- column

- TAX PRACTICE RESPONSIBILITIES

Understanding the updated tax ethical standards

Related

CPA firm M&A tax issues

Return preparer reliance on third-party tax advice

IRS broadens Tax Pro Account for accounting firms and others

Editor: James Sansone, CPA

To promote ethical behavior in the accounting profession, a code of professional conduct is necessary. The AICPA Code of Professional Conduct (the AICPA Code) was developed to guide CPAs in their professional responsibilities when performing services. Generally, the AICPA Code applies to all services performed by a member. However, specific AICPA guidance exists for specific services, such as the Statements on Auditing Standards for auditing services and the subject of this column, the Statements on Standards for Tax Services (SSTSs). Because state boards of accountancy are responsible for issuing CPA licenses or permits, the states decide whether they will adopt the AICPA Code or develop a code of professional responsibilities of their own. Many states have adopted the AICPA Code, which means that CPAs licensed in those states must apply the AICPA Code when performing services.

The AICPA’s newly revised SSTSs are enforceable ethical standards that AICPA members must follow when performing tax services. The SSTSs were originally issued in 2000 and updated in 2009. In 2018, the AICPA undertook a revision project to reorganize the existing SSTSs and add new standards to keep pace with the evolving CPA profession (see Holets, “AICPA Finalizes New Standards on Tax Positions,” 54-8 The Tax Adviser 44 (August 2023), and “Proposed AICPA Tax Standards Address New Concerns,” 53-11 The Tax Adviser 48 (November 2022)). The previous SSTSs will be archived in an easy-to-navigate structure. The revised SSTSs are effective Jan. 1, 2024.

This article provides a general overview of the revised SSTSs. Sample cases are included as practical illustrations of how to apply the revised tax standards.

Background

The new revised SSTSs are organized in four parts:

- SSTS No. 1, General Standards for Members Providing Tax Services

- SSTS No. 2, Standards for Members Providing Tax Compliance Services, Including Tax Return Positions

- SSTS No. 3, Standards for Members Providing Tax Consulting Services

- SSTS No. 4, Standards for Members Providing Tax Representation Services

SSTS No. 1 contains general standards that apply to members providing all types of tax services. It includes Advising on Tax Positions (§1.1), Knowledge of Errors (§1.2), Data Protection (§1.3), and Reliance on Tools (§1.4).

SSTS No. 2 contains standards that apply to members providing tax compliance services. Tax compliance services include preparation of original returns, amended returns, claims for refund, and information returns. It also contains standards on Tax Return Positions (§2.1), Tax Return Questions (§2.2), Reliance on Information From Others (§2.3), Use of Estimates (§2.4), and Departure From Previous Positions (§2.5).

SSTS No. 3 contains standards that apply to members providing tax consulting services. A “tax consulting engagement” is a service whereby the CPA is hired solely to provide tax advice on a specific issue.

SSTS No. 4 contains standards that apply to members providing tax representation services. A “tax representation engagement” generally involves representing a taxpayer before a tax authority in either a tax examination or appeals process.

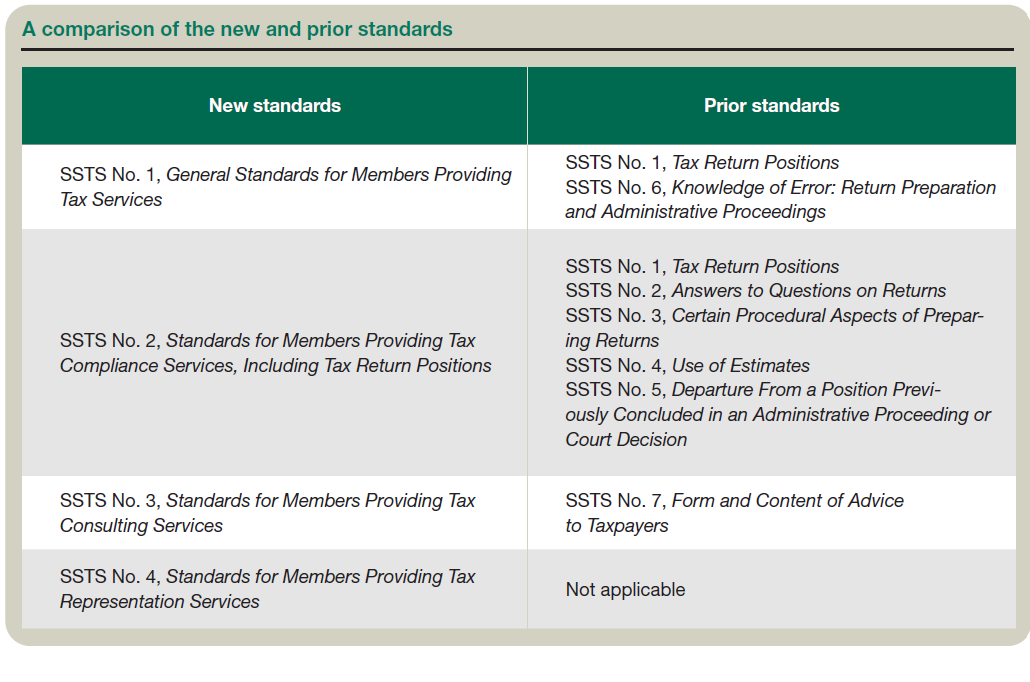

The table “A Comparison of the New and Prior Standards,” below, compares the new revised tax standards and related prior SSTSs. The revised SSTSs have added new standards on data protection, reliance on tools, and tax representation services.

