- tax clinic

- REAL ESTATE

Recent changes to the Sec. 179D energy-efficient commercial buildings deduction

Please note: This item is from our archives and was published in 2023. It is provided for historical reference. The content may be out of date and links may no longer function.

Editor: Greg A. Fairbanks, J.D., LL.M.

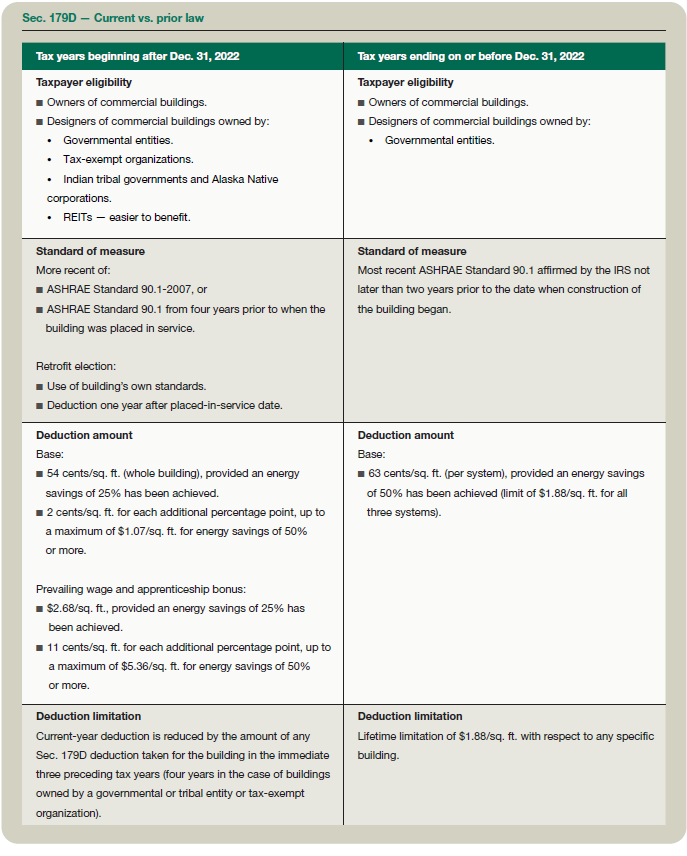

The energy efficient commercial buildings deduction under Sec. 179D provides taxpayers with an incentive to make certain commercial building property more energy efficient. The Sec. 179D deduction has been in effect since Jan. 1, 2006, and was made permanent as part of the Consolidated Appropriations Act of 2021, P.L. 116-260, enacted in December 2020. A new and enhanced version of Sec. 179D was signed into law on Aug. 16, 2022, as part of the Inflation Reduction Act of 2022, P.L. 117-169. The new rules under Sec. 179D apply for tax years beginning after Dec. 31, 2022, and to qualifying property placed in service after that date.

These newly enacted changes to Sec. 179D provide additional opportunities for taxpayers, including as much as $5.36 per square foot (sq. ft.) in immediate deductions to encourage the construction of energy-efficient commercial buildings and multifamily buildings that are at least four stories tall. In addition, certain provisions under the revised Sec. 179D expand the opportunity for energy efficient retrofits of older buildings to become eligible for the deduction, by reducing applicable requirements. Taxexempt organizations are also provided an incentive to make their facilities more energy efficient under the new provisions. However, taxpayers must also be aware of added complexity under the new rules, including the requirement to meet certain prevailing wage and apprenticeship standards to achieve the maximum deduction.

Who is eligible?

Under prior law, taxpayers that owned commercial buildings could be entitled to a deduction under Sec. 179D. Taxpayers that design buildings owned by governmental entities could also benefit because those governmental entities were able to allocate the Sec. 179D deduction to the person “primarily responsible” for the design. Thus, architects and engineering firms could benefit from this provision. Taxpayers that were both the designer and the builder of commercial building property were also eligible for the deduction. Sec. 179D(d)(3) significantly expands the list of organizations that may allocate their Sec. 179D deduction. The new list includes:

- Governmental entities;

- Tax-exempt organizations; and

- Indian tribal governments and Alaska Native corporations.

