- tax clinic

- GAINS & LOSSES

Revisiting Sec. 1202: Strategic planning after the 2025 OBBBA expansion

Related

Businesses urge Treasury to destroy BOI data and finalize exemption

IRS generally eliminates 5% safe harbor for determining beginning of construction for wind and solar projects

Prop. regs. issued on new qualified tips deduction

Editors: Brian Hagene, CPA, CGMA (CPAmerica), and Susan M. Grais, CPA, J.D., LL.M. (Ernst & Young LLP)

In a tax environment defined by uncertainty and complexity, advisers are under increasing pressure to deliver proactive and strategic planning, especially in the context of business sales, transitions, and liquidity events. For founders, early investors, and owners of closely held businesses, one of the most generous and underutilized opportunities in the Code remains Sec. 1202, the qualified small business stock (QSBS) exclusion.

Originally enacted in 1993, Sec. 1202 has been steadily enhanced over time. Most recently, the July 4, 2025, passage of the law known as the One Big Beautiful Bill Act (OBBBA), H.R. 1, P.L. 119–21, expanded key parts of the statute, including higher gain exclusion caps, broader qualification thresholds, and new partial exclusions for earlier exits. These changes have pushed Sec. 1202 from a niche incentive to a central pillar of small business tax planning.

This item offers a practical guide for tax professionals seeking to identify, preserve, and maximize Sec. 1202 benefits. From entity structuring and gifting strategies to timing traps and compliance pitfalls, the following discussion is intended to help turn a technically complex Code section into a powerful, real–world planning opportunity.

Revisiting the basics

Sec. 1202 allows for the exclusion of up to 100% of capital gains on the sale of QSBS, provided several conditions in the statute are met. While it has existed since 1993, the provision gained renewed relevance with significant enhancements under the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010, P.L. 111–312; the lowering of the corporate tax rate in 2018 to 21% by the Tax Cuts and Jobs Act, P.L. 115–97; and now with the 2025 OBBBA expansion.

For tax advisers, understanding the framework of Sec. 1202 is critical, as even small missteps can jeopardize eligibility. The exclusion offers substantial federal tax savings but requires careful attention to timing, structure, and compliance. The key requirements, including those updated by the OBBBA, are outlined below.

QSBS requirements

To qualify for gain exclusion under Sec. 1202, stock must meet five core statutory requirements, each of which must be satisfied to maintain eligibility. While the OBBBA expanded certain thresholds and introduced partial exclusions, these foundational rules remain intact.

Qualified small business (Sec. 1202(d)): The corporation issuing the stock must be a qualified small business (QSB). To be a QSB, a corporation must be a domestic C corporation, and prior to the OBBBA, for tax years beginning on or before July 4, 2025, the aggregate gross assets of the corporation (or any predecessor thereof) could not exceed $50 million at all times on or after Aug. 9, 1993, before the stock’s issuance and immediately after the stock’s issuance. The OBBBA increased the aggregate gross–asset limit to $75 million for stock issued after July 4, 2025. Aggregate gross assets are the amount of cash and aggregate adjusted basis (not the fair market value) of other property held by the corporation. In the case of a parent–subsidiary controlled group as defined in Sec. 1202(d)(3)(B), for purposes of the limit, all members of the controlled group are treated as one corporation.

Original issuance (Sec. 1202(c)(1)(B)): The taxpayer must acquire the stock at original issuance, directly from the corporation or through an underwriter, in exchange for money, property (excluding stock), or as compensation for services to the corporation. Stock purchased on the secondary market or acquired from another shareholder does not qualify.

Eligible shareholder (Sec. 1202(a)(1)): Only noncorporate taxpayers (e.g., individuals, trusts, and estates) may claim the Sec. 1202 exclusion. Passthrough entities including partnerships, S corporations, regulated investment companies, and common trust companies, may pass the exclusion through to their partners or shareholders, provided they meet the requirements set out in Sec. 1202(g).

Active business (Sec. 1202(e)): For stock to be QSBS, during substantially all of the taxpayer’s holding period of the stock, at least 80% (by value) of the corporation’s assets must be used in the active conduct of a qualified trade or business, and the corporation must be an eligible corporation (i.e., any domestic corporation other than a domestic international sales corporation (DISC), a former DISC, a regulated investment company, a real estate investment trust, a real estate mortgage investment conduit, or a cooperative). Corporations in certain industries are excluded; see the discussion below.

