- feature

- ESTATES, TRUSTS & GIFTS

Recent developments in estate planning: Part 1

Please note: This item is from our archives and was published in 2020. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Trust distributions in kind and the Sec. 643(e)(3) election

Supercharging retirement: Tax benefits and planning opportunities with cash balance plans

Revisiting Sec. 1202: Strategic planning after the 2025 OBBBA expansion

EXECUTIVE | |

|

This article is the first of two parts of an annual update on recent developments in trust, estate, and gift taxation. It covers trusts and gift tax issues. The second part, in the November issue, will cover developments in estate and generation-skipping transfer (GST) taxation, as well as inflation adjustments.

Trusts

Treasury and the IRS issued proposed regulations1 under Sec. 67(g) clarifying that certain deductions allowed to an estate or nongrantor trust are not miscellaneous itemized deductions and, thus, are not affected by the suspension of the deductibility of miscellaneous itemized deductions contained in the law known as the Tax Cuts and Jobs Act2 (TCJA). The proposed regulations affect Secs. 67 and 642. [Update: In September 2020, after this issue went to press, the IRS finalized these proposed regulations with few changes. See news coverage of the final regulations here.]

Added to the Code by the TCJA, Sec. 67(g) suspends the deduction of certain miscellaneous itemized deductions for tax years 2018 through 2025. For purposes of Sec. 67, miscellaneous itemized deductions are defined as itemized deductions other than those listed in Secs. 67(b)(1) through (12).

The adjusted gross income (AGI) of an estate or trust generally is computed for Sec. 67 purposes in the same manner as AGI for an individual, although certain additional deductions are allowed. Specifically, Sec. 67(e) allows these items to be factored into determining AGI:

- Deductions for costs paid or incurred in connection with the administration of the trust or estate if those costs would not have been incurred if the property were held by an individual;

- Deductions available under:

•Sec. 642(b) (the personal exemption);

•Sec. 651 (income distribution deduction for trusts distributing current income only); and

•Sec. 661 (income distribution deduction for estates and trusts accumulating income or distributing corpus).

Sec. 67(e) effectively removes these deductions from being itemized deductions under Sec. 63(d) and treats them as deductions that may be taken in calculating AGI under Sec. 62(a).

In July 2018, the IRS issued Notice 2018-61 to announce its intention to issue regulations clarifying the effect of Sec. 67(g) on the deductibility of certain expenses described in Secs. 67(b) and (e) that are incurred by estates and nongrantor trusts. The notice stated that the regulations would clarify that expenses described in Sec. 67(e) are deductible in determining the AGI of an estate or nongrantor trust for the tax years in which Sec. 67(g) applies.

Sec. 642(h) allows beneficiaries succeeding to estate or trust property to deduct the carryover or excess if, upon termination, the estate or trust has: (1) a Sec. 172 net operating loss carryover or a Sec. 1212 capital loss carryover; or (2) deductions for its last tax year that exceed gross income for the year. The excess deduction under Sec. 642(h)(2), however, may only be allowed in computing taxable income, must be taken into account in computing the beneficiaries’ tax preference items, and may not be used in computing gross income.3 This means that the existing regulations treat excess deductions on termination of an estate or trust as a single miscellaneous itemized deduction for the beneficiary that may be disallowed under Sec. 67(g).

An excess deduction under Sec. 642(h)(2) may be composed of: (1) deductions allowable in calculating AGI under Secs. 62 and 67(e); (2) itemized deductions under Sec. 63(d) allowable in calculating taxable income; and (3) miscellaneous itemized deductions, which are currently disallowed under the TCJA.

Regarding Sec. 67, the proposed regulations would amend the language in Regs. Sec. 1.67-4 to clarify that Sec. 67(g) does not prevent an estate or nongrantor trust from claiming deductions for expenses described in Sec. 67(e)(1) or (2), because these deductions are not miscellaneous itemized deductions.

Addressing Sec. 642(h), the proposed regulations provide that each deduction that is part of the Sec. 642(h)(2) excess deduction retains its separate character as: (1) an amount allowed in arriving at AGI; (2) a non—miscellaneous itemized deduction; or (3) a miscellaneous itemized deduction. The character of the deductions does not change when succeeded to by a beneficiary or when the estate or trust terminates. The proposed regulations would also require the fiduciary to separately identify deductions that may be limited when the beneficiary claims those deductions.

The proposed regulations use the principles under Regs. Sec. 1.652(b)-3 to allocate each deduction among the classes of income in the year the estate or trust terminates to determine the character and amount of the excess deductions under Sec. 642(h)(2). Under Regs. Sec. 1.652(b)-3(a), deductions that are directly attributable to one class of income are allocated to that income. The proposed regulations would treat the amount and character of any remaining deductions, after applying Regs. Sec. 1.652(b)-3, as excess deductions available to beneficiaries under Sec. 642(h)(2).

The proposed regulations under Regs. Sec. 1.67-4 simply set forth the correct construction of Sec. 67 as it applies to trusts and estates and, therefore, are nothing new.

The interesting changes set forth in the proposed regulations are in the regulations under Sec. 642(h). Before the release of the proposed regulations, many practitioners believed that excess deductions that might have been deductible by a trust or estate under Sec. 67(e) may be a miscellaneous itemized deduction in the hands of the beneficiary. For example, tax preparation fees that would be deductible by a trust or estate would be a miscellaneous itemized deduction in the hands of a beneficiary and would therefore be nondeductible. The proposed regulations instead divide the excess deductions into three categories: (1) deductions allowable in calculating AGI under Secs. 62 and 67(e); (2) itemized deductions under Sec. 63(d) that are allowed in calculating taxable income; and (3) miscellaneous itemized deductions, which are temporarily disallowed under the TCJA. In the case of tax preparation fees, they would be a category 1 deduction and, therefore, deductible in computing the beneficiary’s AGI — a logical approach that is very taxpayer-friendly.

