the Sec. 117 exclusion. In general, a payment for services is not excluded from gross income. There are exceptions to this rule for the National Health Service Corps Scholarship Program, the Armed Forces Health Professions Scholarship and Financial Assistance Program, and a comprehensive student work-learning-service program.8 Also, qualified tuition reductions for graduate students are tax-free if the graduate student performs teaching or research activities for an eligible educational institution.9 Unless one of these exceptions applies, the student should receive a Form W-2, Wage and Tax Statement, for the income earned for the service performed. Any income reported on a Form W-2 will be considered earned income.

In addition, although they are not Sec. 117 scholarships, any qualifying payment received through the Department of Veterans Affairs that is used to pay for education or training, such as funds received under the GI Bill, are not included in income.10

Exceptions for athletic or other scholarships that require services to be performed

Athletic and certain other scholarships that require effort from the participant, such as those that require students to be in musical ensembles, have historically not been included in gross income because of Rev. Rul. 77-263. This IRS ruling is based on the U.S. Supreme Court’s decision in Bingler v. Johnson11 and the Tax Court case Heidel.12 In Bingler, the Supreme Court held that compensation exists if there is a quid pro quo relationship between the parties. In other words, a person receives a payment only in response to an action the recipient produced, whether in the past, present, or future. Heidel involved a student who would continue to receive the scholarship even if the student did not actually participate in the sport because of injury or even a lack of desire. According to the Tax Court, receiving a scholarship with no strings attached does not meet the quid pro quo test and therefore qualifies to be excluded from gross income under Sec. 117.

Whether athletic or similar service-based scholarships still qualify under the no-strings-attached test is debatable, but at this point the IRS has chosen not to press the issue. Assuming there is no change in treatment for these scholarships, they would be treated like any other qualifying scholarship. However, the authors believe that if the IRS were to push the issue, especially for athletic programs of larger schools where it is not uncommon for student athletes to receive full tuition, room and board, and possibly other funds for their service in the athletic program, a court might find that the holding in Bingler did not apply. Many of these programs would likely stop providing a scholarship to any student who decided to no longer participate in the activity, demonstrating the quid pro quo relationship and the conditions that are inherently attached to the scholarship. Thus, a court could find that the facts were distinguishable from those in Bingler and hold that the funds the student-athlete received were earned income that must be included in gross income rather than nontaxable scholarship payments.

Kiddie tax background

To understand the kiddie tax implications of the recent TCJA changes, it is instructive to first review how the Code differentiates earned from unearned income, the history of the kiddie tax, and when the kiddie tax applies.

Earned vs. unearned income

The Code defines earned income as “wages, salaries, or professional fees, and other amounts received as compensation for personal services actually rendered.”13 In essence, it includes all forms of compensation that are paid for work the taxpayer performed. Any compensation that does not fall into the earned income category is considered unearned income, which by default includes any income that is not earned. Form 8615, Tax for Certain Children Who Have Unearned Income, which reports the kiddie tax, calculates unearned income for a qualifying child by taking all the child’s income and subtracting both earned income and any penalties paid for early withdrawal of savings. This means the unearned income includes, but is not limited to, income from dividends, interest income, certain royalties, most rent income, and capital gains. An often-overlooked form of unearned income for a child is taxable scholarship income for which a Form W-2 is not issued because it is not earned income.14

History of the kiddie tax

The kiddie tax, which was first introduced in the Code by the Tax Reform Act of 1986,15 applied to tax years beginning after Dec. 31, 1986. At that time, the kiddie tax applied only to children who were under the age of 14. Over the next 30 years, the scope of the tax has progressively increased, and it may now apply to college students from 19 to 23 years old, some of whom could be receiving scholarships that pay other costs besides tuition and qualifying expenses.

In addition, the TCJA made a significant change to the tax rate of the kiddie tax. The child is no longer taxed at the parent’s top marginal tax rate and is instead taxed at a modified tax rate that is based on the rate that applies to estates and trusts. This change simplifies the completion of Form 8615, which in prior years required the child to include taxable income of the parent (line 6) and any other qualifying children (line 7). The incomes for those other individuals either may not be available or, possibly, the parent or sibling may not want to reveal to the child that information. This information is no longer needed.

