- tax clinic

- expenses & deductions

Electing the UNICAP historic absorption ratio under the modified simplified production method

Related

Why LIFO, why now?

Navigating safe-harbor rules for solar and wind Sec. 48E facilities

Businesses urge Treasury to destroy BOI data and finalize exemption

Editor: Christine M. Turgeon, CPA

A taxpayer subject to the uniform capitalization (UNICAP) rules under Sec. 263A must capitalize all direct costs and certain indirect costs properly allocable to real property and tangible personal property produced by the taxpayer and to real and personal property acquired by the taxpayer for resale. A taxpayer producing inventory is subject to the UNICAP rules unless it qualifies for the small business taxpayer exception under Sec. 263A(i). Complying with the UNICAP rules often requires taxpayers to undertake complex and time-consuming calculations. Taxpayers interested in simplifying compliance with the UNICAP rules may want to consider electing the historic absorption ratio (HAR).

Background

Under the UNICAP rules, direct and indirect costs capitalized to inventory in a taxpayer’s financial statements generally are characterized as Sec. 471 costs. Costs not capitalized as Sec. 471 costs but that are required to be capitalized under the UNICAP rules are treated as additional Sec. 263A costs. Taxpayers must allocate additional Sec. 263A costs to inventory produced or acquired for resale during the tax year and capitalize these costs to the extent allocable to ending inventory. Taxpayers often utilize simplified methods outlined in the Treasury regulations under Sec. 263A to determine the amount of additional Sec. 263A costs capitalized to ending inventory.

In 2018, the IRS published final regulations under Sec. 263A (2018 regulations) that introduced a new simplified method for capitalizing additional Sec. 263A costs to ending inventory — the “modified simplified production method” (MSPM). This method was first available for tax years beginning on or after Nov. 20, 2018. The 2018 regulations prohibit large producers (defined as those with average annual gross receipts exceeding $50 million in the three previous tax years) from including negative adjustments (defined as indirect costs included in Sec. 471 costs that are not required to be capitalized under Sec. 263A) in additional Sec. 263A costs under the simplified production method. However, large producers may include negative adjustments in additional Sec. 263A costs under the MSPM. As a result, most large producers effectively were required to change their accounting method to the MSPM.

Regs. Sec. 1.263A-2(c)(3)(i) provides that taxpayers using the MSPM must compute additional Sec. 263A costs allocable to eligible property remaining on hand at the close of the tax year as shown in the table “Formula for Additional Sec. 263A Costs,” below. Regs. Sec. 1.263A-2(c)(3)(ii) (B) provides that the preproduction absorption ratio is computed as preproduction additional Sec. 263A costs divided by preproduction Sec. 471 costs.

Regs. Sec. 1.263A-2(c)(3)(ii)(D) provides that the production absorption ratio is computed as shown in the table “Formula for Production Absorption Ratio,” below.

Although the MSPM is considered a simplified approach for allocating additional Sec. 263A costs to ending inventory, taxpayers must perform a complex analysis in order to (1) identify Sec. 471 costs, (2) classify additional costs incurred during the year, (3) allocate book-tax differences in costs (i.e., Schedule M-3 net income or loss reconciliation adjustments), and (4) bifurcate ending inventory. For example, taxpayers must classify or allocate capitalizable costs between preproduction costs and production costs and must classify or allocate ending inventory between preproduction inventory and production inventory. As a result, taxpayers using the MSPM may need to dedicate significant resources to prepare Sec. 263A calculations each year.

The MSPM with a HAR election

Regs. Sec. 1.263A-2(b)(4) provides that taxpayers may use the MSPM with a HAR election. The HAR election allows taxpayers to use a HAR for a specified period of years (the qualifying period) instead of calculating the actual preproduction and production absorption ratios under the MSPM each year. If the election is made, the HAR — based on actual ratios computed during a test period — must be used for each tax year within the qualifying period. The test period is the three-tax-year period immediately preceding the tax year in which the HAR is elected.

Regs. Sec. 1.263A-2(b)(4)(ii)(A) provides that the preproduction HAR is computed as preproduction additional Sec. 263A costs incurred during the test period divided by preproduction Sec. 471 costs incurred during the test period. Regs. Sec. 1.263A-2(b)(4)(ii)(A) provides that the production HAR is computed as shown in the table “Formula for Production HAR.”

Observation: The preproduction and production ratios under the MSPM with a HAR election are calculated in a manner similar to the ratios computed under the MSPM, but total costs for the entire test period are used instead of costs for a single tax year.

The HAR is used during the qualifying period, which includes the first five tax years starting with the year the HAR is elected. Once the qualifying period ends, the taxpayer must compute actual preproduction and production absorption ratios under the MSPM for the following year (the recomputation year) to assess whether the actual recomputation year absorptionratios are within 0.5% (plus or minus) of the HAR. If both recomputation year ratios meet the threshold, the taxpayer may continue to use the HAR for the recomputation year and the following five tax years (the extended qualifying period). However, if one or both recomputation year ratios do not meet the threshold, the taxpayer must use actual preproduction and production ratios under the MSPM for the recomputation year and the subsequent two tax years (an updated test period), compute a new HAR using the updated test period ratios, and then use the new HAR for another five-year qualifying period.

Example: A calendar-year taxpayer complied with the 2018 regulations by filing Form 3115, Application for Change in Accounting Method, to change its method of accounting to the MSPM with its 2019 federal income tax return. The taxpayer used the MSPM to calculate the amount of additional Sec. 263A costs capitalized to ending inventory for its 2019 tax year and continued to do so for its 2020 and 2021 tax years. In 2022, the taxpayer made a HAR election using data from its MSPM calculations for the prior three tax years (i.e., 2021, 2020, and 2019, or the test period). For this example, see the table “Assumptions for the Example,” below.

