- feature

- partners & partnerships

Surprisingly taxable partnership distributions

Related

Partner redemptions from ‘dry’ partnerships

Death of an LLC member: Basic tax considerations

Penalties under codified economic substance doctrine upheld

In general, distributions from a partnership do not result in a taxable transaction and generally only reduce the partner’s basis in their partnership interest. Unfortunately, this is not always true, and some very unexpected taxable transactions may result from the distribution of money or property from the partnership.

Consistent with flowthrough entity treatment, taxes on partnership income are paid by partners as the income is earned, regardless of whether any income is distributed. As a result, any eventual property and/or monetary distributions, except for excess money distribution as discussed below, from a partnership generally do not create taxable income to the recipient partner.

However, multiple exceptions can create taxable income causing taxpayers problems when they are not adequately planned for, such as contributions of liabilities to a partnership or changes in the terms of a liability.

Each of the following can result in the creation of taxable income for the recipient partner, and in some cases the partnership itself will have taxable income that will flow through to the partners, even to partners who are not receiving a distribution:

- A distribution of money in excess of the basis in the partnership interest (Sec. 731(a));

- A distribution of marketable securities, as described in Sec. 731(c);

- A reduction in share of partnership liabilities, as described in Sec. 752(b);

- A distribution of property involving a disguised sale, as described in Sec. 707(a) (2)(B);

- A distribution of property with precontribution gains, as described in Secs. 704(c) and 737; and

- A disproportional distribution, as defined in Sec. 751(b).

This article discusses each of these items further and provides illustrative examples.

Distribution of money

It is always extremely important to properly track a partner’s basis in the partnership interest. Tracking basis is especially important when dealing with the distribution of money or anything that is defined to be treated as money for purposes of the Code because, under Sec. 731(a), a distribution of money will result in the creation of taxable income when a partner receives a distribution greater than the tax basis of the partner’s interest in the partnership (hereinafter, outside basis).

Unfortunately, the definition of “money” in the Code is much more expansive than just the actual distribution of currency. Distributions of “money” can include the distribution of marketable securities or a decrease in the partner’s allocated share of liabilities resulting from either a reduction in the partner’s share of partnership liabilities or from the contribution of individual liabilities to a partnership by the partner.1

More detailed discussion and examples of these distributions treated as money follow, beginning with distributions of marketable securities.

Distribution of marketable securities

A partnership should be careful when distributing marketable securities as defined by Sec. 731(c)(2) since the fair market value (FMV) of such securities is treated as “money” for purposes of Sec. 731(a), with limitations found in Sec. 731(c)(3)(B).

Example 1: The AB Partnership distributed all of Marketable Security Q to A, a 50% partner, in a current distribution and all of the land it owns to partner B. All assets were purchased by the partnership. These assets had equal FMVs at the time of distribution, but the distributions create different tax results for the two partners.

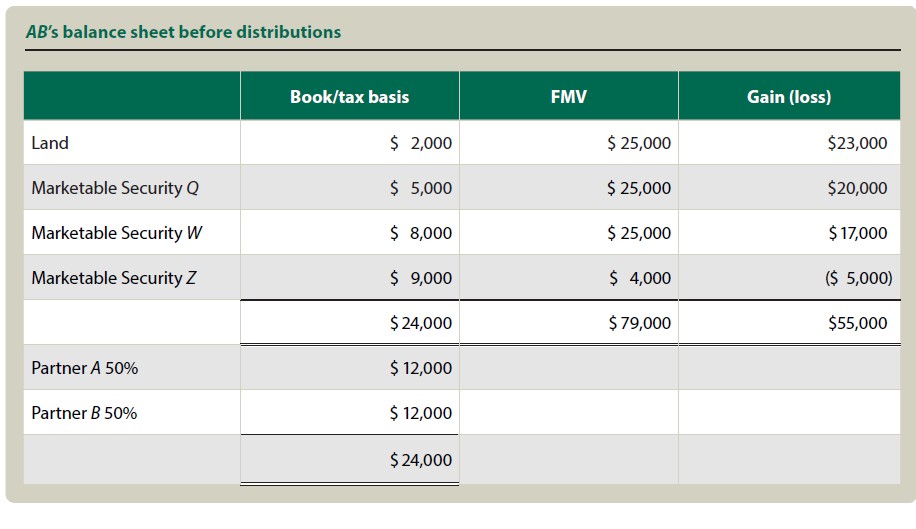

The AB Partnership balance sheet just before the distributions is shown in the table “AB’s Balance Sheet Before Distributions.”

Assume that A’s basis and B’s basis in their partnership interests was $12,000 each just prior to the distributions. Sec. 731(c), with limitations, states that the FMV of the marketable securities distributed will be treated as money for purposes of Sec. 731(a), and therefore gain will have to be recognized to the extent that the amount distributed exceeds the partner’s outside basis. The distribution of the land is governed by Sec. 733, and the basis of the land to B by Sec. 732. The distribution of the land falls under the general rules for property distributions and does not result in any gain being recognized. It is strictly a substituted-basis transaction.

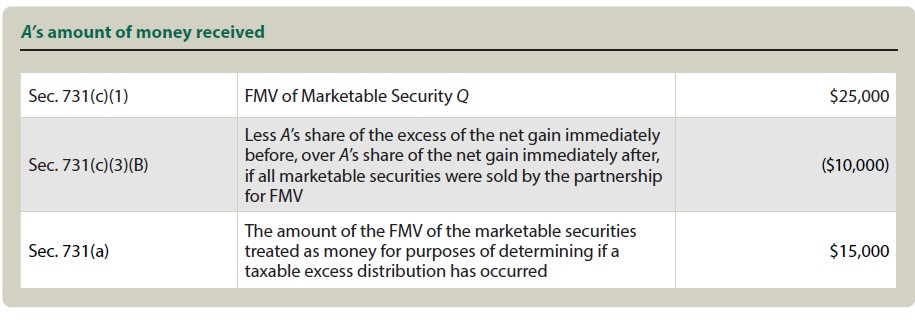

Under Sec. 731(c)(3)(B), the amount of the FMV of marketable security distributions treated as money is reduced by the excess, if any, of the partner’s share of the net gain that would be recognized if all of the marketable securities immediately before the distribution were sold by the partnership ([$20,000 + $17,000 + ($5,000)] × 50% = $16,000 in this example) over the partner’s share of the net gain that would be recognized if the partnership sold all of the marketable securities that the partnership still held immediately after the distribution ([$17,000 + ($5,000)] × 50% = $6,000 in this example, with $10,000 being the excess amount of $16,000 over $6,000). Note that for these calculations, all marketable securities held by the partnership are treated as marketable securities of the same class and issuer.2 This means that, in this example, the amount of money A has received for purposes of Sec. 731 is $15,000, computed as shown in the table “A’s Amount of Money Received.”