Transfers between grantor trusts

In IRS Letter Ruling 202022002, the IRS ruled that the sale between a trust from which the beneficiary had a general power of appointment and a grantor trust created by that beneficiary is not recognized as a sale for federal income tax purposes because the beneficiary is treated as the owner of both trusts.

Trust 1, a nongrantor trust, was established by the settlor creating subtrusts for the benefit of the each of the settlor’s children and grandchildren. The settlor funded Trust 1 with shares in a company. The trust agreement prohibited a distribution of the shares but allowed for the distribution of the proceeds from the sale of the shares. Trust 1 subsequently transferred the shares to a limited liability company (LLC) treated as a partnership for tax purposes in exchange for interests in the LLC. The same restriction applicable to the shares in the company also applied to the interests in the LLC.

The trust agreement of Trust 1 provides that when a beneficiary reaches the age of 40, the beneficiary has the right to withdraw all of the assets of his or her subtrust except the LLC interests. The beneficiary who was the subject of the ruling request withdrew all of the assets of her subtrust except the LLC interests.

The beneficiary created Trust 2, a grantor trust as to the beneficiary. The beneficiary’s subtrust created under Trust 1 agreed to sell the interests in the LLC to Trust 2 in exchange for cash and a promissory note. Trust 1 represented that the beneficiary would have the right to withdraw the cash and promissory note from her separate trust after the sale of the interests in the LLC. Trust 1 requested a ruling confirming that it would not recognize gain on the sale of the interests in the LLC to Trust 2.

The IRS’s analysis relied almost exclusively on Rev. Rul. 85-13, which sets forth the IRS’s long-standing position that grantor trusts are disregarded entities and, therefore, transactions between a grantor and his or her grantor trust are disregarded for income tax purposes. Applying Rev. Rul. 85-13 to the proposed transaction, the IRS concluded that the sale would not be recognized because the beneficiary would be treated as wholly owning the assets of both trusts. Regarding her subtrust under Trust 1, the beneficiary would be treated as the owner after the transaction under Sec. 678(a)(1) because of her power to withdraw the trust’s assets (i.e., the cash and promissory note) received from Trust 2 in exchange for the LLC interest.

In Rev. Rul. 2007-13, following several letter rulings it previously released, the IRS provides that transfers between two grantor trusts created by the same grantor are disregarded under the reasoning of Rev. Rul. 85-13. This is the first letter of which the author is aware where the IRS ruled that Rev. Rul. 85-13 applies to transfers between a grantor trust created by the grantor and a grantor trust created as a result of the application of Sec. 678. The result is a logical application of Rev. Rul. 85-13. Going one step further, it would seem the same nonrecognition principle should apply to transfers between nongrantor trusts with two different grantors (neither of whom is the beneficiary), over which the same beneficiary has a power that would create grantor trust status under Sec. 678.

It is curious that the IRS ruled that the sale between the trusts occurred while the trusts were grantor trusts, as it was the sale that triggered grantor trust status of the beneficiary’s separate trust under Sec. 678 as to her subtrust in Trust 1. Before the sale, the subtrust was a nongrantor trust as to the beneficiary, as it held an asset the beneficiary could not withdraw, the LLC interest. It was the sale of the LLC interest by the subtrust that triggered the grantor trust status because, after the sale, the subtrust held only proceeds of the sale that were subject to the beneficiary’s withdrawal power, triggering grantor trust status under Sec. 678.

Valuation of beneficial interests

In Letter Ruling 201932001, the IRS ruled that the termination of a GST tax-exempt trust and the proposed distribution of the trust assets to beneficiaries will not cause the trust, or any terminating distributions from the trust, to be subject to GST tax or gift tax. The IRS ruled that the proposed transaction, in substance, is a sale of the life tenant’s and the life tenant’s grandchildren’s interests to the life tenant’s children, requiring the recognition of gain or loss.

A settlor created an irrevocable trust for the benefit of his son that was grandfathered from the GST tax. The material purpose of the trust was to ensure that the son received an income stream for his support. Under the terms of the trust agreement, the trustees are required to distribute all of the net income of the trust to the son, and, upon his death, distribute the remainder to his issue, per stirpes. The trust agreement does not authorize any distributions of principal during the son’s life. The son has four living adult children and eight living grandchildren, four of whom are adults.

Under the applicable state statute, matters that may be resolved by a nonjudicial settlement include termination of the trust, provided that court approval of the termination is obtained in accordance with state law, and the court must conclude that continuance of the trust is not necessary to achieve any material purpose of the trust. The state statute further provides that upon the termination, the court may order the trust property distributed as agreed by the parties to the agreement or otherwise as the court determines is equitably consistent with the trust’s purposes.

The son, the children, and the grandchildren entered into an agreement, which provided that the continuance of the trust was no longer necessary to achieve any clear material purpose of the trust because the son’s net worth had grown significantly such that he did not need income from the trust for his support. The agreement further provided for the termination of the trust and the distribution of its assets among the son, the children, and the grandchildren in accordance with the actuarial value of each beneficiary’s share. The court approved the agreement. The trustees requested IRS rulings on the GST tax, gift tax, and income tax consequences of the termination and the distribution of the trust assets.

