- tax clinic

- partners & partnerships

Partnership extraordinary-item treatment for accounting method adjustments

Related

TEFRA petition filing deadline is jurisdictional

Prop. regs. would make permanent safe harbor for furnishing information on Sec. 751 property

IRS updates FAQs on business interest limitation, premium tax credit

Editor: Christine M. Turgeon, CPA

The regulations under Secs. 481(a) and 706 separately set forth rules governing a partnership’s treatment of accounting method changes and partner allocations but do not provide clear guidance on how income from an unfavorable Sec. 481(a) adjustment should be allocated among partners with varying interests during the four-year recognition period. This uncertainty raises questions as to determining the amounts of each partner’s Sec. 704(b) account, tax capital account, and outside tax basis in its partnership interest.

Also, guidance is lacking as to determining the U.S. federal income tax consequences of Sec. 481(a) adjustments upon a sale of a partnership interest — i.e., Sec. 743(b) basis adjustments, allocations of Sec. 743(b) basis adjustments among the partnership’s assets under Sec. 755, and Sec. 751 ordinary-income recognition. Improper reporting could result in the IRS’s making adjustments and determining that the partnership has an imputed underpayment liability under the centralized partnership audit rules of the Bipartisan Budget Act of 2015 (BBA), P.L. 114-74.

Example: AB, a two-person partnership on the cash method of accounting, admits a new partner C, a publicly traded corporation, to form the equal ABC partnership. The only asset of the AB partnership is an unrealized receivable. Because Partner C is a C corporation, the partnership must change to an accrual method of accounting under Sec. 448(a).

A taxpayer changing one or more methods of accounting generally must compute an adjustment under Sec. 481(a). This Sec. 481(a) adjustment is the amount necessary to prevent amounts from being duplicated or omitted as a result of the method change. In this example, assume the change in method of accounting results in a $300 unfavorable Sec. 481(a) adjustment (i.e., an increase to the partnership’s taxable income) that is recognized ratably over a period of four tax years. How the income associated with the Sec. 481(a) adjustment should be allocated among the partners in each year is unclear.

Sec. 481(a) and Sec. 706 background

Rev. Proc. 2015-13, Section 3.15, indicates that an accounting method change is effective as of the beginning of the tax year in which the change is made. Additionally, under the accounting method rules, the taxpayer immediately adjusts its tax basis in the assets and liabilities subject to the change for 100% of the Sec. 481(a) adjustment, even though the income from an unfavorable Sec. 481(a) adjustment generally is spread over four tax years (Regs. Sec. 1.481-1; Rev. Proc. 2015-13, §7.03).

Regulations under Sec. 706 provide rules for determining partners’ distributive shares of partnership items when a partner’s interest in a partnership varies during a tax year (Regs. Sec. 1.706-4(a)(1)). (A separate set of rules applies for allocable cash-basis items. Although it is unclear whether a Sec. 481(a) adjustment is an allocable cash-basis item, this discussion assumes that the allocation of the adjustment is governed by the general principles of Regs. Sec. 1.706-4.) These rules generally permit the partnership to allocate the items between the prevariation and post-variation periods using either a proration method or an interim closing-of-the-books method. Partnerships using the proration method apply special rules to so-called extraordinary items that cannot be prorated.

Partnerships instead must allocate these items in proportion to partners’ interests in the partnership at the time of day on which the extraordinary item occurred (Regs. Sec. 1.706-4(e)). The regulations include as an extraordinary item the items relating to an accounting method change that is initiated by the filing of the appropriate form after a variation occurs (Regs. Sec. 1.706-4(e) (2)(v)).

Accounting method changes generally require IRS consent. The IRS provides automatic consent for method changes for certain types of items (see Rev. Proc. 2015-13, §6.03(1), and Rev. Proc. 2022-14). However, changes for which automatic consent is not specifically provided (nonautomatic changes) are subject to a formal IRS consent process. Nonautomatic changes require Form 3115, Application for Change in Accounting Method, to be filed within the tax year of the requested change, while the Form 3115 for automatic changes of accounting methods may be filed within the year of change and through the due date (including extensions) for filing the partnership’s tax return for the tax year of change.

In the example above, the admission of Partner C is not the initiation of the method; rather, it is related to an automatic change of accounting method that was filed by the partnership after the variation occurred. Thus, Sec. 706 likely would treat the adjustment as an extraordinary item that is allocated among the partners in proportion to their interests at the time of day on which the extraordinary item occurred (i.e., day 1 of the year of change).

