- tax clinic

- partners & partnerships

Impact of business interest expense limitation regs. on partner redemptions

Related

IRS seeks to scrap basis‑shifting TOI reporting regulations

Partner redemptions from ‘dry’ partnerships

Death of an LLC member: Basic tax considerations

Editor: Kevin Anderson, CPA, J.D.

The already considerable challenge of properly characterizing and reporting partnership redemption transactions has only grown more Byzantine due to new basis adjustments under Sec. 163(j). These basis adjustments include those for partners under Regs. Sec. 1.163(j)-6(h), finalized and revised in September 2020 by T.D. 9905 (the final regulations), and those for partnerships under corresponding Prop. Regs. Sec. 1.163(j)-6(h)(5) that were proposed, also in September 2020, under REG-107911-18 (the proposed regulations). This item analyses two related examples of partner redemptions — with and without Sec. 163(j) basis adjustments — to highlight and clarify both the existing and new issues.

Background

The Sec. 163 final regulations provide, in part, that a partner reduces their basis in their partnership interest, but not below zero, by the amount of excess business interest expense (EBIE) allocated to them. Additionally, if a partner disposes of their interest in the partnership, the regulations provide that immediately before the disposition, the partner will get an outside basis addback for the excess, if any, of the previous basis reductions for EBIE over the amounts the partner has been able to deduct as business interest expense paid or accrued.

For partial dispositions, the final regulations adopt a taxpayer-friendly proportionate approach, generally providing that the EBIE addback will be fractionally allowed, based on the ratio of the fair market value (FMV) of the transferred interest over the total predisposition FMV. However, note that in the case of a partner redemption, the final regulations require a complete redemption, as they explicitly state that “a disposition includes a distribution of money or other property by the partnership to a partner in complete liquidation of its interest in the partnership” (Regs. Sec. 1.163(j)-6(h)(3); emphasis added).

On Sept. 14, 2020, the government issued the proposed regulations to address some complex issues that warranted additional study and comments from the public. Prop. Regs. Sec. 1.163(j)-6(h)(5) creates a corresponding partnership basis adjustment upon partner dispositions (partnership Sec. 163(j) basis adjustment). This adjustment ensures inside and outside basis parity. The partnership basis adjustment is generally allocated in the same manner as a Sec. 734(b) basis adjustment to capital gain property, except that the partnership Sec. 163(j) basis adjustment is never depreciable or amortizable, even if the underlying property to which the adjustment is assigned is depreciable or amortizable. If the disposition was the complete redemption of a partner by the partnership, whether via a distribution of money or other property, the partnership Sec. 163(j) basis adjustment is made among the properties only after the partnership has allocated its Sec. 734(b) basis adjustment. While these rules ultimately reflect a taxpayer-favorable result, they do increase the compliance burden on tax practitioners.

From a tax perspective, partner redemptions already represent one of the most complex equity transactions a partnership can engage in. Specifically, tax practitioners must navigate the rules for Secs. 731 through 736 and Sec. 751 to properly characterize “redemption” distributions. In general, the rules of Sec. 751(b) apply first to the portion of the distribution that is treated as a sale or exchange of Sec. 751 property (hot assets). Any Sec. 751(b) gain will be ordinary in character and can apply to either the redeemed partner or the partnership, depending on the facts. Additionally, the amounts of Sec. 751(b) gain can vary depending on whether the final or proposed regulations under Sec. 751 are used.

The proposed regulations under Sec. 751 (REG-151416-06) can only be applied before they are finalized through publication in the Federal Register if the relevant time and consistency rules enumerated in the preamble are met. In general terms, Regs. Sec. 1.751-1 requires a deemed distribution and sale approach to calculating gain related to hot assets, while Prop. Regs. Sec. 1.751-1 allows for a comparison of each partner’s potential hot asset gain immediately before and after the distribution. Tax practitioners would be well advised to assess the potential difference in results between the final and proposed Sec. 751 regulations. Once the hot asset portion of any gain is isolated, Secs. 731 through 736 then apply to determine the tax treatment of the remaining amount of the distribution (Regs. Sec. 1.751-1(b)(1)(iii)).

