- tax clinic

- FOREIGN INCOME & TAXPAYERS

On DRD, the IRS seeks to have its cake and eat it too

Related

Businesses urge Treasury to destroy BOI data and finalize exemption

IRS generally eliminates 5% safe harbor for determining beginning of construction for wind and solar projects

Deducting corporate charitable contributions

Editor: Greg A. Fairbanks, J.D., LL.M.

The IRS Office of Chief Counsel released Chief Counsel Advice memorandum (CCA) 202436010 on Sept. 6, 2024, concluding that a controlled foreign corporation (CFC) is not allowed a dividends-received deduction (DRD) under Sec. 245A for a dividend received from another foreign corporation in which it held a 45% interest. Since the enactment of the Tax Cuts and Jobs Act (TCJA), P.L. 115-97, taxpayers have wrestled with the application of Sec. 245A to dividends received by CFCs, so this advice is welcome insight.

Plain-language interpretation of Sec. 245A(a) in the CCA

Dividend income, in the hands of a CFC, could represent Subpart F income for the CFC’s U.S. shareholder(s) unless an exception applies. Sec. 245A could allow a deduction equal to the amount of such dividend, thereby avoiding a net Subpart F inclusion with respect to the dividend received.

In the CCA, the Chief Counsel’s Office focused on the plain language of Sec. 245A(a), which requires that the recipient of the dividend from a specified foreign corporation (SFC) be both a “domestic corporation” and a “United States shareholder” of the SFC. The CCA argues that neither condition is met under the facts presented.

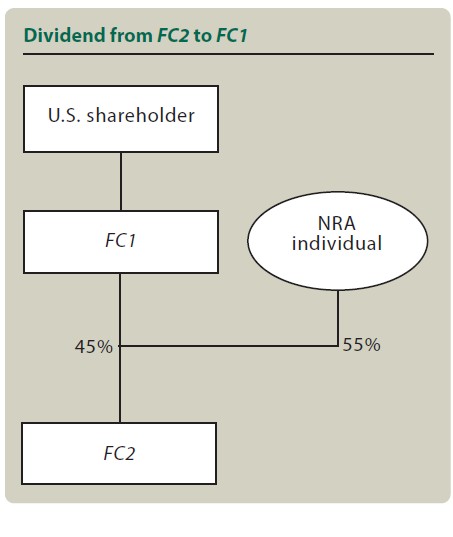

The example presented in the CCA includes a corporate domestic U.S. shareholder that wholly owns a CFC (FC1), which in turn owns 45% of a single class of stock of a foreign corporation (FC2). The remaining stock of FC2 is owned by a nonresident alien (NRA) individual. In the example, FC1 receives a dividend from FC2, as shown in the diagram “Dividend From FC2 to FC1,” below. The CCA concludes that FC1 would not be entitled to a DRD under Sec. 245A for the dividend it receives from FC2 because FC1 is neither a domestic corporation nor a U.S. shareholder with respect toFC2.

Counterarguments to the plain-language interpretation of Sec. 245A(a)

Although the conclusion in the CCA is a brief 14 words, the Chief Counsel’s Office addressed several arguments against a plain-language interpretation of Sec. 245A(a), including whether other statutory provisions change the interpretation and whether the legislative history of the TCJA should factor into the interpretation.

Ultimately, the Chief Counsel’s Office asserted that the statutory language of Sec. 245A(a) is “clear and unambiguous in identifying the type of taxpayer to which it applies” and concluded it was determinative. It emphasized that Congress’s use of the word “domestic” in Sec. 245A(a) could not be overlooked. If Congress intended to make a DRD under Sec. 245A for foreign corporations, the IRS noted, Congress could have drafted Sec. 245A with “language analogous to [Secs.] 243 and 245.” Neither Sec. 243 nor 245 clarifies that a corporation must be domestic or foreign in order for the provisions of the section to apply. Given that Sec. 245A provides a DRD only for a domestic corporation that is a U.S. shareholder, the Chief Counsel’s Office maintained that the statute’s plain language must be respected and that the DRD is available only in such a case.

In the CCA, the Chief Counsel’s Office rejected the argument that the legislative intent of Sec. 245A was to provide a DRD to both domestic corporations and CFCs. In the Conference Report to the TCJA (H.R. Conf. Rep’t No. 115-466, 115th Cong., 1st Sess. (2017)), footnote 1486 discusses the term “domestic corporation.” The footnote states that a domestic corporation includes “a controlled foreign corporation treated as a domestic corporation for purposes of computing the taxable income thereof” and references Regs. Sec. 1.952-2. The footnote also states that “a CFC receiving a dividend from a 10-percent owned foreign corporation that constitutes subpart F income may be eligible for the DRD with respect to such income.” While footnote 1486 to the Conference Report suggests that a DRD could be available to a CFC, the Chief Counsel’s Office, again pointing to the “clear and unambiguous” language of Sec. 245A(a), concluded that further interpretation was unwarranted and that the statutory language should control.