Holding period (Sec. 1202(a)): To claim the full exclusion, the taxpayer must hold the QSBS for five or more years. Under the OBBBA, for stock acquired after July 4, 2025, a partial exclusion of 50% of gain is allowed for QSBS held for three years and a partial exclusion of 75% of gain is allowed for stock held for four years. If the stock is sold earlier, a Sec. 1045 rollover may preserve eligibility if it is reinvested in new QSBS within 60 days, provided the original stock was held for more than six months.

Amount of gain exclusion (pre-OBBBA)

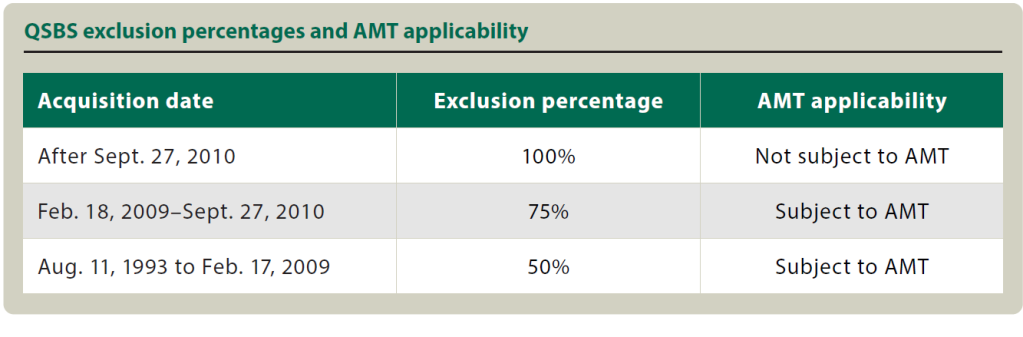

For QSBS acquired before July 4, 2025, the exclusion percentage and the applicability of alternative minimum tax (AMT) depend on the date the QSBS was acquired, as shown in the table “QSBS Exclusion Percentages and AMT Applicability.”