Regarding GST tax, the IRS noted that Regs. Sec. 26.2601-1(b)(4)(i)(D) provides that a modification of the governing instrument of an exempt trust by judicial reformation, or nonjudicial reformation that is valid under applicable state law, does not cause an exempt trust to lose its exempt status, if the modification does not shift a beneficial interest in the trust to any beneficiary who occupies a lower generation than the person or persons who held the beneficial interest prior to the modification, and the modification does not extend the time for vesting of any beneficial interest in the trust beyond the period provided for in the original trust. A modification of an exempt trust results in a shift in beneficial interest to a lower generation beneficiary if the modification can result in either an increase in the amount of a GST or the creation of a new GST.

The IRS concluded that the termination of the trust and the proposed distribution will neither cause a beneficial interest to be shifted to a beneficiary who occupies a generation lower than the beneficiaries who held the interests prior to the termination, nor extend the time for vesting of any beneficial interest in the trust beyond the period provided for in the original trust, as long as the actuarial values of the trust accurately represent the actuarial value of each beneficiary’s interest. Accordingly, it ruled that the court-approved termination and the proposed distribution will not cause the trust, or any terminating distributions from the trust, to become subject to GST tax.

Regarding gift tax, the IRS recognized that Sec. 2512(b) provides that where property is transferred for less than an adequate and full consideration in money or money’s worth, the amount by which the value of the property exceeded the value of the consideration is deemed a gift that is included in computing the amount of gifts made during the calendar year.

The IRS ruled that in the present case, the beneficial interests, rights, and expectancies of the beneficiaries will be substantially the same, both before and after the termination and the proposed distribution, as long as the actuarial values of the trust accurately represent the actuarial value of each beneficiary’s interest. Thus, the IRS concluded that no transfer of property will be deemed to occur as a result of the termination and distribution. Accordingly, the termination and distribution will not result in a transfer by any beneficiary of the trust that is subject to the gift tax.

Regarding income tax, the IRS started its analysis by focusing on the basis of the interests in the trust. Generally, the basis of the interest of life tenants and remaindermen of a trust equals a proportionate part of the uniform basis of the trust’s assets under Regs. Secs. 1.1015-1(b) and 1.1014-5. Sec. 1001(e)(1) provides that in determining gain or loss from the sale or disposition of a term interest in property, that portion of the adjusted basis of the interest that is determined pursuant to Sec. 1015 is disregarded. Under Sec. 1001(e)(2), “term interest in property” includes an income interest in a trust but does not include a remainder interest.

The IRS next analyzed the recognition of gain on the sale of an interest in a trust. In Rev. Rul. 72-243, the proceeds received by the life tenant of a trust, in consideration for the transfer of the life tenant’s entire interest in the trust to the holder of the remainder interest, are treated as an amount realized from the sale or exchange of a capital asset under Sec. 1222. The right to income for life from a trust estate is a right in the estate itself.

In Rev. Rul. 69-486, a non-pro rata distribution of trust property was made in kind by the trustee, although the trust instrument and local law did not convey authority to the trustee to a make a non-pro rata distribution of property in kind. The distribution came about as a result of a mutual agreement between the trustee and the beneficiaries. Because neither the trust instrument nor local law conveyed authority to the trustee to make a non-pro rata distribution, Rev. Rul. 69-486 held that the transaction was equivalent to a pro rata distribution followed by an exchange between the beneficiaries, an exchange that required recognition of gain under Sec. 1001.

In the present case, the IRS considered the proposed transaction was in substance a sale of the son’s and the grandchildren’s interests to the children under Rev. Rul. 69-486. The amounts the son received as a result of the termination of the trust were amounts received from the sale or exchange of a capital asset to the children under Rev. Rul. 72-243. Because the son’s basis in the income interest of the trust is a portion of the entire basis of the property under Sec. 1015(b), and because the disposition of the son’s term interest is not part of a transaction in which the entire interest in the trust is transferred to a third party, the son’s adjusted basis in his interest in the trust is disregarded under Sec. 1001(e). The son’s holding period in the life interests in the trust exceeds one year. Accordingly, the entire amount the son realized as a result of the early termination of the trust is long-term capital gain under Sec. 1222(3). The grandchildren are treated the same as the son.

To the extent that a child exchanges property, including property deemed received from the trust, for the interests of the son and the grandchildren, the child will recognize gain or loss on the property exchanged. The IRS held that, for purposes of determining gain or loss, the amount realized by each child on the exchange of property for trust interests held by the son and the grandchildren will be equal to the amount of cash and fair market value (FMV) of the trust interests received in exchange for the transferred assets under Regs. Sec. 1.1001-1(a) and Rev. Rul. 69-486.

Gift tax

Defined-value clause

In Nelson,4 the Tax Court held that the defined-value clause the husband and wife taxpayers used to transfer interests in a family limited partnership (FLP) did not prevent the IRS from imposing gift tax based on the percentage interests stated in the transfer instrument.

The taxpayers held interests in an FLP. As part of the wife’s estate plan, she transferred an FLP interest to an intentionally defective grantor trust and subsequently sold interests in the FLP to the trust. The gift and sale transfer instruments contained the following clauses regarding the amount of FLP interests to be transferred:

- The gift instrument provided, in pertinent part: “[The taxpayer] desires to make a gift and to assign to . . . [the Trust] her right, title, and interest in a limited partner interest having a fair market value of [$2,096,000] as of December 31, 2008 . . . , as determined by a qualified appraiser within ninety (90) days of the effective date of this Assignment.”

- The sale instrument provided, in pertinent part: “[the taxpayer] desires to sell and assign to . . . [the Trust] her right, title, and interest in a limited partner interest having a fair market value of [$20,000,000] as of January 2, 2009 . . . , as determined by a qualified appraiser within one hundred eighty (180) days of the effective date of this Assignment . . .”

