- tax clinic

- FOREIGN INCOME & TAXPAYERS

Short-term relief for foreign tax credit woes

Related

IRS issues guidance on treaty application to reverse foreign hybrids

Key international tax issues for individuals and businesses

IRS announces prop. regs. on international tax law provisions in OBBBA

TOPICS

Editor: Greg A. Fairbanks, J.D., LL.M.

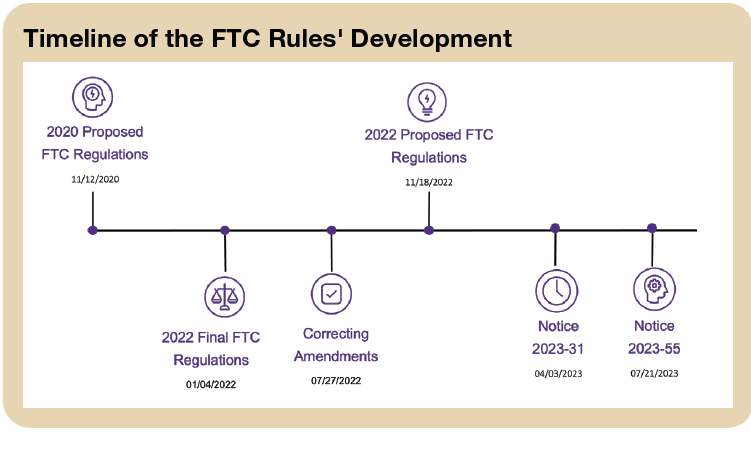

The foreign tax credit (FTC) rules stand out as one of the most dynamic and fluctuating areas in the evolution of international taxation in the last few years. This journey commenced when the final FTC regulations (T.D. 9959) were published on Jan. 4, 2022. These regulations aimed to modernize and clarify the prior FTC regulations to address issues that had arisen since 1983. However, the final regulations also raised major concerns among taxpayers and practitioners. These concerns centered on stringent new rules that rendered ineligible many foreign income taxes that had qualified as a foreign tax credit for decades.

Recognizing the validity of these concerns, the IRS took steps to provide targeted relief by releasing technical corrections to the final FTC regulations and by introducing proposed FTC regulations (REG-112096-22) on Nov. 22, 2022. Both releases were intended to address some of the major issues that had arisen under the final FTC regulations. Despite these efforts, the regulations still presented a series of interpretive challenges that left taxpayers wondering whether some of the outcomes under the regulations were intended by the IRS.

On July 21, 2023, in a surprising turn of events, nearly two years after the release of the final regulations, the IRS completely reversed course with the release of Notice 2023-55. The notice offers optional, broad, temporary relief, essentially rolling back certain provisions to a modified version of the regulations in place before the new final regulations were issued. In other words, the IRS temporarily pushed the proverbial “Undo” button, providing much-needed relief to taxpayers. This action by the IRS was unprecedented, effectively revising regulations that may have already been applied to returns with due dates that had passed.

This item offers some context regarding these developments, followed by a discussion of the notice and the relief it offers.

Background

Sec. 901(a) allows a credit for foreign taxes paid or deemed paid for foreign income, war profits, and excess profits. Sec. 903 similarly allows a credit for a tax paid in lieu of a tax on income, war profits, or excess profits. Sec. 901 and 903 regulations provide detailed guidance on how to determine the creditability of a foreign tax. See the graphic “Timeline of the FTC Rules’ Development” for recent key milestones.

Under the 2022 final FTC regulations, a foreign tax is a foreign income tax only if it is a net income tax meeting a net gain requirement as provided under Regs. Sec. 1.901-2(a)(3), and a foreign levy is a “tax paid in lieu” of a tax on income only if it meets a substitution requirement as provided under Regs. Sec. 1.903-1(b)(2). The final regulations follow the “all or nothing” rule that a foreign levy is either creditable or not creditable for all taxpayers subject to the levy.

The 2022 FTC regulations modified the net gain requirement to limit the role of the predominant-character analysis in determining whether a tax meets each of the components of the net gain requirement. In addition, the 2022 FTC regulations also substantially modified the substitution requirement by including four additional requirements (i.e., the generally imposed net income tax requirement, the nonduplication requirement, the close-connection requirement, and the jurisdiction-to-tax requirement) and separate requirements for covered withholding tax (i.e., the generally imposed net income tax requirement, the withholding tax on nonresidents requirement, the nonduplication requirement, the close-connection requirement, and the source-based attribution requirement).

Challenges and concerns with FTC regulations

The final FTC regulations presented a multitude of challenges, including:

- Application of strict per se cost recovery rules, necessitating alignment of U.S. and foreign rules from a policy perspective;

- Income sourcing requirements that deviated from global tax norms;

- Ambiguous treatment of certain unique taxing regimes, such as territorial systems; and

- A one-size-fits-all “attribution” rule required for analyzing a diverse range of jurisdictional taxation systems.

These left taxpayers treating various levies in their entirety as non-creditable, even when the levy had been unquestionably creditable for decades prior to the release of the final FTC regulations.

Commentators raised concerns about these issues and more. It seems that the issues raised were substantial enough for the IRS to undertake a comprehensive reevaluation of the regulatory framework. As that analysis is ongoing, taxpayers may apply the temporary relief provided in the notice

Notice 2023-55

On July 21, 2023, the IRS released the unexpected Notice 2023-55 providing temporary relief to taxpayers in determining whether a foreign tax paid or accrued during tax years beginning on or after Dec. 28, 2021, and ending on or before Dec. 31, 2023, (the relief period) is eligible to be claimed as an FTC. The notice provides the following temporary relief for foreign taxes paid or accrued during the relief period:

- Taxpayers may apply former Regs. Secs. 1.901-2(a) and (b) instead of the existing Regs. Secs. 1.901-2(a) (definition of foreign income tax) and (b) (net gain requirement). The former regulations allow taxpayers to use a less-stringent version of the net gain rules and without the attribution requirement.