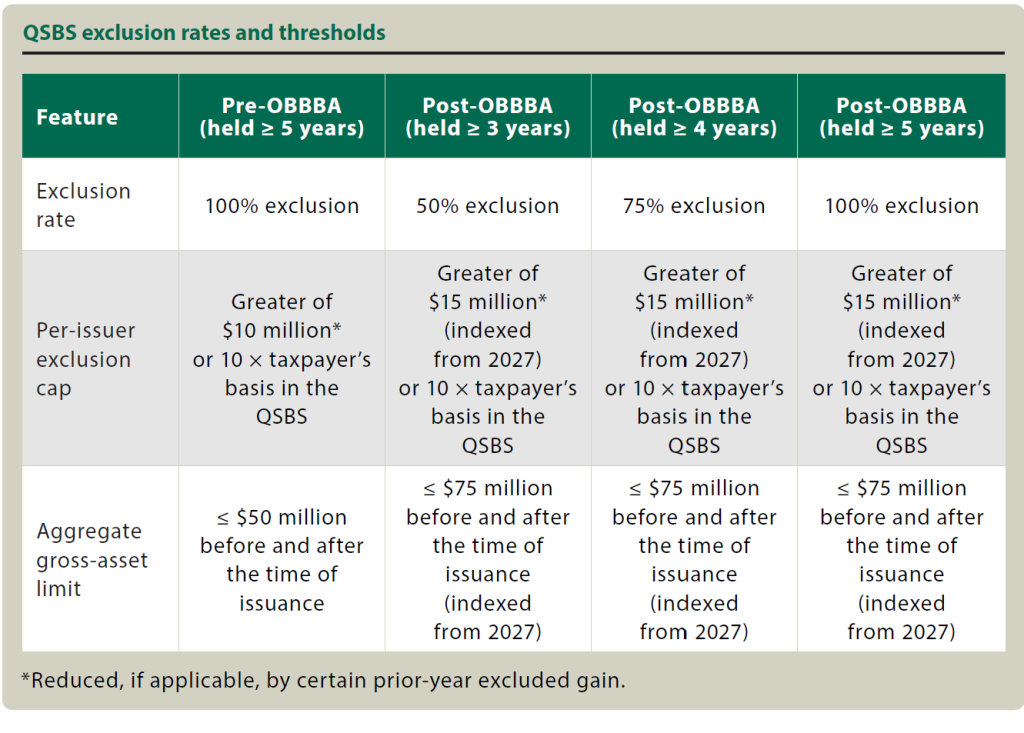

Under the pre–OBBBA rules, the maximum gain eligible for exclusion for a tax year is subject to a per–issuer exclusion cap, which is generally the greater of $10 million (reduced by certain prior–year excluded gain) or 10 times the taxpayer’s basis in the stock.

Changes under the OBBBA

Sec. 1202 has, since Sept. 28, 2010, allowed taxpayers to exclude up to 100% of gain on the sale of QSBS held for five or more years. The OBBBA significantly broadens access to the exclusion by introducing partial gain exclusions for earlier exits and raising the eligibility ceilings for the per–issuer exclusion cap and the aggregate gross–assets test, offering new planning opportunities for liquidity events.

Tiered exclusion amounts: A key change is the introduction of tiered gain exclusions based on the QSBS holding period:

- 50% exclusion for QSBS held three years;

- 75% exclusion for QSBS held four years; and

- 100% exclusion for QSBS held five years.

This structure offers flexibility for earlier exits while still rewarding longer holding periods, a shift likely to resonate with founders, investors, and employees facing real–world liquidity needs.

Expanded eligibility ceilings: The new law also raises eligibility ceilings for companies to qualify under Sec. 1202:

- The dollar amount for purposes of the per-issuer exclusion cap increases from $10 million to $15 million and, for tax years beginning after 2026, is indexed for inflation; and

- The aggregate gross-asset test limit rises from $50 million to $75 million, also indexed for inflation after 2026.

The change to the gross–asset test limit expands QSBS eligibility to a broader range of businesses, particularly in high–growth sectors like technology, manufacturing, and professional services, giving founders and tax advisers more planning room, especially for companies approaching the pre–OBBBA limits. The change to the dollar amount for purposes of the per–issuer exclusion cap potentially increases the amount of the QSBS exclusion a taxpayer may be entitled to.

Effective date and transition considerations: The change to the tiered gain exclusions and the increase in the gain exclusion cap apply to QSBS acquired after July 4, 2025. Stock acquired before that date remains subject to the prior rules, including the $10 million gain exclusion cap and five–year holding period. The change to the aggregate gross–asset test applies to QSBS issued after July 4, 2025. Advisers should review acquisition dates carefully and consider timing strategies for future equity issuances, financing rounds, or restructurings to ensure clients benefit from the expanded rules.

Sec. 1202 remains a powerful tool for tax–efficient exits, but its value depends on early planning and sustained compliance. With the new enhancements under the OBBBA, tax professionals should revisit client structure, equity strategies, and exit timelines to ensure that QSBS eligibility is fully preserved. See the table “QSBS Exclusion Rates and Thresholds.”

Planning opportunities

Entity structuring: C corporation status from the start: One of the most common barriers to QSBS eligibility is entity structure. Again, Sec. 1202 only applies to domestic C corporations, which means businesses operating as limited liability companies or S corporations must convert before issuing qualifying stock.

This makes early–stage planning critical. Advisers should help clients with high–growth potential weigh the long–term tradeoffs between flowthrough flexibility and QSBS eligibility. While the corporate tax rate remains relatively low at 21%, the combined effective rate, when including potential double–taxation on dividends, can approach 40%. This makes the C corporation structure less tax–efficient in some scenarios, but for clients pursuing rapid growth and an eventual equity exit, the QSBS benefit can outweigh that cost. C corporation status does not just enable QSBS eligibility, it also starts the holding–period clock.

Only equity issued after the effective date of conversion qualifies for exclusion. Value created during passthrough years can disqualify earlier stock. Timing and documentation are essential to preserve future tax benefits.

Best practice: Document the conversion clearly and confirm that stock is issued directly from the corporation after C corporation status is effective. Proper planning is far more cost–effective than seeking an IRS letter ruling or requiring shareholders to fund a post–transaction Sec. 1202 analysis.