Sec. 179(d)(3) allows tax-exempt organizations to negotiate the allocation of the deduction to the designer of the property, which may result in a sizable amount of savings in the development of new projects. Groups with a substantial amount of real estate, such as universities, hospitals, and religious organizations, may find this opportunity particularly beneficial.

Further, Sec. 312(k)(3)(B) was amended to make it easier for real estate investment trusts (REITs) and their shareholders to benefit from the Sec. 179D deduction. Under new Sec. 312(k) (3)(B)(ii), REITs are allowed to reduce earnings and profits (E&P) by the Sec. 179D deduction amount in the year the energy-efficient components are placed in service (or the year of final certification for retrofit property). In contrast, under prior law, the Sec. 179D deduction reduced REIT E&P ratably over a period of five tax years.

Energy-efficient commercial building property

To be eligible, energy-efficient property must be installed on certain types of buildings, as described in Sec. 179D(c)(1). These are largely commercial buildings and multifamily buildings that are at least four stories tall. Eligible property includes schools, churches, hospitals, and other property within the scope of Standard 90.1 published by the American Society of Heating, Refrigerating, and Air Conditioning Engineers (ASHRAE) and the Illuminating Engineering Society of North America. The buildings must also be located in the United States. Further, such property must be installed as part of:

- The interior lighting systems (exterior lighting does not qualify);

- The heating, cooling, ventilation (HVAC), and hot water systems; or

- The building envelope (e.g., windows and roofing).

These provisions are consistent with existing law, though taxpayers would benefit from additional guidance. For example, it is not clear whether solar systems used to power the interior lighting systems as well as the rest of the building would be eligible.

Amount of deduction

Under prior law, installation of the energy-efficient property needed to reduce the total annual energy and power costs by 50% to be eligible for the Sec. 179D deduction. The amount of the deduction was 63 cents per sq. ft. Of qualified building property for each of three eligible systems installed on the property. These are interior lighting, HVAC and hot water, and building envelope systems, as noted above. The amount of the deduction was capped at $1.88 per sq. ft. If all three systems were installed and was limited to the amount spent for the improvements (both square footage rates were as adjusted for inflation for tax years beginning in 2022; see Sec. 179D(b)(2) before amendment by the Inflation Reduction Act and Rev. Proc. 2021-45).

Under the changes, the amount of the Sec. 179D deduction is based on the amount of annual energy savings and whether prevailing wage and apprenticeship standards have been met. A base deduction with a sliding scale starts at 54 cents per sq. ft., provided an energy savings of 25% has been achieved. An additional deduction of 2 cents per sq. ft. Is allowed for each additional percentage point of energy savings achieved above the 25% baseline, up to a maximum of $1.07 per sq. ft. For energy savings of 50% or more (see Sec. 179D(b)(2) after amendment by the Inflation Reduction Act and Rev. Proc. 2022-38). By reducing the baseline annual energy savings percentage requirements from 50% to 25% and adding a sliding scale, the new rules expand the deduction opportunity to include older properties, for which owners previously had difficulty achieving the 50% energy savings threshold.

If the prevailing wage and apprenticeship standards are met, the amounts described previously are significantly increased. The sliding scale starts at $2.68 per sq. ft., provided the requisite 25% energy savings baseline has been achieved. The additional deduction for each additional percentage point of energy savings above the 25% baseline is 11 cents per sq. ft., up to a maximum of $5.36 per sq. ft. For energy savings of 50% or more (see new Sec. 179D(b) (3) and Rev. Proc. 2022-38). Consistent with prior law, the amount of the deduction is also limited to the amount spent for the improvements, regardless of whether the prevailing wage and apprenticeship standards are met.

To meet the prevailing wage standards under new Sec. 179D(b)(4), laborers and mechanics employed by the taxpayer, or any contractor or subcontractor, are to be paid wages at rates that meet or exceed the prevailing wage for that locality. The prevailing wage standards are maintained by the Department of Labor. Prevailing wages are established both by job type and by locality and will likely be different for projects that take place in different parts of the United States. As such, a number of questions arise. For example, it is unclear whether additional guidance in the form of a safe harbor(s) will be issued to alleviate the difficulty for building owners of monitoring the payment of wages by contractors and subcontractors.

