- tax clinic

- credits against tax

New advanced energy project tax credits under the Inflation Reduction Act

Related

Deductibility of transaction costs incurred by an indirectly acquired entity

IRS issues guidance on treaty application to reverse foreign hybrids

Practical tax issues related to qualified reopenings

Editor: Anthony Bakale, CPA

The Inflation Reduction Act, P.L. 117-169, rejuvenated and expanded an energy credit program under Sec. 48C(e) that now provides for up to $10 billion in tax credits for qualified investments in new, expanded, or reequipped manufacturing facilities that produce certain emissions-reducing technologies.

The IRS in February 2023 provided guidance under this provision via Notice 2023-18 on how and when taxpayers can apply for the credits, which include a base rate credit of 6% of qualifying investment amounts that increases to 30% if certain requirements related to prevailing wages and apprenticeships are met (Sec. 48C(e)(4)). The intent is for the credits to be awarded in multiple rounds, with 40% of the credits awarded in Round 1 of the application process, which began on May 31, 2023, with the deadline for submission of a concept paper to the Department of Energy (DOE) being July 31, 2023. Round 2 is contemplated to commence immediately following the close of Round 1. The IRS then released Notice 2023-44 on May 31, 2023, and it provides a clearer definition and examples of qualifying advanced energy projects. It also provides more guidance regarding the application process and further clarifies the selection criteria used to evaluate projects.

The application is intended to be a multistep process, with the initial step being submission of the concept paper to the DOE. After reviewing the concept paper, the DOE will encourage or discourage taxpayers to submit a full joint application to the DOE and the IRS for certification of the credit award. Review of Notice 2023-18 and any successor notices is critical in preparing the concept paper and subsequent application, the details of which are too involved to cover adequately in this item.

The credit can be claimed in the year the qualifying investment for the eligible property is placed in service. Eligible property placed in service prior to being awarded an allocation of the Sec. 48C credits is not eligible to receive the allocation. Once the allocation is awarded and the eligible property is placed in service, there are provisions to elect to claim the credit under rules similar to those for qualified progress expenditures under former Sec. 46(c)(4) and (d) as in effect before the enactment of the Revenue Reconciliation Act of 1990 (Title XI of the Omnibus Budget Reconciliation Act of 1990, P.L. 101-508) (see Sec. 48C(b)(2)).

If the IRS accepts a taxpayer’s Sec. 48C application for a project, it notifies the taxpayer by sending a letter allocating Sec. 48C credits (allocation letter). A taxpayer will have two years from receiving an allocation letter to provide evidence to the DOE that the certification requirements have been met. The DOE will notify the IRS and the taxpayer that it has received the taxpayer’s notification that the certification requirements have been met. The Service will then notify the taxpayer that it has certified the project by sending the taxpayer a certification letter.

The taxpayer will have two years from the date of the certification letter to place the project in service and to notify the DOE that it has done so. The DOE then notifies the taxpayer and the IRS that it has received the notification. If the property is not placed in service by the applicable date, or the taxpayer has not notified the DOE that it has done so, the taxpayer will forfeit the credits allocated to the project.

What qualifies for the energy investment tax credit program?

Three broad categories of qualifying advanced energy projects qualify for the credit:

Clean energy manufacturing and recycling projects: The project must reequip, expand, or establish an industrial or manufacturing facility for the production or recycling of advanced energy property, which includes:

- Property designed to produce energy from the sun, water, wind, geothermal deposits, or other renewable resources;

- Fuel cells, microturbines, or energy storage systems and components;

- Electric grid modernization equipment or components;

- Property designed to capture, transport, remove, use, or sequester carbon oxide emissions;

- Equipment designed to refine, electrolyze, or blend any fuel, chemical, or product that is renewable or is low-carbon and low-emission;

- Property designed to produce energy conservation technologies;

- Electric or fuel cell vehicles and associated technology, components, and charging or refueling components;

- Hybrid vehicles with a gross vehicle weight of at least 14,000 pounds and related technologies, components, and materials; and

- Other advanced energy property designed to reduce greenhouse gas (GHG) emissions, as may be determined by the Treasury secretary.

Recent guidance further defined the term “facility” as eligible property that makes up the qualified investment that is part of the qualified advanced energy project. Eligible property means that it is necessary for the production or recycling of certain property; reequipping certain industrial or manufacturing facilities; or reequipping, expanding, or establishing certain industrial facilities and is tangible, depreciable personal property that is an integral part of the qualified investment facility.