Practical illustrations

In each of the following sample cases, the revised SSTSs are used to address the CPA’s professional responsibilities in the performance of services. Only issues related to professional standards are discussed. Specific technical issues are not addressed.

Case 1: Tax compliance services

Two brothers formed a partnership for their plumbing business. They indicate that they have filed “most” of their partnership returns but do not recall the last year they filed. They need help filing all tax returns the IRS requires; however, they did not keep accurate books and records. Although all bank statements are available, some cash expenses do not appear on the bank statements. The brothers indicate that they can provide estimated costs for direct material, direct labor, and other operating expenses.

The CPAs are hired to prepare tax returns for the missing tax years. Because the clients have unfiled tax returns, it is the CPAs’ responsibility to promptly inform the clients of this and recommend that the missing tax returns should now be filed (¶1.2.6, SSTS No. 1). The CPAs should also advise the clients of the consequences of the errors, such as tax deficiencies and potential penalties. If the clients refuse to file the missing returns, the CPAs should consider withdrawing (¶1.2.7, SSTS No. 1). In a case in which the client is unwilling to comply, the CPAs are still subject to confidentiality rules and cannot inform the taxing authority without the clients’ consent (¶1.2.8, SSTS No. 1).

Other issues that the CPAs should be aware of are their responsibilities related to the clients’ lack of proper recordkeeping. Generally, CPAs may use estimates if they exercise professional judgment (¶¶2.4.2 and 2.4.3, SSTS No. 2). CPAs can rely on information without verification but should make reasonable inquiries about the information provided (¶2.3.2, SSTS No. 2). Further, CPAs should take reasonable steps to ensure the client responds to requests for information needed to prepare a complete and accurate tax return (¶2.2.2, SSTS No. 2).

Another issue to be mindful of is the CPA’s ability to sign the return. As discussed in Paragraph 2.1.6 of Section 2.1 of SSTS No. 2, “a member should not prepare or sign the tax return unless the member has a good-faith belief that the tax return position has at least a realistic possibility of being sustained administratively or judicially on its merits if challenged.” Alternatively, a member may sign a return containing a tax return position in which “(i) the member concludes there is a reasonable basis for the tax return position, and (ii) the position is appropriately disclosed to the taxing authorities.” In analyzing the possibility of a successful tax position, CPAs should look at the primary sources of tax law: statutory, administrative, and judicial. The more sources CPAs have to support a tax position, the stronger the likelihood it will be sustained on its merits.

Case 2: Tax representation services

A licensed cannabis dispensary and cultivator operates as a C corporation. It received its state dispensary license in 2016 and its cultivator license in 2018. For tax year 2018, the C corporation deducted not only the cost of goods sold but also other business expenses. For tax years 2019 and 2020, the corporation claimed only a cost-of-goods-sold deduction. The IRS examined the corporate tax returns for tax years 2018–2020, examining details of sales, cost of goods sold, and other business expenses. The IRS disallowed all business expenses for 2018 but allowed the cost-of-goods-sold deductions for tax years 2018, 2019, and 2020.

In this case, the CPA is hired to represent the client in an IRS examination. As part of the CPA’s compensation for the representation engagement, the corporation’s CFO proposed a bartering transaction with the CPA; the CPA would receive product from the cannabis dispensary’s inventory.

The CPA determines that the tax return for 2018 is incorrect because it contains nondeductible expenses. Because the client filed the tax return with errors and it is now the subject of an administrative proceeding, it is the CPA’s responsibility to promptly inform the client of the potential consequences of the error and recommend corrective action (¶1.2.6, SSTS No. 1). The CPA is not allowed to inform the taxing authority of an error without the taxpayer’s permission (¶1.2.8, SSTS No. 1).

Because this is a tax representation engagement, the CPA will also refer to SSTS No. 4, Standards for Members Providing Tax Representation Services, for guidance. In addition to SSTS No. 4, the CPA should also follow other guidance that governs representation services, such as U.S. Treasury Department Circular 230, Regulations Governing Practice Before the Internal Revenue Service (31 C.F.R. Part 10).

Tax representation is a niche service. For that reason, the CPA should obtain technical competence by attending continuing education seminars on the topic or becoming involved in a technical tax committee with the state CPA society (¶4.1.3, SSTS No. 4). The CPA should act with integrity and professionalism when dealing with the IRS (¶4.1.5, SSTS No. 4). If the CPA becomes aware that the client’s conduct may be fraudulent or criminal, the CPA can consider withdrawing from the engagement (¶4.1.7, SSTS No. 4). At the conclusion of the tax audit, the CPA is required to review the tax authority’s findings with the client and discuss the consequences (¶4.1.8, SSTS No. 4).