This general ordering is somewhat muddied by the fact that Sec. 751(b) does not apply to Sec. 736(a) payments to the extent they are treated as a distributive share of partnership income or a guaranteed payment (Regs. Sec. 1.751-1(b)(4)(ii)). Secs. 731 through 736 determine the type of payment being made, whether gain or loss should be recognized, and whether a step-up or step-down in basis is necessary, for both the partner and the partnership.

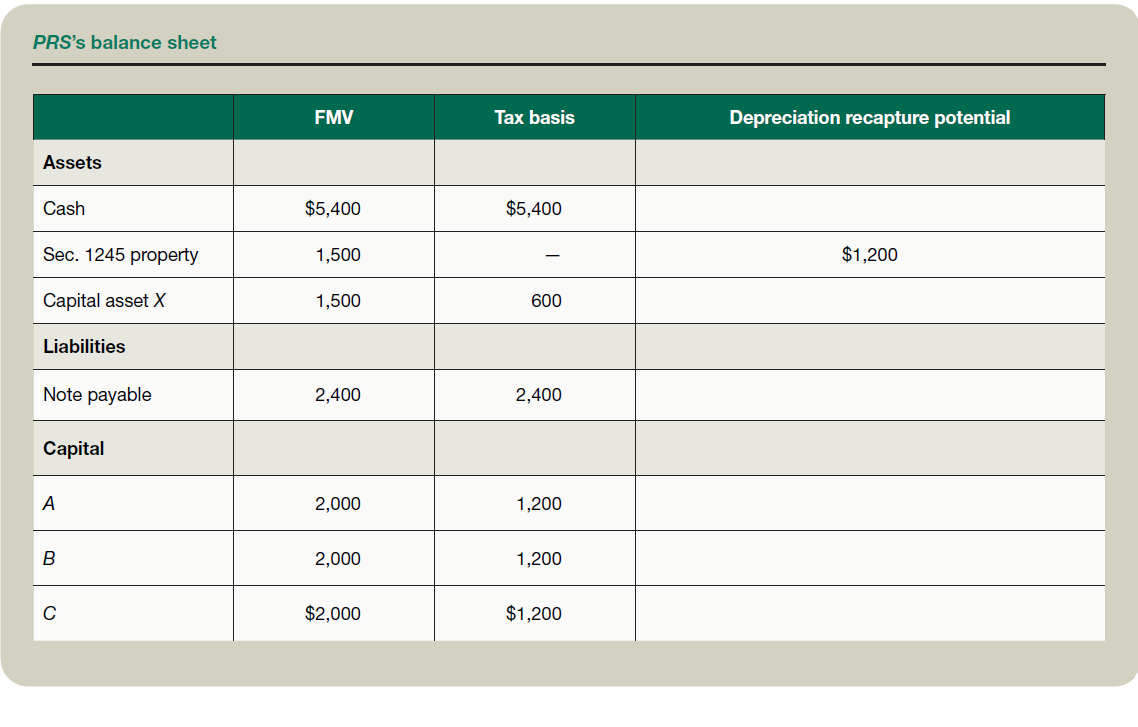

Example 1: Using the framework established above, this example illustrates a relatively straightforward partner redemption before adding the complexity of the Sec. 163(j) basis adjustments. Assume the following facts:

- Partnership PRS has three equal partners — A, B, and C — who made cash contributions to acquire their interests upon formation;

- Each partner’s outside basis immediately before the distribution is $2,000, including $800 of liabilities allocated to the partners under Sec. 752;

- PRS will make a $2,000 distribution to Partner C in complete liquidation of their interest in PRS;

- Sec. 736(a) does not apply to this distribution;

- PRS will elect to apply Prop. Regs. Sec. 1.751-1 when determining the Sec. 751(b) gain for Partner C;

- PRS will make a valid Sec. 754 election for the current tax year;

- PRS’s business interest expense paid and accrued has always been deductible in full (i.e., no prior EBIE); and

- The balance sheet of PRS immediately before the liquidating distribution to Partner C is as shown in the chart “PRS’s Balance Sheet,” below.

