- column

- TAX PRACTICE & PROCEDURES

Categorizing FAQs in the guidance sphere

Please note: This item is from our archives and was published in 2021. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

IRS proposal eases provision of 1099-DA statements by digital asset brokers

IRS issues higher 2026 depreciation limits for passenger automobiles

New Schedule 1-A for tips, OT, car loans, and senior deductions published

TOPICS

Editor: Valrie Chambers, CPA, Ph.D.

Ten years ago, in an AICPA Tax Insider article, this author asked and answered the question: “How Heavy Is an FAQ?” The answer — that FAQs are not binding guidance — remains true today despite hundreds of FAQs added to the IRS website since 2010. Just with COVID-19 tax changes alone for 2020, the IRS has issued over 500 FAQs.

This discussion reviews how IRS guidance is categorized depending on how and where it is issued and what is considered binding guidance, including for “substantial authority” purposes. This review is offered to help in understanding where FAQs fit. This discussion also provides tips for effectively using FAQs. Given the significant quantity of them issued on tax topics of wide application, it is clear the IRS does not expect us to ignore them. And, often, there is no other information available to help apply recently enacted law changes.

Comparing types of documents issued by the IRS

The classification of documents written and released by Treasury and the IRS is multifaceted. Perhaps an analogy is the seven-tier classification system biologists use for animals (kingdom, phylum, class, order, family, genus, and species).

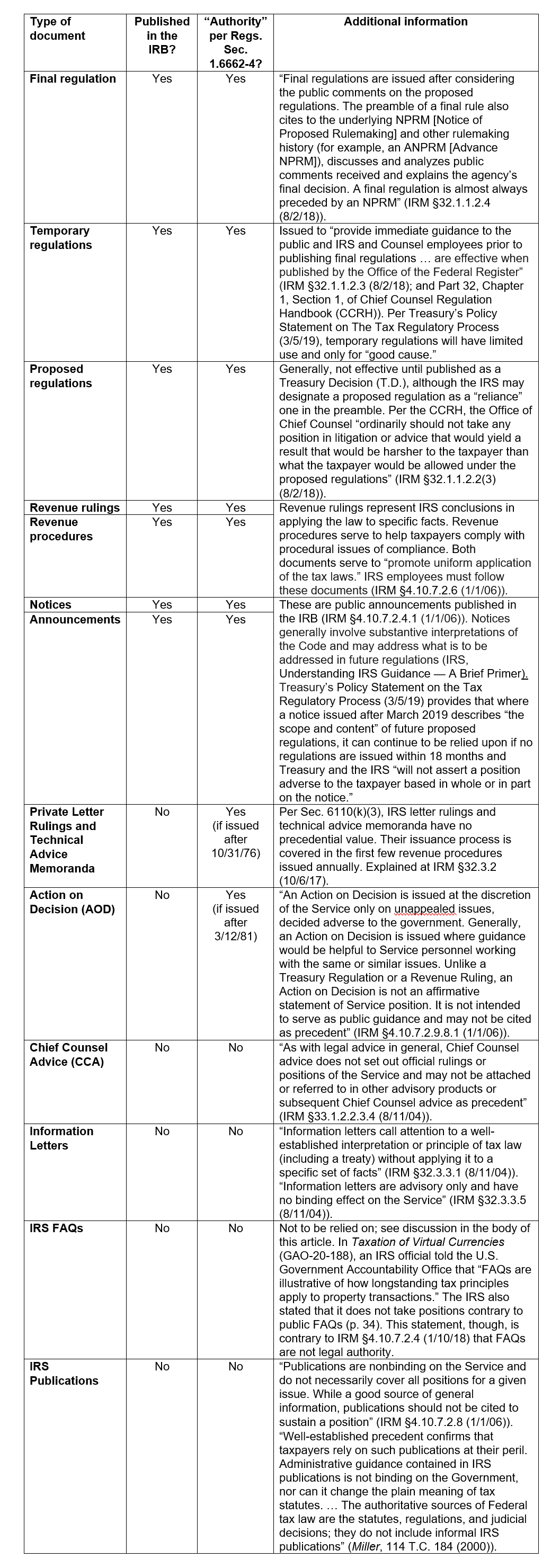

The table “Documents From Treasury and the IRS” (at the end of this article) lists a sampling of commonly used documents from Treasury and the IRS. This table indicates whether the document is published in the weekly Internal Revenue Bulletin (IRB). Regs. Sec. 601.601(d)(2)(ii)(a) explains the important role of the IRB in the guidance process as follows:

The Internal Revenue Bulletin is the authoritative instrument of the Commissioner of Internal Revenue for the publication of official rulings and procedures of the Internal Revenue Service, including all rulings and statements of procedure which supersede, revoke, modify, amend, or affect any previously published ruling or procedure. The Service also announces in the Bulletin the Commissioner’s acquiescences and nonacquiescences in decisions of the U.S. Tax Court (other than decisions in memorandum opinions), and publishes Treasury decisions, Executive orders, tax conventions, legislation, court decisions, and other items considered to be of general interest.

