- tax clinic

- expenses & deductions

M&A pitfalls for deferred research expenditures

Related

Deductibility of transaction costs incurred by an indirectly acquired entity

IRS issues guidance on treaty application to reverse foreign hybrids

Practical tax issues related to qualified reopenings

Editor: Kevin Anderson, CPA, J.D.

Before the enactment of the 2017 law known as the Tax Cuts and Jobs Act (TCJA), P.L. 115-97, taxpayers could deduct expenditures related to research or experimental (R&E) activities immediately. Although a taxpayer could choose to amortize the expenditures under Sec. 174(b) or 59(e), that was not the default rule.

Effective for amounts paid or incurred in tax years beginning after Dec. 31, 2021, the TCJA replaced the text of Sec. 174 and, among other changes, requires taxpayers to amortize R&E expenditures over five or 15 years (depending on whether the expenditures relate to foreign research activities). Although the change may appear to be purely a timing difference, taxpayers that engage in common merger-and-acquisition (M&A) transactions may find that the deductions are passed to the buyer or lost altogether. Taxpayers with significant deferred R&E expenditures should take care to avoid losing these deductions if possible.

As of this writing, Treasury and the IRS have issued minimal guidance on current Sec. 174, and future guidance may provide more clarity or different results than what is detailed in this item.

Former Sec. 174

Prior to the TCJA, former Sec. 174(a) allowed the immediate deduction of R&E expenditures paid or incurred during a tax year. Taxpayers had the option of amortizing R&E expenditures for 60 months or more. To qualify for this elective deferral treatment, the expenditures had to meet several criteria, including that they be “chargeable to capital account but not chargeable to property of a character which is subject to the allowance under section 167 … or section 611” (former Sec. 174(b)(1)(C)).

To the extent R&E expenditures were deferred in this manner, the deferral increased the taxpayer’s basis in the related property, and to the extent they were subsequently deducted, the basis in property was correspondingly reduced (Sec. 1016(a)(14)). If a taxpayer deferred R&E deductions under former Sec. 174(b) and subsequently abandoned the related project, it could potentially claim a loss under Sec. 165.

Taxpayers also had a second option to amortize R&E expenditures that would otherwise be deductible over a 10-year period (Sec. 59(e)). A similar adjustment to the taxpayer’s basis in its property was made for R&E expenditures deferred and subsequently deducted under Sec. 59(e). Although the TCJA did not modify Sec. 59(e), the effects of the interaction between the requirements of Sec. 59(e) and current Sec. 174 are not entirely clear, and the election under Sec. 59(e) may not be available for some or all R&E expenditures paid or incurred in tax years beginning after Dec. 31, 2021.

Post-TCJA Sec. 174

The current text of Sec. 174(a)(2) now requires taxpayers to “charge [R&E] expenditures to capital account” and amortize the deductions related to these expenditures over five years (or 15 years for expenditures relating to “foreign research”). The amortization begins at the midpoint of the tax year in which the expenditures were incurred.

Current Sec. 174(d) also changes the treatment of dispositions or abandonment of property related to deferred R&E expenditures. Instead of realizing a loss on disposition or abandonment, the taxpayer is not allowed any deduction and must continue amortizing R&E expenditures.

The language requiring deferred R&E expenditures to be charged to capital account in both former Sec. 174(b) and current Sec. 174(a) could lead taxpayers to infer that the treatment of deferred R&E expenditures in that respect is the same under both provisions. However, in Rev. Proc. 2023-11 the IRS took the position that R&E expenses deferred under former Sec. 174(b) increase a taxpayer’s basis in the related property, while expenses deferred under current Sec. 174(a) do not result in a change in basis and are simply tracked in a separate R&E account.

Although the statute’s text is not free from uncertainty, the IRS’s position is consistent with the addition of current Sec. 174(d), the removal in current Sec. 174 of the reference to Sec. 1016 (adjustments for basis), and the fact that Sec. 1016 was not amended and therefore still refers to former Sec. 174(b)(1). As a result, rather than use basis to offset gain or create a loss on the disposition of a taxpayer’s assets, the taxpayer must continue to amortize the deductions, even if the taxpayer no longer has an operating business.