GHG reduction projects: The project must reequip an industrial or manufacturing facility with equipment designed to reduce GHG emissions by at least 20% through the installation of:

- Low- or zero-carbon process heat systems;

- Carbon capture, transport, utilization, and storage systems;

- Industrial processes that improve energy efficiency and reduce waste; or

- Any other industrial technology designed to reduce GHG emissions, as determined by the Treasury secretary.

Critical material projects: The project must reequip, expand, or establish an industrial facility for the processing, refining, or recycling of critical materials. Critical materials are defined at 30 U.S.C. Section 1606(a)(2) and include certain minerals, elements, or substances the DOE designates as having a high risk of supply chain disruption and serve an essential function in certain energy technologies.

A few unique twists to the program

Taxpayers should note that the program emphasizes projects and investments in “energy communities,” for which Congress has reserved $4 billion of the $10 billion in credits. These energy communities include locations that have been or are heavily dependent on fossil fuels as a driver of local economic activity, employment, and government revenue (Sec. 45(b)(11)(B)). The facility is treated as located within the energy community census tract if 50% or more of its square footage is in the area that qualifies. The DOE has provided a full map of the census tract communities.

The revised program offers something previous iterations did not — eligibility for direct pay or transferability of the credits. These options will allow taxpayers to monetize projects in ways not previously available and should simplify deal structures significantly.

Rules prevent “double-dipping” by projects that are receiving a tax credit under Sec. 48 (energy credit), 48A (advanced coal project), 48B (gasification project), 48E (clean electricity investment), 45Q (carbon oxide sequestration), or 45V (clean hydrogen) (Sec. 48C(f)). The Sec. 48C credit also is not allowable for any project that includes the production of property used in refining or blending nonrenewable transportation fuels (Sec. 48C(c)(1)(B)).

What is the prevailing-wage requirement?

To claim the highest available Sec. 48C credit percentage of 30%, taxpayers must pay prevailing wages and offer apprenticeship programs during construction, alteration, and repair activities of qualifying projects.

To qualify for the enhanced credit rate:

- Taxpayers must pay prevailing wages to any laborers and mechanics employed by the taxpayer and any contractors or subcontractors involved in the reequipping, expansion, or establishment of a manufacturing facility that is part of a qualifying advanced energy project. Prevailing wages for this purpose are the rates paid for similar work where the project is located, as determined by the Labor secretary. Procedures are provided in Notice 2023-18 to cure both unintentional failures and those by intentional disregard of the rule to pay the prevailing wage to an applicable laborer. The Labor secretary has published prevailing-wage information on a federal government website, sam.gov, which gives the prevailing wages for specific labor classifications and geographic areas (under “Wage Determinations”). Note that there is an alternative method for acquiring prevailing-wage information when an activity or geographic area is not listed on the website (see Notice 2022-61, §3.02).

- Taxpayers are required to maintain records for work performed, including by contractors and subcontractors, that show laborers and mechanics were not paid less than prevailing wages. Notice 2022-61, Section 3.03, provides definitions for terms such as “wages”; “laborer or mechanic”; and “construction, alteration, or repair.”

What is the apprenticeship requirement?

To satisfy the apprenticeship requirement, taxpayers must ensure that qualified apprentices perform at least an applicable percentage of total labor hours with respect to construction, alteration, or repair work on the project.

Total labor hours include any work performed by contractors or subcontractors, and the applicable percentage is determined based on the date construction began on a qualified facility (Sec. 45(b)(8)(A)(ii)):

- Before Jan. 1, 2023: 10%;

- After Dec. 31, 2022, and before Jan. 1, 2024: 12.5%; and

- After Dec. 31, 2023: 15%.

The applicable percentages in each year are subject to requirements for apprentice-to-journey worker ratios provided by the Department of Labor or applicable state apprenticeship agencies. In addition to meeting the applicable-percentage requirement, a taxpayer that employs four or more individuals to perform construction, alteration, or repair work must also meet a separate participation requirement and employ one or more qualified apprentices to perform the work.

Like the prevailing-wage requirements, taxpayers must maintain books and records that show they met the apprenticeship requirements for their own employees as well as for any contractors and subcontractors they hire for the project. They also may meet the apprenticeship requirement through the good-faith-effort exception if they are unable to obtain the proper apprenticeship labor (see Sec. 45(b)(8)(D)(ii)). To meet this exception, taxpayers must request qualified apprentices from a registered apprenticeship program in accordance with usual and customary business practices for registered apprenticeship programs in a particular industry. They should document requests to these programs, as well as the program’s denial or nonresponse.

What are the penalties for not meeting the requirements?

