- feature

- TAX ACCOUNTING

Transfer pricing: The C-suite needs to be informed

Related

Why LIFO, why now?

Navigating safe-harbor rules for solar and wind Sec. 48E facilities

Businesses urge Treasury to destroy BOI data and finalize exemption

For the most part, the CEOs of large multinational corporations (MNCs) do not need to know much about tax issues. CEOs are already busy, charged with developing a vision and strategy for growth, overseeing financial management and resource allocation, maximizing organizational capabilities, motivating diverse and global workforces, and managing other success factors. However, transfer pricing is not your run-of-the-mill tax issue.

Several factors make transfer pricing unusually important to the CEOs of MNCs:

- Enormous dollar amounts at issue: Transfer pricing is consistently the largest tax risk for MNCs; together, the three largest transfer pricing disputes with the IRS, including subsequent tax years, involve approximately $100 billion in taxes, penalties, and interest.

- Penalties and interest rates: Transfer pricing tax deficiencies involving over $20 million of proposed tax adjustments can carry a 40% penalty in the United States; penalty rates are even higher in some other countries. Interest rates on underpayment of taxes have recently increased.

- Financial reporting risk: Transfer pricing exposure can create financial reporting issues under FASB ASC Topic 740, Income Taxes, as an uncertain tax position.

- Customs issues: Transfer pricing changes can impact customs valuations and tariffs, which may hinder the free flow of goods or increase costs ultimately borne by the customer.

Individually, the factors mentioned above might not justify briefing the CEO on a tax issue; together, they present a compelling case that the CEO should at least have an overview understanding of the company’s transfer pricing policies and an ability to respond to first-level questions on transfer pricing from investors, journalists, and politicians.

Two recent events underscore how transfer pricing issues can impact CEOs and their companies.

In November 2023, U.S. Sen. Elizabeth Warren, D-Mass., publicized her letter to the CEO of Microsoft concerning Microsoft’s SEC Form 8-K filing disclosure of an “egregious example of corporate tax evasion and misbehavior” through a transfer pricing arrangement called cost-sharing. At issue is $28.9 billion in taxes, plus penalties and interest. The four-page letter demands that the CEO estimate penalties and interest, explain why the full amount was not disclosed to investors, identify executives who “were aware of the scheme,” and explain when and how its external tax adviser was involved in the decision to implement the disputed arrangement.1

In March 2023, Amgen Inc. was sued by investors for omitting the amount of an IRS proposed adjustment, $10.7 billion in transfer pricing—related taxes, penalties, and interest, in its quarterly financial filing.2

What is transfer pricing?

“Transfer pricing” refers to the setting of the internal price for transactions between entities owned or controlled by the same entity for goods, services, intangible property transfers, rents, and loans. In transactions between unrelated parties, economic forces such as the law of supply and demand produce a fair price; when the entities to the transaction are controlled by the same party, the pricing of the transaction is within the group’s control. Thus, the transfer price controls the allocation of income and loss between the group’s related parties and the taxable income in the countries where the MNC has operations.

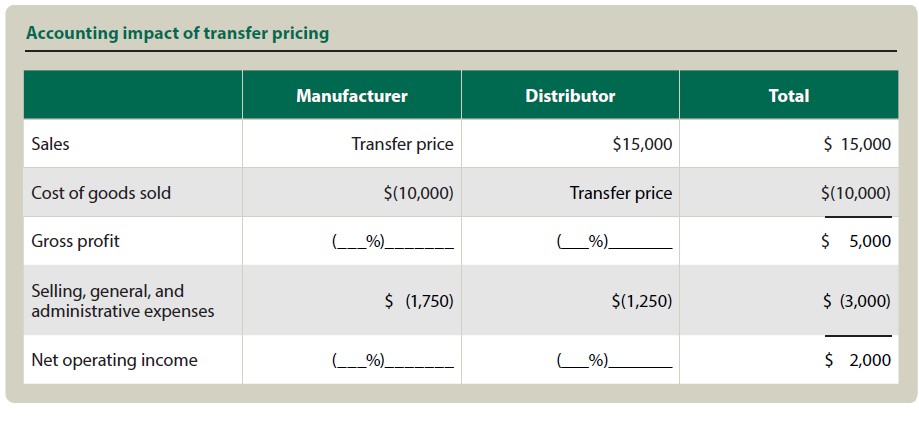

As illustrated in the chart “Accounting Impact of Transfer Pricing,” below, the transfer pricing does not change the pretax income of the consolidated group but only the allocation of profits between the related parties.