For purposes of Sec. 731(a)(1), the money considered received by A is $15,000, which exceeds A’s outside basis of $12,000. As a result, A is required to recognize a $3,000 gain. His $12,000 outside basis will be reduced by $5,000, the basis of Security Q to the partnership, resulting in an ending outside basis of $7,000.3 A will take a basis in the security received equal to $8,000, which consists of the partnership’s tax basis of $5,000 increased by the $3,000 gain recognized under Sec. 731(a).4

Consequently, this distribution of a marketable security treated as money results in A recognizing taxable income, which may require the sale of Security Q by A (creating another taxable gain) if he was not adequately prepared for the tax liability created by the distribution. On the other hand, B will not recognize any gain from the distribution of the land to her. Her outside basis will be reduced by $2,000, and her basis in the investment land will be $10,000.5

Reduction in share of partnership liabilities

Under Sec. 752(b), a reduction in a partner’s share of liabilities is treated as a distribution of “money” to the partner. The distribution of “money” reduces the partner’s outside basis and may result in taxable gain if the distribution exceeds the partner’s outside basis.6 For this reason, the proper allocation of liabilities is an important component of the calculation of a partner’s outside basis. The determination of the type of liability, recourse or nonrecourse, and various characteristics of the liability determines how the liability is allocated to the partners.

The allocation of recourse liabilities depends on which partner bears the risk of economic loss in the event the liability is not repaid. The regulations apply a constructive liquidation methodology using the economic book numbers as defined in Regs. Sec. 1.704-1(b)(2)(iv), which assumes that all assets are worthless (except for assets with nonrecourse liabilities attached to them, which are considered to be worth the amount of the nonrecourse liability) with the subsequent losses7 and gains allocated to the partners in accordance with their loss or gain sharing ratios. Then any partner whose capital account is in a deficit is deemed to contribute property in an amount equal to the deficit, with the relative deemed contributions made by the partners used to allocate the recourse liabilities.8 Limited partners and members of a limited liability company (LLC) will not be allocated any recourse debt unless the lender can seek payment from the limited partner (member) and the limited partner (member) has no right of reimbursement from another partner or member.9

The allocation of nonrecourse debt, on the other hand, is not a function of economic risk by the partner, because, by definition, no partner bears an economic risk of loss from a nonrecourse liability in the event the liability is not repaid. The lender’s only recourse is the foreclosure on the property securing the liability. The regulations allocate each nonrecourse liability separately using a three-tier regime on a property-by-property basis.

The first tier is allocated based on the partner’s share of partnership minimum gain and is closely associated with the allocation of nonrecourse deductions relative to that property as discussed in Regs. Sec. 1.704-2. The second tier is allocated based on the partner’s share of the Sec. 704(c) minimum gain and is associated with the partnership having a precontribution gain on the property with the nonrecourse debt.10 The third tier allocates the remaining nonrecourse liability based on the partner’s profit-sharing ratio.11 In the case of an LLC taxed as a partnership, a recourse debt made to the partnership would be treated as a nonrecourse debt for purposes of liability allocation to the members, provided no member is personally liable on the debt.

The allocations are important here, again, because a reduction in a partner’s share of partnership liabilities is treated as a distribution of “money” to the partner. Such a reduction in a partner’s share of liabilities can be the result of:

- Changing whether a liability is recourse or nonrecourse to the partnership through refinancing. This simple change necessitates the use of a different allocation method and may result in a change in the amount of liability allocated to a partner.

- The partnership refinancing a liability and borrowing the proceeds from a partner or related lender on a nonrecourse basis. Under the regulations, this type of liability is allocated to the partner who is related to the lender.12

- The partnership using existing money to pay down a partnership liability, thereby reducing the amount of liabilities available to allocate to the partners.

- Distributing a liability to a partner, reducing the available partnership liabilities allocated to the other partners.

- The partnership selling property subject to a liability and the buyer taking the property subject to the attached liability.

- A partner contributing a liability to the partnership and part of the liability being allocated to other partners.

- A change in a partner’s ownership percentage resulting in a reduction in the amount of liability allocated to that partner. For example, this can happen when a new partner is added to the partnership, a situation illustrated in the following example:

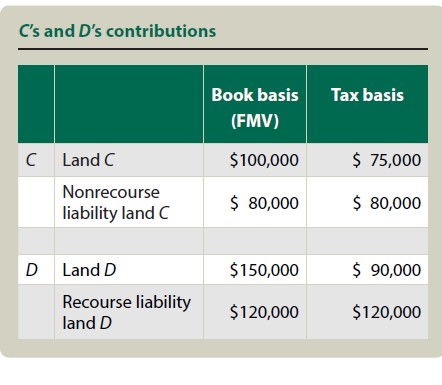

Example 2: Consider the contributions made by C and D in the formation of the CD general partnership (a 40%/60% partnership), as detailed in the table “C’s and D’s Contributions.” Both liabilities were from unrelated lenders, and the partnership assumed the recourse liability contributed by D.

