- tax clinic

- CONSOLIDATED RETURNS

Dual consolidated losses: Recapture considerations

Related

Navigating safe-harbor rules for solar and wind Sec. 48E facilities

Businesses urge Treasury to destroy BOI data and finalize exemption

IRS generally eliminates 5% safe harbor for determining beginning of construction for wind and solar projects

Editor: Jeffrey N. Bilsky, CPA

The economic challenges brought about by the COVID-19 pandemic prompted many businesses to rationalize their international structures with an emphasis on selling or otherwise disposing of underperforming foreign entities. Disposing of foreign entities may have tax consequences under the dual consolidated loss (DCL) rules of Sec. 1503(d).

This item discusses an interesting issue that arises under those rules in the following example, which involves a corporation that must recapture DCLs on the sale of a foreign entity:

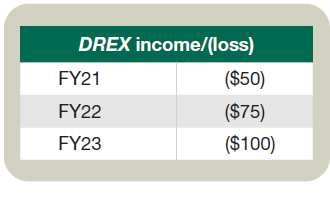

Example: USP, a domestic corporation that is not a member of a consolidated group, conducts foreign operations through a disregarded entity in Country X (DREX). DREX is subject to Country X corporate income tax on a residence basis. DREX incurred losses in fiscal year 2021 (FY21) to fiscal year 2023 (FY23), as set forth below. The losses were reflected on DREX’s books and records. To benefit from DREX’s losses, USP made domestic use elections (DUEs) pursuant to Regs. Sec. 1.1503(d)-6(d) and filed annual recertifications for two of its loss years (FY21 and FY22) pursuant to Regs. Sec. 1.1503(d)-6(g). USP used the DCL in each year to offset its other income during that year.

At the end of FY23, USP sold its interests in DREX to an unrelated foreign corporation, which was a triggering event under Regs. Sec. 1.1503(d)-6(e). USP was not permitted to make a DUE for the DREX loss in FY23 because of the triggering event in that year (Regs. Sec. 1.1503(d)-6(d)(2)). Thus, the FY23 DCL is subject to the domestic use limitation of Regs. Sec. 1.1503(d)-4(b).

As discussed below, USP has a potential DCL recapture of $125 (sum of the income/loss in DREX during FY21 and FY22) in FY23 because of the triggering event (see table, “DREX Income/(Loss),” below).

DCL overview

Broadly speaking, the DCL rules are designed to prevent an entity that is taxed in both the United States and a foreign jurisdiction from “double dipping” in terms of losses. “Double dipping” means using a single economic loss to offset income in both of the tax jurisdictions (see, generally, Kubitz and Sites, “The Dual Consolidated Loss Quandary,” 43 The Tax Adviser 93 (February 2012)).

More specifically, when a foreign entity elects to be disregarded for U.S. tax purposes, it becomes a “hybrid entity separate unit” potentially subject to the DCL rules. The DCL rules apply to losses in dual resident corporations and separate units (Regs. Sec. 1.1503(d)- 1(b)(5)). A separate unit includes an interest in a hybrid entity separate unit (Regs. Sec. 1.1503(d)-1(b)(4)). A hybrid entity is an entity that is not taxable as a corporation for U.S. federal income tax purposes (e.g., a DRE) but is subject to an income tax of a foreign country as a corporation either on its worldwide income or on a residence basis (Regs.Sec. 1.1503(d)-1(b)(3)). In the case of a separate unit, a DCL is a net loss attributable to the separate unit under Regs. Sec. 1.1503(d)-5 (Regs. Sec. 1.1503(d)- 1(b)(5)).

The income or DCL of a separate unit is computed using only the items of income, gain, deduction, and loss attributable to the separate unit as determined for U.S. federal income tax purposes (with certain modifications), translated into U.S. dollars at the appropriate exchange rate under Sec. 989(b) (Regs. Sec. 1.1503(d)-5(c) (1)). In the case of a hybrid separate unit, items of income, gain, deduction, and loss are generally attributable to a hybrid entity separate unit to the extent they are reflected on the separate books and records of the hybrid entity (Regs. Sec. 1.1503(d)-5(c)(3)).

Under Regs. Sec. 1.1503(d)-2, a DCL generally cannot “offset, directly or indirectly, the income of a domestic affiliate” — the domestic use limitation — unless, pursuant to Regs. Sec. 1.1503(d)-6(b), the appropriate electing party under the regulation, which includes an unaffiliated domestic owner, makes a DUE and files a certification with its income tax return for each tax year during the certification period that there has been no foreign use of the DCL (Regs. Sec. 1.1503(d)-6(g)). An unaffiliated domestic owner includes a domestic owner that is not a member of a consolidated group (Regs. Sec.1.1503(d)-1(b)(11)). A domestic owner is a domestic corporation that has one or more separate units (Regs. Sec. 1.1503(d)-1(b)(9)). A domestic affiliate includes a domestic owner (Regs.