When does the kiddie tax apply?

As of 2018, the kiddie tax affects anyone who meets the following criteria as outlined in Sec. 1(g)(2):

- The child is:

- Under the age of 18;

- 18 and has earned income that is less than half the person’s own support; or

- 19 to 23, a full-time student, and has earned income that is less than half the person’s own support.

- Has at least one living parent; and

- Is not married and filing a joint return with the spouse.

Although scholarships in some cases are considered income that is taxable to the child, they do not count toward the child’s own support when determining if the child qualifies for the kiddie tax.16

When a child meets the definition above and has unearned income worth more than two times the reduced standard deduction amount for a dependent (in 2018 this amount is equal to $2,100 in unearned income), the child must complete Form 8615 to calculate the amount of tax owed. The first $1,050 of unearned income is offset by the taxpayer’s standard deduction and therefore is not taxed. The second $1,050 is taxed at the child’s tax rate. Anything above $2,100 is taxed at the modified estate and trust rates.

It is important to note that a child over 18 years but less than 24 years old will not be subject to the kiddie tax if he or she is a part-time student or not a student at all; gets married (and files a joint return); has earned income that is more than half of his or her own support; or loses both parents.

Change in tax rates

The amount of tax owed by a child who is subject to the kiddie tax differs from the amount that would have been calculated under the pre-TCJA rules. The amount of the difference depends on the type of unearned income (whether the income receives preferential tax treatment granted for long-term capital gains and qualified dividends) of the child and the tax rate of the parent. Whether the new rules produce a more favorable or more unfavorable result than the old rules depends on the circumstances. In general, children whose parents are in higher tax brackets will pay less taxes than they would have under the old rules, while children who have a larger amount of unearned income and parents in lower tax brackets will pay more taxes than they would have pre-TCJA.

One notable advantage of the change implemented by the TCJA is the child’s ability to use rates from the lower modified trust and estate tax brackets, thereby saving some tax on the first portion of the child’s unearned income. Before, the child was most likely paying tax at the parent’s top marginal tax rate for all of his or her income with little, if any, advantage of a progressive tax table. Today, there are fewer tax brackets within the modified trust and estate tax table, but the child is able to take advantage of all of them, depending on the child’s income.

The rates do go up quickly, reaching 24% when taxable income that does not qualify for preferential treatment exceeds $2,600, 35% when it exceeds $9,300, and 37% when it exceeds $12,750. But in comparison, had the change to a different tax table not been made, a child of a parent in the top tax bracket in 2019 would owe a flat rate of 37% on all unearned income over $2,100 that did not receive preferential treatment.

Like the tax rates that apply to individuals, the modified trust and estate tax tables that apply to the kiddie tax have preferential tax treatment for long-term capital gains and qualified dividends. For 2019, the tax treatment is 0% on the first $2,650, 15% on income over this amount up to $12,950, and 20% on amounts over $12,950. The thresholds for preferential tax treatment do not correspond to the thresholds for other unearned income, as presented in the preceding paragraph.

Example: A full-time student attends a private liberal arts school during the 2019 calendar year with qualified tuition and fees equal to $32,000 and room, board, and other unqualified expenses equal to $18,000 per year. With the post-TCJA kiddie tax change, it does not matter if the student comes from a wealthy family or one with no income. The student has no additional income beyond the scholarships received. If the student had received a scholarship that was not specifically earmarked for any unqualified expenses and the total of all scholarships was less than or equal to the qualified tuition and fees of $32,000, the student would not have to include the scholarship in income. Because the scholarship exceeds $32,000, the student will have unearned income for the amount received in excess of $32,000 that is subject to the kiddie tax. However, for purposes of calculating the student’s standard deduction, the scholarship amount over $32,000 is treated as earned income.