As described above, start by applying the rules of Sec. 751 and then applying the rules of Secs. 731 through 736. Since PRS has chosen to apply Prop. Regs. Sec. 1.751-1, it measures Partner C’s share of Sec. 751 unrealized gain before the redemption as $400 ($1,200 of Sec. 1245 recapture × Partner C’s one-third interest) and share of Sec. 751 unrealized gain after the redemption as $0 (Partner C is redeemed for cash and so does not receive any hot assets in the distribution). As a result, Partner C will recognize + $400 of Sec. 751(b) gain immediately before the liquidating distribution and increase their outside basis in their partnership interest by $400. PRS also increases its basis in the Sec. 1245 property by $400, ensuring that partners A and B will not recognize the ordinary income already picked up by Partner C.

Since the example assumes that Sec. 736(a) does not apply, the full $2,000 paid to Partner C will be treated as a payment to which Sec. 736(b) applies. Immediately before the liquidating distribution, Partner C’s outside basis was $2,000; after recognizing the gain of $400 under Sec. 751(b), the outside basis will be increased to $2,400. Partner C will thus recognize an additional $400 of gain under Sec. 731(a)(1) ($2,000 of cash proceeds + $800 of liability relief – $2,400 of outside basis).

Since PRS has a Sec. 754 election in effect, it will also receive a basis step-up under Sec. 734(b)(1)(A) for the $400 of Sec. 731(a)(1) gain recognized by Partner C. PRS determines the assignment of that basis adjustment among its assets under the rules of Sec. 755. Since the adjustment is triggered by a cash distribution, it can only be assigned to capital gain property (Regs. Sec. 1.755-1(c) (1)(ii)). In general, the Sec. 755 regulations divide property into two buckets: capital gain property (which consists of capital assets and Sec. 1231 property) and ordinary income property (anything that is not capital gain property). In the case of hot assets, the regulations require a bifurcation of the asset between the unrealized receivable portion of the asset, which is treated as ordinary income property, and the rest of the asset, which is treated as capital gain property (Regs. Sec. 1.755-1(a)(1)). In this example, the Sec. 1245 property’s depreciation recapture potential is treated as a separate asset from the rest of the Sec. 1245 property.

Once the total increase to capital gain property is determined, increases in basis are allocated among capital gain property, based first on its relative unrealized appreciation and then on its relative FMV, if the basis step-up exceeds unrealized appreciation. The Sec. 1245 property has an FMV of $1,500, a tax basis of $0, and a depreciation recapture of $1,200. Since the asset has to be bifurcated into its capital gain and ordinary income components, there is only $300 of capital gain appreciation ($1,500 FMV – $800 of Sec. 751 gain potential – $400 tax basis). Note that the $400 Sec. 751(b) basis adjustment that PRS recorded occurred first, so depreciation recapture potential has decreased by $400 and tax basis has increased by $400, but total capital gain appreciation on the Sec. 1245 property is unchanged from before the Sec. 751(b) basis adjustment.

Capital asset X has $900 of capital gain appreciation ($1,500 FMV – $600 tax basis). Total capital gain appreciation is thus $1,200, of which the Sec. 1245 property has 25% of the appreciation ($300 Sec. 1245 property capital gain appreciation ÷ $1,200 total capital gain appreciation), and capital asset X has the remaining 75% of appreciation ($900 capital asset X appreciation ÷ $1,200 total capital gain appreciation). This results in the $400 Sec. 734(b) adjustment being assigned among the properties: $100 to the Sec. 1245 property ($400 Sec. 734(b) adjustment × 25% share of total capital gain property appreciation) and $300 to capital asset X ($400 Sec. 734(b) adjustment × 75% share of total capital gain appreciation).

