- tax clinic

- corporations & shareholders

Sec. 338(g) elections for foreign corporations and ‘creeping acquisitions’

Related

Navigating safe-harbor rules for solar and wind Sec. 48E facilities

Businesses urge Treasury to destroy BOI data and finalize exemption

IRS generally eliminates 5% safe harbor for determining beginning of construction for wind and solar projects

Editor: Jeffrey N. Bilsky, CPA

In business acquisitions, one of the key issues for negotiation between a purchaser and a seller is whether to structure the deal as a stock or an asset acquisition. For U.S. federal income tax purposes, taxpayers can elect to treat a stock acquisition as an asset acquisition when certain conditions are met. Such an election can often have favorable U.S. tax implications for the purchaser. However, U.S. purchasers that acquire stock in a foreign corporation in stages should be aware of a potential pitfall associated with making such an election.

Sec. 338(g) elections

A Sec. 338(g) election allows a purchasing corporation to treat a qualified stock purchase (QSP) as an asset acquisition, solely for U.S. tax purposes. Several conditions must be met to qualify as a QSP, including that both the purchaser and the target must be corporations. Also, the purchasing corporation must generally acquire at least 80% of the total voting power and value of the target corporation’s stock within a 12-month acquisition period in a taxable transaction or a series of such transactions from an unrelated seller or sellers. A Sec. 338(g) election may be made unilaterally.

When a Sec. 338(g) election is made, the target corporation is treated as if it sold all its assets at the close of the acquisition date in a single taxable transaction and, as a new corporation, purchased all the assets as of the beginning of the day following the acquisition date. The acquisition date is defined as the first day on which a QSP has occurred.

If the fair market value (FMV) of a target corporation’s assets is greater than their tax basis, the deemed sale of assets under a Sec. 338(g) election should result in a taxable gain for the target corporation. Foreign target corporations with no U.S. trade or business activities are generally not subject to U.S. federal income tax on such gains.

Potential advantages for a U.S. purchaser associated with making a Sec. 338(g) election with regard to the acquisition of a foreign target corporation can include:

- Stepping up the foreign target corporation’s assets to FMV. This can allow for greater amortization/ depreciation deductions for U.S. tax purposes, thereby reducing the foreign corporation’s income that may be subject to U.S. tax at the level of the U.S. purchaser (under an anti-deferral regime such as Subpart F or the global intangible low-taxed income (GILTI) regime). A step-up in the target corporation’s assets can also increase the amount of qualified business asset investment, which can reduce a U.S. shareholder’s inclusion under the GILTI regime.

- Elimination of the historical target’s tax attributes, including the target corporation’s earnings and profits and tax pools. This, in turn, eliminates the need to recompute such attributes for U.S. tax reporting purposes.

A Sec. 338(g) election has no effect on any non-U.S. tax attributes (including net operating losses), as this is solely a U.S. tax election.

‘Creeping acquisitions’

For a variety of reasons, a purchaser may acquire a target corporation’s stock in stages. This could occur, for example, when a purchaser first acquires stock of a target corporation in the open market rather than through a formal tender offer (which may typically involve the purchaser paying a premium). Such a strategy is often referred to as a “creeping acquisition.” A similar example could be where a substantial portion of the target corporation’s shares are acquired first, followed by a subsequent “squeeze-out” by the purchaser of the remaining selling shareholders. An acquisition that occurs in stages can still meet the conditions for being a QSP, provided that the purchasing corporation acquires at least 80% of the target corporation stock, both by vote and value, within a 12-month acquisition period.

Care should be taken, however, when a U.S. purchasing corporation acquires a foreign target corporation in stages and that foreign target corporation is treated as a controlled foreign corporation (CFC) for U.S. tax purposes.

CFCs and constructive ownership

A foreign corporation is treated as a CFC when it is more than 50% owned, by vote or value, by U.S. shareholders. A U.S. shareholder is defined as a U.S. person that owns at least 10%, by vote or value, of the stock in the foreign corporation. A U.S. shareholder can own its shares in the foreign corporation directly, indirectly, or constructively. Notably, due to the repeal of Sec. 958(b)(4) as part of the law known as the Tax Cuts and Jobs Act, P.L. 115-97, a U.S. shareholder may constructively own shares in a foreign corporation by way of “downward attribution.”

A detailed explanation of the constructive ownership and downward attribution rules is outside the scope of this item. However, among many other scenarios, the rules can generally cause:

- Attribution of ownership to a corporation from its shareholder. For example, a corporation can constructively own shares in its sister corporation when a parent corporation owns at least 50% by value of each corporation.