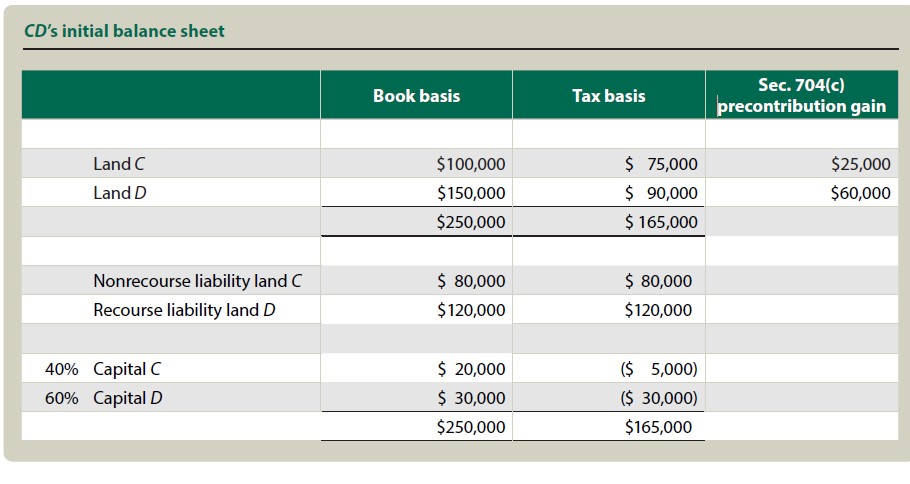

CD general partnership’s initial balance sheet is shown in the table “CD’s Initial Balance Sheet,” with the ownership percentages being calculated based on each partner’s interest in the partnership, using the partners’ relative contributions of property to the partnership.13 The “Book Basis” column is based on the capital maintenance rules found in the regulations and is initially based on FMVs.14 The “Tax Basis” column is based on the carryover adjusted tax basis rules found in Sec. 723 and is equal to the transferor partner’s tax basis in the property transferred into the partnership. The difference between these two columns equals the initial Sec. 704(c) pre-contribution gain or loss that belongs to the contributing partner, and it is assumed for this example that either the traditional method or the traditional method with curative allocations will be used for allocation of the Sec. 704(c) precontribution gain.

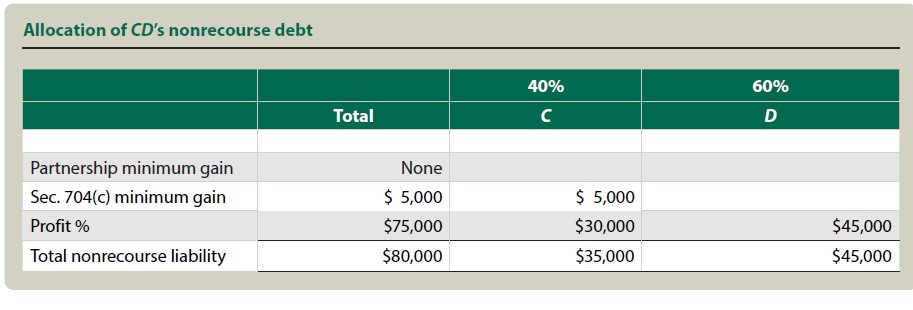

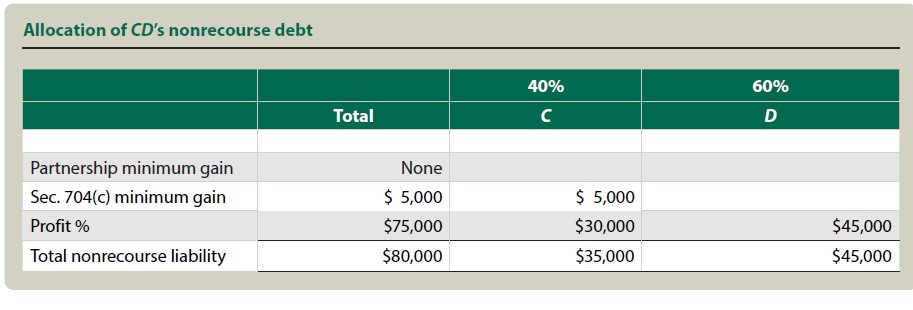

Based on the regulations, the nonrecourse debt is allocated as shown in the table “Allocation of CD’s Nonrecourse Debt” on page 39.15

Partnership minimum gain generally only exists when the adjusted book basis of a property with nonrecourse debt attached is less than the nonrecourse debt. In this case, there is no partnership minimum gain because the property would not produce a book gain if the property was transferred in satisfaction of the nonrecourse liability.16 The Sec. 704(c) minimum gain results because land C has a precontribution gain of $25,000, and if the property was transferred to the lender in satisfaction of the nonrecourse liability, a $5,000 tax gain would be recognized (i.e., a minimum amount of precontribution gain exists). This gain would then be allocated to the partner who has the precontribution gain, C.17 The $75,000 balance of the nonrecourse liability is allocated based on the partners’ profit percentages, the most common method of allocating this tier.18

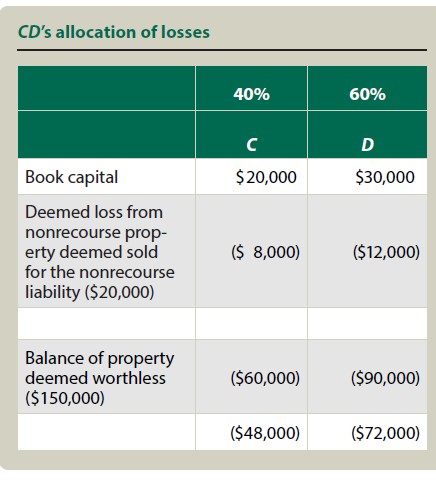

Following the regulations, the recourse debt is allocated based on the relative deemed contributions made by the partner after all of the property is deemed worthless (nonrecourse property is deemed to be worth the amount of the nonrecourse liability) and the resulting losses allocated to the partners’ book capital accounts as shown in the table “CD’s Allocation of Losses.”19

The $120,000 recourse liability will be allocated $48,000 to C and $72,000 to D, based on their economic risk of loss, as demonstrated by their deficit book capital accounts from the constructive liquidation.20

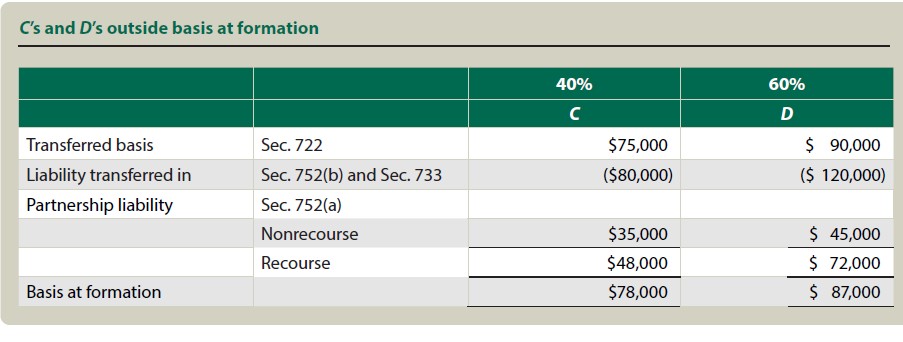

The partners’ outside bases at formation are shown in the table “C’s and D’s Outside Basis at Formation.”