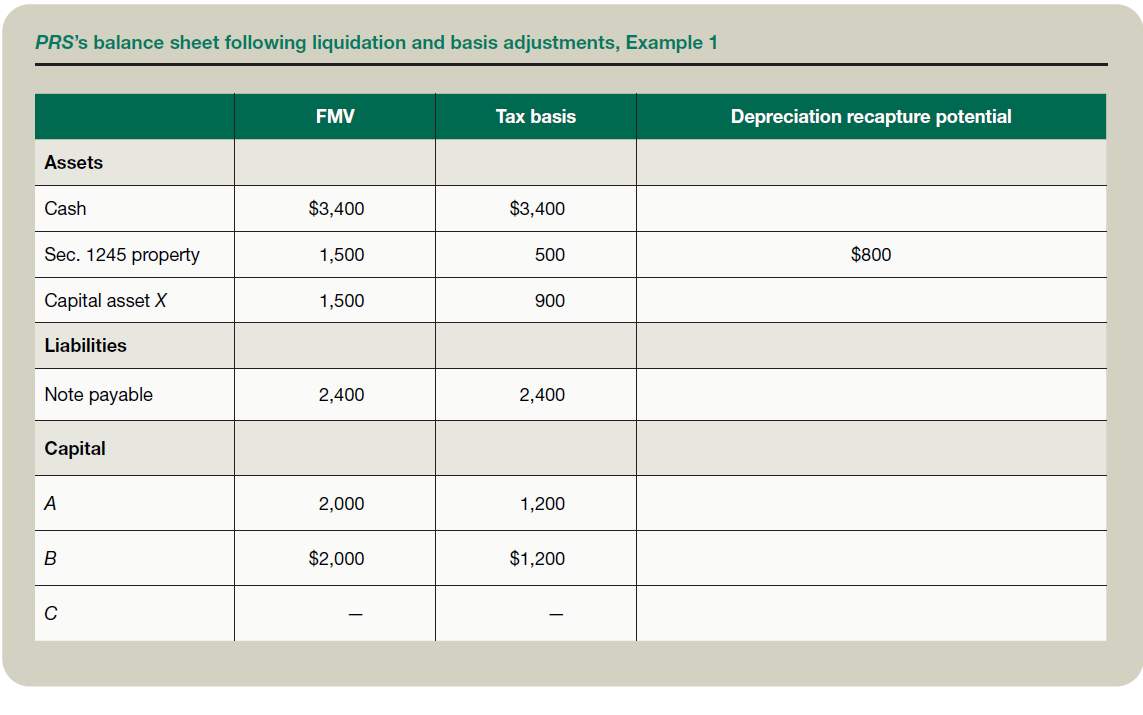

Note that if the Sec. 734(b) adjustment exceeded total unrealized appreciation of $1,200, the excess would be allocated based on the properties’ relative FMVs. The increase in basis on the Sec. 1245 property is treated as newly purchased recovery property, and PRS may use any applicable recovery period and method for that specific asset, other than bonus depreciation under Sec. 168(k) (Regs. Secs. 1.168(k)-2(b)(3)(iv)(C) and 1.734-1(e)(1)). Immediately following the liquidating distribution and the basis adjustments, PRS’s balance sheet is as shown in the chart “PRS’s Balance Sheet Following Liquidation and Basis Adjustments, Example 1,” below.

Now that there is an understanding of how the rules operate in the absence of the new Sec. 163(j) basis adjustments, Example 2 illustrates how those adjustments complicate the analysis.