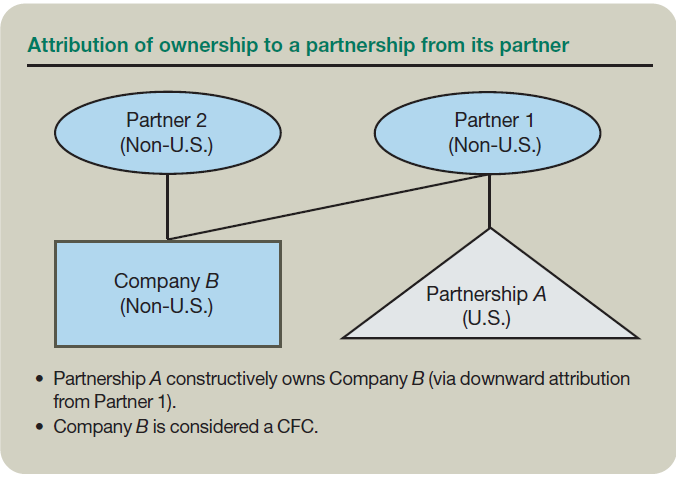

- Attribution of ownership to a partnership from its partner. For example, a partnership can constructively own shares in a sister corporation when a partner in the partnership also owns stock in the sister corporation. There is no ownership threshold requirement for such attribution.

Examples of these two fact patterns are shown, respectively, in the figures “Attribution of Ownership to a Corporation From Its Shareholder” and “Attribution of Ownership to a Partnership From Its Partner,” below.

With the repeal of Sec. 958(b)(4), which prevented downward attribution, many foreign corporations may be treated as CFCs due to constructive ownership by U.S. shareholders, even when those foreign corporations have no direct or indirect U.S. shareholders.

CFCs are subject to anti-deferral rules including Subpart F and the GILTI regime, both of which can subject direct or indirect U.S. shareholders to U.S. tax on certain earnings of the CFC, even in the absence of actual distributions.

Potential pitfall

As noted above, acquisitions of foreign corporations that occur in stages need to be carefully analyzed. More specifically, a potential pitfall can occur when a U.S. purchasing corporation first acquires a shareholding of 10% or more (but less than 80%) in a foreign target corporation that is treated as a CFC (due to direct, indirect, or constructive ownership) and then later acquires a shareholding in the target corporation that crosses the 80% threshold required for a QSP.

Making a Sec. 338(g) election results in the foreign target corporation being deemed to sell its assets at FMV as of the date of the QSP. If the FMV of the assets is greater than the target corporation’s tax basis, the deemed sale would result in a gain to the target corporation.

When the target corporation is a CFC, this gain should, in turn, be included on a pro rata basis in the target corporation’s direct and indirect U.S. shareholders’ taxable income, either as Subpart F income or as a GILTI inclusion (the nature of the gain will dictate which anti-deferral regime applies). Any Subpart F income and GILTI for the year can be reduced by any of the seller’s gain that is recharacterized as a dividend under Sec. 1248 (which generally applies only in the case of U.S.-tax-resident sellers).

Thus, if the purchasing corporation is a direct or indirect U.S. shareholder in the foreign target corporation before the acquisition date, and the foreign target corporation is a CFC, making a Sec. 338(g) election can trigger a U.S. income inclusion under GILTI or Subpart F for the purchasing corporation.

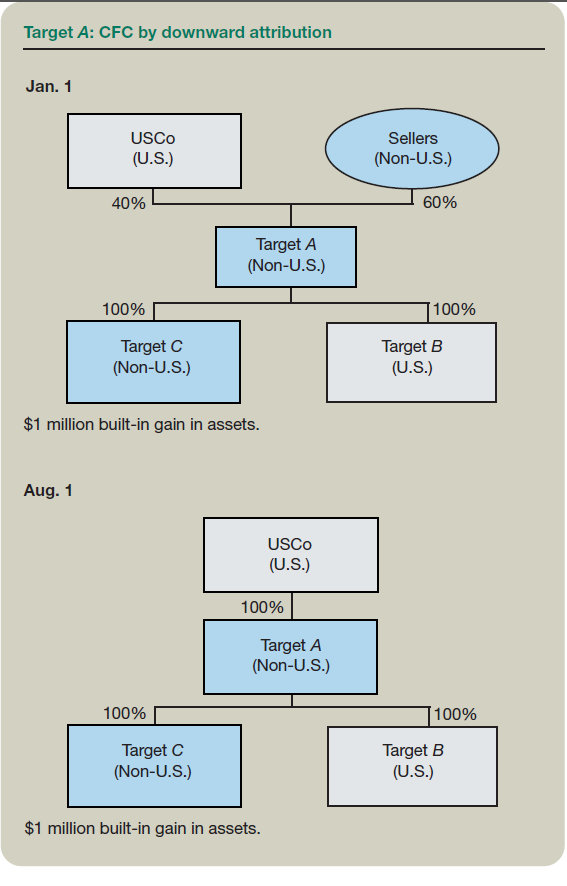

Example 1: A U.S. corporation (USCo) intends to acquire a foreign target corporation (Target A) and Target A’s subsidiaries. Target A’s subsidiaries include a wholly owned U.S. corporation (Target B) and a wholly owned foreign corporation (Target C). Target A’s sellers are non-U.S. residents. Target C is treated as a CFC for U.S. tax purposes as a result of Target B constructively owning 100% of its shares through downward attribution. Consider further that Target C has a built-in gain in its assets of $1 million.