Increasing a transfer price shifts operating income (loss) from the distributor to the manufacturer; conversely, decreasing a transfer price shifts operating income (loss) from the manufacturer to the distributor. This transfer pricing adjustment directly affects where income is taxed. This concept is crucial in international taxation and has resulted in the adoption of the arm’s-length standard, among other international tax rules, for Organisation for Economic Co-operation and Development (OECD) nations.

How did transfer pricing become so important?

For decades, corporate tax executives have been asked what tax issues cause them the greatest concern. Transfer pricing has consistently been at or near the top of that list. The reasons discussed below are a large part of why transfer pricing produces so much concern and why that concern has recently increased.

Enormous amounts at issue

A number of very large transfer pricing disputes have received recent attention. In August 2024, the Tax Court held that The Coca-Cola Co. owed additional taxes of approximately $2.7 billion and applicable interest of approximately $3.3 billion for tax years 2007—2009. The company has appealed.3

As noted above, the IRS has proposed to increase Amgen’s taxable income by over $23 billion for tax years 2010—2015, which would result in approximately $10.7 billion of additional taxes and penalties, plus interest for that period.

As also noted above, Microsoft is currently engaged in a long-standing transfer pricing dispute with the IRS over $28.9 billion of additional taxes, plus penalties and interest for tax years 2004—2013. In the aggregate, these three cases represent taxpayer transfer pricing exposure in excess of $50 billion of tax, penalties, and interest. Each taxpayer has the same issue in subsequent years, resulting in possible exposure to a combined $100 billion of taxes, penalties, and interest.

A major reason for the increase in transfer pricing amounts at issue is the IRS’s focus on intangibles transactions in transfer pricing examinations. These transactions are highly subjective and inherently difficult to value due to the lack of closely comparable transactions for unique intangibles. The amounts at issue are amplified by the increasing importance of intangibles in a modern business. In a study of the value of intangibles relative to the overall value of S&P 500 companies, the percentage in 1975 was 17%, increasing to 90% in 2020.4 Thus, to the extent more transfer pricing disputes focus on intangibles, it is not surprising that amounts in dispute have risen.

Increased assertion of Sec. 6662 penalties and increased interest rates

The IRS has recently taken a more assertive stance regarding the imposition of Sec. 6662 penalties. Further, the interest rates associated with tax underpayments have recently increased. The combination of these factors has resulted in substantially increased amounts being at issue in transfer pricing disputes.

Secs. 6662(e) and (h) provide for 20% and 40% penalties, respectively, for certain Sec. 482 transfer pricing adjustments made by the IRS. Amounts are excluded from the calculation to the extent the taxpayer appropriately documents that it applied one of the transfer pricing methods in the Sec. 482 regulations in a reasonable manner. If the proposed net transfer pricing adjustment exceeds $20 million, the 40% penalty may be applied. The IRS has in recent years embarked on an effort to apply Sec. 6662 penalties more frequently than in the past, specifically stating that documentation must be of a sufficient quality to prevent imposition of the penalty.5 The IRS is asserting penalties in four recent transfer pricing cases — Amgen ($10.7 billion of tax, penalties, and interest); Newell Brands ($90 million of tax and $34 million in related penalties for tax years 2011 through 2015); Airbnb (tax of $1.33 billion and $573 million in penalties for 2013); and Microsoft ($28.9 billion of taxes, plus penalties and interest).

Other countries also impose penalties for reported transfer pricing results that deviate significantly from an arm’s-length result. Careful documentation can also be important to avoiding foreign country transfer pricing penalties.

There are no special rules regarding the imposition of interest on tax deficiencies created by transfer pricing; however, the amounts of additional taxes and penalties combined with the long time for resolution of cases produces exceedingly large interest amounts. Further, interest rates have recently increased. The combination of large proposed adjustments, long examination periods, and newly increased interest rates will produce large amounts of interest.

Financial reporting risk

The financial reporting rules under Topic 740 require companies to identify and report uncertain tax positions (UTPs) in their financial statements. Tax positions, which include transfer pricing issues, are evaluated using a two-step process. First, a tax position is only recognized at all if, based on the technical merits, that position is expected to be sustained upon examination.6If the position is recognized, the second step is measurement of the tax benefit. The tax benefit from the tax position “shall initially and subsequently be measured as the largest amount of tax benefit that is greater than 50 percent likely of being realized upon settlement with a taxing authority that has full knowledge of all relevant information.”7Given the size of transfer pricing issues and the IRS scrutiny of transfer pricing transactions, transfer pricing has become one of the most significant UTPs.

The measurement step considers both sides of the transaction and assumes that tax authorities have full knowledge of all relevant information, so detection risk is not a consideration. Measurement also includes interest on any deficiency and any penalties imposed by the respective jurisdictions on any underpayment of tax.Disclosure of the interest and penalty classification policy is required in the footnotes of the financial statements.8

The measurement of the tax position is often based on management’s best judgment of the amount the taxpayer would ultimately accept in a settlement with taxing authorities. Given the IRS’s historically poor track record in litigation and reluctance to assert penalties, companies willing to pursue tax litigation have often concluded that low or no reserve was necessary.

Issues have begun to emerge regarding the application of Topic 740 to transfer pricing matters. In 2023, the Roofers Local No. 149 Pension Fund sued Amgen Inc. and others based on Amgen’s alleged failure to adequately disclose information about transfer pricing disputes with the IRS regarding the allocation of profits between Amgen affiliates in the United States and Puerto Rico.9 Although Amgen disclosed the existence of the transfer pricing dispute with the IRS, alleging that the IRS positions were “without merit,” Amgen omitted the fact that the amount at issue was over $10.7 billion in total. In other cases, commentators have begun to question how a taxpayer could have a multibillion-dollar tax dispute on appeal yet reserve less than $500 million.10

Customs overlap with transfer pricing

Merchandise imported into the United States is appraised for customs purposes in accordance with U.S. customs valuation laws and reported to U.S. Customs and Border Protection (CBP) at the time of importation. The most common method of appraisement is transaction value — ”the price actually paid or payable for the merchandise when sold for exportation to the U.S.,” plus amounts for statutorily enumerated additions to the extent not otherwise included in the price actually paid or payable.11 Assuming there is a bona fide sale between related parties and one of the arm’s-length tests is satisfied, the transaction value basis of appraisement can be applied to the imported goods. However, any post-importation adjustment to the transaction value price must be reported to CBP and satisfy objective ”formulaic” requirements in order to use the transaction value method.

What do CEOs and other corporate decision-makers need to know?

Given the ultimate oversight responsibility and authority of the CEO position, the materiality and sensitivity of transfer pricing issues warrant some level of awareness by the CEO. The impact of transfer pricing on the company’s financial statements would be of primary importance, since the financial statements are the company’s representation to potential investors. Thus, the CEO should be briefed regarding any tax reserves due to a transfer pricing UTP. The CEO should be familiar with any information contained in the company’s SEC Form 10-K, Annual Report, regarding IRS examination activity, proposed adjustments, and expected outcomes (including penalties and interest), as investors, financial reporters, and even senators have been known to ask follow-up questions regarding transfer pricing issues mentioned in financial statements.12 In one instance, the omission of the amount of the IRS proposed adjustment in the financial statements was deemed important enough to file a shareholder lawsuit.13

Looking forward, environmental, social, and governance (ESG) issues and transfer pricing issues related to their implementation may dictate a need for CEO awareness. ESG reporting and ratings are currently being championed in the private and not-for-profit sectors. The public sector bears monitoring, as ESG may converge with existing tax and transfer pricing principles described under the OECD Guidelines for Multinational Enterprises on Responsible Business Conductand U.S. tax proposals. EU Directive 2022/246414 recognizes that ESG reporting should account for existing international principles and frameworks such as the OECD Guidelines for transfer pricing.

Finally, the exercising of effective operational oversight by a CEO may necessitate some awareness of the company’s material transfer pricing policies. If cross-border transactions with related parties make up a significant portion of global revenues — especially if valuable intangibles are involved — the CEO should possess an overview understanding of the transfer pricing policies and expectations of examinations and likely outcomes.

CEOs and other corporate executives have a duty to shareholders to run the company as profitably as possible. That duty extends to setting transfer prices to achieve the lowest duties, currency issues, and income taxes; however, the transfer pricing rules in the United States and other countries must be addressed. Any perceived tax efficiency achieved by a non-arm’s-length transfer policy could easily be overwhelmed by a transfer pricing dispute with the potential for large professional fees and additional tax, penalties, and interest.

Footnotes

1Letter, Sen. Elizabeth Warren, D-Mass., to Satya Nadella, Microsoft (Oct. 17, 2023).

2Ökten, Pfatteicher, and Schoorl, “Amgen’s $10.7 Billion Case Is Call for Transfer Pricing Clarity,” Bloomberg Tax, Tax Insights & Commentary (Oct. 16, 2024).

3The Coca-Cola Company and Subsidiaries, No. 31183-15, T.C. (8/2/24, decision entered). See also news release, The Coca-Cola Co., “U.S. Tax Court Enters Decision in Ongoing Dispute Between The Coca-Cola Company and the U.S. Internal Revenue Service” (Aug. 2, 2024).

4Ocean Tomo, Intangible Asset Market Value Study.

5IRS website, “Transfer Pricing Documentation Best Practices Frequently Asked Questions (FAQs).” See also IRS Publication 5316, Internal Revenue Service Advisory Council Public Report (November 2018), “Large Business & International Subgroup Report, Issue One: Transfer Pricing Documentation,” p. 107.

6FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes — an Interpretation of FASB Statement No. 109 (June 2006).

7FASB ASC Paragraph 740-10-30-7.

8FASB ASC Paragraph 740-10-50-19.

9Roofers Local No. 149 Pension Fund v. Amgen Inc., No. 1:23-cv-02138 (S.D.N.Y. 3/14/23) (complaint filed).

10See, e.g., Rapoport, “Amgen, Coke Set Aside Only Fraction of Billions They May Owe IRS,” Daily Tax Report, Bloomberg Tax (Nov. 20, 2024).

1119 U.S.C. §1401a(b).

12E.g., Sen. Elizabeth Warren’s letter noted above.

13The Amgen shareholder litigation discussed above.

14European Union Directive 2022/2464 of the European Parliament and of the Council (Dec. 14, 2022).

Contributors

Steven C. Wrappe, J.D., LL.M., is a managing director, and Chris Lee, MTax, is senior manager, transfer pricing, both with Grant Thornton Advisors LLC, in Washington, D.C., and San José, Calif., respectively. For more information about this article, contact thetaxadviser@aicpa.org.

AICPA & CIMA MEMBER RESOURCES

Articles

Bettge and Reboulet, “Taxpayer-Initiated Transfer Pricing Adjustments in MAP,” 55-6 The Tax Adviser 17 (June 2024)

Wrappe and Lee, “Increased U.S. Transfer-Pricing Enforcement: What’s at Stake?” 55-2 The Tax Adviser 24 (February 2024)

Varadharajan et al., “Integrating Transfer Pricing and ESG: Practical Considerations,” 54-9 The Tax Adviser 10 (September 2023)

Podcast episode

“What You Need to Know About BEPS 2.0: Pillar One and Pillar Two,” AICPA Tax Section Odyssey podcast (May 23, 2024)

Resources

OECD BEPS 2.0 — Pillar One and Pillar Two

CPE self-study

U.S. Transfer Pricing and Global BEPS

For more information or to make a purchase, visit aicpa-cima.com/cpe-learning or call 888-777-7077.