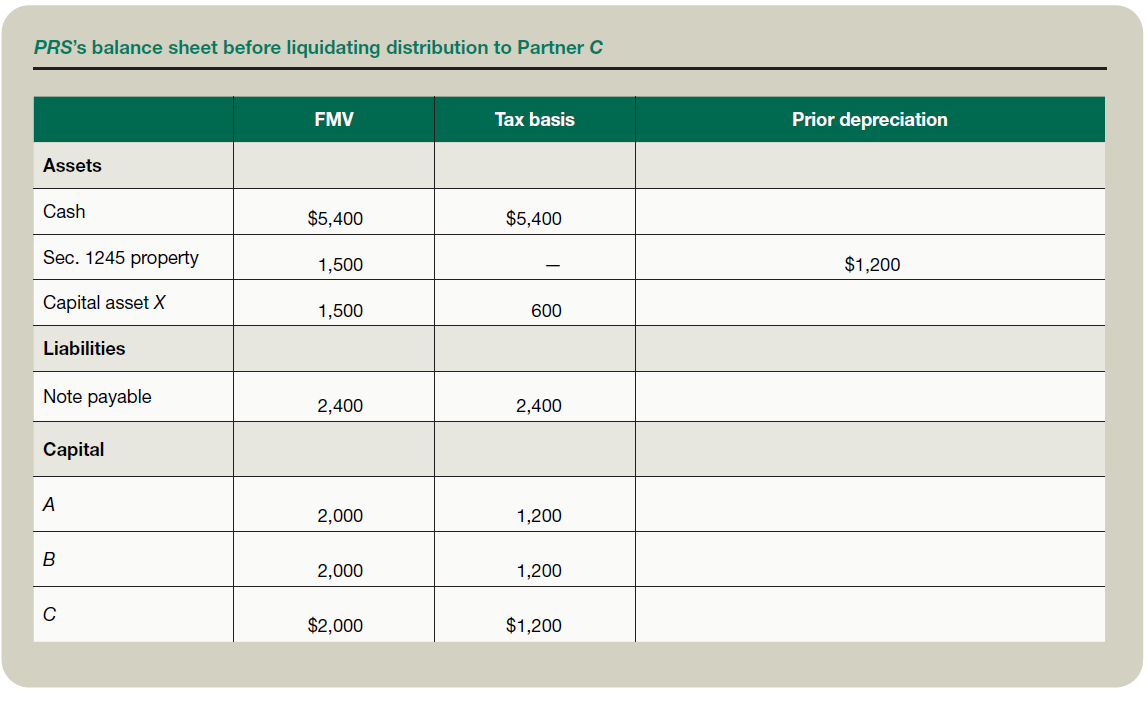

Example 2: Assume the same facts as Example 1, except that PRS has previously paid $300 of interest that was allocated $100 each to the partners as EBIE and has not been deducted by the partners as business interest expense paid or accrued. The balance sheet of PRS immediately before the liquidating distribution to Partner C is as shown in the chart “PRS’s Balance Sheet Before Liquidating Distribution to Partner C,” below.

Partner C’s Sec. 751(b) gain is unchanged from Example 1 at $400, since their share of unrealized hot asset gain remains $400 before the distribution and $0 after. Their adjusted outside basis immediately after the Sec. 751(b) gain recognition is $2,400 ($2,000 outside basis immediately before distribution + $400 of Sec. 751(b) gain recognized). As with Example 1, PRS receives a corresponding $400 step-up in its basis in the Sec. 1245 property.

This now leads to the first complicating factor from the Sec. 163(j) basis adjustments. Since Partner C has $100 of EBIE that they have not previously been able to deduct as business interest expense paid or accrued, they are entitled to an outside basis increase immediately before their redemption under Regs. Sec. 1.163(j)-6(h)(3). The $100 basis increase ensures that Partner C will not ultimately suffer a basis decrease for a deduction they never benefited from. Partner C’s final outside tax basis immediately before the distribution is $2,500 ($2,400 outside basis after Sec. 751(b) gain recognition $100 Regs. Sec. 1.163(j)-6(h)(3) basis adjustment).

Partner C must then compute their Sec. 731(a)(1) gain by taking their cash proceeds of $2,000 plus their liability relief of $800 against their outside basis of $2,500, resulting in $300 of gain. Partner C’s Sec. 731(a)(1) gain triggers a corresponding basis adjustment to PRS under Sec. 734(b)(1)(A) for the same amount, $300. PRS’s Sec. 734(b) basis adjustment must then be allocated among its capital gain properties. Since the relative capital gain appreciation is identical to that of Example 1, the $300 adjustment is allocated $75 to the Sec. 1245 property ($300 Sec. 734(b) adjustment × 25% share of total capital gain appreciation) and $225 to capital asset X ($300 Sec. 734(b) adjustment × 75% share of total capital gain appreciation).