- Taxpayers may apply the existing substitution requirement under Regs. Sec. 1.903-1 without applying the jurisdiction-to-tax excluded income requirement and source-based attribution requirement.

Generally speaking, these changes remove the so-called attribution requirements, which mandate that the foreign law require a sufficient connection between the foreign country and the taxpayer’s activities or investments or that arm’s-length standards be in place. The changes also remove the specific cost recovery requirement, including the per se aspects. The various attribution requirements and the cost recovery requirement were the two provisions that prevented creditability of foreign taxes in most cases.

Taxpayers may apply this temporary relief to foreign taxes paid in any relief year, provided that the taxpayer satisfies the following requirements:

- The taxpayer must apply the temporary relief to (1) all foreign taxes paid by the taxpayer in the taxpayer’s relief year, and (2) all foreign taxes that are paid by any other person (a) in a tax year that begins on or after Dec. 28, 2021, and that ends with or within the taxpayer’s relief year, and (b) for which the taxpayer would be eligible to claim a credit, as provided in Sec. 901 (determined without regard to certain limitations described in Regs. Sec. 1.901-1(b), such as in Secs. 901(m), 245A(d), etc.), if the taxpayer applied the temporary relief to such foreign taxes. This includes foreign taxes paid by a controlled foreign corporation (CFC) of which the taxpayer is a U.S. shareholder in the CFC’s tax year that ends with or within the U.S. shareholder’s relief year.

- A member of a consolidated group may apply the temporary relief to a relief year only if all members of the consolidated group apply the temporary relief to the relief year.

- The taxpayer may not apply the temporary relief in a relief year to claim a credit, as provided under Sec. 901, for any amount of foreign tax for which a deduction is allowed in the relief year or any other tax year.

It is important to emphasize that the notice did not completely reverse the new final FTC regulation package. While the new final FTC regulation package (i.e., T.D. 9959) introduced numerous changes to various aspects of the FTC rules, the notice specifically addresses the targeted changes mentioned earlier. Consequently, the other modifications found in T.D. 9959, including the unfavorable adjustment to local refundable tax credits and the treatment of digital service taxes discussed below, among many others, continue to be in effect.

Relief period

Taxpayers may apply this temporary relief to foreign taxes paid or accrued during tax years beginning on or after Dec. 28, 2021, (i.e., the effective date of the 2022 final regulations) and ending on or before Dec. 31, 2023. Thus, although calendar-year taxpayers have relief until 2024, fiscal-year taxpayers with years ending after Dec. 31, 2023, will still need to apply the final FTC regulations for those tax years. Although not released as of this writing, the IRS is expected to extend the notice’s relief to future tax years.

Continued non-creditability of digital service taxes

The notice revises the nonconfiscatory gross basis tax rule under former Regs. Sec. 1.901-2(b)(4)(i), replacing the existing rule with the following: “[n]o foreign tax whose base is gross receipts or gross income satisfies the net income requirement, except in the case of a foreign tax whose base consists solely of investment income that is not derived from a trade or business, or wage income (or both).” Therefore, under the temporary relief, a foreign country’s digital service tax does not satisfy the net income requirement of former Regs. Sec. 1.901-2(b)(4)(i), because the base of the tax is gross receipts or gross income and does not consist solely of investment income that is not derived from a trade or business, or wage income.

In addition, the notice indicates that a foreign country’s digital service tax that applies by its terms to any income subject to that foreign country’s net income tax remains non-creditable as a tax in lieu of an income tax because it would fail the nonduplication requirement under Regs. Secs. 1.903-1(c)(1)(ii) and (2)(i).

Final thoughts

Given the coexistence of the 2022 final FTC regulations, proposed FTC regulations, and the notice, taxpayers are faced with the challenge of navigating various regulatory regimes that may affect the 2023 tax year (and possibly beyond), depending on the taxpayer’s election. This situation also offers calendar-year taxpayers a unique opportunity to select one of three potential sets of rules to access the creditability of the foreign taxes for the 2023 tax year:

- Option 1: Application of the 2022 final FTC regulations;

- Option 2: Application of the 2022 final FTC regulations with the proposed regulations; or

- Option 3: Application of the 2022 final FTC regulations with the notice.

Although it is anticipated that the vast majority of taxpayers will opt for the temporary relief outlined in the notice, it is crucial to make this decision based on the unique circumstances of each taxpayer. There may be scenarios in which the application of the 2022 final regulations could prove more advantageous. For example, in rare situations where a company has an FTC carryforward it does not anticipate using and is in an excess credit position, deducting portions of the uncreditable foreign taxes may result in lower overall tax liabilities.

Taxpayers should immediately evaluate the effect of the optional relief on their tax profile, including its impact on financial statement positions. In most cases, it seems that creditability positions in line with prior years may be maintained. Where taxpayers have already filed returns taking positions that certain foreign taxes are not eligible as an FTC under the 2022 FTC regulations, amended or superseding returns may allow for refund claims where taxes were deducted that may now be viewed as creditable.

Editor Notes

Greg A. Fairbanks, J.D., LL.M., is a tax managing director with Grant Thornton LLP in Washington, D.C. For additional information about these items, contact Fairbanks at greg.fairbanks@us.gt.com. Contributors are members of or associated with Grant Thornton LLP.