- feature

- procedure & administration

Microcaptive insurance arrangements subject to new rules

Related

Average tax refund rises 11%; total filings decline

IRS broadens Tax Pro Account for accounting firms and others

AICPA urges Treasury, IRS to simplify Sec. 951 documentation rules

Final regulations1 recently went into effect that define listed transactions2 and transactions of interest3 involving small insurance companies known as microcaptive insurers. This marks a new chapter of the ever–changing microcaptive tax story. Despite the Jan. 14, 2025, effective date of the regulations, taxpayers who have filed an original or amended tax return reflecting their participation in a microcaptive listed transaction or transaction of interest prior to Jan. 14, 2025, generally may have to disclose the transaction if the period of limitation for assessment of tax for any tax year in which the taxpayer participated did not end on or before Jan. 14, 2025.4

This article examines the final regulations governing microcaptive insurance arrangements and their effect on taxpayers and their advisers. For background, this article also provides an overview of microcaptive insurance arrangements and a recent timeline leading up to the issuance of the final regulations.

Overview of microcaptive insurance companies

To protect against certain risks, businesses can create “captive” insurance companies that are typically owned by the business, its owners, or related parties to the business or owners. There are tax advantages to this arrangement because the insured party can deduct the premium payments as a business expense. In addition, under a provision in the Code that benefits small insurers, the insurance company can exclude from taxable income up to $2.85 million (for tax year 2025) of premium payments per year by electing under Sec. 831(b) to be taxed only on its investment income. As a result, the insured party can take a deduction, and there is no corresponding tax on the captive insurer. These small insurance companies are referred to as microcaptives.

Captives are not licensed to sell insurance to the general public. Generally, they are used to insure related entities for commercial property and casualty risks, employer–backed health insurance stop–loss, workers’ compensation reinsurance, and losses for commercial auto liability. Recently, as large insurance companies have raised their premiums significantly or pulled out of whole geographic regions, such as southern California and Florida, captive insurance has become more attractive as an alternative to traditional commercial insurance.5

If microcaptive insurance arrangements are used for bona fide insurance purposes, the Code permits them. However, the arrangements set up by business owners (often on the advice of unscrupulous promoters or advisers) frequently lack the true attributes of insurance, for example, by insuring implausible risks, failing to address genuine business needs, duplicating the business’s commercial insurance coverage, or charging excessively high premiums.6

The IRS has sought to combat the use of abusive microcaptive arrangements through audits and litigation. The Service has also sought to discourage taxpayers from using these arrangements by highlighting them every year since 2015 (other than 2020) in its Dirty Dozen lists (see “Recent Timeline of Microcaptive Guidance and Litigation,” below).

The microcaptive final regulations

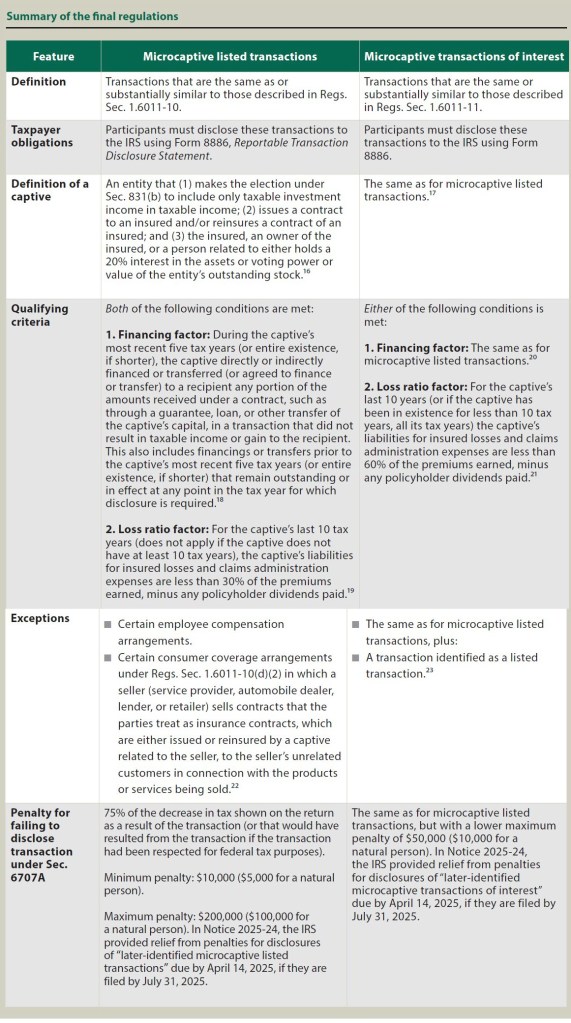

The final regulations under Regs. Secs. 1.6011–10 and 1.6011–11 specify characteristics of, respectively, listed microcaptive transactions and microcaptive transactions of interest, principally by how they regard the microcaptive’s loss ratio and the presence of certain financing arrangements between the captive and insured that Treasury and the IRS consider to have a high potential for tax avoidance. See the chart, “Summary of the Final Regulations,” on page 64 for more on the regulations’ features and implications.

