- column

- CASE STUDY

Calculating an LLC member’s amount at risk

Related

Partner redemptions from ‘dry’ partnerships

Death of an LLC member: Basic tax considerations

Penalties under codified economic substance doctrine upheld

Losses from the activities of individual taxpayers are limited to the amount with respect to which the taxpayer is at risk (Sec. 465(a)). Members in a limited liability company (LLC) carrying on the activity may encounter special considerations in determining their at-risk amount, especially those concerning the LLC’s debt.

Generally, an LLC member’s amount at risk is the sum of:

- Cash contributed to the LLC (cumulative) (Prop. Regs. Sec. 1.465-22(a));

- The cumulative adjusted basis of other property contributed to the LLC (Prop. Regs. Sec. 1.465-23(a));

- The member’s share of LLC recourse debt on the measurement date (Prop. Regs. Sec. 1.465-24);

- The member’s share of any other LLC debt for which the member is ultimately liable on the measurement date (Prop. Regs. Sec. 1.465-24); and

- The member’s share of any LLC qualified nonrecourse debt.

Because of the limited liability afforded to LLC members, members may not be able to include any of the LLC’s debt in their amount at risk under items 3 or 4 above. Members can include a portion of the LLC’s debt in their amount at risk only under the following situations:

- A member or members elect to assume liability for LLC debts under a state statute that allows such an assumption;

- The member is a former general partner in a partnership that converted to LLC status, and state law requires the member to remain liable for recourse debts incurred prior to the conversion;

- The member has a financial responsibility to make contributions to the LLC that are available to the LLC’s creditors (e.g., because of a capital contribution obligation or an obligation to return a prohibited distribution); or

- The member is the creditor with respect to an LLC debt or has the ultimate responsibility for payment of the debt.

The amount at risk is reduced by the cumulative allocation to the member of LLC taxable losses and deductions. Although not stated in Sec. 465, the regulations provide that a member’s amount at risk should be increased by the member’s cumulative share of LLC income and gains and reduced by any cumulative distributions to the member (Prop. Regs. Secs. 1.465-22(b) and (c)).

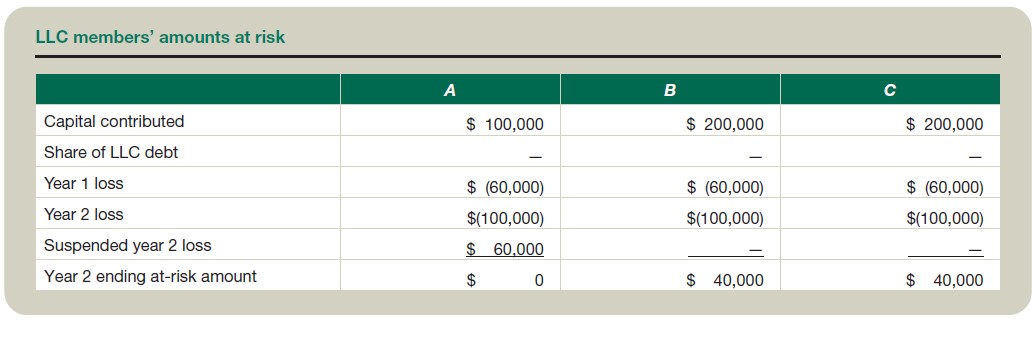

Example. Calculating a member’s amount at risk: An LLC is formed for geothermal exploration and is classified as a partnership for federal tax purposes. The LLC has three equal members, A, B, and C. The LLC was formed in year 1 with capital contributions of $200,000 each by B and C. A contributed earthmoving equipment that had a $200,000 fair market value (FMV) and an adjusted basis of $100,000. The LLC borrowed $3 million under a recourse note from the bank to purchase a tract of land for exploration. The LLC reported losses in year 1 of $180,000 and in year 2 of $300,000. The calculation of each member’s amount at risk at the end of year 2 is shown in the table “LLC Members’ Amounts At Risk,” below.

The members cannot increase their amounts at risk by any portion of the LLC debt because they have no economic risk with respect to the debt (see Prop. Regs. Sec. 1.465-24(a)(1)). Under state law, even though the debt is recourse to the LLC, the members’ limited liability protects them from any obligation to fund the debt — in the event of a default, the creditor can attach only the LLC’s assets. Given no change in the debt structure of the LLC and no additional contributions or distributions to or from the LLC in future years, B and C would each be able to deduct $40,000 of additional LLC losses. A can deduct only $40,000 of the year 2 LLC loss allocated to him because of his limited amount at risk — he can deduct no subsequent losses from the LLC until his at-risk amount increases.

Including LLC debt in a member’s amount at risk

Generally, a member’s amount at risk is increased for the amount of debt related to the at-risk activity for which the member is ultimately liable. This creates a stricter standard for allocating recourse debt to members who guarantee LLC debt than is used in either the basis determination rules or the Sec. 704(b) allocation rules. The following list addresses the specific rules for determining whether borrowed amounts can be included in a member’s amount at risk.

