- tax clinic

- partners & partnerships

Partners’ basis on the liquidation of an insolvent partnership

Related

TEFRA petition filing deadline is jurisdictional

Prop. regs. would make permanent safe harbor for furnishing information on Sec. 751 property

IRS updates FAQs on business interest limitation, premium tax credit

Editor: Christine M. Turgeon, CPA

In the current economic environment, some partnerships owe debt in excess of the fair market value (FMV) of their assets. If these insolvent partnerships liquidate, it may be difficult to determine their partners’ tax bases in the property they receive due to the operation of Sec. 752(c) — a provision that is poorly understood and has little interpretative guidance to assist taxpayers with its application. After illustrating the situation, this item discusses Sec. 752(c) and relevant IRS guidance.

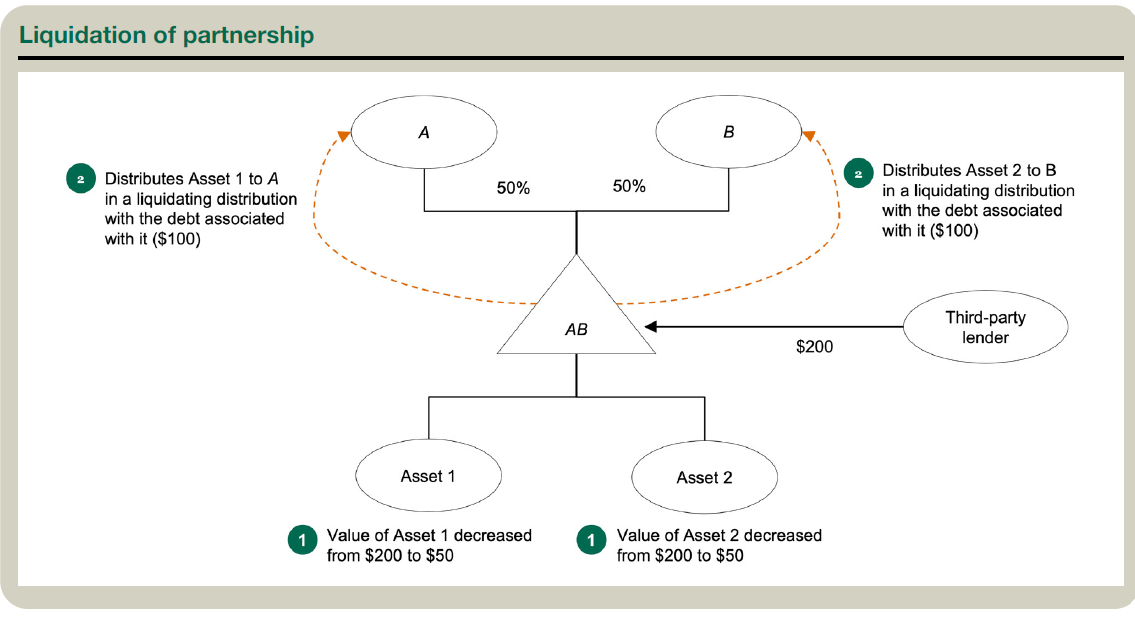

Example 1: Consider a partnership owned equally by Partner A and Partner B, who each contributed $100 cash. The partnership borrows $200 on a nonrecourse basis from an unrelated third party and uses the $400 total cash to purchase Asset 1 for $200 and Asset 2 for $200, with both assets subject to the debt. Following the acquisition, Partner A and Partner B each have a tax basis of $200 in their partnership interest ($100 of contributed cash plus $100 share of partnership debt) (see the diagram and table “Formation of Partnership,” below).

Following formation, an unexpected global pandemic arises, and the partnership suspends operations, causing the values of Asset 1 and Asset 2 to decline to $50 each. Partner A and Partner B agree to terminate thepartnership by distributing Asset 1 to Partner A and Asset 2 to Partner B, with each asset subject to $100 debt (see the diagram “Liquidation of Partnership,” below).