The Chief Counsel’s Office also argued that language in footnote 1486 misapplied Regs. Sec. 1.952-2(b), stating that, while those regulations provide the framework for how foreign corporations determine their taxable income, the regulations are not absolute and do not treat a foreign corporation as a domestic corporation for purposes of applying Sec. 245A. And finally, it argued that even if Regs. Sec. 1.952-2(b) treated a CFC as a domestic corporation, Regs. Sec. 1.952-2(c) would preclude the CFC from being treated as a “United States shareholder” and render the CFC ineligible for the DRD provided in Sec. 245A.

Questions remain around the plain-language interpretation of Sec. 245A(a)

On its face, the Chief Counsel’s Office’s conclusion seems logical: Follow the plain language meaning of the enacted law. However, the result can be called into question. The mechanics of Sec. 245A(a) yield a different result if the U.S. shareholder (in the CCA’s example) held a direct interest in FC2. In this case, the U.S. shareholder’s 45% interest in FC2 would have yielded a dividend eligible for a DRD under Sec. 245A because FC2 would have had a U.S. shareholder that was a domestic corporation. It follows that the U.S. tax treatment of a dividend paid by a 10%-owned SFC depends on the SFC’s ownership to determine whether the dividend paid by the SFC is excludable or deductible from the taxable income in receipt of the dividend. Alternatively, if FC2 were a CFC due to other U.S. ownership, a dividend paid out of untaxed earnings and profits from FC2 to FC1 is potentially excludable from FC1′s gross income under Sec. 954(c)(6), limiting the need for Sec. 245A to avoid a net Subpart F inclusion.

Sec. 954(c)(6)(C) provides that the “look-thru rule” in Sec. 954(c)(6)(A) applies to tax years of foreign corporations beginning after Dec. 31, 2005, and before Jan. 1, 2026, and to tax years of U.S. shareholders with or within which such tax years of foreign corporations end. Once the look-thru treatment expires under the statute, a dividend paid from a lower-tier CFC to an upper-tier CFC will align with the treatment under the CCA when a lower-tier SFC pays a dividend to an upper-tier CFC. In a Sec. 954(c)(6) era, the upper-tier CFC’s Subpart F income would include the CFC-to-CFC dividend, as it is no longer eligible for look thru, and the CFC’s Subpart F income would include the SFC-to-CFC dividend, with no eligible deduction under Sec. 245A, based on the CCA, resulting in a similar taxation of the dividend under either scenario.

Contrasting IRS arguments regarding statutory text in Varian

The strong adherence to statutory text by the Chief Counsel’s Office when interpreting Sec. 245A(a) can be contrasted with the IRS’s arguments in Varian Medical Systems, Inc., 163 T.C. No. 4 (2024). In that case, the Tax Court concluded that Sec. 245A applies to fiscal-year taxpayers in a very specific manner based on how Congress drafted the effective dates in the TCJA. The IRS argued that it had the authority to alter that outcome through regulation to reach what it perceived to be the congressionally intended outcome.

The Varian court concluded that the law can result in disparate treatment for seemingly similarly situated taxpayers, and, in cases where the plain text of the statute is unambiguous, the plain text of the statute should control (see Beavers, “Sec. 245A Dividends-Received Deduction Allowed for Sec. 78 Dividend,” 55-10 The Tax Adviser 58 (November 2024)).

Contrast that with the conclusion reached by the Chief Counsel’s office in issuing its advice. The CCA is more consistent with the line of thinking in the Tax Court’s decision in Varian in this regard, if one agrees that the language on this issue is clear and unambiguous. In Varian the IRS argued the opposite — that the plain-text meaning of the effective dates of Sec. 245A and amended Sec. 78, as enacted by the TCJA, needed additional clarification and issued regulations to further clarify the effective dates in the statute. The Tax Court ultimately rejected the clarification of the effective dates that the IRS appended in Regs. Sec. 1.78-1. It appears that the IRS wants to have its cake and eat it too when it comes to Sec. 245A.

Evaluating the CCA’s impact on DRD tax positions

The IRS’s 2024—25 Priority Guidance Plan includes a project for issuing regulations under Sec. 245A. In a recent International Fiscal Association conference, a spokesperson of the IRS Office of Associate Chief Counsel (International) indicated that other projects continue to take priority and that the CCA was issued in part due to delays in the release of the forthcoming regulations (Velarde, “Dividend Deduction Regs. Behind Line of Higher-Priority Guidance,” 115 Tax Notes Int’l 1902 (Sept. 12, 2024)). Although the CCA is nonbinding, it indicates that the forthcoming regulations may align with the position outlined therein. Further, the CCA indicates the likely IRS litigating position on this matter should taxpayers choose to take contrary positions.

The CCA “provides non-taxpayer-specific legal advice regarding the application of [Sec.] 245A(a)” and “may not be used or cited as precedent.” Taxpayers and U.S. shareholders of CFCs that have included a CFC-level deduction under Sec. 245A with respect to a dividend received from a specified 10%-owned foreign corporation should review the CCA and evaluate the effect on any positions taken.

Editor Notes

Greg A. Fairbanks, J.D., LL.M., is a tax managing director with Grant Thornton LLP in Washington, D.C.

For additional information about these items, contact Fairbanks at greg.fairbanks@us.gt.com.

Contributors are members of or associated with Grant Thornton LLP.