Additional guidance is necessary to define the apprenticeship requirements of Sec. 179D(b)(5) and is forthcoming. The rules will be similar to the rules in Sec. 45(b)(8), which largely require that a certain percentage of hours be performed by qualified apprentices (i.e., 12.5% of hours in 2023 and 15% in 2024 and after).

The new rules also modified the standard used to measure energy savings. ASHRAE Standard 90.1 is now used to determine if there has been a reduction in total annual energy and power costs. This standard provides the minimum requirements for energy-efficient design of most buildings and, notably, does not include low-rise residential buildings. Under prior law, the most recent ASHRAE Standard 90.1 affirmed by the IRS not later than two years prior to the date when construction of the building began was used as the baseline to determine energy savings. Under Sec. 179D(c)(2) as amended, the new baseline is ASHRAE Standard 90.1-2007 or, if more recent, the ASHRAE Standard 90.1 from four years prior to when the building was placed in service. The new rules provide a more definitive frame of reference for taxpayers by using the placed-in-service date of the building rather than the date construction began.

Under prior law, the deduction cap of $1.88 per sq. ft. (as adjusted for inflation) also served as a lifetime limitation on the amount of Sec. 179D deduction that could be taken with respect to any specific building. There is no lifetime limitation under the new rules. Rather, the deduction allowed in the current year is reduced by the amount of any Sec. 179D deduction that was taken for that building in the immediate three preceding tax years (four years in the case of buildings owned by a governmental or tribal entity or taxexempt organization; see Sec. 179D(b)(1) (B) ). As a result, periodically undertaking energy-efficient projects allows for an additional benefit under the new rules.

Alternative deduction for retrofits

Under prior law, the retrofitting of many older buildings was not eligible for the Sec. 179D deduction because the 50% energy savings threshold could not be met. The new law provides two amendments that make it easier for these retrofits to be eligible for a Sec. 179D deduction. First, the sliding scale discussed above under Sec. 179D(b)(2) provides a benefit for older properties that could only achieve the lower threshold of 25% or more in energy savings.

Second, Sec. 179D(f) adds a new alternative deduction for retrofits that is elective on a building-by-building basis. Under this alternative, the level of energy usage, rather than the level of energy cost, is used to determine the extent the building is more energy-efficient. To make this computation, the building’s specific level of energy usage intensity (EUI) before the retrofit is measured against the building’s EUI after the retrofit to determine a percentage reduction in annual energy usage. The same sliding scale described above is used to determine the amount of incentive allowed. The amount of this incentive is limited to the cost of the energyefficient property placed in service. Using the building’s own energy usage as a baseline helps taxpayers with older buildings that cannot meet the contemporary one-size-fits-all ASHRAE Standard 90. 1 to qualify for a deduction.

This alternative requires a “qualified retrofit plan” that specifies the modifications to the building that are expected to reduce the building’s EUI by 25% or more. No governmental agency is required to review or approve the plan, although it must be certified by a professional (e.g., an architect or engineer). Under this alternative, the Sec. 179D deduction is not taken when the property is placed in service but rather is allowed one year later, upon the completion of a “final certification” establishing the percentage reduction in annual energy usage.

Expanded opportunity under Sec. 179D

As this item shows, the Inflation Reduction Act’s modifications and new provisions under Sec. 179D create additional tax savings opportunities for taxpayers that invest in energy-efficient building construction projects. As summarized in the table “Sec. 179D — Current vs. Prior Law,” these provisions broaden the scope of taxpayers eligible for the deduction. It would be sensible for taxpayers to evaluate the new rules under Sec. 179D as part of their annual tax planning to identify tax savings opportunities.

Editor Notes

Greg A. Fairbanks, J.D., LL.M., is a tax managing director with Grant Thornton LLP in Washington, D.C. Contributors are members of or associated with Grant Thornton LLP. For additional information about these items, contact Mr. Fairbanks at 202-521-1503 or greg.fairbanks@us.gt.com.