Implications for specific M&A transactions

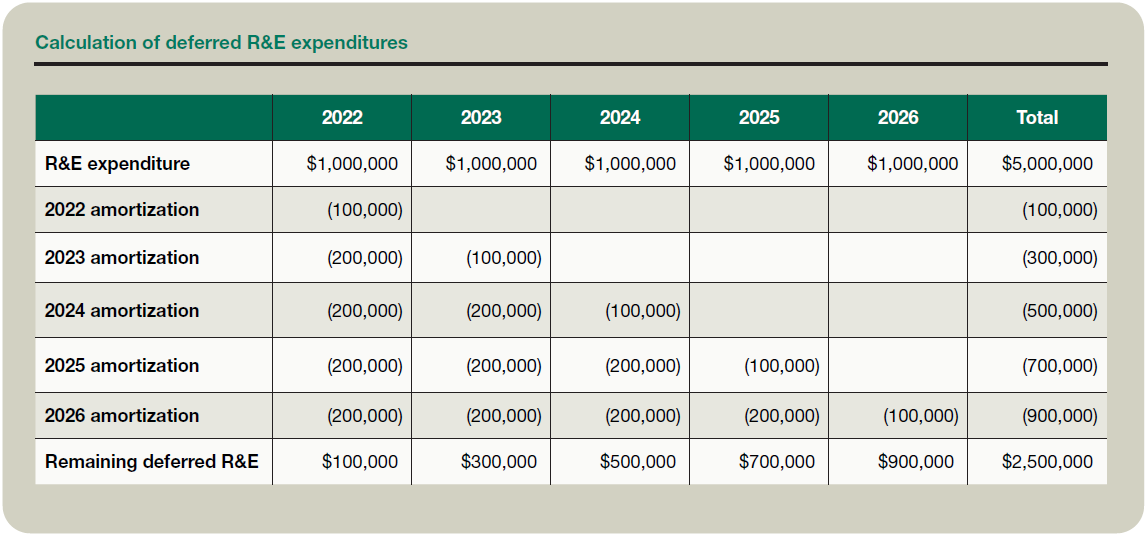

For purposes of the examples discussed below, assume the following facts unless otherwise noted. XYZ Co. Is a C corporation using the calendar year as its tax year and is not a member or the parent of a consolidated group. The corporation has a single owner, M, who is an individual and a U.S. resident. XYZ Co. Has incurred $1 million of R&E expenditures in each of the years 2022, 2023, 2024, 2025, and 2026, all of which were paid in cash during the tax year. None of the R&E expenditures are chargeable to property that would be subject to depreciation under Sec. 167, related to foreign research within the meaning of current Sec. 174(a)(2)(B), or eligible for an election under Sec. 59(e). As of Jan. 1, 2027, XYZ Co. Has $2.5 million of R&E expenditures deferred under current Sec. 174 (see the chart, “Calculation of Deferred R&E Expenditures”).

Example 1. Corporate stock sale: On Jan. 1, 2027, M sells 100% of his stock in XYZ Co. To Buyer in exchange solely for cash. Although XYZ has incurred $2.5 million in remaining deferred expenditures (thereby reducing the purchase price or cash available to M) and not deducted them, no acceleration of the R&E deferral is available.

Unless M can negotiate a higher purchase price based on the R&E attribute’s tax value, he will lose the tax benefit for the R&E expenditures incurred. It is worth noting that for Sec. 382 purposes, deferred R&E expenditures would not be treated as pre-change losses when deducted in future years (see Sec. 382(d)).

Example 2. Corporate asset sale: On Jan. 1, 2027, XYZ Co. Sells all its assets to Buyer, including any assets relating to the deferred R&E expenditures. In return, XYZ Co. Receives cash and an assumption of XYZ’s liabilities. Under current Sec. 174, XYZ Co. Did not increase its basis in assets for deferred R&E expenditures (as it would have under former Sec. 174), and therefore its gain would not be reduced for the deferred expenditures.

Assuming XYZ does not liquidate (either de facto or actually), it would continue amortizing the R&E expenditures. The allowed amortization deduction of $900,000 of R&E expenditures for 2027 could be used to offset any gain from the asset sale. However, $1.6 million of R&E expenditures would be cumulatively deducted in years 2028, 2029, 2030, and 2031. If XYZ does not have any operations or other sources of income, it will be unable to utilize these losses in the year of the deduction, and current law does not allow for a net operating loss carryback (other than for certain farming and insurance company losses; see Sec. 172(b)(1)(A), as amended by the TCJA).

If XYZ does liquidate (either actually or de facto), then the taxable Sec. 331 liquidation would result in the elimination of the deferred R&E deductions.

Example 3. S corporation stock sale with Sec. 338 election: Assume that XYZ Co. Is an S corporation. Assume also that XYZ Co.’s inside basis in assets is equal to M’s outside basis in XYZ Co., except for the difference caused by deferral of R&E expenditures (in other words, M’s outside basis is $2.5 million greater than XYZ’s basis in identifiable assets, on account of XYZ’s not yet deducting the deferred R&E expenditures but having already paid them). On Jan. 1, 2027, M sells 100% of his stock in XYZ Co. To Buyer in exchange for cash. M and Buyer jointly make an election under Sec. 338(h)(10).