Revisions from the proposed regulations

During the notice–and–comment period for the proposed regulations, the IRS and Treasury received more than 100 public comments. They modified some aspects of the proposed regulations, including by making the following changes:

Loss ratio factor: The loss ratio factor is calculated by dividing the liabilities for insured losses and claims administration expenses by the premiums earned (after subtracting policyholder dividends) during the loss ratio computation period (the captive’s most recent 10 tax years). The final regulations lowered the loss ratio factor threshold for classifying a microcaptive transaction as a listed transaction from 65% to less than 30% over the most recent 10 years. This change significantly reduces the number of captives classified as listed transactions that the IRS deems abusive and intends to scrutinize.

For transactions of interest, the threshold is slightly reduced to less than 60% over the most recent 10 years or the captive’s existence, aligning with Treasury’s stated goal of identifying potential tax avoidance.

Financing factor: The financing factor for listed transactions remains unchanged in the final regulations from the proposed regulations but is now also applied to transactions of interest. In the preamble to the final regulations, the IRS and Treasury explained that a microcaptive transaction of interest, like a listed transaction, may involve related–party financing, which poses the potential for tax avoidance.

Conjunctive test for listed transactions: A microcaptive is classified as a listed transaction if it meets both the loss ratio factor threshold (less than 30%) and the financing factor. Treasury and the IRS explained in the preamble to the final regulations that the reason for this change from the proposed regulations, narrowing the scope of covered transactions, was that related–party financing does not necessarily create tax avoidance, depending on its terms.

For transactions of interest, meeting either criterion — loss ratio below 60% or engaging in certain financial transfers — triggers classification of the transaction.

Changes to the consumer coverage arrangement exception: The final regulations maintain an exception for listed transactions and transactions of interest involving captives participating in consumer coverage arrangements, such as warranty programs.24 This exception excludes legitimate seller–related insurance arrangements from heightened IRS scrutiny by focusing on business exclusivity and unrelated–customer thresholds.

Examples of listed transactions and transactions of interest

Microcaptive listed transactions involve certain types of microcaptive insurance arrangements that have little or no economic substance. In contrast, microcaptive transactions of interest have characteristics suggesting tax avoidance but are not yet deemed abusive.

Example 1: An owner of a small retail business with relatively low–risk operations establishes a microcaptive insurance company to insure his store from unusual risks that are uncommon on the commercial market (for example, earthquake insurance in Ohio). To maximize the tax benefits, the captive charges its insured $1.2 million for premiums for the policy year after year. Because no claims are made for that unusual event over a 10–year period, the captive has a 0% loss ratio. Then, the captive loans back to the insured the premiums its insured pays, with no taxable income or gain resulting to the insured from the transaction. The IRS identifies this arrangement as a listed transaction because of its low loss ratio over a 10–year period, the funds returned to owners in a nontaxable way, and the overall lack of a bona fide insurance purpose.

Example 2: An owner of a manufacturing business sets up a microcaptive insurance company to insure her business from risks that might normally be insurable with traditional insurance (for example, business interruption, wildfires, hurricanes, cyberthreats, auto insurance on its vehicle fleet, etc.). The captive charges premiums that are commensurate with what a traditional insurer might charge. The manufacturing business had good luck and has not had significant claims for five years in a row. After paying a few modest claims, the captive only has a 35% loss ratio. The captive makes no loans with the premiums it receives. Although the captive insurance appears bona fide, the IRS nevertheless believes this to be a transaction of interest, and the captive, its owner, and the insured are all required to disclose it as a reportable transaction.

Other considerations

Several additional recent developments and concerns besides the issuance of the final regulations suggest that microcaptive transactions will continue to be raised as a major issue with the IRS in its guidance, enforcement, and litigation priorities.

Revocation of election

In January 2025, the IRS released a revenue procedure25 that makes it easier for companies to revoke their Sec. 831(b) election and simplifies the administrative process allowing for automatic consent from the IRS for the revocation. A revocation of a Sec. 831(b) election allows a company to no longer be classified as a captive insurance company beginning in the year of revocation. However, if the alternative tax under Sec. 831(b) does not apply, either because the premiums exceed the threshold or the entity fails to meet the diversification requirements for that year, then the entity may still be considered a captive as long as the Sec. 831(b) election remains.