Neither the gift nor the sale instruments contained a clause defining FMV or subjecting the FLP interests to reallocation after the valuation date. Based on the appraisals, the wife believed she gifted 6.14% and sold 58.65% of her interests in the FLP.

The husband and wife filed gift tax returns for 2008 (the year of the gift) and 2009 (the year of the sale). The 2008 gift tax return reported the transfer of a 6.14% interest in the FLP corresponding to the values of the FLP interests as set forth in the appraisal. The taxpayers did not report the sale on their 2009 gift tax return. In 2013, the IRS issued notices of deficiency determining that, based on the percentage interests set forth in the gift instrument, the amount of the gift of the FLP interests was $3,522,018, as opposed to $2,096,000, and in the sale instrument, the amount of the sale of the FLP interests was $33,607,038, as opposed to $20,000,000.

The taxpayers filed suit in the Tax Court. The issue before the court was whether the wife transferred interests in the FLP that had defined values of $2,096,000 and $20,000,000 or were percentage interests of 6.14% and 58.65%.

Citing prior cases, the Tax Court noted that, in determining the amount of property that is transferred by gift, the courts have relied on the transfer documents as opposed to subsequent events. The courts have respected the terms of the formula, even though the percentage amount was not known until the FMV was subsequently determined, because the dollar amount was known.

In the case before it, the Tax Court determined that the valuation clause was similar to clauses provided by taxpayers in the prior cases. However, the court relied on the plain language of the transfer instruments and determined that the instruments called for the percentage interests to be calculated based on FMV, as determined by a qualified appraiser, within a certain number of days of the effective dates of the transfers. Consequently, the FLP interests could not be adjusted to ensure the transfers did not exceed the values provided in the transfer instruments because the clauses contained no adjustment clause. Thus, the court determined that the wife transferred percentage interests in the FLP as opposed to a specific dollar amount that resulted in the deficiency.

The taxpayers had argued that the transfer clauses should be construed similar to defined-value clauses that were upheld in previous cases.5 The Tax Court stated:

By urging us to interpret the operative terms in the transfer instruments as transferring dollar values of the limited partnership interests on the bases of fair market value as later determined for federal gift and estate tax purposes, [the taxpayers] ask us, in effect, to ignore “qualified appraiser . . . within . . . [a fixed period]” and replace it with “for federal gift and estate tax purposes.” While they may have intended this, they did not write this. They are bound by what they wrote at the time.6

The Tax Court next focused on the value of the FLP. It examined the valuation of the FLP and the underlying corporation. For the stock of the corporation held by the FLP, the court applied a 15% lack-of-control discount and a 30% lack-of-marketability discount. Taking the valuation of the stock into consideration, the court applied a 5% lack-of-control discount and 28% lack-of-marketability discount for the FLP interests. As a result, the court determined that the value of the FLP interests transferred to the trust by gift was $2,524,983 (as opposed to the $2,096,000 reported by the taxpayers) and by sale was $24,118,933 (as opposed to the $20,000,000 reported by the taxpayers).

While defined-value clauses are useful tools in minimizing unintended gift tax consequences of related-party transactions, the proper language of the valuation clause is key. The defined-value clause used in this case named the appraiser as the final arbiter of value for purposes of determining the FLP interests that were gifted and sold while it should have been left up to the Code to be the final arbiter of value. Under Sec. 2504(c), the value of a transfer by gift is the value as finally determined for gift tax purposes. The taxpayers failed to use the proper valuation clause language and, as a result, incurred unintended gift tax consequences from the gift and sale transactions.

Tax-affecting in valuation of passthrough entities

In Estate of Jones,7 the Tax Court held that tax-affecting the earnings of an S corporation and limited partnership was appropriate in determining their value under the discounted-cash-flow (DCF) method of valuation.

The taxpayer founded Seneca Sawmill Co. (SSC) in 1954 as a lumber manufacturing business. In 1986, SSC elected S corporation status. Originally relying on timber from federal lands, SSC began purchasing its own land in 1989. In 1992, the taxpayer formed Seneca Jones Timber Co. (SJTC), a limited partnership, to hold timberlands intended to be SSC’s inventory and to obtain debt financing secured by the timberlands. SSC was the 10% general partner of SJTC and contributed to SJTC the timberland it had recently acquired. SSC and SJTC shared a management team and headquarters.

SSC’s shareholders could not sell, give away, or otherwise transfer their SSC stock, except in compliance with a buy-sell agreement. Any sale of SSC stock that caused SSC to cease to be an S corporation would be null and void under the agreement unless SSC and the holders of a majority of its outstanding shares consented. If an SSC shareholder intended to sell, give away, or otherwise transfer SSC stock to a person other than a family member, the shareholder had to notify SSC, which had a right of first refusal. If SSC declined to purchase, the other shareholders were given the option to purchase.

If either SSC or the other shareholders exercised their option to purchase, the purchase price was the FMV, which was to be mutually agreed upon or, if the parties could not agree, determined by an appraisal. Under the buy-sell agreement, the reasonably anticipated cash distributions allocable to the shares had to be considered, and discounts for lack of marketability, lack of control, and lack of voting rights had to be applied in determining the FMV.

Under SJTC’s partnership agreement, no transfer of SJTC partnership units was valid if it would terminate the partnership for federal or state tax purposes. The consent of all partners was required for the substitution of a transferee of SJTC partnership units as a limited partner. A transferee who was not substituted as a limited partner would be an assignee (only entitled to distributions from the partnership). Limited partners were also subject to a buy-sell agreement that mirrored SSC’s buy-sell agreement.