Taxpayers and tax practitioners might find it difficult to answer two critical questions in this situation: (1) whether the partners or partnership recognize gain or loss on the liquidation of the insolvent partnership and (2) how much tax basis each partner should have in the property received in the liquidation of its partnership interest. The answers to these questions rest on the proper application of Sec. 752(c).

Evolution of Sec. 752(c)

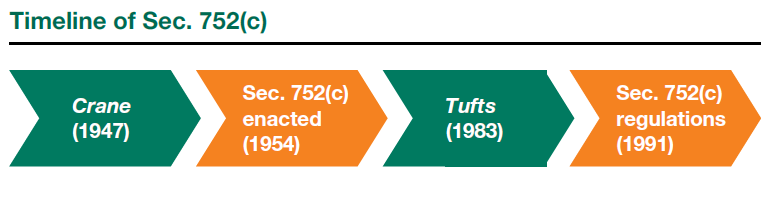

Two U.S. Supreme Court cases, legislation, and Treasury regulations issued over the course of half a century have shaped how a sale or distribution of property subject to a liability is treated (see the graphic “Timeline of Sec. 752(c),” below).

The tax consequences of transferring assets subject to nonrecourse debt have been a key topic in the tax law since at least 1947. In Crane, 331 U.S. 1 (1947), the Supreme Court addressed whether a taxpayer realized an economic benefit when it was relieved of a nonrecourse obligation as part of a property transfer.

The Court reasoned that a person with equity in property subject to nonrecourse debt will treat the debt as their own, effectively treating the nonrecourse debt as recourse to the property owner for tax purposes. Accordingly, the Court held that the amount realized on the sale or disposition of property includes the amount of any nonrecourse debt.

The Crane Court did not need to address whether it would reach a different conclusion if the property were worth less than the debt to which it was subject but acknowledged that scenario in a footnote to its opinion (footnote 37):

Obviously, if the value of the property is less than the amount of the mortgage, a mortgagor who is not personally liable cannot realize a benefit equal to the mortgage. Consequently, a different problem might be encountered where a mortgagor abandoned the property or transferred it subject to the mortgage without receiving boot. [Crane, 331 U.S. at 14, n. 37]

In 1954, Congress modified Sec. 752 in response to the Crane Court’s unanswered question in footnote 37. Sec. 752(c) provides, “For purposes of this section, a liability to which property is subject shall, to the extent of the fair market value of such property, be considered as a liability of the owner of the property.” Sec. 752(d) provides that liabilities in the sale of a partnership interest will be treated in the same manner as liabilities in a sale of property not associated with a partnership.

The Supreme Court considered the extent of this Sec. 752(c) FMV limitation in Tufts, 461 U.S. 300 (1983). The Tufts Court determined that Sec. 752 establishes different standards depending on whether the issue arises in a sale of partnership interests or in a partner contribution or distribution. The Court established that applying Sec. 752(c) to sales of partnership property would render Sec. 752(d) meaningless. Thus, the Court held that Sec. 752(c) applies only in the context of transactions described in Secs. 752(a) and (b), that is, when partners’ shares of partnership debt increase or decrease as a result of a partner contribution or distribution. The Court believed that this interpretation best advanced Congress’s purpose of preventing partners from artificially inflating their bases in partnership interests under Secs. 752(a) and 752(b) by debt amounts that were unsupported by potential capital outlays.

In 1991, the IRS and Treasury issued Regs. Sec. 1.752-1(e), which was consistent with the Supreme Court’s decision in Tufts. The regulation states:

If property is contributed by a partner to the partnership or distributed by the partnership to a partner and the property is subject to a liability of the transferor, the transferee is treated as having assumed the liability, to the extent that the amount of the liability does not exceed the fair market value of the property at the time of the contribution or distribution.

Thus, Sec. 752(c) applies only in connection with a contribution to or distribution from a partnership. In the context of a partnership distribution made as part of the liquidation of an insolvent partnership, the impact of Sec. 752(c) depends on whether the liquidation itself is a taxable event.