Under Prop. Regs. Sec. 1.163(j)-6(h) (5), PRS is also entitled to a $100 basis adjustment, corresponding with Partner C’s basis adjustment under Regs. Sec. 1.163(j)-6(h)(3). Since this transaction was a distribution in complete liquidation of the partner, the partnership Sec. 163(j) basis adjustment must be allocated among PRS’s capital gain properties only after the Sec. 734(b) basis adjustment has been allocated among them. In the Example 2 facts, there was originally $1,200 of unrealized appreciation from capital gain property, split $300 and $900 between the Sec. 1245 property and capital asset X, respectively. Since the Sec. 734(b) adjustment consumed only $300 of the total unrealized appreciation in capital gain property, $900 of unrealized appreciation remains. Since the partnership Sec. 163(j) basis adjustment is only $100, which is less than the $900 remaining unrealized appreciation in capital gain property, the full $100 will be allocated in the 25% and 75% ratios to the Sec. 1245 property and capital asset X, respectively. This ratio would change only if the basis adjustment exceeded the remaining unrealized appreciation, since the partnership Sec. 163(j) basis adjustment follows the same allocation rules as a Sec. 734(b) basis adjustment to capital gain property.

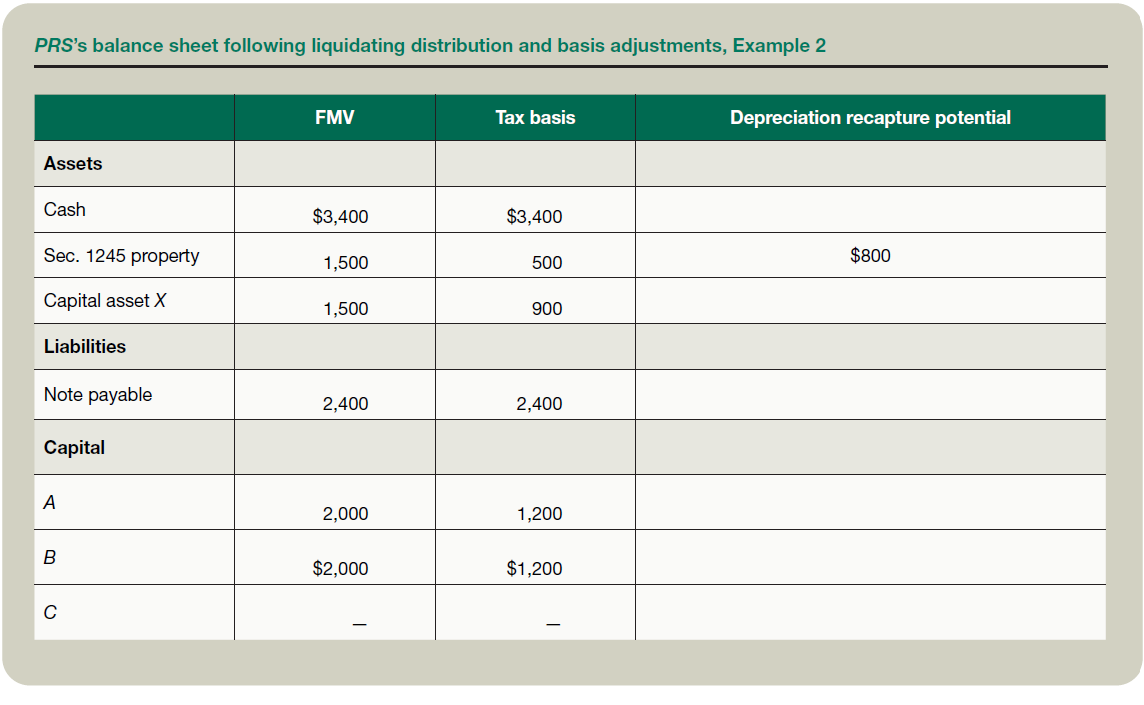

Thus, the $100 partnership Sec. 163(j) basis adjustment is split $25 to the Sec. 1245 property ($100 total basis adjustment × 25% remaining share of capital gain property unrealized appreciation) and $75 to capital asset X ($100 total basis adjustment × 75% remaining share of capital gain property unrealized appreciation). Immediately following the liquidating distribution and the basis adjustments, PRS’s balance sheet is as shown in the chart “PRS’s Balance Sheet Following Liquidating Distribution and Basis Adjustments, Example 2,” below.