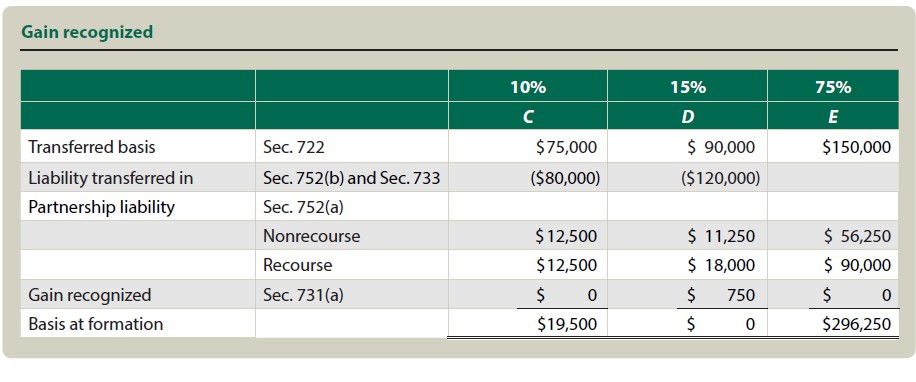

If a third partner, E, is admitted with a cash contribution of $150,000, then D will be required to recognize a gain of $750 due to the reallocation of the partnership liabilities as a result of the change in the partner’s interest in the partnership: C now owns 10%, D now owns 15%, and E owns 75% (see the table “CD After Admitting a Third Partner”).

The updated allocation of liabilities and the calculation of basis for each partner is detailed in the tables. D now has an excess distribution of money since he is allocated less of the partnership liabilities. The result is that he must recognize a $750 gain under Sec. 731(a). The table “Allocation of Nonrecourse Debt” details this allocation with the third partner E.

The table “Allocation of Recourse Debt” details this allocation with three partners. In this scenario, the $150,000 cash contributed by E is added to the $150,000 Land D balance, which again, based on the regulations, is deemed worthless when determining the allocation of the recourse debt.

The table “Gain Recognized” details how the amounts determined above relate to the $750 gain recognized by D when the third partner E is included. Each partner’s basis at formation is also calculated.

Continuing with the same example, assume the nonrecourse liability is refinanced with a nonrecourse loan from E’s father. The entire nonrecourse liability will now be allocated to E since it is a related-party loan.21 E, by way of her relation to her father, bears the risk of loss in the event the loan is not repaid. This reallocation will require D to recognize an additional $11,250 gain (on top of the previous $750 gain). C’s outside basis will be reduced by $12,500 to $7,000. E’s outside basis will now include all of the nonrecourse liability, for a total of $320,000, which consists of her $150,000 cash contribution, her $90,000 share of the partnership’s recourse liability, and the entire $80,000 of nonrecourse liability.

The same result as above would occur if the nonrecourse liability was refinanced and E guaranteed repayment of the loan. E would now bear the risk of loss if the nonrecourse loan was not repaid. The lender would seek payment from E, and she would not have a right of reimbursement from the other partners since the liability would still be nonrecourse to them.22 C’s basis would be adjusted by the same amount, and D would be treated as having the same calculated taxable distribution.

Distribution of property resulting in a disguised sale

A disguised sale under Sec. 707(a)(2)(B) involves a transaction between a partner and partnership that, when viewed in its totality, is treated as a sale or exchange rather than a simple contribution of money or property and a distribution of money or property separately.

The transaction could consist of:

- A contribution of property followed by a distribution of money, or a contribution of money followed by a distribution of property;

- A contribution of property with a liability attached when that liability does not have a business purpose for being transferred into the partnership (tax-avoidance liability); or

- A contribution of property followed by a distribution of property.

The legislative regulations under Sec. 707 create a two-year rule that moves the burden of proof to the taxpayer for transfers occurring within a two-year period of the transfer date. Such transfers are presumed to be a sale unless the facts and circumstances clearly establish otherwise. Transfers spaced apart beyond two years are presumed not to be a sale unless facts and circumstances clearly establish otherwise.23

Regs. Sec. 1.707-4 discusses certain distributions that are generally not considered part of a sale, specifically:

- Guaranteed payments and preferred returns for use of capital;

- Operating cash flow distributions; and

- Reimbursements for preformation expenditures.

The guaranteed payment or preferred return must be reasonable in amount in order to avoid treatment as part of a sale. The regulations provide a safe-harbor rule to determine a reasonable amount based on 150% of the highest applicable federal rate and the appropriate compounding period or periods.24 Distributions that exceed these amounts can be problematic, with the resulting transaction being partially characterized as a taxable sale. The regulations also provide a definition for operating cash flow distributions.25

The following example of a disguised sale involves the contribution of money and land followed by an immediate distribution of money to one of the partners.

Example 3: J, S, and T decide to form JST Partnership to farm land contributed by S. J and T contribute $500,000 each, and S contributes land with an FMV of $2,000,000 and a tax basis of $1,100,000. Immediately after the contribution by S, the partnership distributes $500,000 in money to her. The intended ownership of the partnership based on the capital contributions is one-sixth for J, one-sixth for T, and four-sixths for S.