Another problematic issue is the proposed bartering of the client’s inventory. Normally, CPAs are free to barter; however, because this inventory is still considered illegal on a federal basis, this type of arrangement could be considered a discreditable act or other ethical violation.

The CPA should also consider other factors when representing clients, such as (1) obtaining an understanding with the client regarding objectives and terms of the engagement through an engagement letter; (2) obtaining the taxpayer’s power of attorney; (3) determining if a requested representation service is considered an unauthorized practice of law; (4) determining if a CPA license or registration in another jurisdiction is required; and (5) determining if the CPA may encounter a conflict of interest (¶4.1.9, SSTS No. 4).

Case 3: Tax consulting services

V and Associates LLC is a single-member LLC in which V is the managing member and currently owns 100%. The firm is currently treated as a sole proprietorship for tax purposes. V is considering admitting one of his associates, M, as an equity member. In exchange for services, M will receive a 20% interest in V and Associates. The fair market value of services rendered by M in exchange for the LLC interest is $20,000. V needs tax consulting services in order to analyze the tax consequences for all parties involved, including the entity.

In this case, the CPA is hired to provide tax consulting services. For guidance, the CPA will refer to SSTS No. 3 for tax consulting standards, in addition to SSTS No. 1 for general standards. The CPA should use professional judgment to ensure the tax advice is competent (¶3.1.2, SSTS No. 3). Further, the CPA must follow the same guidance for tax positions as discussed in Section 2.1 of SSTS No. 2 when providing tax consultation services (¶3.1.4, SSTS No. 3). The CPA can communicate the tax advice orally or in writing (¶3.1.3, SSTS No. 3); however, best practice suggests that communication in writing is the preferred method. The CPA does not have additional professional responsibilities to communicate the impact of subsequent events (¶3.1.5, SSTS No. 3).

Additionally, the CPA should advise the client that tax advice is based on the CPA’s understanding of the client’s facts and the applicable laws existing on the date that the advice is provided. Although subsequent changes in the law or other developments could affect previously rendered advice, the CPA does not have an obligation to update the previously issued advice (¶¶3.1.5 and 3.1.11, SSTS No. 3).

If the CPA intends to provide advice to M as well as V, or if M is a former tax client of the CPA, there is likely a conflict of interest. The CPA should consider the information in “Ethical Conflicts” (ET §1.000.020) of the AICPA Code as well as Section 10.29 of Treasury Circular 230.

Key takeaways from these examples

The sample cases illustrate how to apply the revised SSTSs. Note that each case addressed three key issues in professional tax ethics: (1) the tax position on a tax return; (2) client confidentiality; and (3) due professional care in performance of duties. As with real-life scenarios, each case had its own set of facts and ethical considerations. In practice, it is important to remember to analyze each case carefully and apply the relevant standards accordingly.

New standards on data protection and reliance on tools

Technology allows CPAs to perform their services efficiently and effectively. CPAs also possess sensitive client data. Paragraph 1.3.4 of Section 1.3 of SSTS No. 1 states that “[a] member should make reasonable efforts to safeguard taxpayer data, including data transmitted or stored electronically.” Encrypting files with strong passwords is an effective method to protect clients’ data (¶1.3.7, SSTS No. 1). CPAs are free to use electronic tools or outsource certain tasks if they make reasonable efforts to ensure that the client’s data is protected (¶1.3.8, SSTS No. 1). CPAs must also consider applicable privacy laws and industry standards for data protection (¶¶1.3.5 and 1.3.7, SSTS No. 1).

CPAs can rely on electronic tools such as tax preparation software and online tax research libraries (¶1.4.2, SSTS No. 1); however, CPAs are required to exercise due professional care when relying on an electronic tool, and the use of such a tool does not absolve members of their professional responsibilities under the AICPA Code or other applicable ethical standards (¶¶1.4.3 and 1.4.4, SSTS No. 1).

Key takeaways from the SSTS revisions

The objective of the SSTS revision project was to reorganize the existing standards to make them easier to navigate and apply in practice. Additionally, new standards were added to address reliance on electronic tools and data protection. As the profession continues to evolve, so will the tax standards. The new revised structure will make it easier to add new standards as necessary.

Professional standards are necessary to guide CPAs in the performance of their professional responsibilities. CPAs must remember to perform all services with due professional care and exercise sound professional judgment.

Contributors

Luis Plascencia is a CPA practitioner who also teaches at City Colleges of Chicago and serves on the state board of accountancy in Illinois (Illinois Board of Examiners). James Sansone, CPA, is a managing director at RSM US LLP. Both Plascencia and Sansone are members of the AICPA Tax Practice Responsibilities Committee. For more information on this column, contact thetaxadviser@aicpa.org.