- tax clinic

- ESTATES, TRUSTS & GIFTS

The final countdown: Benefiting from the higher BEA before it potentially expires

Related

Trust distributions in kind and the Sec. 643(e)(3) election

Estate of McKelvey highlights potential tax pitfalls of variable prepaid forward contracts

Recent developments in estate planning

Editors: Alexander J. Brosseau, CPA, and Greg A. Fairbanks, J.D., LL.M.

Since passage of the Tax Cuts and Jobs Act (TCJA), P.L. 115–97, in 2017, taxpayers have benefited from a doubled lifetime basic exclusion amount (BEA). As of 2025, each individual can use their $13.99 million BEA to transfer assets tax–free during life or at death. But absent legislation, that temporarily enhanced BEA will sunset and effectively be reduced by half on Jan. 1, 2026. Time is ticking, and many taxpayers are focused on utilizing the BEA before the countdown ends. The question is, will it? Certainly, the odds of a near–term BEA sunset diminished markedly last November after President Donald Trump won a second term in the White House and congressional Republicans secured majorities in both the House and Senate for the next two years — the same power structure that was present when Republicans enacted the TCJA.

But the cost of extending the TCJA — even on a short–term basis — is a multi–trillion–dollar endeavor, and Republicans are balancing myriad other budget priorities, including additional tax cut proposals put forward by Trump during his campaign. And over the longer term, it is also true that demographic changes in the United States will only exacerbate what are already vast fiscal imbalances, a dynamic that could pressure lawmakers to find new revenue or spending savings within the budget.

Given this uncertainty, taxpayers expecting to have a taxable estate who have the wherewithal and desire to make gifts may consider doing so now rather than waiting to see if the clock runs out on the enhanced BEA.

The benefit of giving it away now

A common question among taxpayers is, if they utilize the enhanced BEA now, will there be adverse consequences should the BEA decrease? The IRS issued regulations to alleviate this concern and confirmed there is no clawback of the enhanced BEA (T.D. 9884). For estate tax purposes, a taxpayer’s BEA will be the greater of the exclusion amount at the date of death or the exclusion amount used during life. As such, failure to use this opportunity before the sunset can have adverse economic impacts on a taxpayer’s family by subjecting the unused amount to estate tax.