Legal challenge to the microcaptive regulations

Following the release of the final regulations, a lawsuit was filed in the Northern District of Texas claiming the IRS had thereby exceeded its authority in violation of the Administrative Procedure Act (APA).26 The plaintiff alleges the loss ratio thresholds for both listed transactions and transactions of interest are inconsistent with common practices within the insurance industry and are arbitrary and capricious under the APA. Further, the plaintiff argues the microcaptive regulations are contrary to congressional intent to support the use of microcaptive insurance to mitigate high–severity risks that occur very infrequently. Companies with microcaptive insurance should continue to monitor this case for further developments.

Form 8886 disclosure

Companies engaging in reportable microcaptive arrangements must disclose the transaction on Form 8886, Reportable Transaction Disclosure Statement. Failure to report a reportable transaction can result in substantial penalties, as shown in the chart, “Summary of the Final Regulations,” below.27

The final regulations clarify that transactions involving captives insuring third–party risks are not considered listed transactions or transactions of interest, provided specific considerations are met. This clarification benefits companies that previously filed Form 8886 as a precautionary measure to avoid compliance risks.

Advice for practitioners

The final regulations alleviate some burdens that Sec. 831(b) microcaptives faced under the proposed regulations and reduce the number of microcaptive insurance arrangements classified as listed transactions. Nonetheless, uncertainties remain, particularly regarding the regulations’ alignment with prior rulings and court decisions. This ambiguity may pose challenges for some in the captive insurance market, which continues to expand due to broader insurance market conditions and coverage availability.

As this area of tax law continues to evolve, ongoing legal challenges and future guidance will be critical in shaping its application. Advisers must remain vigilant in monitoring these developments to effectively navigate the complexities and risks inherent in this dynamic regulatory landscape.

Footnotes

1T.D. 10029.

2Regs. Sec. 1.6011-10(a).

3Regs. Sec. 1.6011-11(a).

4Regs. Secs. 1.6011-10(h) and 1.6011-11(h). In Notice 2025-24, the IRS provided relief from penalties for such initial disclosures due by April 14, 2025, if they are filed by July 31, 2025.

5Cohn, “Insurance Crisis That Started in Florida, California is Spreading. Your State Could Be Next,” CNBC (July 2, 2024).

6Pak, “Distribution of Risk in Captive Insurance Companies,” 53-11 The Tax Adviser 18 (November 2022).

7IRS News Release IR-2015-19.

8Reserve Mechanical Corp., T.C. Memo. 2018-86, aff’d, 34 F.4th 881 (10th Cir. 2022). See also Pak, “Distribution of Risk in Captive Insurance Companies,” 53-11 The Tax Adviser 18 (November 2022).

9CIC Services, LLC, 593 U.S. 209 (2021). See also Newkirk and Webber, “Microcaptive Insurance Arrangements After CIC Services,” 53-9 The Tax Adviser 18 (September 2022).

10CIC Services, LLC, 592 F. Supp. 3d 677 (E.D. Tenn. 2022).

11Announcement 2023-11.

12REG-109309-22.

13IRS News Release IR-2024-105.

14T.D. 10029.

15Ryan LLC, No. 3:25-cv-00078 (N.D. Tex. 1/17/25) (amended complaint filed).

16Regs. Sec. 1.6011-10(b)(1).

17Regs. Sec. 1.6011-11(b)(1).

18Regs. Sec. 1.6011-10(c)(1).

19Regs. Secs. 1.6011-10(c)(2) and 1.6011-10(b)(2)(ii).

20Regs. Sec. 1.6011-11(c)(1).

21Regs. Secs. 1.6011-11(c)(2) and 1.6011-11(b)(2)(ii).

22Regs. Secs. 1.6011-10(d) and 1.6011-10(b)(9).

23Regs. Sec. 1.6011-11(d).

24Regs. Secs. 1.6011-10(d)(2) and 1.6011-11(d)(2).

25Rev. Proc. 2025-13.

26Ryan LLC, No. 3:25-cv-00078 (N.D. Tex. 1/17/25) (amended complaint filed).

27Sec. 6707A. See also Knight and Knight, “Full Disclosure: When Tax Transactions Must Be Reported,” 233-2 Journal of Accountancy 24 (February 2022).

Contributors

Kaitlin Newkirk, CPA, MST, M.Acc., is an assistant professor in the Williams College of Business at Xavier University in Cincinnati. Sarah Webber, CPA, J.D., LL.M., is an associate professor in the School of Business Administration at the University of Dayton in Dayton, Ohio. For more information on this article, contact thetaxadviser@aicpa.org.

AICPA & CIMA MEMBER RESOURCES

Podcast episode

CPE self-study

For more information or to make a purchase, visit aicpa-cima.com/cpe-learning or call 888-777-7077.