For nonautomatic changes of accounting methods, if the variation occurs after the filing of Form 3115, the partners within the partnership may agree to use either the closing-of-the-books method or the proration method under Regs. Sec. 1.706-4(a)(3)(iii). Whichever method is selected ultimately will affect how the income associated with the Sec. 481(a) adjustment is allocated among the partners in the partnership. However, if the variation occurred prior to filing the Form 3115, then the income recognized from the Sec. 481(a) adjustment will be allocated among the partners in a similar manner regardless of the method selected, due to the extraordinary-item rules.

If a Sec. 481(a) adjustment is treated as an extraordinary item, the year 1 adjustment likely would be allocated proportionately among the original partners in the partnership on day 1 of year 1 (i.e., Partners A and B), with no allocation to Partner C in the first year. It is not clear, however, how the Sec. 481(a) adjustment would be allocated among the partners in years 2 through 4.

Partnership allocation approaches

The partnership’s journal entry recorded on its tax basis balance sheet would be a debit to accounts receivable for 100% of the Sec. 481(a) adjustment on day 1 of year 1 and a credit to taxable income for 25% of the Sec. 481(a) adjustment. However, there are three possible approaches to allocating the other 75% of the Sec. 481(a) adjustment in years 2 through 4 to the credit side of the journal entry.

Specifically, the credit side of the journal entry might be recorded to (1) equity (the equity approach); (2) a liability (the liability approach); or (3) an accounts receivable contra-asset account (the contra-asset approach). The approach taken would affect how the income associated with the Sec. 481(a) adjustment is allocated among the partners in the partnership in years 2 through 4, which would have ripple effects across the partnership, including on the partners’ Sec. 704(b) and tax capital accounts, outside tax basis, and Sec. 743(b) basis adjustments.

Equity approach: Under the equity approach, the partnership would credit equity for the entire Sec. 481(a) adjustment on day 1 of year 1 (i.e., increasing Sec. 704(b) and tax capital of the partners inside the partnership). This approach would create a mismatch between each of the partners’ inside and outside tax bases because the partnership reflects the entire basis related to the adjustment on day 1 of year 1, but the partner does not recognize all of the income on day 1 of year 1.

As a result, this method would create a disparity between inside and outside tax bases until year 4, when the Sec. 481(a) income has been fully recognized by the partnership, increasing the partners’ outside tax bases. A partnership that adopts the equity approach potentially could double-count income related to the Sec. 481(a) adjustment, distorting Sec. 704(b) and tax capital accounts.

The table “Equity Approach Adjustments,” below, in which Partner C is admitted to the partnership as a one-third partner, giving rise to a Sec. 481(a) adjustment, illustrates the tax accounting for this approach when applied appropriately.