Liquidation of an insolvent partnership

Partnership distributions generally are governed by Sec. 731 and its underlying regulations. However, Sec. 1001 more generally governs how taxpayers should compute the amount realized on the sale or other disposition of property. Regs. Sec. 1.1001-2(a) requires taxpayers to include in the amount realized the amount of liabilities from which the taxpayer is discharged in connection with the sale or disposition. When proposed, this rule created a conflict in the case of partnership liquidations between the regulations under Sec. 1001, which required full inclusion of the debt amount, and Sec. 752(c), which excludes the liability to the extent of insolvency. Final regulations under Sec. 1001 issued in 1980 (T.D. 7741) resolved this conflict by clarifying that, for purposes of Sec. 1001, contributions and distributions of property between a partner and a partnership are not sales or other dispositions of property (Regs. Sec. 1.1001-2(a)(4)(iv)). Thus, the tax treatment of a liquidating distribution generally is determined solely with respect to Sec. 731, without regard to the determination of the amount realized otherwise required by Sec. 1001. Because Sec. 731 frames the partnership liquidation as a substituted basis transaction, the proper application of Sec. 752(c) is important to providing that the tax basis of the distributed property is neither overstated nor understated.

2011 informal guidance

To understand how to apply Sec. 752(c) to Example 1, it is helpful to first look at a 2011 generic legal advice memorandum (GLAM), AM 2011-003 (Aug. 18, 2011). There, the IRS addressed a fact pattern in which an insolvent foreign corporation converted to a partnership by making a check-the-box election. The IRS applied Sec. 752(c) to the deemed contribution of the assets and liabilities to the newly formed partnership because the foreign corporation was insolvent.

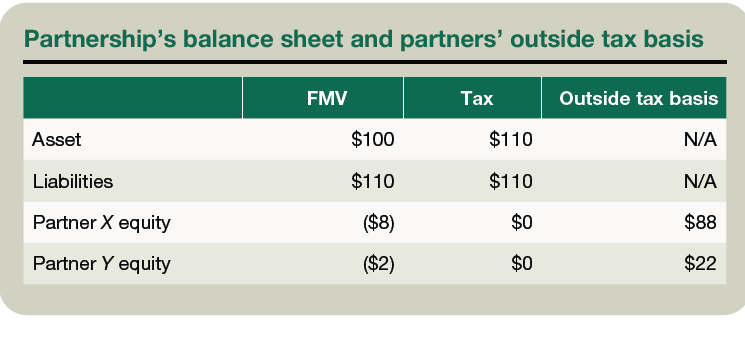

The facts set forth in the GLAM state that a U.S. corporation, X, owns 100% of foreign corporation Y and that X and Y together own 80% and 20%, respectively, of foreign corporation Z. The FMV of Z’s assets is $100, and Z’s adjusted basis in the assets is $120. Z also owes debt of $110. Z elects to be treated as a partnership for U.S. federal tax purposes, causing Z to be deemed liquidated for U.S. federal tax purposes, followed by a deemed contribution to the new partnership. On the deemed corporate liquidation, the GLAM concludes that X is deemed to receive 80% of Z’s assets with a tax basis of $88 (80% of $110, applying the Sec. 1001 rule), while Y is deemed to receive 20% of Z’s assets with a tax basis of $22 (20% of $110, applying the Sec. 1001 rule).

The GLAM analyzes two alternative situations with respect to the partnership deemed contribution in which the debt is either recourse or nonrecourse.

GLAM Situation 1, recourse debt: In Situation 1, the $110 debt is recourse and owed to Partner X. X is treated as contributing an asset with $88 of tax basis subject to debt of only $80 because the debt is limited to the FMV of the property contributed (80% of $100 value). The full amount of the debt is allocated back to X under Sec. 752 because the debt is recourse to X, giving X tax basis in its partnership interest of $108 ($88 basis in contributed Z assets, plus X’s $20 net increase in allocated debt resulting from the contributions). In determining X’s increase in allocated debt, the GLAM treats the partnership as assuming only $100 of debt from the partners ($80 from X and $20 from Y), applying Sec. 752(c) with respect to the contribution. The $20 debt deemed assumed from Y shifts to X under the debt allocation rules.