- Member loans: A member’s amount at risk is increased by the amount of any loans made by the member to the LLC to the extent that the member’s basis in the LLC interest would be increased under Sec. 752 (see Prop. Regs. Sec. 1.465-7). Consequently, the amount of a recourse or nonrecourse loan made by a member is typically included in the member’s amount at risk.

- Member guarantees: See the discussion of loan guarantees below.

- Recourse debts that become nonrecourse: Recourse debts, if any, that become nonrecourse upon the occurrence of some event or the lapse of time are amounts at risk during the recourse period — if they are motivated by business reasons and are consistent with normal commercial loan practices (see Prop. Regs. Sec. 1.465-5). An LLC will seldom have recourse debt.

- Protection against loss: Members are not considered to be at risk for borrowed amounts (or for contributions of cash or property) to the extent that they are protected against loss by agreement among the members or by operation of law. To the extent a member has the legal right to sue other members for reimbursement of amounts expended to pay LLC creditors (e.g., under a guarantee), the member is considered to be protected against loss (see Prop. Regs. Sec. 1.465-6). An LLC member is almost always protected against loss by operation of the state LLC statute. Consequently, LLC members can seldom include the LLC’s debt in their amount at risk.

- Interest other than as a creditor: Amounts borrowed by an LLC from a lender with an interest other than that of a creditor (or from a lender related to a person (other than the borrower) who has an interest other than as a creditor) are not considered amounts at risk. Consequently, except to the extent provided in regulations, amounts borrowed by a member from the following persons are not at risk: (1) another member; (2) anyone who has an equity or profits interest in the activity; or (3) a person who is related to such other member or person with an equity or profits interest in the activity. Members are considered to have an interest other than as a creditor if they have either a capital interest in the activity or an interest in the net profits of the activity (in the case of loans for which the member is personally liable and nonrecourse loans secured by property with a readily ascertainable FMV), or if they stand to receive financial gain (other than interest) from the activity or sale of the activity (in the case of nonrecourse loans secured by property without a readily ascertainable FMV) (Regs. Sec. 1.465-8). But the interestother- than-as-a-creditor rules do not apply to loans that are qualified nonrecourse financing or loans that would be qualified nonrecourse financing if they were nonrecourse debts.

- Pledged property: Members are at risk to the extent of the FMV of property they have pledged to secure LLC debt unless the pledged property is used in the at-risk activity (see Sec. 465(b)(2)(B)).

Impact of loan guarantees

Prop. Regs. Sec. 1.465-6(d) provides that a taxpayer’s guarantees of debt are not included in the amount at risk until the taxpayer actually pays the guaranteed amounts and has no right to reimbursement. The current IRS position is that the guarantee of nonrecourse debt (most LLC debt is nonrecourse debt or exculpatory debt that is recourse to the LLC but nonrecourse to the members) does not create an amount at risk for deducting losses. However, the Tax Court has been more willing to look at the economic issues involved in deciding whether at-risk amounts should be increased for nonrecourse debt guarantees. Three Tax Court cases, Abramson, 86 T.C. 360 (1986); Gefen, 87 T.C. 1471 (1986); and Bennion, 88 T.C. 684 (1987), have permitted an increase in at-risk amounts for guarantees by partners or members in LLCs classified as partnerships if:

- The guarantee is absolute and unconditional;

- There is no right of subrogation, contribution, or reimbursement from the entity or any other owner; and

- The guarantor bears the ultimate responsibility for the debt, or a portion of the debt, if the entity defaults in a worst-case scenario. The worstcase scenario is essentially equivalent to the hypothetical transaction described in Regs. Sec. 1.752-2(f), Example (1), where all of the entity’s assets, including cash, are deemed to be worthless and each owner’s responsibility for the various entity obligations is measured by the true economic risk each member bears.

In addition to these Tax Court cases, there are other reasons to question the appropriateness of the proposed regulations, including:

- The proposed regulations were issued in 1979, primarily as a response to the abusive tax shelter problems that were proliferating at that time. Further, the at-risk rules were not applied to real estate (where nonrecourse financing predominates) until 1986;

- No further clarification or guidance has been issued (except in the areas of qualified nonrecourse debt and an interest other than as a creditor) since the proposed regulations were issued; and

- In Field Service Advisory 200025018 the IRS followed the reasoning of Abramson, Gefen, and Bennion and indicated that a member who enters into an agreement to pay a liability of an LLC or guarantees an LLC liability is considered at risk to the extent of those liabilities if there is no right of reimbursement from the other members.

In generic legal advice memo AM 2014-003, the IRS indicated that when a member of an LLC classified as a partnership or disregarded entity guarantees LLC debt, the member is at risk for the guaranteed debt without regard to whether the member waives any right to subrogation, reimbursement, or indemnification from the LLC, but only to the extent (1) the member has no right of contribution or reimbursement from persons other than the LLC; (2) the member is not otherwise protected against loss; and (3) the guarantee is bona fide and enforceable by LLC creditors.