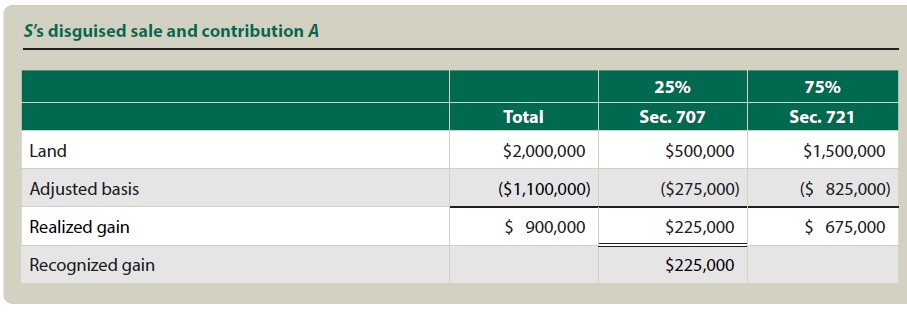

However, under Sec. 707(a)(2)(B) and the regulations thereunder, S’s contribution of land followed by the distribution of $500,000 will be treated as a disguised sale of 25% of the land to the partnership, with the 75% balance treated as a nontaxable contribution under Sec. 721.26 The partnership’s total basis in the land will be $1,325,000, made up of the $500,000 purchased portion and the $825,000 contribution.27 S will recognize a gain of $225,000 on her tax return and will have a precontribution gain remaining under Sec. 704(c) of $675,000. See the table “S’s Disguised Sale and Contribution A”

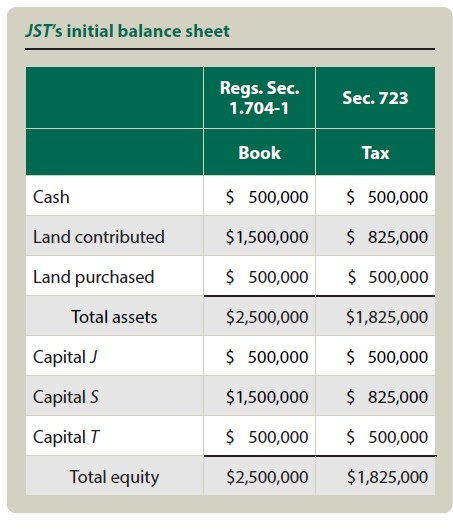

The initial balance sheet for the partnership shows that the part of the land that is contributed by S has a $675,000 precontribution gain. The partners’ interest in the partnership based on the relative capital contributions are now 20% to J, 20% to T, and 60% to S, and S will recognize a $225,000 taxable gain due to the disguised sale of the land. The economic balance sheet based on the application of the regulations demonstrates this by way of the capital accounts and the determination of the partner’s interest in the partnership, as shown in the table “JST’s Initial Balance Sheet.”

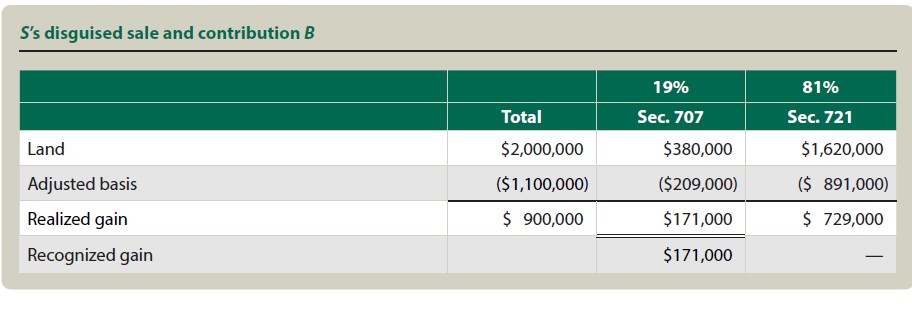

The above transaction can be further complicated if a nonqualified liability is involved.28 Continuing with Example 3, above, suppose S borrowed $200,000 on a nonrecourse basis from an unrelated bank six months prior to the contribution of the land and liability to the partnership. The borrowed money was used to buy a vacation home. Immediately after the contribution, the partnership distributed $300,000 in money to S. In this case, the debt is defined as a nonqualified liability (it was incurred within two years of the contribution of the property, and the facts and circumstances cannot clearly establish that it was not incurred in anticipation of the transfer29), and S is treated as having received consideration in the amount of the liability that she is relieved of in the transfer to the partnership.30

Assuming the partnership has no other liabilities, S is deemed to have been relieved of $80,000: the $200,000 liability transferred to the partnership less the 60% of the $200,000 liability allocated back to S. The total consideration received by S is now $380,000, which consists of the $300,000 of money distributed to her after the land contribution, plus the $80,000 of liabilities allocated to the other partners ($200,000 transferred liability – $120,000 allocated share of partnership liabilities = $80,000 sale proceeds). In this case, S has sold 19% of the land and contributed 81% of the land to the partnership, as shown in the table “S’s Disguised Sale and Contribution B.”

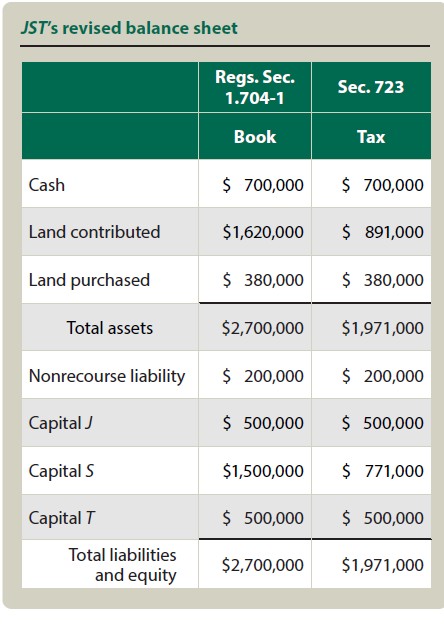

The revised balance sheet now shows a precontribution gain of $729,000 and a lower tax basis in the land, as shown in the table “JST’s Revised Balance Sheet.” The partners’ interests in the partnership based on the relative capital contributions are still 20% to J, 20% to T, and 60% to S. The nonrecourse liability of $200,000 consists of $120,000 that was contributed by S with the land and $80,000 that is part of the purchase of the land. S will recognize a gain of $171,000 due to the disguised sale of the land.

Distribution of property with precontribution gains

Property with a precontribution gain that is distributed to another partner within seven years of contribution to the partnership results in the contributing partner being required to recognize the precontribution gain as if the property had been sold.31 The contributing partner will have taxable income, that partner’s outside basis will increase, and the partnership’s tax basis in the property being distributed will increase to immediately before the distribution by the amount of gain recognized.