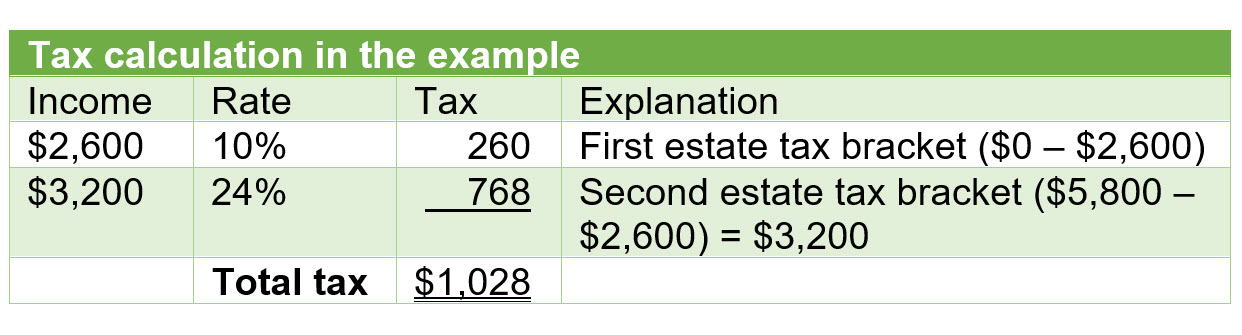

If this student receives a full-ride scholarship of $50,000, the $18,000 received to cover room, board, and other unqualifying expenses is not an amount received as a qualified scholarship. Therefore, the student will recognize it as unearned income for kiddie tax purposes. The student will have $18,000 of gross income, which will be reduced by the dependent’s standard deduction of $12,200 (the lesser of the maximum standard deduction for a single individual or the student’s earned income for standard deduction purposes, which includes any taxable scholarship amount, plus $350) to produce taxable income of $5,800. The $5,800 will be taxed using the modified estate and trust tax tables. The tax is calculated as shown in the table “Tax Calculation in the Example.”

As the example shows, a student who receives enough from one or more scholarships to go to school for free may be on the hook for more than he or she expected. In some cases, a student whose parents do not make very much money may be surprised to find he or she owes more in taxes than the parents, even though the student did not have a job and did not receive anything beyond the ability to go to school. The student’s belief that he or she is receiving a free education may be short-lived when the student is confronted with a tax bill due to a scholarship and has no money to pay it. The student may be forced to take a job to pay the taxes.

Reporting on Form 1098-T

Every eligible educational institution is required to file a Form 1098-T, Tuition Statement, for each student that is enrolled and has a reportable transaction. However, some exceptions apply for courses taken for no academic credit, for nonresident alien students, and for students whose qualified tuition is paid in full by scholarships or waived.17

On the Form 1098-T, the educational institution is to report amounts received as payment for qualified tuition and related expenses less reimbursements or refunds during the calendar year in box 1 and all scholarships or grants in box 5. The scholarships that are listed in box 5 include all scholarships the institution knows or should know about, regardless of whether the payment is received directly by the institution, or a check is endorsed by the student.18

From the Form 1098-T requirements, one can see that in many cases, in an ideal world, as long as the educational institution properly completes the Form 1098-T, any total scholarship amount received in excess of qualified tuition should be easily calculated by taking the scholarships listed in box 5 and subtracting qualified tuition payments as reported in box 1. However, it is not so straightforward. Form 1098-T has specific exceptions where the form does not need to be filed, such as when qualified tuition is paid in full. In many of the cases where scholarships end up being taxable, the tuition is paid in full and thereby a Form 1098-T is not required. In addition, the educational institution will most likely report any scholarship that is received by the institution, but there may be situations where the scholarship is received directly by the student and not reported to the institution. Both of these situations present a gap in the amount of taxable income that can be calculated from the Form 1098-T by the taxpayer and by the IRS.