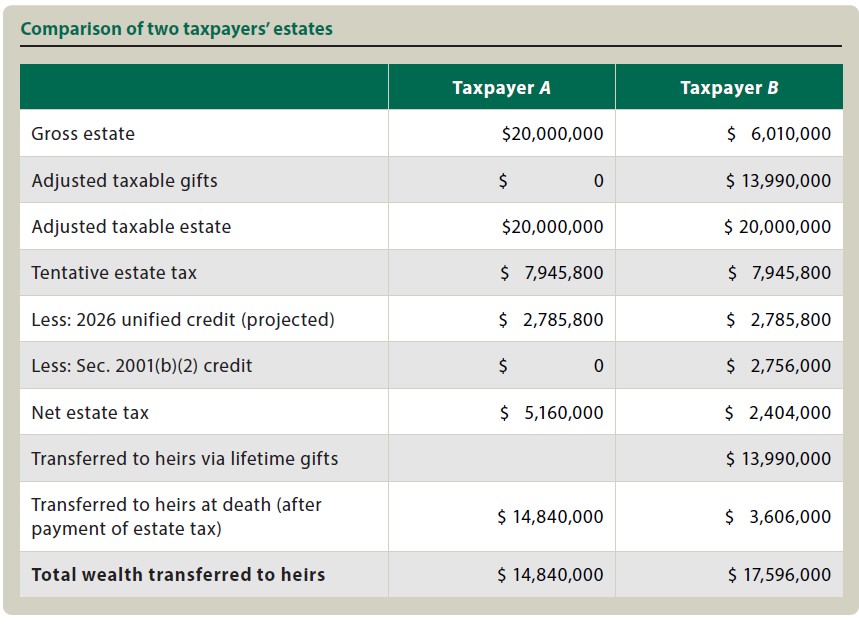

Example 1: Taxpayer A has an adjusted taxable estate of $20 million on Dec. 31, 2025. Taxpayer A made no prior gifts and dies on Jan. 1, 2026, when the top marginal rate is 40% and the BEA is $7.1 million. Assume the same facts for Taxpayer B, except that Taxpayer B made a $13,990,000 taxable gift in 2025. As a result of giving their assets away now to utilize the full BEA available in 2025, Taxpayer B will have transferred an additional $2,756,000 to their heirs compared to Taxpayer A, as shown in the chart “Comparison of Two Taxpayers’ Estates.”

Would’ve, could’ve, should’ve and the case for cash flow modeling

As taxpayers plan to utilize their enhanced BEA, it is important to avoid letting a tax benefit alone induce a transfer. In other words, if the taxpayer was not otherwise considering a transfer, the potential decrease in the BEA is not a reason in and of itself to make a transfer. Taxpayers need to appreciate that for a transfer to be effective for transfer tax purposes, the taxpayer must actually part with dominion and control of the assets, including all of the benefits that come with those assets. Unfortunately, cash flow impacts of gifting may be forgotten in the planning process.

Example 2: Assume Taxpayer C gifts an interest in a partnership to an irrevocable grantor trust. Grantor trusts are disregarded for income tax purposes, meaning that Taxpayer C will pay all the tax on the partnership income, even though the investment is legally owned by the trust. Further, the trust will receive all the cash distributions from the investment, and Taxpayer C will receive none. This is generally tax–efficient planning because the trust is able to grow unimpeded by the income tax Taxpayer C is paying on the trust’s income, and that tax depletes Taxpayer C’s estate without being considered a gift. However, Taxpayer C did not model out the cash flow prior to making the transfer. In the years following the transfer, the partnership generates significant income, resulting in Taxpayer C having to make significant income tax payments to the point where Taxpayer C is left struggling to comfortably fund their lifestyle.

How might Taxpayer C have improved this outcome? As a starting point, taxpayers should evaluate their total wealth, determining what portion they need to retain to meet their ongoing cash needs and considering transferring the excess. Then, when evaluating planning alternatives, long–term models can be prepared to determine whether the taxpayer can bear each alternative’s cash flow impacts. If it appears a plan may overwhelm the taxpayer’s desire or ability to sustain it, the taxpayer could consider tempering the amount of gifting or building flexibility into the trust document. This might include structuring grantor trust provisions so that the taxpayer can relinquish grantor powers, causing the trust to become regarded and bear its own tax. Taking ample time to model scenarios and build in flexible trust provisions may help alleviate potential future regret.

Avoiding analysis paralysis — from simple to complex

It is not unusual for individuals to be overwhelmed when evaluating transfer tax techniques and deciding what assets to transfer to utilize the BEA. However, making gifts does not have to be complicated. The most straightforward option is an outright gift of cash or appreciated marketable securities. Beyond outright gifts, options such as dynasty and spousal lifetime access trusts (SLATs), among others, may be appealing.

Dynasty trusts: Utilizing a dynasty trust rather than making gifts outright may better preserve a legacy for future generations and provide optionality for further wealth transfer through leveraged sale transactions. A dynasty trust is a trust established for the benefit of children and more remote descendants. Such trusts are permitted in all states, but the law of perpetuities in each state controls how long they can exist. Some states (e.g., South Dakota) have recently amended their trust statutes to allow trusts to exist in perpetuity, and individuals can create a trust in a state that is not their state of residence.

Because these trusts are intended to benefit multiple generations, they are typically designed to use a taxpayer’s generation–skipping transfer tax (GSTT) exemption. That exemption amount is currently tied to the BEA. To the extent that a taxpayer allocates GSTT exemption to the dynasty trust, the trust assets will not be subject to further gift, estate, or GST tax until they are distributed or the trust terminates. For this reason, dynasty trusts can be very effective transfer tax tools.