The GLAM limits its application of Sec. 752(c) to determining each partner’s tax basis in its partnership interest. As noted above, Sec. 752(c) applies only “[f]or purposes of this section.” The Tufts decision further limited its application by holding that Sec. 752(c) applies only to Secs. 752(a) and 752(b). Critically, the GLAM does not apply Sec. 752(c) when determining the tax basis of the partnership’s property, giving X and Y substituted tax basis equal to the full tax basis of the contributed property ($110 total) under Sec. 723, without regard to its insolvency. Thus, Sec. 723 is not affected by Sec. 752(c) — this result appears consistent with the strict limiting language of the statute and the Tufts decision. Additionally, the full $110 of debt would be reflected on the partnership’s balance sheet, as summarized in the table “Partnership’s Balance Sheet and Partners’ Outside Tax Basis, below”.

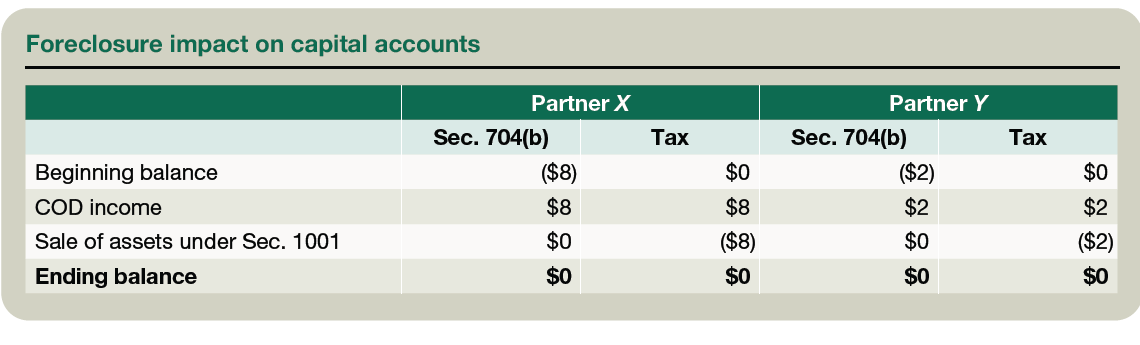

Given the partnership’s starting point confirmed by the GLAM, we can analyze the tax consequences to the partners if, immediately after the contribution, the bank foreclosed on the debt and seized the partnership assets. Assuming the debt is recourse under state law and Sec. 7701(g) does not apply, and because Sec. 752(c) applies only for purposes of Secs. 752(a) and (b), the partnership would have $10 of cancellation-of-debt (COD) income under Sec. 61(a)(11) (equal to the debt amount less the FMV of the assets subject to the debt) and a sale or exchange of the $100 of property under Sec. 1001 with a tax basis of $110. Depending on the character of the property, the partnership would have $10 of Sec. 1231, capital, or ordinary loss, for an overall net income impact of zero, resulting in the pre-liquidation balance sheet shown in the table “Foreclosure Impact on Capital Accounts,” below.

We can similarly analyze the tax consequences to the partners if, instead of a foreclosure, the partnership liquidated and distributed the assets and liabilities back to the partners in the same manner in which they were contributed. As calculated above, X has a tax basis in its partnership interest before the liquidation of $108. As a result of the liquidation, X has a Sec. 752(b) deemed distribution of $100 for the relief of its share of partnership debt and a Sec. 752(a) deemed contribution for its assumption of $80 of that liability in the liquidating distribution.

Both the Sec. 752(a) amount and the Sec. 752(b) amount are limited by the value of the property pursuant to Sec. 752(c). As a result, under Sec. 732, X’s tax basis in the asset it receives is $88 ($108 – $100 + $80), subject to debt of $88 (the $80 deemed distributed under Sec. 752(c), plus the $8 X was deemed to hold outside the partnership under Sec. 752(c) as a result of the contribution). Thus, Sec. 752(c) properly ensures that Partner X is returned to the same position X was in prior to the contribution to the partnership.