If the debt is qualified nonrecourse financing, the member’s amount at risk is increased by the amount guaranteed to the extent that (1) the debt was not previously taken into account by that member; (2) the guaranteeing member has no right of contribution or reimbursement from persons other than the LLC and is not otherwise protected against loss within the meaning of Sec. 465(b)(4); and (3) the guarantee is bona fide and enforceable by LLC creditors.

When an LLC member guarantees qualified nonrecourse debt, the debt is no longer considered qualified nonrecourse financing if the guarantee is bona fide and enforceable by creditors of the LLC, and the guaranteed debt will no longer be includible in the at-risk amount of other nonguarantor LLC members, which could lead to the recapture of previously deducted losses for those members that are no longer at risk for the guaranteed debt.

In Chief Counsel Advice memo (CCA) 201606027, the IRS held that certain guarantees by a member of an LLC (classified as a partnership) made the guarantor personally liable. So, to the extent of the guarantee, debt that would otherwise be qualified nonrecourse financing debt was not includible in the other members’ at-risk amount. These guarantees (sometimes referred to as “bad boy” guarantees) are conditioned on the occurrence of certain events that are usually within the LLC’s or guarantor’s control.

Historically, most practitioners have ignored these “bad boy” guarantees when determining who is personally liable for debt, since it is generally economically disadvantageous for the borrower or guarantor to trigger them and therefore highly unlikely that the borrower or guarantor would do so. After hearing concerns from numerous practitioners and real estate professionals, the IRS clarified the CCA. In generic legal advice memo AM 2016-001, the Service said that unless the facts and circumstances show otherwise, guarantees of qualified nonrecourse financing debt that are triggered by the following events will be ignored (unless and until payment is made) for purposes of determining who (if anyone) is personally liable for the debt:

- The borrower fails to obtain the lender’s consent before obtaining subordinate financing or transfer of the secured property;

- The borrower files a voluntary bankruptcy petition;

- Any person in control of the borrower files an involuntary bankruptcy petition against the borrower;

- Any person in control of the borrower solicits other creditors of the borrower to file an involuntary bankruptcy petition against the borrower;

- The borrower consents to or otherwise acquiesces or joins in an involuntary bankruptcy or insolvency proceeding;

- Any person in control of the borrower consents to the appointment of a receiver or custodian of assets; or

- The borrower makes an assignment for the benefit of creditors or admits in writing or in any legal proceeding that it is insolvent or unable to pay its debts as they come due.

Observation: Qualified nonrecourse financing debt that a member has guaranteed to the extent that one of the events listed immediately above occurs generally can be shared by all members for determining their at-risk amounts because such guarantees are generally ignored.

Amounts borrowed from related taxpayers

A member’s amount at risk may be increased by amounts borrowed from a person that is related to the member, unless the related person has an interest in the activity other than as a creditor or borrowed the money on a nonrecourse basis. However, a member’s amount at risk cannot be increased by amounts borrowed from a person who is related to a person (other than the member) that has an interest in the activity other than that of a creditor. The rules of Secs. 267(b) and 707(b)(1) define a related party under the at-risk rules, except that 10% is substituted for 50% when referring to ownership percentages (Sec. 465(b)(3)(C)). Additionally, persons engaged in businesses under common control (as defined in Secs. 52(a) and (b)) are considered to be related.

Deficit restoration obligations

In Hubert Enterprises, the Tax Court held that a member’s capital account deficit restoration obligation (DRO) provided in an LLC’s operating agreement did not result in additional at-risk amounts for the member until the obligation was activated upon liquidation of the LLC. This decision regarding the effect of a DRO was vacated by the Sixth Circuit and remanded back to the Tax Court based on the fact that it violated the established standard for determining an at-risk liability — whether in the worst case a member would be the “payor of last resort” (Hubert Enterprises, Inc., 230 Fed. Appx. 526 (6th Cir. 2007), vacating and remanding in part 125 T.C. 72 (2005)).

In 2008, the Tax Court reheard the case and held that the member’s DRO did not create an at-risk amount because the DRO was not an unconditional promise to contribute additional capital but required the member to contribute additional capital only if the member liquidated its interest in the LLC and had a deficit capital account (Hubert Enterprises, Inc., T.C. Memo. 2008-46). The court noted that the DRO did not render the member the payer of last resort but that the person who bore the risk of loss on a default was the LLC’s recourse creditor. Additionally, the member was not the payer of last resort because the member had a limited obligation to fund any debt (up to the amount of his negative capital account), which was not necessarily the same amount as his proportionate share of the LLC’s debt.

Note: It is unusual for LLC members to agree to a DRO. More likely, the members will agree to a qualified income offset if they are attempting to meet the substantial-economic-effect safe harbor.

Contributor

Shaun M. Hunley, J.D., LL.M., is an executive editor with Thomson Reuters Checkpoint. For more information about this column, contact thetaxadviser@aicpa.org. This case study has been adapted from Checkpoint Tax Planning and Advisory Guide’s Closely Held C Corporations topic. Published by Thomson Reuters, Carrollton, Texas, 2024 (800-431-9025; tax.thomsonreuters.com).