In May 2009, the taxpayer formed seven family trusts, made gifts to those trusts of SSC voting and nonvoting stock, and made gifts to his three daughters of SJTC limited partnership interests. The taxpayer timely filed a 2009 gift tax return, reporting values based on accompanying appraisals that resulted in total gifts of about $20,895,000. The IRS’s notice of deficiency asserted that the values should have been drastically increased, which resulted in total gifts of approximately $119,987,000 and a gift tax deficiency of $44,986,416.

The taxpayer filed a petition in the Tax Court in November 2013. He died on Sept. 14, 2014, and was replaced in the proceeding by his estate. The estate engaged another appraiser who used a DCF method and calculated values somewhat higher than the values reported on the taxpayer’s gift tax return but far smaller than the values asserted by the IRS. An appraiser engaged by the IRS used a net-asset-value (NAV) approach and determined the value of an SJTC limited partner unit to be slightly higher than the notice of deficiency.

Although the Tax Court reviewed numerous issues in the case, two are of key importance. First, the court examined whether SSC and SJTC were operating companies that should be valued under an income approach (using a DCF analysis), which was presented by the taxpayer’s expert, or a natural resource holding company (using an NAV approach), as the IRS argued. Whether an income or asset-based approach was used for valuing SSC and SJTC made a substantial dollar difference. The court noted that the parties did not dispute that SJTC was a going concern, but also noted that it had aspects of both an operating company (e.g., plants trees and harvests and sells the logs) and an investment or holding company (timberlands are its primary asset and they would retain and increase in value, even if SJTC was not profitable on a year-to-year basis). The court stated: “[T]he less likely SJTC is to sell its timberlands, the less weight we should assign to an asset-based approach.”

The Tax Court agreed with the estate that it was not likely that SJTC would sell or be forced to sell its timberlands. The holders of blocks of SJTC limited partnership units could not force a sale of its timberlands under the partnership agreement, and SSC, which had the exclusive authority to direct SJTC to make such a sale, would never exercise that authority. Additionally, SSC’s continued operation as a sawmill company depended on SJTC’s continued ownership of timberlands, and there was no likelihood that SSC, as SJTC’s general partner, would direct SJTC to sell its timberlands while SSC continued operations as a sawmill.

Furthermore, the court agreed with the estate that SJTC and SSC should be considered a single business operation even though they were separate legal entities. The court concluded that because SJTC and SSC were so closely aligned and interdependent that, in valuing SJTC, it was appropriate to consider the relationship with SSC and vice versa. Accordingly, the court held that an income-based approach, like the DCF method, was more appropriate for SSC and SJTC than the NAV method valuation.

Next, the Tax Court reviewed whether it was proper for the estate’s expert to have “tax-affected” the earnings of SJTC and SSC when projecting their net cash flow for valuation purposes. Generally, in the context of passthroughs, the term “tax-affecting” refers to reducing the earnings of a passthrough business for an assumed corporate tax rate, creating a scenario akin to valuing minority interests in a C corporation, where appraisers will typically start with a variable related to earnings on an after-tax basis because C corporations pay tax at the entity level. The estate’s expert tax-affected the earnings of SJTC and SSC by using the combined federal and state individual tax rates as a proxy for the corporate rates they would bear if they were C corporations, to adjust for the differences between passthrough entities and C corporations.

The estate argued that a hypothetical buyer and seller would acknowledge the fact that SJTC is a passthrough entity, and its partners are taxed at their ordinary rates on their shares of partnership income and gain, when determining the FMV of a limited partner interest. And, therefore, a valuation of SJTC must consider a hypothetical partner’s tax liabilities in its expected return on its investment. The IRS objected to tax-affecting, arguing that there was no evidence that SJTC or SSC would lose its passthrough status and indicated that the court had rejected tax-affecting in cases such as Gross, Estate of Gallagher, and Estate of Giustina.8

However, the Tax Court explained that prior cases did not prohibit tax-affecting the earnings of a passthrough entity per se. The court elaborated that the question in those cases, as here, was not whether to consider the tax benefits inuring to a passthrough entity but rather how. Since this is a fact-based issue, the court noted that in the prior cases it was determined that tax-affecting was not appropriate for various reasons based on the specific facts of those cases. However, in the current case, the court concluded that the estate’s detailed tax-affecting analysis was appropriate:

We find on the record before us that [the estate] has more accurately taken into account the tax consequences of SJTC’s [passthrough] status for purposes of estimating what a willing buyer and willing seller might conclude regarding its value. [The estate’s] adjustments include a reduction in the total tax burden by imputing the burden of the current tax that an owner might owe on the entity’s earnings and the benefit of a future dividend tax avoided that an owner might enjoy . . . . [The estate’s] tax-affecting may not be exact, but it is more complete and more convincing than [the IRS’s] zero tax rate.9

The Tax Court addressed tax-affecting for both a partnership and an S corporation. The court’s discussion first addressed SJTC, and then specifically targeted SSC when it stated, without qualification:

[The estate] used the same methodology to tax-affect [the] valuation of SSC except that [it] used a different rate for the dividend tax avoided because [the] analysis of the implied benefit for SSC’s shareholders in prior years yielded a different rate. We accept [the estate’s] method of tax-affecting the valuation of SSC for the same reasons we accepted it for the valuation of SJTC.10

After addressing other issues the IRS raised with it, the Tax Court agreed with the taxpayer’s expert’s valuation. Therefore, the taxpayer owed very little additional gift tax.