Example 4: M contributes Land M to the L general partnership on July 15, 2020. The land had an FMV of $21,000 and an adjusted tax basis of $12,000. On Oct. 12, 2022, the L general partnership distributes Land M to S, another partner, when the property’s FMV had increased to $27,000. M’s outside basis just before the distribution is $24,000, and S’s outside basis is $35,000.

M must recognize and pay taxes on a $9,000 gain (the amount of the precontribution gain, as if the property were sold), even though she is not receiving the land or participating in a distribution. M’s outside basis increases by the $9,000 recognized gain, and the partnership’s basis in the land is increased to $21,000. S reduces her outside basis by $21,000 (the partnership’s increased tax basis in the property distributed), and she now has a $21,000 tax basis in Land M and a $14,000 basis in her partnership interest (which is S’s $35,000 pre-distribution outside basis less the $21,000 basis in the distributed Land M).

A partner that previously contributed property with precontribution gain may also be required to recognize that gain when there is a distribution of any property other than money to that partner within seven years of the contribution date.32 The partner recognizes the lesser of:

- The remaining net precontribution (builtin) gain; or

- The excess of the FMV of the distributed property over the partner’s outside basis immediately before the distribution.

The recipient partner’s outside basis is increased by the amount of gain recognized, and the partnership’s inside basis in that property is increased by the gain recognized by the recipient partner. Then, the partner’s outside basis is decreased by the partnership’s basis in the property distributed. There is no gain recognized, though, if the property distributed was originally contributed by the recipient. The partnership is merely returning the partner’s own property. In this case, the general partnership distribution rules will apply.

Example 5: On June 10, 2020, J contributed Land L to the S limited partnership. The property had an FMV of $34,000 and an adjusted basis of $26,000 at the time of the contribution. This is the only contribution of appreciated property by J. On Nov. 2, 2022, the S limited partnership distributed a different piece of land, purchased by the partnership on Aug. 10, 2019, to J (FMV $39,000 and adjusted basis of $30,000). J’s outside basis just prior to the distribution was $33,500.

J must recognize gain equal to the lesser of (1) the remaining $8,000 net precontribution gain ($34,000 – $26,000), or (2) $5,500 (the excess of the $39,000 FMV of the distributed property over J’s outside basis, $33,500). In this case, J will recognize a taxable $5,500 gain. His outside basis will increase by $5,500 from $33,500 to $39,000 and then decrease by $30,000 (the basis of the property distributed). The partnership will increase its basis in Land L contributed by J from $26,000 to $31,500, and J will still have $2,500 of net precontribution gain remaining.

Disproportional distributions of property under Sec. 751(b)

Sec. 751(b) treats certain distributions as a sale or exchange of property between a partner and the partnership. This can happen in either non-liquidating or liquidating partnership distributions when two classifications of property are present: (1) unrealized receivables and inventory items and (2) all other partnership property.33 A Sec. 751(b) sale occurs when the partner’s share between these two property classifications changes. The result is that part of the distribution is in reality a taxable exchange of property between the partner and the partnership.

As the examples will make clearer, the analysis begins with determining whether there has been a change in the FMV of the partner’s share of the two classifications of property. This is done by using a table to compare the partner’s share of property before and after the distribution. If it is determined that there is a net difference within a classification of property, then an exchange under Sec.

751(b) has occurred, which is often referred to as a disproportional distribution. The transaction is handled in three steps:

1. Identify the deemed distribution of the property to the partner (i.e., the property that should have been distributed in a proportional distribution).

2. Calculate the Sec. 751(b) exchange (i.e., swapping the property that was actually received for the deemed property that should have been received). This exchange can produce taxable income for the partner and the partnership, depending on the property being exchanged.

3. Handle the balance of the distribution under Secs. 731, 732, and 733.

The following example is a disproportional non-liquidating distribution:

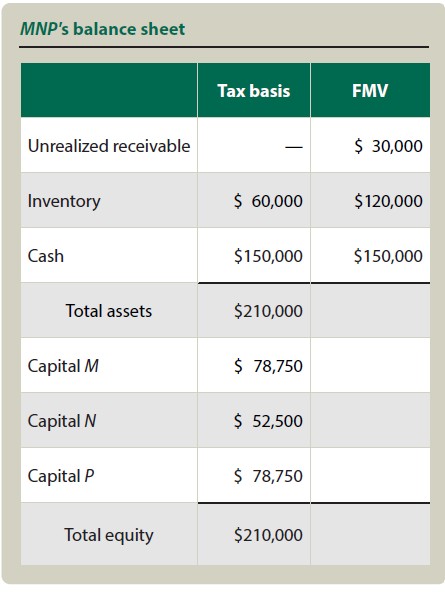

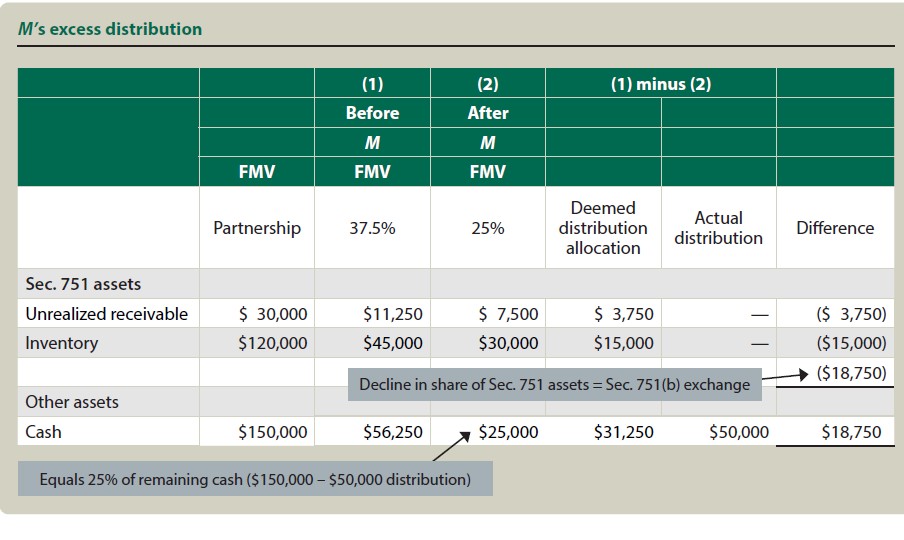

Example 6: The MNP general partnership with partners M, N, and P makes a cash distribution of $50,000 to M, which reduces her partnership interest from 37.5% to 25%. As seen in the table “MNP’s Balance Sheet,” the partnership assets include an unrealized receivable, which is a Sec. 751(c) asset, and inventory that is substantially appreciated and therefore a Sec. 751(d) inventory item. This sets up the analysis with two classifications of property, Sec. 751 assets (sometimes referred to as “hot assets”) and other property. M’s outside basis prior to the distribution was $78,750.