XYZ is treated as selling its assets to an unrelated party in exchange for cash and the assumption of XYZ’s liabilities (Regs. Sec. 1.338(h)(10)-1(d) (3) ). XYZ is then treated as transferring the proceeds received from the sale to M and liquidating (Regs. Sec. 1.338(h) (10) -1(d)(4)). The deemed liquidation would be taxable under Sec. 331, and M would recognize any gain or loss on his shares of XYZ Co. Since M’s outside basis is $2.5 million higher than XYZ’s inside asset basis, he may be able to take a $2.5 million capital loss on the deemed liquidation (Secs. 1001(a) and 1221(a)). In addition, there would be no carryover of tax attributes, and the deferred R&E deductions would be eliminated.

Example 4. S corporation asset sale: The facts are the same as in Example 2, except that XYZ Co. Is an S corporation. Assume also that XYZ Co.’s inside basis in the assets is equal to M’s outside basis in XYZ Co., except for the difference caused by the deferral of R&E expenditures (i.e., M’s outside basis is $2.5 million greater than XYZ’s basis in identifiable assets, on account of XYZ’s not yet deducting the deferred R&E expenditures but having already paid them).

If XYZ does not liquidate following the sale, it will continue to amortize and deduct the $2.5 million of R&E expenditures through 2031. Assuming XYZ distributes all the sale proceeds, M would still have $2.5 million of basis in the XYZ stock. As such, he may be able to deduct the R&E expenditures as they are amortized, leading to a significantly better outcome than in Example 3 despite otherwise similar transactions. However, M may have limitations on the deductions under the excess business loss (Sec. 461(l)) and/or passive activity loss (Sec. 469) rules. Moreover, he may not have other income to offset the deductions.

Example 5. Nonrecognition transactions: M and XYZ Co. May also want to engage in nonrecognition transactions. If XYZ Co. Was a subsidiary of another corporation, it may liquidate following the sale in a transaction that would qualify under Sec. 332. Alternatively, if XYZ was an S corporation and M wanted to bring on a new private-equity investor, XYZ may contribute its assets to a new company under Sec. 351 or Sec. 721.

Whether XYZ Co.’s deferred R&E expenditures would carry over to an acquiring corporation, stay with XYZ Co., or be eliminated (if XYZ liquidated) is far from clear. In certain nonrecognition transactions, some of a corporate taxpayer’s attributes may carry over to the acquiring corporation (Sec. 381(a)). Such nonrecognition transactions include Sec. 332 liquidations and some reorganizations under Sec. 368(a)(1). Although Sec. 381 applies only to certain transactions and lists only specific tax attributes, the regulations under Sec. 381 leave open the possibility that a successor corporation could potentially have attributes carry over in a transaction to which Sec. 381 does not apply or have attributes not listed in Sec. 381 carry over (Regs. Sec. 1.381(a)-1(b)(3)). In Philadelphia & Reading Corp., 602 F. 2d 338 (Ct. Cl. 1979), the taxpayer was able to carry over capitalized mining exploration and development costs to a subsidiary in a Sec. 351 transaction.

Relying in part on that case, the IRS issued a private ruling (Letter Ruling 201033014) allowing R&E expenditures deferred under Sec. 59(e) to be carried over in a Sec. 351 “drop-down” followed by a divisive reorganization under Secs. 368(a)(1)(D) and 355.

Based on these authorities, it may be possible for a taxpayer to carry over deferred R&E expenditures in nonrecognition transactions. However, absent clearer guidance, taxpayers may need to request a private letter ruling to do so.

Structuring transactions in light of new Sec. 174

Although much of the attention paid to current Sec. 174 has focused on the required change from deducting to amortizing R&E expenditures, the less obvious changes to the treatment of deferred R&E expenditures when the underlying assets are disposed of create serious pitfalls and traps for the unwary. Taxpayers entering into M&A transactions should be aware that they could permanently lose the deferred deductions and, when possible, should structure into transactions that reduce the risk of losing these attributes. Buyers likewise should understand whether the deferred expenditures will carry over after the acquisition and whether that makes a stock purchase more attractive than an asset purchase.

Editor notes

Kevin Anderson, CPA, J.D., is a managing director, National Tax Office, with BDO USA LLP in Washington, D.C.Contributors are members of or associated with BDO USA LLP. For additional information about these items, contact Anderson at 202-644-5413 or kdanderson@bdo.com.