Gifting and stacking strategies (Sec. 1202(h)): One of the lesser–known opportunities within Sec. 1202 is the ability to multiply the exclusion amount through strategic gifting. Because the $10 million (pre–OBBBA) or $15 million (post–OBBBA) exclusion is applied per taxpayer, it may be possible to “stack” exclusions by gifting QSBS to family members or grantor trusts.

Stacking strategies require careful, early planning (see Lederman and Casteel, “Qualified Small Business Stock: Gray Areas in Estate Planning,” 55–4 The Tax Adviser 30 (April 2024)). Gifts must occur before a binding sale agreement is in place; otherwise, the IRS may attribute the gain to the donor. It is also critical to preserve the stock’s original–issuance and holding–period characteristics.

Best practice: Coordinate closely with estate planners to ensure the gift structure aligns with broader succession or wealth–transfer goals. Use trusts with independent beneficiaries and avoid post–sale gifts, which may be challenged under the step–transaction doctrine.

Holding period and rollover awareness: While the five–year holding period remains the key to full QSBS exclusion, the OBBBA’s new tiered thresholds at three and four years create planning opportunities for clients who may need earlier liquidity.

Advisers should:

- Track acquisition dates carefully, especially across multiple issuances;

- Identify when QSBS may qualify for 50%, 75%, or 100% exclusion; and

- Consider Sec. 1045 rollovers if clients must sell QSBS before meeting the full exclusion holding period threshold.

To qualify for Sec. 1045 rollover, the original QSBS must have been held for more than six months before the sale. Sec. 1045 allows taxpayers to reinvest proceeds from the sale of QSBS into new QSBS within 60 days and carry over the original holding period. Though underutilized, a Sec. 1045 rollover can preserve exclusion potential in time–sensitive transactions.

Best practice: Maintain a detailed tracking workpaper for clients with multiple issuances or gifts to clearly document acquisition dates, holding periods, and applicable exclusion tiers.

Pitfalls and misconceptions

Stock not acquired at original issuance:To qualify under Sec. 1202, stock must be acquired at original issuance, meaning the taxpayer must receive it directly from the corporation or through an underwriter, not through secondary market purchases or transfers from other shareholders. This requirement frequently disqualifies stock acquired during reorganizations, redemptions, or internal buyouts, unless the transaction is properly structured.

Certain tax–free corporate transactions allow for partial or full preservation of QSBS status — specifically, Sec. 351 contributions and Sec. 368 reorganizations (Sec. 1202(h)(4)). These provisions apply only if specific structural requirements are met and can be complex in practice.

- Sec. 351 transactions: If a taxpayer transfers QSBS to another corporation in a tax-free exchange under Sec. 351, the stock received in return can retain QSBS status, but only to the extent of gain that would have been recognized had the exchange not qualified for nonrecognition. This treatment depends on satisfying the 80% control test under Sec. 368(c), under which the acquiring corporation must control at least 80% of the vote and value of each class of stock of the QSB corporation.

- Sec. 368 reorganizations: In a reorganization under Sec. 368, QSBS exchanged for non-QSBS may still retain its original QSBS character — but again, only to the extent of built-in gain at the time of the exchange. Any post-reorganization appreciation qualifies as QSBS gain only if the new stock independently qualifies as QSBS going forward.

These provisions create a narrow path for preserving QSBS benefits during tax–deferred transactions. However, the retained QSBS status applies only to pre–transaction gain, not to future appreciation, unless the successor stock meets all QSBS eligibility criteria.

Best practice: Carefully document how and when stock was acquired, including any tax–free exchanges under Sec. 351 or 368. In closely held or family–owned businesses, where restructurings are common, ensure that any transfer preserves original–issuance treatment or meets the criteria for continued QSBS eligibility through nonrecognition rules.

Redemptions:Sec. 1202 has strict anti–abuse rules related to stock redemptions. Stock acquired by a shareholder is not treated as QSBS if a company redeems any of its own stock from the shareholder or a person related (within the meaning of Sec. 267(b) or 707(b)) to the shareholder within the period two years before or after the stock’s issuance (Sec. 1202(c)(3)). Many corporations unintentionally trip this rule during restructurings or partial buyouts, especially in transactions involving related entities.