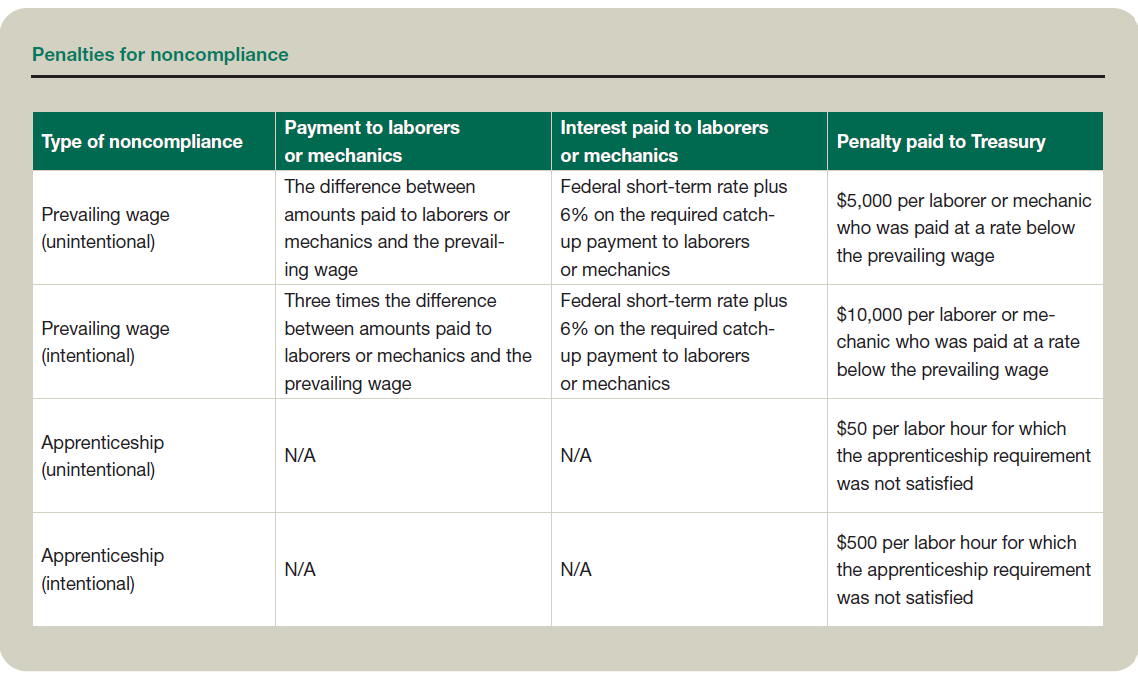

Various penalties and payments apply if taxpayers do not meet prevailing-wage and apprenticeship requirements and claim the enhanced credit rates. The type of penalty depends on whether they intentionally disregarded the requirements, based on the facts and circumstances (see Secs. 45(b)(7)(B) and (8)(D)(i)(II)). Potential payments to laborers or mechanics and penalties to Treasury for noncompliance include those shown in the table “Penalties for Noncompliance” below.

The next step is to submit an application through the eXCHANGE portal. The application must be submitted no later than 45 days after the DOE begins the acceptance process. The DOE will review applications to ensure they comply with eligibility and other threshold requirements. For those that do, the DOE will then conduct a technical review and provide the IRS with recommendations and rankings regarding which applications to accept or reject.

The IRS makes the final decision on projects to be accepted into the program and will notify the awardees via an allocation letter. All Round 1 allocation decisions will be made by March 31, 2024.

Once the application process is complete and a taxpayer has received a credit allocation, it has two years to notify the DOE it has met the certification requirement and an additional two years to place the property in service. If either of those deadlines is not met in a timely fashion, then the taxpayer will forfeit the credits.

The IRS has issued technical review criteria that the DOE will evaluate when making recommendations to the IRS: commercial viability, GHG emission impacts, strengthening U.S. supply chains and domestic manufacturing for a net-zero economy, and workforce and community engagement.

Based on past iterations of this credit, it is anticipated that the demand for it will likely exceed the supply of available funds, making the application for credits a very competitive process. Taxpayers should keep in mind that there are specific set-asides for projects located in energy communities. For taxpayers that intend to pursue these credits, it’s a good idea to start planning now and register on the eXCHANGE portal sooner rather than later.

Editor Notes

Anthony Bakale, CPA, is a tax partner with Cohen & Company Ltd. in Cleveland. For additional information about these items, contact Bakale at tbakale@cohencpa.com. Contributors are members of or associated with Cohen & Company Ltd.