This is the first case in which the Tax Court allowed tax-affecting of a passthrough entity. In the previous cases cited in the opinion, the court made it clear that it never held that tax-affecting for passthrough entities was per se prohibited; it noted that in those past cases the taxpayer had not clearly laid out a way that tax-affecting was appropriate under the facts of the case. Going forward, this case shows how to argue in favor of tax-affecting and a possible road map as to how to do it.

Loans were gifts

In Estate of Bolles,11 the Tax Court held that advances the decedent made to one of her sons over many years to support his struggling architecture business were more properly characterized as gifts and, therefore, were properly included in computing her estate tax liability.

During her life, the decedent made loans to each of her five children and kept personal records of these advancements and the repayments by each child. The advancements made to one child, Peter, far exceeded the advancements made to the other four children. From 1985 to 2007, the decedent transferred $1,063,333 to or for the benefit of Peter. After 1998, Peter failed to make any repayments to the decedent although he did have gainful employment.

In 1989, the decedent created a revocable trust. Peter was originally excluded from any distributions from the revocable trust. However, as part of the decedent’s estate plan, the revocable trust was later amended to no longer exclude Peter from distributions. The amendment provided a formula to account for the loans made to Peter during the decedent’s life.

In conjunction with the amendment, Peter executed an “Acknowledgement and Agreement Regarding Loans,” stating that he had received, directly or indirectly, loans from the decedent in the amount of $771,628 and that as of May 3, 1995, he had neither the assets nor the earning capacity to repay the loans. As a result, Peter acknowledged and agreed that, irrespective of the uncollectibility or unenforceability of the loans, or any portions thereof, the entire loan amount specified plus interest thereon is to be taken into account for purposes of determining the loan amount in the amendment to the revocable trust.

The decedent died in 2010, and the IRS assessed the estate with a deficiency in estate taxes based on its position that the loans were gifts.

The Tax Court began its analysis by reviewing the nine factors in Miller12 the court used to determine if an advancement is a gift or a loan: (1) There was a promissory note or other evidence of indebtedness; (2) interest was charged; (3) there was security or collateral; (4) there was a fixed maturity date; (5) a demand for repayment was made; (6) actual repayment was made; (7) the transferee had the ability to repay; (8) records maintained by the transferor and/or the transferee reflect the transaction as a loan; and (9) the manner in which the transaction was reported for federal tax purposes is consistent with a loan. The Tax Court noted that these factors were not exclusive and that in the case of a family loan, an actual expectation of repayment and an intent to enforce the debt were critical for an advancement to be characterized as a loan.

The Tax Court found that the decedent originally expected Peter to be successful in his career and that her advancements during this time could be properly characterized as loans. However, as Peter’s financial situation deteriorated, the decedent lost that expectation, as shown in 1989 when her trust provided for a specific block of Peter’s receipt of assets at the time of her death. At this time, the advancements lost their characterization as loans and became advancements on Peter’s inheritance. As a result, her advances to Peter after 1989 were added to “adjusted taxable gifts,” thereby increasing the decedent’s gross estate by that amount.

Valuation of LLC interests

In Grieve,13 the Tax Court upheld the taxpayer’s gift tax valuation of 99.8% nonvoting interests in two LLCs that the taxpayer had transferred in 2013 to a grantor retained annuity trust (GRAT) and an irrevocable trust, rejecting a valuation/methodology the IRS offered that assumed that a buyer of a 99.8% interest would start by seeking to purchase the 0.2% controlling interest.

The taxpayer was the chairman and chief executive of Ecolab Inc. While at Ecolab, the taxpayer acquired a substantial amount of the corporation’s stock and amassed significant wealth. In the late 1980s or early 1990s, the taxpayer established an FLP to preserve and manage his wealth. The general partner of the FLP was a management company. In the early 2000s, the taxpayer’s eldest daughter became involved in helping the taxpayer manage the family wealth. In 2008, the daughter purchased the management company from the taxpayer and became its president.

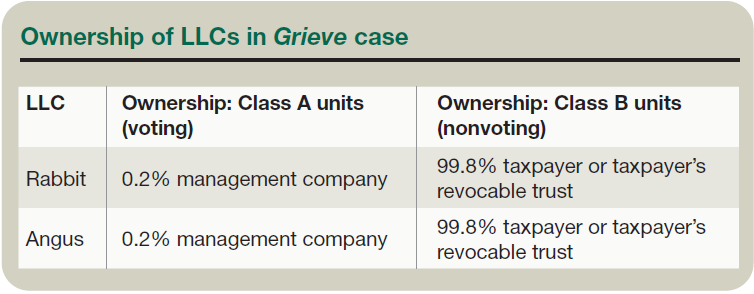

During 2012 to 2013, as part of an estate plan update, the taxpayer created an irrevocable trust for the benefit of his children. Also created during this time frame were two Delaware LLCs: Rabbit 1 LLC (Rabbit) and Angus MacDonald LLC (Angus). The ownership of the LLCs was as shown in the chart “Ownership of LLCs in Grieve Case” (below).

The taxpayer’s daughter, as the management company’s owner, was the chief manager of the LLCs. The taxpayer’s daughter was also the trustee of the taxpayer’s revocable trust (created earlier in time and holding most of the taxpayer’s assets). The assets of both LLCs were largely cash, cash equivalents, and marketable securities. The FMV of those assets were: $9,067,074 in Rabbit; and $31,970,683 in Angus.

Under the LLC agreements, the holders of all Class A units had to consent to the transfer of any units to anyone other than a lineal descendant of the taxpayer, or a trust for the exclusive benefit of any one or more such lineal descendants and/or their spouses, or, in the case of Rabbit, a charitable organization.