On Jan. 1, USCo acquires 40% of Target A. As a result, USCo is considered an indirect U.S. shareholder in Target C, which is considered a CFC at that time due to downward attribution. On Aug. 1 of the same year, USCo acquires the remaining 60% of Target A, resulting in USCo’s owning 100% of Target A and its subsidiaries (see the figure “Target A: CFC by Downward Attribution,” below).

USCo’s acquisition of Target A and its subsidiaries meets the conditions for being considered a QSP. The acquisition date of the QSP is Aug. 1, the date on which the 80% ownership threshold required for a QSP was crossed. USCo would like to make a Sec. 338(g) election for Target C to step its assets up to FMV and claim depreciation/amortization deductions in computing its GILTI/Subpart F inclusions.

The Sec. 338(g) election results in Target C being deemed to sell its assets at FMV as of the date of the QSP (Aug. 1), which results in Target C having a capital gain of $1 million (the built-in gain in its assets). Because USCo is a U.S. shareholder in Target C, a CFC due to constructive ownership, it must include in income its pro rata share of the Subpart F income and GILTI earned by Target C during its tax year that ends on the acquisition date. This notably includes any Subpart F income and GILTI resulting from the deemed sale of Target C’s assets. As a result, USCo should include 40% of the $1 million gain in its taxable income as either Subpart F income or GILTI (it is assumed that none of the sellers’ gain is recharacterized as a Sec. 1248 dividend due to the sellers being non-U.S. residents).

Because a Sec. 338(g) election applies solely for U.S. tax purposes, it is unlikely that any foreign taxes would be paid by Target C on its deemed gain for which USCo could claim a foreign tax credit (and, in any event, such taxes may be limited for foreign tax credit purposes under Sec. 901(m)).

For completeness, note that a similar result could occur even in the absence of the target corporation being a CFC as a result of constructive ownership.

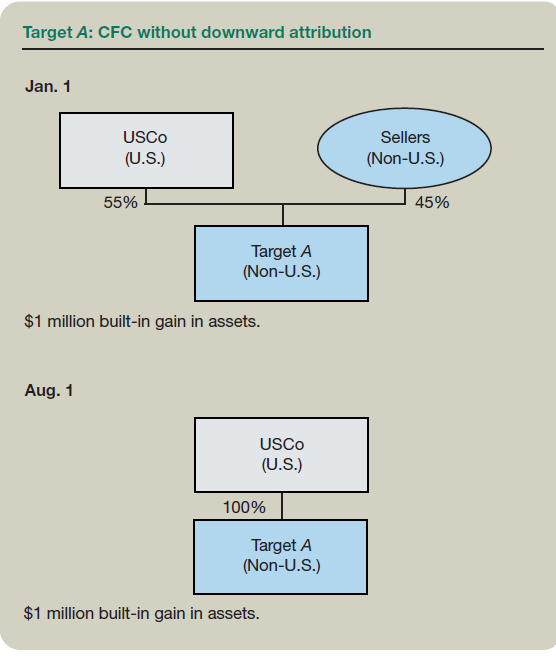

Example 2: Assume that Target A was a stand-alone company with no subsidiaries and that USCo first acquired 55% of its shares on Jan. 1 and the remaining 45% on Aug. 1. Assume in this example that Target A has a built-in gain in its assets of $1 million.

In this scenario, Target A should be treated as a CFC from Jan. 1 as a result of being more than 50% owned by a U.S. shareholder (USCo). The acquisition date for Sec. 338(g) purposes is Aug. 1.

Again, as a result of Target A being treated as a CFC, USCo must include in income its pro rata share of the Subpart F income and GILTI earned by Target A during its tax year that ends on the acquisition date, including any Subpart F income and GILTI resulting from the deemed sale of the target corporation’s assets. Similar to the previous example, this results in USCo including 40% of the $1 million gain in its taxable income as either Subpart F income or GILTI (see the figure “Target A: CFC Without Downward Attribution” below).

Be wary with Sec. 338(g) elections

While Sec. 338(g) elections remain an important tool for U.S. purchasers and can often provide advantages in the context of acquiring foreign target corporations, U.S. purchasing corporations should be wary not to miscalculate when such acquisitions of foreign target corporations are undertaken in stages, particularly when a foreign target corporation is deemed to be a CFC due to downward attribution.

Editor notes

Jeffrey N. Bilsky, CPA, is managing principal, National Tax Office, with BDO USA LLP in Atlanta. Contributors are members of or associated with BDO USA LLP. For additional information about these items, contact Bilsky at jbilsky@bdo.com.