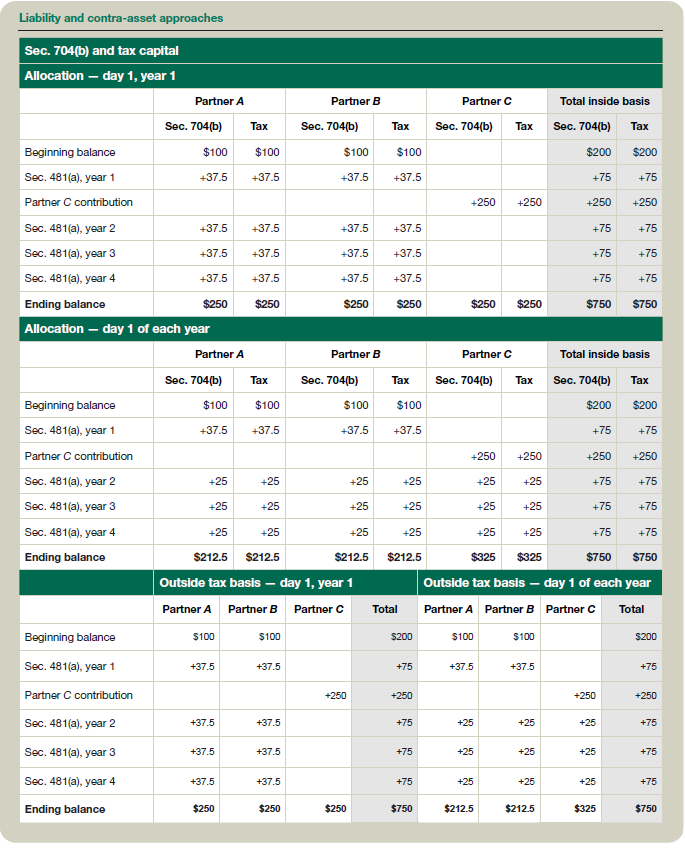

Liability approach: The liability approach would treat the Sec. 481(a) adjustment as a liability, representing future taxable income to be recognized by the partnership. A partnership adopting this approach would record the unrecognized 75% of the adjustment on day 1 of year 1 by crediting a Sec. 481(a) liability. As the partnership recognizes the income in years 2 through 4, it would debit the Sec. 481(a) liability and credit income. As shown in the “Liability and Contra-Asset Approaches” tables, below, this approach would not create any distortion between inside and outside tax bases of the partners; therefore, it would eliminate the risk of double-counting the income in the Sec. 704(b) and tax capital accounts.

A Sec. 481(a) adjustment that is credited as a liability under the liability approach likely would not be deemed to meet the definition of a partnership liability for purposes of Sec. 752. Specifically, the Sec. 481(a) liability would not qualify as an “obligation” under Regs. Sec. 1.752-1(a)(4)(ii) unless it created “a fixed or contingent obligation to make payment.” While the Sec. 481(a) liability would obligate the partnership (and, ultimately, the partners) to take the liability amount into future taxable income, it would not itself create a payment obligation (which might depend, for example, on the tax characteristics of the partners). Even for taxable partners, the tax liability owed would be only a fraction of the Sec. 481(a) liability face amount (depending on the taxpayer’s tax rate). The 75% of the Sec. 481(a) adjustment would be deferred under the procedural accounting method rules of Rev. Proc. 2015-13, and the passing of time would cause it to be recognized.

However, even if the Sec. 481(a) liability is not considered a Sec. 752 liability, it still could be treated as a liability under another provision of the Internal Revenue Code and could be appropriately recorded on the partnership’s tax basis balance sheet. If the unrecognized 75% of the Sec. 481(a) adjustment is deemed a liability under a separate Code provision and is not a Sec. 752 liability, then it likely would not be reported out to the partners on their Schedules K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc., because Secs. 752(a) and 752(b) provide that the allocation of a Sec. 752 liability is treated as a deemed contribution and a deemed distribution of cash that is reflected in the partners’ outside tax bases.

The liability approach may provide a partnership greater flexibility than the equity approach for allocating income associated with the Sec. 481(a) adjustment among the partners in the later years. The accounting method change would be treated as an extraordinary item under Sec. 706, but Sec. 706 does not stipulate how it should be allocated among partners in the post-change period. Thus, the partnership may be able to allocate the associated income only to those entities that were partners on day 1 of year 1 (assuming that they remain as partners) or to all of the partners in years 2 through 4, regardless of whether they were partners on day 1 of year 1.

Contra-asset approach: Under the contra-asset approach, the partnership would credit an accounts receivable contra-asset for the unrecognized 75% of the Sec. 481(a) adjustment. Similar to the liability approach, the partnership would debit the accounts receivable contra-asset account and credit taxable income as the income is recognized. The contraasset approach should eliminate the risk of double-counting the income adjustment in the capital accounts because it would avoid disparities between partner inside and outside tax basis. Additionally, the contraasset approach should eliminate any question around the qualification of the Sec. 481(a) adjustment as a tax liability because the partnership would not reflect a liability on its tax basis balance sheet.

The partnership’s entries in its Sec. 704(b) and tax capital accounts would be identical under either the liability approach or the contra-asset approach, as illustrated in the “Liability and Contra-Asset Approaches” tables. The contra-asset approach potentially could conflict with the principles of Sec. 481(a), which require the partnership to increase the tax basis of the relevant assets and liabilities on day 1 of year 1 (i.e., as reflected under the equity approach). The contra-asset approach would appear to create additional taxable income if the partnership sells the adjusted asset prior to the end of the Sec. 481(a) adjustment spread period. As a result, strict application of the contraasset approach could undermine the four-year deferral period of Sec. 481(a) adjustments.