On Oct. 9, 2013, the taxpayer’s revocable trust transferred its 99.8% nonvoting ownership interest in Rabbit to a two-year, zeroed-out GRAT. On Nov. 1, 2013, the taxpayer transferred his 99.8% nonvoting ownership interest in Angus to the irrevocable trust in exchange for a single-life private annuity that on that date had an FMV of $8,043,675. Therefore, the taxpayer made a gift to the irrevocable trust in the amount by which the value of the 99.8% interest exceeded $8,043,675.

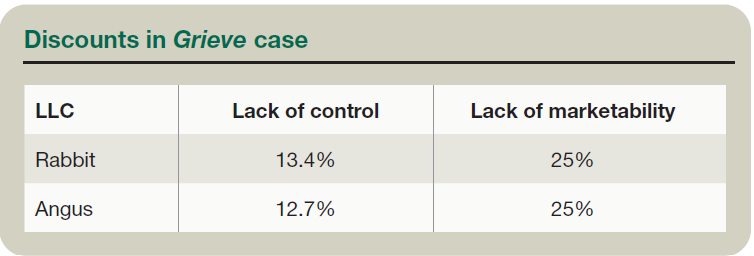

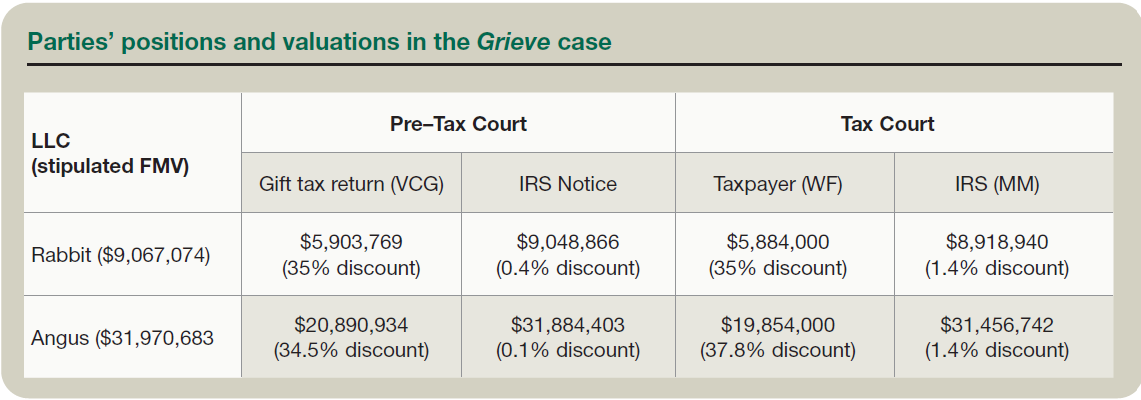

On the taxpayer’s 2013 gift tax return, he reported the values of the 99.8% nonvoting interests based on appraisals prepared by Value Consulting Group (VCG). VCG used a cost approach and adjusted-net-asset method to determine the FMV, applying discounts as shown in the chart “Discounts in Grieve Case.”

To determine the discounts, VCG looked at studies of closed-end mutual funds and closely held equity interests, including restricted stock studies.

The IRS issued a notice of deficiency substantially increasing the values of the LLC interests. In Tax Court, the taxpayer offered additional valuation reports prepared by Will Frazier (WF). The IRS relied on Mark Mitchell (MM) to provide its expert analysis and valuations. The table “Parties’ Positions and Valuations in the Grieve Case” (below) summarizes the parties’ positions and valuations.

WF’s reports independently valued the assets the LLCs held, employing multitiered discounts, which included the application of minority-interest and lack-of-marketability discounts to the limited partnership interest and venture capital funds Angus held. This approach resulted in values slightly lower than those used by VCG.

MM’s approach sought to determine the price at which a 99.8% noncontrolling interest would be bought or sold. MM’s valuations were based on the premise that the reasonable buyer of a 99.8% interest would seek to maximize its economic interest by consolidating ownership through the purchase of the 0.2% interest. MM contended that a willing buyer would consider the likelihood of purchasing the 0.2% interest and, thus, determined that a hypothetical willing seller would seek first to acquire the Class A units for a premium. Therefore, purchasing the Class A units would result in consolidated control and further maximize the value of the Class B units by reducing any discount a hypothetical willing buyer sought.

The Tax Court rejected MM’s approach, noting that the court does not engage in imaginary scenarios as to who a purchaser might be. The court went on to state that MM’s valuations relied on an additional action, the purchase of the Class A units, and to determine the value of the Class B units, a premium to purchase the Class A units must be considered. The court stated that elements affecting value that depend upon events within the realm of possibility should not be considered if the events are not shown to be reasonably probable.

The Tax Court found that the facts did not support the likelihood that a willing seller or a willing buyer of the Class B units would also buy the Class A units and that the Class A units would be available to purchase (the taxpayer’s daughter, the sole owner of the Class A units, testified that she had no intention of selling the units). Thus, to determine the FMV of the Class B units, look at the willing buyer and willing seller of the Class B units and not the willing buyer and willing seller of the Class A units.

Furthermore, the Tax Court found that neither the IRS nor MM provided evidence to support the valuations. Specifically, neither MM nor the IRS:

- Included empirical data to support the premium assigned to the purchase of the Class A units;

- Provided evidence showing the methodology was subject to peer review; or

- Cited case law in support of the methodology.

Accordingly, the Tax Court rejected MM’s valuations of the Class B units of Rabbit and Angus and accepted the values that had been originally reported on the gift tax return.