The Internal Revenue Manual (IRM) also confirms that the IRB is the “authoritative instrument” of the IRS (IRM §4.10.7.2.4 (1/10/18)).

This portion of the IRM also includes the following important reminder not only of relevance to IRS employees but also to taxpayers and tax professionals:

Caution: Internal Revenue Service employees must follow items published in the Bulletin and taxpayers may rely on them. Some items, such as frequently asked questions (FAQs), can be found on get IRS.gov on one line if possible but have not been published in the Bulletin. FAQs that appear on IRS.gov but that have not been published in the Bulletin are not legal authority and should not be used to sustain a position unless the items (e.g., FAQs) explicitly indicate otherwise or the IRS indicates otherwise by press release or by notice or announcement published in the Bulletin.

The IRS also reminds us that not all items published in the IRB are the same in terms of level of authority. Per the IRS webpage, “Tax Code, Regulations and Official Guidance,” available at www.irs.gov:

Rulings and procedures reported in the IRB do not have the force and effect of Treasury tax regulations, but they may be used as precedents. In contrast, any documents not published in the IRB cannot be relied on, used, or cited as precedents in the disposition of other cases.

In addition, the Chief Counsel Regulation Handbook (CCRH), available at www.irs.gov, published in the IRM states: “Federal income tax regulations are the official Treasury interpretation of the Code” (IRM §32.1.1.4 (8/11/04)).

Items published by the administrative branch can also differ as to whether they have retroactive effect. Sec. 7805(b) provides that, generally, regulations are not to be issued with retroactive effect. There are specified exceptions to this rule, such as when regulations are issued within 18 months of the enactment date of a new law or to prevent abuse. Sec. 7805(b)(8) states that Treasury “may prescribe the extent, if any, to which any ruling (including any judicial decision or any administrative determination other than by regulation) relating to the internal revenue laws shall be applied without retroactive effect.” Thus, generally, regulations are presumed to be prospectively effective, while revenue rulings, revenue procedures, and notices are presumed to be retroactively effective unless a statement to the contrary is made.

Another distinction among documents produced by the administrative branch is whether they constitute authority for purposes of determining if “substantial authority” exists to avoid a Sec. 6662 understatement-of-tax penalty for a taxpayer or a Sec. 6694 penalty for a return preparer. The table notes whether each listed document is “authority” per Regs. Sec. 1.6662-4(d). This regulation also explains how to evaluate authorities, considering such factors as age, similarities to taxpayer facts, and type of document.

In March 2019, Treasury issued Policy Statement on the Tax Regulatory Process (available at home.treasury.gov) to “reaffirm” its “commitment to a tax regulatory process that encourages public participation, fosters transparency, affords fair notice, and ensures adherence to the rule of law.” Key points of this statement are that while subregulatory guidance, such as revenue rulings, do not have the force and effect of law, the IRS will not take positions contrary to that guidance. Also, Treasury prefers proposed regulations that must follow the Administrative Procedure Act and allow for public participation before rules are finalized, rather than temporary regulations that are effective when issued.

Considerations in using IRS FAQs

A reminder that can be gleaned from the March 2019 Treasury policy statement is that FAQs are of no consequence in the guidance process. The statement notes that subregulatory guidance does not have the force and effect of law, even though it is published in the IRB. FAQs are not even published in the IRB. Also, FAQs can be renumbered, removed, or modified with no archival remnant to help in finding the original. That is, the IRS has no responsibility to archive FAQs and other items only published on its website. In contrast, items published in the IRB are in a permanent depository. In a July 7, 2020, blog post, available at taxpayeradvocate.irs.gov, National Taxpayer Advocate Erin M. Collins noted this FAQ problem and described it as a violation of the Taxpayer Bill of Rights, namely, the rights to be informed and to a fair and just tax system.

Based on this review of administrative guidance and the reality that, many times, the only guidance available is in the form of FAQs, the following suggestions are offered in using FAQs:

- Look for the origin of the information in the FAQ. The information should stem from the Internal Revenue Code, legislative committee reports, regulations, or judicial decisions. If you find its origin, base your position on that binding guidance.

- If the origin cannot be found, be sure to make a copy of any FAQ you rely on for taking a position on a return or for planning purposes. The copy should be kept with the return as well as in a file you create of those FAQs so you can readily find them even if they are later removed from the IRS website or modified.

- Encourage the IRS to issue interpretive FAQs (ones that do not just summarize binding guidance) in proposed regulations where public comment and prospective effect is desired, or in subregulatory guidance published in the IRB for binding effect on the IRS and a permanent archive.

Documents from Treasury and the IRS

Contributors | |

| Valrie Chambers, CPA, Ph.D., is an associate professor of accounting at Stetson University in Celebration, Fla. Annette Nellen, Esq., CPA, CGMA, is a professor in the Department of Accounting and Finance at San José State University in San José, Calif. Professor Nellen is a member of the AICPA Tax Practice & Procedures Committee. For more information on this article, contact thetaxadviser@aicpa.org. |