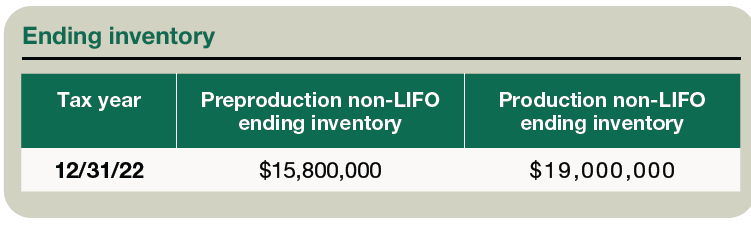

The preproduction HAR is equal to $1,025,000 (from Column A) divided by $51,442,000 (from Column B), resulting in a ratio of 1.9925%. The production HAR is equal to $23,500,000 (Column C) divided by $342,700,000 (Column D), resulting in a ratio of 6.8573%. The preproduction non-LIFO ending inventory of $15,800,000 (see the table “Ending Inventory,” below) is multiplied by the preproduction HAR of 1.9925%, resulting in $314,815 of capitalized preproduction additional Sec. 263A costs. The production non-LIFO ending inventory of $19,000,000 is multiplied by the production HAR of 6.8573%, resulting in $1,302,887 of capitalized production additional Sec. 263A costs. Thus, the total amount of additional Sec. 263A costs capitalized to 2022 ending inventory under the HAR election is equal to $1,617,702 ($314,815 + $1,302,887).

The taxpayer would use the preproduction and production HARs for each of the five tax years within the qualifying period, which spans from 2022 through 2026. In 2027 (the recomputation year), the taxpayer must prepare an actual MSPM calculation and compare the resulting preproduction and production ratios to each corresponding HAR. If either actual ratio deviates by more than 0.5% (plus or minus) from each corresponding HAR, an updated test period consisting of 2027 through 2029 is initiated.

Observation: Taxpayers using the MSPM are unable to apply separate preproduction and production ratios to LIFO inventory, so Regs. Sec. 1.263A- 2(c)(3)(iv) provides special rules that taxpayers must use to compute and apply a combined absorption ratio to LIFO inventory. Regs. Sec. 1.263A- 2(c)(4)(iii) provides additional rules that taxpayers must use to compute the MSPM HAR for LIFO inventory.

How to make the election

A taxpayer making a HAR election must attach a statement to its federal income tax return for the tax year in which the election is made, showing the actual absorption ratios determined under the MSPM during its first test period and the HAR to be used by the taxpayer during its qualifying period. The taxpayer must attach a similar statement to the federal income tax return for the first tax year of an extended qualifying period (i.e., the year after an updated test period).

The HAR election is implemented on a cutoff basis, meaning there is no Sec. 481(a) adjustment. Furthermore, Regs. Sec. 1.263A-2(b)(4)(iii)(A) provides that an updated HAR resulting from an updated test period is not considered a change in accounting method. On the other hand, a taxpayer that wants to revoke a HAR election must file a change in accounting method under the nonautomatic method change procedures.

Pros and cons of the HAR election

The primary advantage of the HAR election is that it simplifies the Sec. 263A calculation process during the qualifying period and any extended qualifying periods. Additionally, because the HAR is based on costs incurred during the test period, significant additional Sec. 263A costs incurred in qualifying-period years may be excluded from capitalization. For instance, if additional tax depreciation costs arise during the qualifying period that were not present during the test period, these costs would not be capitalized as additional Sec. 263A costs during the qualifying period.

Despite these advantages, a taxpayer should consider several issues before making a HAR election. First, if additional Sec. 263A costs are higher than usual during the test period or an updated test period, the HAR election would result in a higher amount of capitalized additional Sec. 263A costs during the qualifying period or an extended qualifying period compared to using actual ratios under the MSPM. In addition, there is a risk that the taxpayer may use a “same as last year” approach for the recomputation year and inadvertently apply the HAR instead of preparing actual ratios under the MSPM, resulting in an unintentional change to an impermissible fixed-ratio method. Furthermore, the recomputation-year calculation introduces additional complexities, such as:

- If the need to calculate actual ratios for the recomputation year is identified too late in the return preparation process, there may not be enough time to prepare the calculation;

- Personnel that prepared the last actual ratios under the MSPM and/or provided data for the calculation (six years after a qualifying period or seven years after an extended qualifying period) may no longer be employed by the company;

- Potentially significant changes to information systems, general ledger systems and accounts, and departments could make it extremely difficult to replicate the MSPM calculations that were prepared during the most recent test period or previous recomputation year; or

- If multiple members of a consolidated group make a HAR election, some members may pass the 0.5% test and some members may fail the 0.5% test, creating different updated test period and qualifying period cycles.

Lastly, if a taxpayer needs to modify its Sec. 471 costs (e.g., due to a change in book costing policies) and/or its additional Sec. 263A costs, the IRS generally requires taxpayers to calculate a Sec. 481(a) adjustment by recomputing all actual ratios in the original test period, subsequent recomputation years, and updated test periods using the new method of accounting, making it extremely difficult for taxpayers to implement these changes. Taxpayers should carefully weigh the pros and cons outlined above and proceed with caution before making a HAR election.

Editor Notes

Christine M. Turgeon, CPA, is a partner with PricewaterhouseCoopers LLP, Washington National Tax Services, in New York City.

For additional information about these items, contact Turgeon at christine.turgeon@pwc.com.

Contributors are members of or associated with PricewaterhouseCoopers LLP.