It is peculiar that the IRS chose to challenge the taxpayer’s valuation by valuing an interest that was not actually transferred — the Class A units of the LLC. By determining the premium that a willing buyer/willing seller would place on the Class A units, it tried to value the Class B units using a subtraction method. The IRS has continued to argue valuation positions that distort the hypothetical willing-buyer/willing-seller test for the measurement of FMV and has been reminded by the courts that the IRS cannot insert specific characteristics about a willing buyer or a willing seller when determining FMV.14 As a result of the IRS’s failed argument, the sizable discounts for the entities that basically held portfolio assets were sustained by the Tax Court.

Willing buyer/willing seller

In CCA 201939002, the IRS determined that a future merger of a corporation whose shares were gifted should be considered for gift tax valuation purposes.

The taxpayer was a co-founder and chairman of the board of a publicly traded corporation. On date 1, the taxpayer transferred shares of the corporation to a GRAT with the remainder interest in the GRAT passing to his children. On date 2, the corporation announced a merger with another corporation. The merging corporation had exclusive negotiations with the other corporation prior to the transfer of shares to the GRAT. The valuation of the first corporation increased substantially after the merger. The IRS reviewed documents related to the merger, including an exclusivity agreement between merging companies, correspondence between them, and board meeting minutes.

The issue considered by the Chief Counsel of the IRS was whether a hypothetical willing buyer and willing seller of the shares of a publicly traded corporation would consider a pending merger when valuing stock for gift tax purposes.

The IRS began its analysis with Sec. 2512(a), which provides the value of property as of the date of a gift shall be the amount of the gift. Under Regs. Sec. 25.2512-1, the value of the property is the price at which the property would change hands between a willing buyer and a willing seller. Both the willing buyer and the willing seller would have a reasonable knowledge of relevant facts. The value of publicly traded stock is generally the FMV per share, determined as the mean between the highest and lowest quoted selling prices on the date of the gift. However, in cases where the value does not reflect the FMV, a modification will be allowed based on other relevant facts and elements of value.

In making its determination, the IRS heavily relied on the holding in Ferguson.15 Even though the opinion in Ferguson dealt exclusively with the assignment-of-income doctrine, it relies upon the proposition that the facts and circumstances regarding a transaction help determine whether a merger is likely to occur. In Ferguson, the taxpayers owned 18% of a company and served as officers and directors. The taxpayers transferred their stock pursuant to a donation-in-kind to a charity and two foundations after a merger agreement had been made with another company and the merger had been approved by a vote from the board. After the transfer, the final shares were tendered, and subsequently, the merger was complete. The Ninth Circuit determined that the transfer occurred after the shares had “ripened” from shares in the company to a fixed right to receive cash when the merger was certain to occur. Thus, the taxpayer realized gain when the shares were subsequently disposed of by the charity and foundations.

Here, the IRS considered the facts to be similar to Ferguson,as the agreement with the merging company was practically certain to go through prior to the taxpayer’s transfer of his stock to the GRAT. Thus, the IRS reasoned that the likelihood of the merger should have been taken into consideration in valuing the corporation’s shares because the mean between the highest and lowest quoted selling price did not reflect the FMV and a modification should have been made.

The IRS takes the position in the CCA that post-transfer events should be considered in determining FMV for gift tax purposes. It is similar to the arguments it has made regarding post-death events being taken into consideration for estate tax valuation purposes; however, it uses the income-tax-anticipatory-assignment-of-income doctrine to get there. It is clear that the hypothetical willing buyer and hypothetical willing seller (which is the valuation standard under Sec. 2512), based on relevant facts, would not have known of the merger because it had not yet been announced. Thus, Chief Counsel had to rely on the regulations to consider other facts because of the belief that the value as set by the stock’s publicly traded price was not reflective of FMV.

Looking forward

Next month, part 2 of this article will cover developments in estate and GST taxation, as well as inflation adjustments.

The views expressed in this article are those of the author and do not necessarily reflect the views of Ernst & Young LLP, or the global EY organization or its member firms.

Footnotes

1REG-113295-18.

2P.L. 115-97.

3Regs. Sec. 1.642(h)-2(a).

4Nelson, T.C. Memo. 2020-81.

5E.g., Succession of McCord, 461 F.3d 614, 627 (5th Cir. 2006); Wandry, T.C. Memo. 2012-88; Estate of Petter, T.C. Memo. 2009-280.

6Nelson, at *21.

7Estate of Jones, T.C. Memo. 2019-101.

8Gross, T.C. Memo. 1999-254; Estate of Gallagher, T.C. Memo. 2011-148; and Estate of Giustina, T.C. Memo. 2011-141.

9Estate of Jones, at *41-*42.

10Estate of Jones, at *48.

11Estate of Bolles, T.C. Memo. 2020-71.

12Miller, T.C. Memo. 1996-3.

13Grieve, T.C. Memo. 2020-28.

14See, e.g., Estate of Giustina, T.C. Memo. 2011-141, rev’d, 586 Fed. Appx. 417 (9th Cir. 2014) (per curiam); Estate of Simplot, 112 T.C. 130 (1999), rev’d, 249 F.3d 1191 (9th Cir. 2001).

15Ferguson, 174 F.3d 997 (9th Cir. 1999), aff’g 108 T.C. 244 (1997).

Contributors | |

| Justin Ransome, CPA, J.D., MBA, is a partner in the National Tax Department of Ernst & Young LLP in Washington, D.C. He was assisted in writing this article by professionals from Ernst & Young’s National Tax Department in Private Client Services — David Kirk, Todd Angkatavanich, Marianne Kayan, Joe Medina, Sean Aylward, Rosy Lor, Caryn Friedman, John Fusco, Nickolas Davidson, Paul Schuh, Ankur Thakkar, and Utena Yang. For more information about this article, contact thetaxadviser@aicpa.org.

|