Other considerations and implications

Much of the uncertainty around a partnership’s treatment of accounting method changes relates to the lack of guidance on how income associated with the adjustment is allocated among the partners of a partnership in years 2 through 4. As discussed above, under the equity approach, 100% of the Sec. 481(a) adjustment would be reflected in the Sec. 704(b) and tax capital accounts in year 1. As a result, the regulations under Sec. 704(b) provide that the Sec. 481(a) income recognized in years 2 through 4 should be allocated in a manner that corresponds with the day 1, year 1, equity journal entry. However, the liability and contra-asset approaches reflect only 25% of the Sec. 481(a) adjustment in the year 1 Sec.704(b) and tax capital accounts. This discrepancy in capital account balances creates significant differences between the approaches upon a sale or exchange of a partnership interest.

Sale or exchange of partnership interest: If a partnership spreads the Sec. 481(a) adjustment ratably over four years, additional issues arise if one partner (the seller) sells all or part of its partnership interest to a new partner (the buyer) during year 2 of the fouryear tax period. If the partnership has a Sec. 754 election in effect, it is not clear how the unrecognized 75% of the Sec. 481(a) adjustment would affect the buyer’s Sec. 743(b) basis adjustment or whether the buyer would step into the seller’s share of the unrecognized Sec. 481(a) income. If a partnership determines that the buyer steps into the seller’s share of the unrecognized Sec. 481(a) income, then the unrecognized income associated with the Sec. 481(a) adjustment would be allocated to the buyer under the hypothetical liquidation construct of Sec. 743(b); accordingly, the Sec. 481(a) adjustment would increase the buyer’s Sec. 743(b) basis adjustment.

If the unrecognized Sec. 481(a) income is included in the Sec. 743(b) adjustment calculation, it is unclear whether the basis adjustment then could be allocated to the deferred Sec. 481(a) adjustment. For example, in the equity approach, the partnership would not record a Sec. 481(a) asset or liability that could be offset by a Sec. 743(b) adjustment. Under the liability approach, the partnership would elect to record a Sec. 481(a) liability for the unrecognized amount of the adjustment in the year of change, but it is unclear whether a buyer’s Sec. 743(b) basis adjustment could be allocated to offset a liability. (Sec. 755 and its regulations describe allocations of basis adjustments among the partnership’s “property.”) If the partnership instead chooses to apply the contraasset approach, the recognition of the Sec. 481(a) income and the release of the Sec. 743(b) basis adjustment would align.

Similar questions surround the potential application of Sec. 751 to the unrecognized Sec. 481(a) income item. Sec. 751 and its regulations are intended to prevent partners from avoiding their shares of partnership ordinary income, but Sec. 751 generally measures ordinary-income amounts by reference to partnership property. As noted above, it is unclear whether the Sec. 481(a) adjustment could qualify as property for this purpose. If the deferred income from a Sec. 481(a) adjustment is not captured within the framework of Sec. 751, then it could be seen as undercutting the principal purpose of Sec. 751 by allowing a partner to exit a partnership with capital gain treatment without having to recognize its share of Sec. 481(a) ordinary income.

BBA centralized partnership audit regime: Finally, what are the implications to a partnership’s using one of the above approaches under the BBA centralized partnership audit procedures? In light of the uncertainties set forth above, the IRS might seek to challenge partnership items under the BBA regime. For example, the IRS might adjust partnership items and determine an imputed underpayment if it disagrees with the partners’ allocations of the income relating to the Sec. 481(a) adjustment. It might then determine that the unrecognized Sec. 481(a) income is not a liability with respect to a partnership adopting the liability approach and challenge the liability reporting on the partners’ Schedules K-1. Or it could challenge a buyer’s Sec. 743(b) adjustment, having determined that a Sec. 481(a) adjustment should not be taken into account when computing the basis adjustment.

Planning for extraordinaryitem treatment

As illustrated above, how the income that arises from an unfavorable Sec. 481(a) adjustment is allocated among the partners of a partnership has direct consequences, but it also affects ancillary partnership items such as Sec. 743(b) basis adjustments, Sec. 751 ordinary-income recognition, and potential imputed underpayment tax liabilities under the BBA rules. Partners that are negotiating a transaction should consider and stipulate how the parties intend to treat the unrecognized Sec. 481(a) adjustment income to prevent potential disagreements among the partners surrounding the allocation of future income and its effect on Sec. 743(b) basis adjustments and Sec. 751 ordinary income. However, without IRS guidance, partnerships could struggle to proactively address risk under the BBA regime.

Editor Notes

Christine M. Turgeon, CPA, is a partner with PricewaterhouseCoopers LLP, Washington National Tax Services, in New York City. For additional information about these items, contact Turgeon at christine.turgeon@pwc.com. Contributors are members of or associated with PricewaterhouseCoopers LLP.