The table “M’s Excess Distribution” demonstrates that M received $18,750 too much money and correspondingly did not receive $18,750 of unrealized receivable and inventory, and, as such, a Sec. 751(b) exchange or disproportional distribution has taken place. The total of the differences within a category would add to zero if there had been no Sec. 751(b) exchange.

M is deemed to have received a distribution of $3,750 of unrealized receivable and $15,000 of inventory, reducing her outside basis by the partnership’s basis in the unrealized receivable and inventory. The unrealized receivable has a tax basis of zero. For simplicity, it is assumed that the inventory has uniform tax basis, and therefore its tax basis would be $7,500, reducing M’s outside basis to $71,250.

M is then considered to exchange the unrealized receivable (with a zero tax basis) and inventory (with a $7,500 tax basis) for the $18,750 of money, resulting in the recognition of an ordinary gain of $11,250 under Sec. 751(b).

The $31,250 balance of money is received as a distribution under Sec. 733 and reduces M’s outside basis to $40,000. The gain from the Sec. 751(b) exchange is ordinary because of the type of property M is selling back to the partnership. In this case, the inventory and unrealized receivable are both ordinary assets. The partnership will increase its basis in the account receivable to $3,750 and in the inventory by $7,500 since it is purchasing these from M in the Sec. 751(b) exchange.34

Liquidating distributions can also result in disproportional distributions of property. A liquidating distribution from a partnership consists of two parts, a Sec. 736(a) payment that is ordinary income to the partner and a Sec. 736(b) payment for the partner’s share of partnership property. The Sec. 736(b) payment is taxable if Sec. 751(b) applies or if money is received in excess of the partner’s outside basis. The determination of whether Sec. 751(b) applies is similar to the method used with nonliquidating distributions.

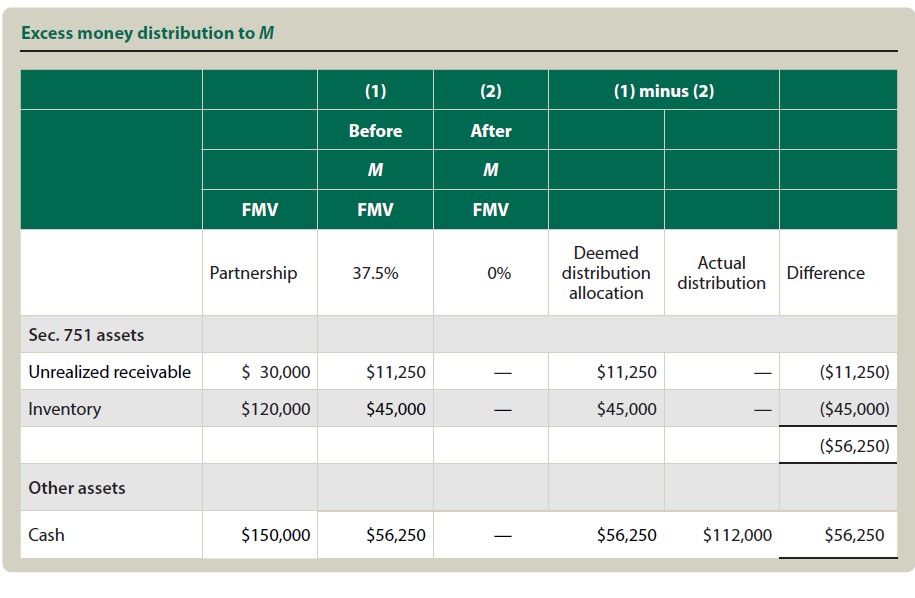

Using the facts in Example 6, M now receives a $115,000 distribution of money in liquidation of her 37.5% interest in the partnership. Capital is a material income-producing factor for the partnership. The partnership has $300,000 of property just before the payment, and M’s share would be $112,500. The $2,500 excess payment is a Sec. 736(a)(2) guaranteed payment, is deductible by the partnership, and is ordinary income to M. The $112,500 balance of the payment is a Sec. 736(b) property payment, and, in this case, part of that payment is received in a Sec. 751(b) exchange. M receives $56,250 too much money, as shown in the table “Excess Money Distribution to M,” and does not receive any unrealized receivable and inventory.

M is deemed to have received a distribution of $11,250 of unrealized receivable and $45,000 of inventory, reducing her outside basis by the partnership’s basis in the unrealized receivable and inventory. The unrealized receivable has a tax basis of zero, and, for simplicity, it is assumed that the inventory has uniform tax basis. Therefore, the inventory’s tax basis would be $22,500, reducing M’s outside basis to $56,250. M is then considered to exchange the unrealized receivable (with a zero tax basis) and inventory (with a $22,500 tax basis) for the $56,250 of money, resulting in the recognition of an ordinary gain of $33,750 under Sec. 751(b). The $56,250 balance of money is received as a distribution under Sec. 733 and reduces M’s outside basis to zero. The gain from the Sec. 751(b) exchange is ordinary because of the type of property M is selling back to the partnership. The partnership will increase its basis in the account receivable to $11,250 and in the inventory by $22,500 since it is purchasing these from M in the Sec. 751(b) exchange.

Tax planning to avoid the unexpected

Since partnerships are flowthrough entities with income being taxed to the separate partners as it is earned, it is commonly expected that eventual distributions will not create taxable events. This article discusses several examples of distributions and other events that may surprisingly create taxable income. Many of these transactions can take place without the partnership’s planning for the unexpected tax consequences. With proper tax planning, however, the partnership and partners can mitigate or avoid the recognition of gains and prepare appropriately to meet the liquidity needs of any unmitigated taxable income that remains.