Sec. 1.1503(d)-1(b)(12)). A foreign use occurs when any portion of a deduction or loss that is taken into account in computing a DCL is made available under the income tax laws of a foreign country to offset or reduce, directly or indirectly, any item of income or gain under such laws and that is or would be considered under U.S. tax principles an item of a foreign corporation (Regs.Sec. 1.1503(d)-3). The certification period is the period up to and including the fifth tax year following the year in which the DCL was incurred (Regs. Sec.1.1503(d)-1(b)(20)).

If a triggering event occurs, a taxpayer that made a DUE must recapture as gross income its DCLs and pay an interest charge (Regs. Secs. 1.1503(d)-6(e) and (h)). A triggering event includes a disposition of 50% or more of the interests (measured by voting power or value) of the domestic owner in the separate unit (Regs. Sec. 1.1503(d)-6(e)(1)(v)). Various exceptions exist; see Regs. Sec.1.1503(d)-6(f).

Offsetting DCL recapture with losses

In the example above, DREX is a hybrid entity separate unit because it is a DRE, but it is subject to Country X corporate income tax on a residence basis. Therefore, its losses are DCLs and ordinarily would be subject to the domestic use limitation. USP is an unaffiliated domestic owner because it is a domestic corporation that is not a member of a consolidated group and that has one or more separate units. Because USP entered into a DUE, it was able to use its DCLs to offset its other income. The sale of the interests in DREX was a triggering event requiring USP to include the DCLs in gross income in FY23.

The issue is how DREX’s FY23 loss interacts with its DCL recapture. In general, Regs. Sec. 1.1503(d)-6(h)(4)(i) provides that “for purposes of computing the taxable income for the year of recapture, no current, carryover or carryback losses may offset and absorb the recapture amount.” Thus, if USP had an overall taxable loss for the year (aside from the DCL recapture), it would have to report the recapture amount and carry forward the taxable loss to the next tax year. For example, if USP had a $500 loss (aside from the DREX loss) in FY23, it would still need to report $125 of recapture income. This much is clear. What is unclear is whether USP’s DCL recapture is taken into account in determining whether DREX has a DCL for FY23. In our example, USP had a DCL recapture amount of $125, while DREX had a loss of $100 in FY23. Is the $100 loss a DCL?

Regs. Sec. 1.1503(d)-5(c)(4)(vi) states, “If all or a portion of a dual consolidated loss that was attributable to a separate unit is included in the gross income of a domestic owner under the recapture provisions of §1.1503(d)-6(h), such amount shall be attributable to the separate unit that incurred the dual consolidated loss being recaptured ” (emphasis added). Does this language allow USP to offset DREX’s FY23 loss of $100 against the $125 of DCL recapture, resulting in no FY23 DCL?

On the one hand, Regs. Sec. 1.1503(d)-6(h)(4)(i) says no loss, including, presumably, the DREX FY23 loss, can offset the $125 recapture amount. On the other hand, Regs. Sec. 1.1503(d)-5(c)(4)(vi) says that the recapture amount is attributable to the DREX separate unit, and Regs. Sec. 1.1503(d)-1(b)(5) says that a DCL is the net loss attributable to a separate unit.

Would it matter if USP had other income for the year? Assume USP had $500 of separate income in FY23. In this case, could it be argued that the prohibition against using losses to offset the recapture amount under Regs. Sec. 1.1503(d)-6(h)(4)(i) would not be violated because the DREX loss would be used to offset USP’s income, not the recapture amount? If USP had no other income for the year, it appears that the prohibition would apply.

Even if USP had other income in FY23, the policy underlying the DCL rules suggests the DREX FY23 loss should be treated as a DCL. The DCL rules are intended to prevent the use of the same loss by a domestic corporation under U.S. federal income tax law and a foreign corporation under foreign tax law. DREX incurred an aggregate net loss of $225 from FY21 to FY23. If the DREX FY23 loss is not a DCL, that loss could be deducted by USP and presumably also be available for foreign use by the buyer.

Assume USP had $500 of separate income in each of FY21 to FY23 or $1,500 in total. The policy underlying the DCL rules would suggest that after the recapture, the aggregate income of USP should be $1,500. If the DREX FY23 loss were not a DCL, USP would have $1,400 of aggregate income because of the DREX FY23 loss: $1,500 of separate income, minus $125 of DREX net losses for FY21 and FY22, plus $125 of recapture, minus the $100 loss of DREX for FY23.

Space for differing positions?

The apparent tension between Regs. Sec. 1.1503(d)-5(c)(4)(vi) and Regs. Sec. 1.1503(d)-6(h)(4)(i) could lead to spirited discussions between taxpayers and their financial auditors (and, potentially, return preparers). It is entirely possible that taxpayers may take different positions for financial reporting and tax return reporting based on these discussions.

Editor notes

Jeffrey N. Bilsky, CPA, is managing principal, National Tax Office, with BDO USA LLP in Atlanta. Contributors are members of or associated with BDO USA LLP. For additional information about these items, contact Bilsky at jbilsky@bdo.com.