GLAM Situation 2, nonrecourse debt: Situation 2 of the GLAM evaluates the same facts as in Situation 1, except that the $110 debt is nonrecourse and is owed to an unrelated third party. The GLAM concludes that the change in debt terms and creditor does not alter the computation of tax basis to X and Y. Again, X is treated as contributing an asset with $88 of tax basis subject to debt of only $80 because debt is limited to the FMV of the property contributed (80% of $100 value).

The only difference in Situation 2 is that the debt assumed from Y no longer shifts to X after assumption by the partnership, because it is now nonrecourse debt owed to an unrelated party. Thus, X is treated as contributing an asset with $88 of tax basis subject to debt of $80 (because debt is limited to the FMV of the property contributed). X has tax basis in its partnership interest of $88 ($88 basis in contributed Z assets, unchanged by Sec. 752 because the $80 deemed distributed to X under Sec. 752(b) nets against X’s $80 deemed contributed by X under Sec. 752(a)). Again, if we extend the GLAM’s conclusion to a subsequent liquidation of the partnership, X would receive the distributed property with the same tax basis of $88 ($88 outside tax basis, less $80 Sec. 752(b) deemed cash distribution, plus $80 Sec. 752(a) deemed cash contribution). This result seems reasonable because the partners’ relationship to the property and the debt before and after the formation and liquidation of the partnership is unchanged.

Application to Example 1: Applying this analysis to the facts in Example 1, recall that Partner A and Partner B equally own a partnership with $200 debt and two assets, each with a tax basis of $200 but a value of only $50. Partner A and Partner B each have a tax basis of $200 in their partnership interest ($100 of contributed cash plus $100 share of partnership debt) prior to the distribution of one of the assets to each partner in liquidation of the partnership.

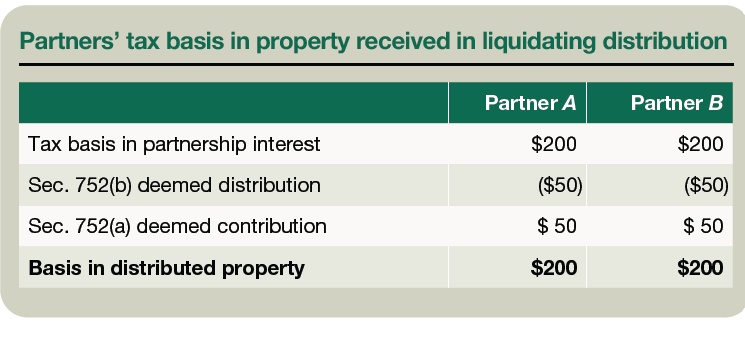

At the time of this liquidation, Partner A and Partner B each have a tax basis of $200 in their partnership interest because the full amount of the debt is already reflected in tax basis under Sec. 705. Upon the liquidation, Partner A and Partner B each have a deemed distribution under Sec. 752(b) of $50 (the debt amount assumed, capped at the value of the asset under Sec. 752(c)) and have a deemed contribution under Sec. 752(a) of $50 (the partnership debt amount relieved, capped at the value of the asset under Sec. 752(c)). Thus, Partner A and Partner B each receive the distributed property with a tax basis of $200 as summarized in the table “Partners’ Tax Basis in Property Received in Liquidating Distribution,” below.

Thus, the distribution and assumption of the nonrecourse debt do not shift the liabilities, and, therefore, the net effect of Sec. 752(c) does not alter the basis of the property to Partners A and B.

Observations

In the absence of precedential guidance addressing the application of Sec. 752(c) to an insolvent partnership, the provision could be interpreted in a manner that causes offsetting aggregate increases and decreases to the partners’ tax bases in their partnership interests, as limited by the property’s value. This interpretation might achieve Congress’s purpose of preventing basis overstatements while conforming to the statutory language of Sec. 752(c), which applies only with respect to Sec. 752 by its terms. Given the complexities in these issues, additional IRS guidance could help taxpayers navigate Sec. 752(c).

Editor Notes

Christine M. Turgeon, CPA, is a partner with PricewaterhouseCoopers LLP, Washington National Tax Services, in New York City.

For additional information about these items, contact Turgeon at christine.turgeon@pwc.com.

Contributors are members of or associated with PricewaterhouseCoopers LLP.