One common pitfall involves Sec. 304 redemptions, where a stock sale between related corporations is recharacterized as a redemption by the acquiring corporation. Even if no direct buyback by the QSBS issuer occurs, these deemed redemptions can still trigger disqualification under Sec. 1202(c)(3), depending on timing and attribution.

Best practice: Evaluate the full capitalization table and all stock transactions, including those between related corporations, when advising on new QSBS issuances. If a Sec. 304 transaction or similar event occurs within the four–year window, assess whether it should be treated as a redemption for QSBS purposes.

Active–business requirement failure:As mentioned above, for stock to qualify under Sec. 1202 as QSBS, at least 80% (by value) of the corporation’s assets must be used in the active conduct of a qualified trade or business during substantially all of the taxpayer’s holding period for the stock. Companies can inadvertently fail this test if they accumulate excess cash, hold investment property, or operate in excluded industries.

Startups and early–stage companies are particularly vulnerable during fundraising rounds, when capital may sit unused. Fortunately, Sec. 1202(e)(6) provides a working–capital exception that allows assets (including cash) to count as used in the active conduct of a trade or business if they are:

- Held as a part of the reasonably required working-capital needs of a qualified trade or business of the corporation, or

- Held for investment and are reasonably expected to be used within two years to finance research and experimentation in a qualified trade or business or increases in working-capital needs of a qualified trade or business.

However, after a corporation has been in existence for at least two years, no more than 50% of its assets can qualify as used in the active conduct of a qualified trade or business by reason of the working–capital exception. Companies must document their intended uses of the assets to substantiate working–capital treatment.

In addition, Sec. 1202(e)(3) excludes certain types of trades or businesses from being QSBs altogether, regardless of how active they are. The statute disqualifies “any trade or business involving the performance of services in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset … is the reputation or skill of 1 or more of its employees.” Also excluded are banking, insurance, financing, investing, or similar businesses; farming businesses; production or extraction of certain products for which percentage depletion is allowed (oil, gas, minerals, etc.); and any operation of a hotel, motel, restaurant, or similar business.

This language is broadly interpreted and frequently applies to service–based businesses, especially those centered on professional expertise, intellectual labor, or personal branding. Even a cash–efficient, growth–stage firm can be disqualified based on its industry classification or income source.

Best practice: Actively monitor the company’s balance sheet to ensure at least 80% of assets are used in qualifying operations. If the company holds excess cash or nonoperating assets, consider deploying funds toward research and development, hiring, or capital investment. When retaining cash for business needs, document plans internally or in board materials to support the working–capital exception. Also, evaluate the company’s industry classification and revenue model early to confirm it is not among the excluded service categories.

Sec. 1202 matters now more than ever

With higher thresholds, tiered exclusions, and broader applicability, QSBS has become a cornerstone of proactive tax planning. It is no longer a niche benefit reserved for a narrow slice of startup founders; it now applies to a wider range of clients across industries and entity stages.

Sec. 1202 remains one of the most powerful and often overlooked provisions in the Code for small business owners, founders, and early investors. With recent legislative changes expanding its reach, there is more reason than ever for tax advisers to proactively integrate QSBS into their planning conversations. But the opportunity does not happen by accident. It depends on entity structure, timing, documentation, and a long–view approach to planning, areas where tax advisers can deliver transformative value.

As clients look to navigate increasingly complex growth, succession, and liquidity paths, Sec. 1202 offers more than just a tax break. It is a tool that, when used well, can help shape generational wealth outcomes. Whether you are advising on a startup formation, a midcycle restructuring, or a family succession plan, now is the time to ask: “Could this qualify for QSBS?” In a landscape of uncertainty, that single question could unlock one of the most powerful planning opportunities in a tax adviser’s toolkit.

Editors

Brian Hagene, CPA, CGMA, is partner/owner at Mathieson, Moyski, Austin & Co. LLP in Lisle, Ill., with CPAmerica. Susan M. Grais, CPA, J.D., LL.M., is a managing director at Ernst & Young LLP in Washington, D.C.

For additional information about these items, contact thetaxadviser@aicpa.org.

Contributors are members of or associated with CPAmerica or Ernst & Young LLP, as designated.