In cases where a tax preparer believes a student might be in a taxable situation because of scholarships, a good starting point for making this calculation is Form 1098-T. However, details for the account the student has with the college/university may be needed in some situations. The account detail should show information for charges such as tuition, fees, room and board, and possibly other charges for items such as books. It will also present what the institution shows for financial aid, which includes grants and scholarships. In addition to Form 1098-T and the student’s account detail, a general inquiry for any other scholarships received or expenses paid may be necessary. However, the preparer should keep in mind that, generally, large scholarships are received directly by the institution.

Strategy to reduce unearned income

Students who find themselves in a situation where they have taxable scholarships can make adjustments in certain cases. Additional expenses, above those reported on Form 1098-T, should be considered by the taxpayer to reduce the taxable scholarship amount. The institution is only required to report on Form 1098-T qualified tuition and related expenses that are billed. However, additional expenses may qualify as qualified tuition and related expenses. To be allowable, the expenses must be required of all students in the course and cannot be considered incidental expenses.19

Incidental expenses include costs associated with room and board, travel, research and clerical help, and equipment that is not required for either enrollment or attendance at an educational institution, or in a course of instruction at the institution. For example, a textbook that is listed as optional on the course syllabus would not qualify, but a course book that is listed as required would be. Additional expenses, such as required books or equipment that are not run through the educational institution’s billing software, may increase the qualified tuition and fees.

When looking for other expenses, the list of qualified tuition and related expenses listed above should not be confused with what expenses qualify for a distribution from qualified tuition programs such as a Sec. 529 college savings plan. These types of programs are more liberal than Sec. 117 and include additional costs such as equipment and room and board (with limitations).20

Because unearned income may come from other sources, taxpayers who are affected by the kiddie tax should look for ways to reduce all unearned income. This can be done by shifting income to nontaxable accounts, deferring income to a period in time when the taxpayer is not affected by the kiddie tax, or recognizing losses that reduce unearned income. While not the focus of this article, the following general strategies can help reduce overall unearned income:

- Switch dividend-paying stocks to ones that do not pay dividends and hold the stocks until the student is age 24;

- Sell stocks that have a capital loss to reduce unearned income, up to $3,000 per year; and

- Move investments into a qualified retirement plan when possible — any income and gains produced by the portfolio are not taxable as current-year income.

Scholarship recipients beware

Being accepted into the college or university of choice is a wonderful feeling for many students, and receiving scholarships to help pay for school will reduce the overall cost. While most scholarships are excluded from gross income, students need to be aware of situations where scholarships need to be reported as income and that the income that is reported in some cases could be subject to the new kiddie tax.

Footnotes

1Sec. 1(j) as amended by Section 11001(a) of the law known as the Tax Cuts and Jobs Act of 2017, P.L. 115-97.

2Sec. 117(b)(1).

3Prop. Regs. Sec. 1.117-6(c)(1).

4Sec. 117(a).

5Sec. 170(b)(1)(A)(ii).

6Sec. 117(b).

7Prop. Regs. Sec. 1.117-6(c)(1).

8IRS Publication 970, Tax Benefits for Education (2017), p. 6.

9Id., p. 8.

10Id., p. 7.

11Bingler v. Johnson, 394 U.S. 741 (1969).

12Heidel, 56 T.C. 95 (1971).

13Sec. 911(d)(2).

14Before 2013, Form 8615, Tax for Certain Children Who Have Unearned Income, was titled Tax for Certain Children Who Have Investment Income. While the definition of investment income/unearned income stayed virtually the same, the change in title was also accompanied by three additional components specifically mentioned in the instructions: taxable scholarship and fellowship grants not reported on Form W-2, unemployment compensation, and alimony.

15Tax Reform Act of 1986, P.L. 99-514.

16Sec. 152(f)(5).

17Form 1098-T, Tuition Statement, instructions (2019), p. 2.

18Id., pp. 3-4.

19Regs. Sec. 1.117-6(c)(2).

20Sec. 529(e)(3).

Contributors | |

| Mark C. Nielsen, CPA, MBA, is an assistant professor of accounting, and James M. Hopkins, CPA, MA, is a retired professor of accounting, both at Morningside College in Sioux City, Iowa. For more information on this article, contact thetaxadviser@aicpa.org.

|