The final balance sheet in total is identical between Example 1 and Example 2. However, in Example 1 the Sec. 734(b) basis adjustment to the Sec. 1245 property was $100, and the full amount would be eligible for depreciation deductions. On the other hand, in Example 2 the Sec. 734(b) basis adjustment to the Sec. 1245 property is only $75. While the $75 of Sec. 734(b) basis adjustment is eligible for depreciation, the $25 partnership Sec. 163(j) basis adjustment assigned to the Sec. 1245 property is not. The identical post-distribution balance sheets thus obscure a difference in the timing and character of future income and deduction items.

Considering whether to apply the proposed regulations

The proposed regulations’ approach of not allowing depreciation or amortization on a partnership Sec. 163(j) basis adjustment is consistent with preserving the proper character of the EBIE. To illustrate, in Example 2, Partner C may have a permanent cash flow reduction, compared with a situation where the interest expense had been deductible. This is because, if the interest expense had become deductible, it would have been an ordinary deduction to Partner C, but the basis increase under Regs. Sec. 1.163(j)-6(h)(3) will only offset capital gain or increase capital loss on the partnership interest sale/ redemption.

Thus, Partner C could have a 17% disparity in cash flow in a situation where the interest is deducted, versus a situation where they only get the basis add-back, assuming ordinary and capital gains tax rates of 37% and 20%, respectively. Essentially, that becomes the true cost of the Sec. 163(j) limitation to Partner C. If the proposed regulations allowed for depreciation on the partnership Sec. 163(j) basis adjustment, they could effectively convert at least a portion of the nondeductible interest expense allocated to Partner C to depreciation expense allocated among the remaining partners. This would seem to contravene the whole purpose of the Sec. 163(j) limitation, so the disallowance of depreciation or amortization on the adjustment makes sense.

Both examples illustrate the complexity of partnership redemption transactions with and without the impact of the proposed regulations and final regulations. The examples also ignore potentially complicating factors such as preexisting Sec. 704(c) layers and multitier partnership complexities.

Tax practitioners should take note that, while the actual carryover and tracking of EBIE will generally occur at the partner level, the partnership must be able to determine how much EBIE remains for each partner upon a partial or full disposition of a partnership interest. Since practitioners in nontiered structures do not have to otherwise track this information, they will need to decide whether to be proactive and track it annually or gather it only when an actual disposition occurs. While this item focuses specifically on redemption transactions, partnership interest sales and partnership terminations can also give rise to Sec. 163(j) basis adjustments. Given that, and the changes to the adjusted taxable income computations for tax years beginning after Dec. 31, 2021, many partnerships are likely to be affected by these basis adjustments.

The final regulations require the partner basis adjustment under Regs. Sec. 1.163(j)-6(h)(3) to be made; however, the partnership Sec. 163(j) basis adjustment exists only under the proposed regulations. The proposed regulations can be applied by taxpayers as long as Prop. Regs. Sec. 1.163(j)-6 is applied consistently and all the rules are applied to that tax year and all subsequent tax years. In general, given that the partnership Sec. 163(j) basis adjustment can only be positive, taxpayers are likely to benefit from applying the proposed regulations to any year where they have a potential basis adjustment. However, for tiered partnership structures, careful consideration should be given to the full breadth of the rules under Prop. Regs. Sec. 1.163(j)-6(j) before committing to applying the proposed regulations in full.

Editor notes

Kevin Anderson, CPA, J.D., is a managing director, National Tax Office, with BDO USA LLP in Washington, D.C.Contributors are members of or associated with BDO USA LLP. For additional information about these items, contact Anderson at 202-644-5413 or kdanderson@bdo.com.