Spousal lifetime access trusts: SLATs are a common estate planning tool that provide an “escape hatch” for individuals reluctant to make large gifts for fear that they could one day need the assets they have given away. In a typical SLAT, Spouse 1 gifts to a trust for the benefit of Spouse 2 and the spouses’ children and future descendants. The SLAT utilizes Spouse 1’s BEA while providing Spouse 2 a discretionary (or mandatory) income interest for life.

These trusts are commonly utilized, but individuals considering funding a SLAT should proceed with caution. First, SLATs may be “leaky.” If Spouse 2 receives distributions from the trust, that is in effect a waste of Spouse 1’s BEA because those assets are pulled into Spouse 2’s gross estate. Second, SLATs are also generally not an efficient use of GSTT exemption if distributions to the spouse and children are anticipated. Third, SLATs generally do not tolerate divorce well. In the event of a divorce, the beneficiary spouse generally will retain their lifetime interest in the trust. At the same time, since SLATs are typically designed as grantor trusts, the donor spouse will remain liable for payment of the SLAT’s income taxes, even if income is distributed to their former spouse. Finally, if Spouse 1 and Spouse 2 both fund SLATs, care in drafting the trust provisions is essential to avoid triggering the reciprocal trust doctrine (see Estate of Grace, 395 U.S. 316 (1969)). If the provisions of both trusts are virtually the same, the IRS could collapse the transaction and treat each trust as self–settled.

Tuning up prior planning

If an individual has already employed gifting strategies in prior years and is not comfortable with making additional transfers, the individual may believe there is no work to be done prior to the BEA sunset. However, these individuals can use the time remaining to review prior gift transactions and determine if the enhanced BEA can be used to address potential undesired outcomes. Two areas to consider are the status of intrafamily loans and the GSTT profile of irrevocable trusts.

Intrafamily debt: Loans between family members are common. If these loans are in default or are likely to default in the future, the lender should explore potential remedies. A few options include:

- Utilize the enhanced BEA to forgive some or all of the outstanding debt;

- Gift additional assets to the borrower in order for them to pay some or all of the outstanding debt; and

- Foreclose on the debt and take back collateral.

Trust GSTT inclusion ratio review: Often, a review of prior gifting can uncover missed GSTT elections or unreported gifts to trusts that are intended to be GSTT–exempt. Given the increased GSTT exemption, now is a great time to review the GSTT profile of established trusts. If a trust is determined to have an inclusion ratio of between zero and one and, therefore, future distribution to a skip–person would be partially subject to GSTT, taxpayers could consider using the enhanced BEA to fully exempt the trust via a late allocation.

Basic blocking and tackling

While a variety of options are available for using the enhanced BEA, basic blocking and tackling should not be ignored. In addition to larger gifts intended to utilize the enhanced BEA, taxpayers should consider annual gifting, utilizing the annual gift tax exclusion, making payments on behalf of others directly to medical and educational services providers, and making transfers to Sec. 529 educational plans for children or grandchildren. In 2025, a grandparent can contribute $95,000 to a Sec. 529 plan for their grandchild without incurring gift or GST tax if they elect to spread the gift over five years (note, though, that other gifts to the same grandchild would use a portion of the enhanced BEA).

Time is ticking. Taxpayers and advisers should be cognizant of the potential planning opportunities over both the near and medium term as lawmakers confront the looming expiration of the TCJA — including the enhanced BEA — at the end of 2025 as well as longer–term fiscal concerns that could pressure policymakers to look for ways to generate additional revenue.

Editors

Alexander J. Brosseau, CPA, is a senior manager in the Tax Policy Group of Deloitte Tax LLP’s Washington National Tax office. Greg Fairbanks, J.D., LL.M., is a tax managing director with Grant Thornton LLP in Washington, D.C.

For additional information about these items, contact thetaxadviser@aicpa.org.

Contributors are members of or associated with Deloitte Tax LLP or Grant Thornton LLP as noted in the byline.

This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional adviser. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication.