- feature

- SPECIAL INDUSTRIES

CHIPS Act final regs. offer many taxpayer-friendly provisions

Related

Deductibility of transaction costs incurred by an indirectly acquired entity

IRS issues guidance on treaty application to reverse foreign hybrids

Practical tax issues related to qualified reopenings

The final regulations1 issued by Treasury and the IRS to implement the advanced manufacturing investment credit (AMIC) include many taxpayer–friendly provisions. Found in Sec. 48D, the AMIC benefits companies that manufacture semiconductors or semiconductor manufacturing equipment (including certain companies that co–locate qualified property, e.g., qualified integral air separation units for chemical production, at an advanced manufacturing facility).

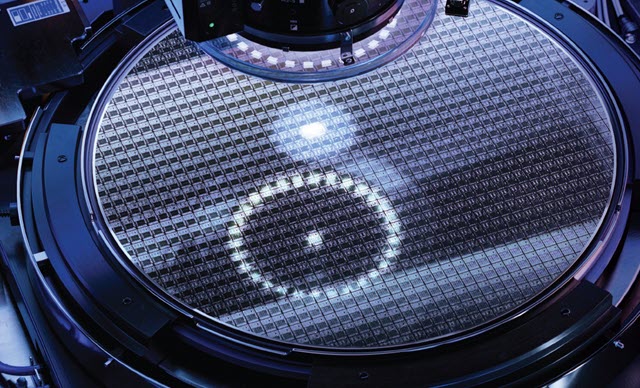

The AMIC was enacted under the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act of 20222 to incentivize semiconductor and semiconductor equipment manufacturing in the United States. Congress passed the CHIPS Act out of concern about the declining global position of the United States as a producer of semiconductor chips, which are small, complex devices essential to computers, household appliances, and other types of electronics.

The final regulations apply to property that is placed in service after Dec. 31, 2022, and during a tax year ending on or after Oct. 23, 2024. Before discussing these regulations, issued in October 2024, some further information about the AMIC may be useful.

Background of the AMIC

Sec. 48D allows eligible taxpayers3 to claim the AMIC, which equals 25% of the basis of any qualified property placed in service during a tax year in an advanced manufacturing facility. The property must be placed in service after Dec. 31, 2022.4 (Editor’s note: Shortly after this article was published, Congress increased this percentage to 35%, effective for property placed in service after Dec. 31, 2025, under Section 70308 of the law commonly known as the One Big Beautiful Bill Act, H.R. 1, P.L. 119-21.)

The AMIC does not apply to property for which construction begins after Dec. 31, 2026.5 For qualified property whose construction began before Jan. 1, 2023, the AMIC is available only for the portion of the basis attributable to the property’s construction, reconstruction, or erection after Aug. 9, 2022 (the date the CHIPS Act was enacted).6

“Qualified property” is defined as tangible property that meets all the following criteria:

- May be depreciated (or amortized in lieu of depreciation);

- Is

- Constructed, reconstructed, or erected by the taxpayer, or

- Acquired by the taxpayer if the original use of such property commences with the taxpayer; and

- Is integral to the operation of the advanced manufacturing facility.7

An “advanced manufacturing facility” is defined as “a facility for which the primary purpose is the manufacturing of semiconductors or semiconductor manufacturing equipment.”8

Qualified property does not include the portion of the basis of any property that is attributable to qualified rehabilitation expenditures (as defined in Sec. 47(c)(2)).9

For qualified progress expenditures, rules similar to Secs. 46(c)(4) and (d) (as in effect on the day before the enactment of the Revenue Reconciliation Act of 199010) will apply.11

Taxpayers may elect to treat the AMIC as a payment of federal income tax equal to the AMIC, instead of as a credit against the federal income tax liability for that tax year (i.e., an elective payment election).12 Special rules for an elective payment election allow a partnership or S corporation to receive a payment instead of a tax credit for property held directly by a partnership or an S corporation.13

Recapture rule: Sec. 50(a)(1) generally requires a taxpayer’s tax liability to increase by the recapture percentage of the aggregate decrease in the credits allowed under Sec. 38 from all prior tax years. The recapture rule applies if, during any tax year, the taxpayer disposes of investment credit property, or the property ceases to be investment credit property, before the close of the recapture period. The aggregate decrease results from “reducing to zero any credit determined under [Sec. 50(a)(1)] with respect to such property.”14

Sec. 50(a)(3)(A), also enacted by the CHIPS Act, includes a separate recapture rule requiring the taxpayer’s federal income tax liability for the tax year in which an applicable transaction occurs to increase by 100% of the aggregate decrease in the credits allowed under Sec. 38 for all prior tax years. An applicable transaction is “any significant transaction (as determined by [the IRS], in coordination with the Secretary of Commerce and the Secretary of Defense) involving the material expansion of [the] semiconductor manufacturing capacity of such applicable taxpayer in the People’s Republic of China or a foreign country of concern.”15 The aggregate decrease results “from reducing to zero any [investment] credit determined under [Sec.] 46 which is attributable to the [AMIC] under [Sec.] 48D(a) with respect to such property.”16

The recapture rule applies if the applicable transaction occurs before the close of the 10–year period beginning on the date the taxpayer placed the property eligible for the AMIC in service.17 The applicable–transaction recapture rule will not apply if the taxpayer demonstrates that the transaction has been ceased or abandoned within 45 days of a determination and notice by the IRS.18

Final regulations

Turning now to the final regulations, here are noteworthy aspects:

Definitions: The final regulations refine and clarify the definitions of “semiconductor manufacturing,”19 “semiconductor manufacturing equipment,”20 “semiconductor packaging,”21 and “significant transaction.”22 Further, the final regulations introduce new definitions, such as, with respect to semiconductor manufacturing, “semiconductor wafer production,”23 “assembly,”24 and “testing.”25 Consistent with the proposed regulations,26 the final rules primarily apply long–established credit mechanics and procedures common to all investment tax credits (including the Sec. 48D credit).

Determining basis: For property whose construction began before Jan. 1, 2023, (and is placed in service after Dec. 31, 2022) the final regulations clarify that taxpayers must allocate the portion of the property’s basis attributable to construction, reconstruction, or erection after Aug. 9, 2022, (the enactment date of the CHIPS Act) by using any reasonable method, including applying the principles of Sec. 461; only this post–enactment portion of the basis is eligible for the AMIC. Rules similar to those in Regs. Secs. 1.48–2(b)(2), 1.48–11(b)(5)(i), and 1.48–12(c)(1) also apply.27

Additionally, the final regulations remove the proposed requirement that taxpayers determine the basis immediately before the qualified property is placed in service. For qualified property, “basis” has the same meaning as in Regs. Sec. 1.46–3(c).28 In the preamble, Treasury and the IRS indicate that the property’s basis “can include capital expenditures, as defined in section 263 of the Code and [Regs. Secs.] 1.263(a)-1 through 1.263(f)-1.”

Coordination with rehabilitation credit: The final regulations use an example to address uncertainty as to how the AMIC coordinates with the Sec. 47 rehabilitation credit. In the example, the basis of any qualified property meeting the definition of qualified rehabilitation expenditures is excluded from the AMIC, regardless of whether a taxpayer actually claims a rehabilitation credit for those qualified rehabilitation expenditures.29

Although commenters requested that the final regulations clarify whether the AMIC affects any other federal tax credits, the final regulations only include the special rule for coordination with the rehabilitation credit. Because, the preamble stated, it would require a careful examination of numerous other provisions, Treasury and the IRS declined to address the impact of the AMIC on other federal credits.

Qualified progress expenditures election: Under the rules for qualified progress expenditures in Regs. Sec. 1.46–5, taxpayers may elect to increase the qualified investment (as defined in Sec. 48D(b)(1)) in any advanced manufacturing facility of an eligible taxpayer for the tax year by any qualified progress expenditures made after Aug. 9, 2022. If a partnership or S corporation is constructing progress expenditure property, the final regulations clarify that Regs. Secs. 1.46–5(o)(1) and (p) allow the partnership or S corporation to make a qualified progress expenditure election under Regs. Sec. 1.46–5, provided the partnership or S corporation intends to make an elective payment election under Sec. 48D(d) and Regs. Sec. 1.48D–6. The same rule applies if the progress expenditure property is being constructed for the partnership or S corporation.30

Qualified property: To clarify that a taxpayer’s ownership of an advanced manufacturing facility is not a prerequisite for claiming the AMIC, the final regulations add a definition for “part of an advanced manufacturing facility.” Under that definition, property is part of an advanced manufacturing facility if it is “located or co–located either at the advanced manufacturing facility, or on a contiguous piece of land to the advanced manufacturing facility.”31 Parcels or tracts of land are contiguous if they have common boundaries and “would be contiguous but for the interposition of a road, street, railroad, public utility, stream or similar property.”32

Under the final regulations, property that is not located or co–located at an advanced manufacturing facility or on a contiguous piece of land can still be considered part of the advanced manufacturing facility if (1) it is owned by the same taxpayer that owns the advanced manufacturing facility; (2) it is connected to the advanced manufacturing facility (e.g., via pipeline); and (3) “the sole purpose, function, and output of the property is dedicated to the operation of the advanced manufacturing facility.”33 The property also must meet the requirements of Sec. 48D and its regulations.

Under Sec. 48D(b)(2)(B)(ii), qualified property does not include any building or portion of a building used for offices, administrative services, or other functions unrelated to manufacturing. The final regulations reiterate that “tangible depreciable property” does not include buildings and structural components used as offices. To clarify, the final regulations include a list of certain buildings or portions of buildings within advanced manufacturing facilities that are considered related to manufacturing and not considered offices.34 In the preamble, Treasury and the IRS make clear that “whether a particular building or portion of a building is used as an office, for administrative services, or is unrelated to manufacturing is a factual determination.”

If an advanced manufacturing facility that is engaged in the manufacturing of semiconductors also conducts vertically integrated activities (e.g., producing raw materials and manufacturing ingots and wafers), the final regulations only consider property used to manufacture the semiconductors to be property integral to the operation of the advanced manufacturing facility. Treasury and the IRS added more examples to the list of specified property that “normally would be integral to the operation of the advanced manufacturing facility of an eligible taxpayer.”35

Acquired property meets the definition of qualified property under Sec. 48D(b)(2)(A)(iii)(II) if its original use commences with the taxpayer. In general, the term “original use” means, for any property, the first use to which any taxpayer puts the property “in connection with a trade or business or for the production of income.”36 Taxpayers paying or incurring additional capital expenditures to recondition or rebuild property they acquired or owned satisfy the original–use requirement to the extent of the expenditures they paid or incurred.37 A taxpayer’s cost to acquire property reconditioned or rebuilt by another taxpayer, however, does not satisfy the original–use requirement.38

Advanced manufacturing facility: The proposed regulations defined “advanced manufacturing facility” as “a facility of an eligible taxpayer for which the primary purpose … is the manufacturing of finished semiconductors … or the manufacturing of finished semiconductor manufacturing equipment.”39 The final regulations remove “finished” from the definition of advanced manufacturing facility. They also remove “finished” from Regs. Sec. 1.48D–4(c)(1) for purposes of determining whether the facility’s primary purpose is manufacturing semiconductors or semiconductor manufacturing equipment. As a result of this modification, the final regulations define “manufacturing of semiconductor manufacturing equipment” as the physical production of semiconductor manufacturing equipment in a manufacturing facility40 that is used by an advanced manufacturing facility engaged in the manufacturing of semiconductors as defined in Regs. Sec. 1.48D–2(g).41

The final regulations also adopt a minimum threshold to satisfy the “primary purpose” requirement. Under the final regulations, the primary–purpose requirement is satisfied if more than 50% of the facility’s potential output, as measured by the costs of production, revenue received in an arm’s–length transaction, or units produced, is derived from the manufacturing of semiconductors or semiconductor manufacturing equipment.42 The final regulations include four examples (two of which address vertically integrated manufacturers) to illustrate how this rule applies.43

The final regulations expand the definition of “semiconductor manufacturing” to also include “semiconductor wafer production,” which includes “the processes of growing single–crystal ingots and boules, wafer slicing, etching and polishing, bonding, cleaning, epitaxial deposition, and metrology.”44 Treasury and the IRS explained that the clarification that “semiconductor manufacturing” includes “semiconductor wafer production” is consistent with the definition of “semiconductor manufacturing” in the Department of Commerce rules,45 which provide guardrails to prevent the improper use of CHIPS Act funding overseen by the Department of Commerce (Commerce final rule).

Example 2 in Regs. Sec. 1.48D–4(c)(3)(ii) indicates that the term “semiconductor wafer production” encompasses the production of solar wafers. The inclusion of solar wafers in the definition of “semiconductor wafer production” was due to “supply chain and national security considerations regarding the production of solar wafers not present in the case of other related products.”46 The decision to include solar wafers resulted from coordination among Treasury, the IRS, the Department of Commerce, and the Department of Defense.

Although commenters requested that the final regulations further modify the definition of “semiconductor manufacturing” to include additional products and substances, Treasury and the IRS declined to expand the definition further. Thus, consistent with the proposed regulations, the definition of “semiconductor manufacturing” in the final regulations excludes the production of materials and other substances (e.g., polysilicon).

Additionally, the final regulations revise the definition of “semiconductor packaging” to include “assembly” and “testing” within all stages of packaging. Treasury and the IRS explained that this expanded definition “is consistent with the purpose of the [Sec.] 48D credit to incentivize the manufacture of semiconductors within the United States.”47 “Assembly” includes, but is not limited to, wafer–dicing, die–bonding, wire bonding, solder bumping, and encapsulation.48 “Testing” includes, but is not limited to, probing, screening, and burn–in work.49

Treasury and the IRS clarified that the list of examples of semiconductor manufacturing equipment and subsystems is nonexclusive and included additional examples of property that may qualify as semiconductor manufacturing equipment and subsystems.

In addition, the final regulations clarify that a research or storage facility may qualify as integral to the operation of an advanced manufacturing facility only if the property is used in connection with manufacturing semiconductors or semiconductor manufacturing equipment.50 The proposed regulations included specific examples of eligible research and storage facilities. The final regulations retained these examples and added additional storage facility examples.51

Beginning of construction: Consistent with the proposed regulations, the final regulations allow a taxpayer to establish that construction of an item of property has begun by satisfying the physical–work test or the 5% safe harbor.

Under the physical–work test, construction begins “when physical work of a significant nature begins, provided thereafter that the taxpayer maintains continuous construction or continuous efforts.”52 The test’s focus is on the work performed, not the costs. The final regulations provide a nonexclusive list of examples of on–site and off–site activities to help taxpayers determine whether physical work of a significant nature has occurred.53

Under the 5% safe harbor, construction is treated as having begun when the taxpayer (1) pays or incurs 5% or more of the total cost of the property and (2) afterward maintains continuous construction or continuous efforts.54 To determine whether continuous construction or continuous efforts have occurred, all the relevant facts and circumstances are considered.

Under the proposed regulations, “paying or incurring additional amounts included in the total cost of the property”55 could indicate that a taxpayer is engaged in continuous efforts to advance toward completion of a property. The final regulations clarify that taxpayers will satisfy this factor if they pay or incur 5% or more of the property’s total cost “each calendar year after the calendar year during which construction of the property began.”56

Solely for purposes of the beginning of construction, multiple qualified properties or advanced manufacturing facilities will be treated as operated as part of a single project if, at any point during their construction, the multiple properties or facilities are owned by a single taxpayer and two or more of the seven factors listed in Regs. Sec. 1.48D–5(a)(3)(i) are satisfied.57

Related taxpayers (as defined in Regs. Sec. 1.52–1(b)) are treated as one taxpayer when determining whether multiple facilities or properties should be treated as a single project.58

Recapture: Sec. 50(a)(3) includes a special recapture rule that applies if a significant transaction involving the material expansion of semiconductor manufacturing capacity occurs in a foreign country of concern. Sec. 50(a)(3)(C) expressly authorizes Treasury to provide guidance on the recapture requirement for the AMIC.

In addition, Sec. 50(a)(6)(D)(i) expressly authorizes Treasury to determine significant transactions, stating, “The term ‘applicable transaction’ means, with respect to any applicable taxpayer, any significant transaction (as determined by the Secretary, in coordination with the Secretary of Commerce and the Secretary of Defense) involving the material expansion of semiconductor manufacturing capacity of such applicable taxpayer in the People’s Republic of China or a foreign country of concern.”

The final regulations define “significant transaction” as either (1) an investment, whether proposed, pending, or completed, including any capital expenditure, loan, or gift; the formation of a subsidiary, whether classified as a corporation or partnership for federal tax purposes; a merger, acquisition, or takeover; or various other transactions described in Regs. Sec. 1.50–2(b)(10)(i), or (2) having the meaning provided in a required agreement, if a taxpayer enters into a required agreement with the secretary of Commerce under 15 U.S.C. Section 4652(a)(6)(C) and 15 C.F.R. Section 231.112.59

Under the proposed regulations, an “applicable taxpayer” included:

- Any taxpayer that was allowed a Sec. 48D credit or made a Sec. 48D(d)(1) election for the credit, for any tax year preceding the tax year in which the taxpayer entered into an applicable transaction;

- Any partnership or S corporation that has made a Sec. 48D(d)(2) election for a credit determined under Sec. 48D(a)(1) for any tax year preceding the tax year in which the partnership or S corporation entered into an applicable transaction; and

- Any partner in a partnership (directly or indirectly through one or more tiered partnerships) or shareholder in an S corporation for which the entity has made a Sec. 48D(d)(2) election for a credit determined under Sec. 48D(a) for any tax year preceding the tax year in which the partner or shareholder entered into an applicable transaction.60

The final regulations retain the general definition of “applicable taxpayer” from Prop. Regs. Sec. 1.50–2(b)(2)(i)(A) but adopt special rules for partnerships and S corporations. If a partnership or S corporation placed property in service for which the AMIC was determined, the final regulations define “applicable taxpayer” as:

- The partnership and its partners (directly or indirectly through one or more tiered partnerships) or S corporation and its shareholders who were allowed an AMIC for the property for any tax year before the tax year in which the partnership or S corporation entered into an applicable transaction;

- Any partner in the partnership (directly or indirectly through one or more tiered partnerships) or any S corporation shareholder that was entitled to a portion of the AMIC for the property for any tax year preceding the tax year in which the partner or shareholder entered into an applicable transaction;

- Any partnership or S corporation that made an election under Sec. 48D(d)(2) for the AMIC determined under Sec. 48D(a)(1) for any tax year preceding the tax year in which the partnership or S corporation entered into an applicable transaction; and

- Any partner in a partnership (directly or indirectly through one or more tiered partnerships) or S corporation shareholder that was entitled to a portion of any tax-exempt income from the partnership or S corporation and made a Sec. 48D(d)(2) election for any tax year preceding the tax year the partner or shareholder entered into an applicable transaction.61

Some welcome modifications in the final regs.

While the final regulations do not incorporate all the changes requested by commenters, they include many taxpayer–friendly provisions. For example, the final regulations expand the definition of “semiconductor manufacturing” to include “semiconductor wafer production” (including the production of solar wafers). The inclusion of wafer production (including solar) is a welcome addition for many taxpayers deeply integrated in the semiconductor (and solar) manufacturing supply chain. Because of the inclusion of wafer production, manufacturers of semiconductor wafers and solar wafers that did not expect to be able to claim the AMIC may now be able to do so.

The final regulations do not include further upstream production processes, such as the production of precursor materials (e.g., polysilicon), within the scope of “semiconductor manufacturing.” Commenters requested that the production of additional products and substances be included within semiconductor manufacturing; however, the government indicated this would not be appropriate, as those materials are consumed or substantially transformed during the semiconductor manufacturing processes and are not included in the Commerce final rule definition of “semiconductor manufacturing.” Therefore, taxpayers that only produce precursor materials are unable to claim the AMIC and instead may be eligible to obtain funding (e.g., grants or loans) from the government through Commerce’s CHIPS incentive programs.

Additionally, the final regulations’ removal of “finished” from the definition of an “advanced manufacturing facility” reflects industry practice and the modifications to the definitions of “semiconductor manufacturing” and “semiconductor manufacturing equipment.” This modification is good news for certain taxpayers, including, for example, those that manufacture certain critical subsystems in semiconductor manufacturing equipment and those that produce semiconductor wafers and solar wafers.

The government also responded favorably to requests that the final regulations include a minimum threshold that would satisfy the “primary purpose” requirement for an advanced manufacturing facility. Under the final regulations, a facility has the primary purpose of manufacturing semiconductors or semiconductor manufacturing equipment if more than 50% of its potential output, as measured by the costs of production, revenue received in an arm’s–length transaction, or units produced is derived from the manufacturing of semiconductors or semiconductor manufacturing equipment. The adoption of a more–than–50%-threshold minimum standard benefits taxpayers by providing certainty (unlike the proposed regulations, which included only an example suggesting a potential 75% threshold, rather than a set minimum threshold).

In another welcome development, Treasury and the IRS acknowledged that no provision under Sec. 48D requires a taxpayer to own the advanced manufacturing facility as a prerequisite to claiming the AMIC. Therefore, eligible taxpayers that place in service qualified property that is co–located at another taxpayer’s advanced manufacturing facility (e.g., certain companies that design and market semiconductors but contract out the manufacturing, known as “fabless” semiconductor companies because they do not fabricate the devices) may be able to claim the AMIC, assuming they otherwise meet the requirements of Sec. 48D and the final regulations.

Overall, the final regulations provide important guidance for obtaining the Sec. 48D credit for domestic semiconductor industry manufacturing. The final regulations clarify the qualification and implementation rules for the AMIC to promote private sector investment in these advanced manufacturing technologies.

The views expressed are those of the authors and are not necessarily those of Ernst & Young LLP or other members of the global EY organization.

Footnotes

1T.D. 10009, 89 Fed. Reg. 84732.

2P.L. 117-167.

3See Sec. 48D(c). An eligible taxpayer is a taxpayer that (1) is not a foreign entity of concern (as defined in §9901(6) of the William M. (Mac) Thornberry National Defense Authorization Act for Fiscal Year 2021, P.L. 116-283) and (2) has not made an applicable transaction (as defined in Sec. 50(a)) during the tax year.

4See also Wallwork et al., “The CHIPS Act’s Semiconductor Production Credit,” 54-4 The Tax Adviser 39 (April 2023).

5Sec. 48D(e).

6CHIPS Act §١٠٧(f)(١).

7Sec. 48D(b)(2).

8Sec. 48D(b)(3).

9Sec. 48D(b)(4).

10Title XI of the Omnibus Budget Reconciliation Act of 1990, P.L. 101-508 (i.e., before those provisions’ repeal by the act).

11Sec. 48D(b)(5).

12Sec. 48D(d)(1). See also Wallwork et al., “The CHIPS Act’s Advantageous Direct-Pay Election,” 55-11 The Tax Adviser 36 (November 2024).

13Sec. 48D(d)(2)(A).

14Sec. 50(a)(1)(A).

15Sec. 50(a)(6)(D); see also Regs. Sec. 1.50-2(b)(3). A “foreign country of concern” is defined in 15 C.F.R. §231.102 as a “covered nation” as defined in 10 U.S.C. §4872(d) (North Korea, China, Russia, or Iran) or any country that the secretary of Commerce, in consultation with the secretaries of Defense and State and the director of National Intelligence, determines to be engaged in conduct that is detrimental to the national security or foreign policy of the United States.

16Sec. 50(a)(3)(A).

17Id.

18Sec. 50(a)(3)(B).

19Regs. Sec. 1.48D-2(g).

20Regs. Sec. 1.48D-2(o).

21Regs. Sec. 1.48D-2(n)(3).

22Regs. Sec. 1.50-2(b)(10).

23Regs. Sec. 1.48D-2(n)(1).

24Regs. Sec. 1.48D-2(n)(4).

25Regs. Sec. 1.48D-2(n)(5).

26REG-120653-22.

27Regs. Sec. 1.48D-2(c)(2).

28Regs. Sec. 1.48D-2(c)(1).

29Regs. Sec. 1.48D-1(c)(2).

30Preamble, T.D. 10009; Regs. Sec. 1.48D-2(j)(3)(ii).

31Regs. Sec. 1.48D-3(f). See also preamble, T.D. 10009, Summary of Comments and Explanation of Revisions, IV.A. Part of an Advanced Manufacturing Facility.

32Id.

33Id.

34Regs. Sec. 1.48D-3(c)(3).

35Regs. Sec. 1.48D-3(g)(3).

36Regs. Sec. 1.48D-3(e)(1).

37Id.

38Id.

39Prop. Regs. Sec. 1.48D-4(b).