Footnotes

1Sec 731 (c) marketable securities and Sec. 752(b) decrease in share of liabilities.

2Sec. 731(c)(3)(B)(i); Regs. Sec. 1.731-2(b)(1).

3Sec. 731(c)(5).

4Sec. 731(c)(4).

5Sec. 733 outside basis reduction and Sec. 732(a) basis in investment land.

6Sec. 733 basis reduction and Sec. 731(a).

7The amount of losses allocated to a partner cannot exceed that partner’s deficit restoration requirements. In general, this means that a limited partner’s capital accounts cannot go into a deficit. By definition, a limited partner only has at risk its investment and any other amounts agreed to. This also applies to members of a limited liability company (LLC).

8Regs. Sec. 1.752-2(b)(1).

9Regs. Sec. 1.752-2(b)(6).

10For purposes of this article, it is assumed that either traditional or traditional with curative allocation methods will be used for purposes of allocating any Sec. 704(c) precontribution gain. A different result will be obtained if the remedial method is used. These three methods are discussed in detail in Regs. Sec. 1.704-3. For a more in-depth discussion, see Rev. Rul. 95-41.

11Regs. Sec. 1.752-3(a).

12Regs. Sec. 1.752-2(c)(1).

13Regs. Sec. 1.704-1(b)(3).

14Regs. Sec. 1.704-1(b)(2)(iv).

15Regs. Sec. 1.752-3.

16Book basis is determined by the capital maintenance rules in Regs. Sec. 1.704-1(b)(2)(iv). If the partnership revalues its property under Regs. Sec. 1.704-1(b)(2)(iv)(f ), then there will be a change in the amount of the partnership minimum gain. Some or all of the previous partnership minimum gain will become part of the Sec. 704(c) minimum gain. See Regs. Sec. 1.704-2(m), Example 3, for further discussion. See also Regs. Secs. 1.704-2(d) and (g).

17This is from Sec. 7701(g), which states that in determining gain or loss, the FMV of any property shall be treated as being not less than the amount of nonrecourse liabilities such property is subject to. The Sec. 704(c) minimum gain tier in this problem is based on using the traditional method for allocation of precontribution gains. The result will be the same if either the traditional method or the traditional method with curative allocations is used. However, the result will be different if the remedial method is used. See Rev. Rul. 95-41 for a more detailed discussion.

18Regs. Sec. 1.752-3(a)(3) allows for several methods of allocating the third tier of nonrecourse liabilities. For the purposes of this example, it is assumed the most common method is chosen: The allocation is based on “the partner’s share of partnership profits.”

19Regs. Sec. 1.752-2(b). There are two exceptions to the deemed worthlessness, one being the contribution of property to the partnership as an indirect pledge (Regs. Sec. 1.752-2(h)(2)) and another being property that has nonrecourse liabilities attached to it. Property with nonrecourse liabilities is deemed to be worth the amount of the nonrecourse liability. The resulting gain or loss from the nonrecourse property is then allocated to the partners. If there is a gain, then the property has partnership minimum gain, and this is allocated in the same manner as the nonrecourse deduction under Regs. Sec. 1.704-2(b).

20Regs. Sec. 1.752-2(b) and Regs. Sec. 1.752-2(f ), Example 2. For further discussion, see Prop. Regs. Sec. 1.752-2.

21Regs. Sec. 1.752-2(c)(1) and Regs. Sec. 1.752-4(b).

22Regs. Sec. 1.752-2(b)(5).

23Regs. Secs. 1.707-3(c)(1) and (d).

24Regs. Sec. 1.707-4(a)(3)(ii).

25Regs. Sec. 1.707-4(b)(2).

26Regs. Sec. 1.707-3(a)(2).

27The $825,000 is the basis that carries into the partnership under Sec. 723.

28Regs. Sec. 1.707-5(a)(6) provides the requirements for a liability to be a qualified liability. Under Regs. Secs. 1.707-5(a)(6)(i)(A) and (7)(i), a liability that is incurred two years or less prior to the earlier of the date the partner agrees in writing to transfer the property or the date the partner transfers the property to the partnership is not a qualified liability unless the facts and circumstances clearly establish that the liability was not incurred in anticipation of the transfer.

29Regs. Sec. 1.707-5(a)(7).

30Regs. Secs. 1.707-5(a)(1) and (a)(2)(ii).

31Sec. 704(c)(1)(B). See also Prop. Regs. Sec. 1.704-3(f )(3)(v)(B).

32Sec. 737(a).

33A nonliquidating distribution is defined as a distribution that results in the partner still having an ownership interest in the partnership. A liquidating distribution results in the partner’s ownership interest being reduced to zero.

34Prop. Regs. Sec. 1.751-1. The calculation of the change in net Sec. 751 unrealized gain or loss as described in the proposed regulations results in the same amount of gain as the method used in the example. The alternative approach is discussed in the Prop. Regs. Sec. 1.751-1(g) example.

Contributors

Thomas J. Sternburg, CPA, Ph.D., MAS., is a teaching assistant professor of accountancy, and Michael W. Penn Jr., Ph.D., M.Acc., is a senior lecturer of accountancy and Deloitte scholar, both in the Gies College of Business at the University of Illinois at Urbana-Champaign. For more information about this article, contact thetaxadviser@aicpa.org.

AICPA & CIMA MEMBER RESOURCES

Articles

Venables, “Partnership Distributions: Rules and Exceptions,” 55-8 The Tax Adviser 26 (August 2024)

Burton, “Current Developments in Partners and Partnerships,” 55-2 The Tax Adviser 28 (February 2024)

Upcoming webcasts

“Reviewing Partnership Tax Returns: What Are You Missing?” Jan. 22, 1–5 p.m. ET

“Tax Fundamentals of LLCs and Partnerships — Tax Staff Essentials,” Dec. 23, 9 a.m.–5 p.m. ET

Tax Section resources (members only)

CPE self-study

Advanced Taxation LLCs & Partnerships — Tax Staff Essentials

Reviewing Partnership Tax Returns: What Are You Missing?

For more information or to make a purchase, visit aicpa-cima.com/cpe-learning or call 888-777-7077.