40Regs. Sec. 1.48D-2(h).

41Id.

42Regs. Sec. 1.48D-4(c)(1). “The determination of the primary purpose of a facility will be made based on all the facts and circumstances surrounding the construction, reconstruction, or erection of the advanced manufacturing facility of an eligible taxpayer. Facts that may indicate a facility has a primary purpose of manufacturing of semiconductors or manufacturing of semiconductor manufacturing equipment include plans or other documents for the facility that demonstrate that the facility is designed for the manufacturing of semiconductors or manufacturing of semiconductor manufacturing equipment within the meaning of [Regs. Sec.] 1.48D-2. Facts may also include the possession of permits or licenses needed for the manufacturing of semiconductors or manufacturing of semiconductor manufacturing equipment; and executed contracts to a customer to supply such semiconductors or executed contracts to an advanced manufacturing facility as defined in [Regs. Sec. 1.48D-4(b)] to supply such semiconductor manufacturing equipment in place either before or within 6 months after the facility is placed in service.”

43Regs. Sec. 1.48D-4(c)(3).

44Regs. Sec. 1.48D-2(n).

45Preamble, T.D. 10009. “Although the final regulations do not expand the definition of ‘semiconductor’ beyond what is provided in the Commerce Final Rule, the final regulations clarify the definition of ‘semiconductor manufacturing’ by specifying that it includes ‘semiconductor wafer production’ but not further upstream production processes, pursuant to the statutory authority provided under [Secs.] 50(a)(3) and (a)(6)(D)(i) and 7805(a). The clarification that ‘semiconductor manufacturing’ includes ‘semiconductor wafer production’ is consistent with the definition of ‘semiconductor manufacturing’ in the Commerce Final Rule (15 CFR 231.116) issued pursuant to section 103(b) of the CHIPS Act.”

46Id.

47Id.

48Regs. Sec. 1.48D-2(n)(4).

49Regs. Sec. 1.48D-2(n)(5).

50Regs. Sec. 1.48D-3(g)(4).

51Id. “Specific examples of research facilities include research facilities that manufacture semiconductors in connection with research, such as pre-pilot production lines and prototypes, including semiconductor packaging. Specific examples of storage facilities are mineral or chemical storage equipment, gas storage tanks, including high pressure cylinders or specially designed tanks and drums, wastewater storage, and inventory and finished goods warehouses.”

52Regs. Sec. 1.48D-5(c)(1).

53Regs. Sec. 1.48D-5(c)(2). “Specific examples of on-site physical work of a significant nature include the excavation for the foundation and the pouring of the concrete pads of the foundation. Specific examples of off-site physical work of a significant nature include the manufacture of semiconductor manufacturing equipment but only if the manufacturer’s work is done pursuant to a binding written contract and the semiconductor manufacturing equipment is not held in the manufacturer’s inventory.”

54Regs. Sec. 1.48D-5(d).

55Prop. Regs. Sec. 1.48D-5(e)(3)(i).

56Regs. Sec. 1.48D-5(e)(3)(i).

57Regs. Sec. 1.48D-5(a)(3)(i).

58Regs. Sec. 1.48D-5(a)(3)(ii).

59Regs. Sec. 1.50-2(b)(10).

60Prop. Regs. Sec. 1.50-2(b)(2)(i).

61Regs. Sec. 1.50-2(b)(2)(ii).

Contributors

Scott Mackay, MS Tax., is Americas Director of Quantitative Services and National Tax Accounting Periods, Methods & Credits Leader, at EY in Washington, D.C. Susan Grais, CPA, J.D., LL.M., is a managing director at EY in Washington, D.C. Tom Fraase, CPA, is a senior manager in the National Tax Department at EY in San Francisco. For more information about this article, contact thetaxadviser@aicpa.org.

AICPA & CIMA MEMBER RESOURCES

Articles

- Wallwork et al., “The CHIPS Act’s Advantageous Direct-Pay Election,” 55-11 The Tax Adviser 36 (November 2024)

- Wallwork et al., “The CHIPS Act’s Semiconductor Production Credit,” 54-4 The Tax Adviser 30 (April 2023)

Tax Section resource

CPE self-study

For more information or to make a purchase, visit aicpa-cima.com/cpe-learning or call 888-777-7077.