- column

- CAMPUS TO CLIENTS

Integrating personal financial planning into individual income tax courses

Related

Multistate corporate income taxes: An exercise in nexus and apportionment

Supercharging retirement: Tax benefits and planning opportunities with cash balance plans

Revisiting Sec. 1202: Strategic planning after the 2025 OBBBA expansion

Editor: Annette Nellen, Esq., CPA, CGMA

The evolving demands of the accounting profession reflect a need for graduates to possess a diverse set of skills, including personal financial planning (PFP). Accordingly, PFP topics now appear on the Tax Compliance and Planning (TCP) Discipline section of the CPA Exam. The AICPA designed the exam assessments of PFP to focus on planning opportunities and strategies that a newly licensed CPA can identify while preparing and reviewing an individual tax return.

Tax courses are well suited for the introduction of PFP content since most PFP decisions have tax implications. PFP is also a valuable service offering for CPAs that often goes without consideration. This column provides an overview of the tax relation to PFP, how it appears on the CPA Exam, and two examples of PFP assignments appropriate for individual tax courses. While PFP content is appropriate for inclusion in most accounting courses, its introduction in individual tax courses can prepare students for more complex PFP topics in other tax and accounting courses as well as the CPA Exam.

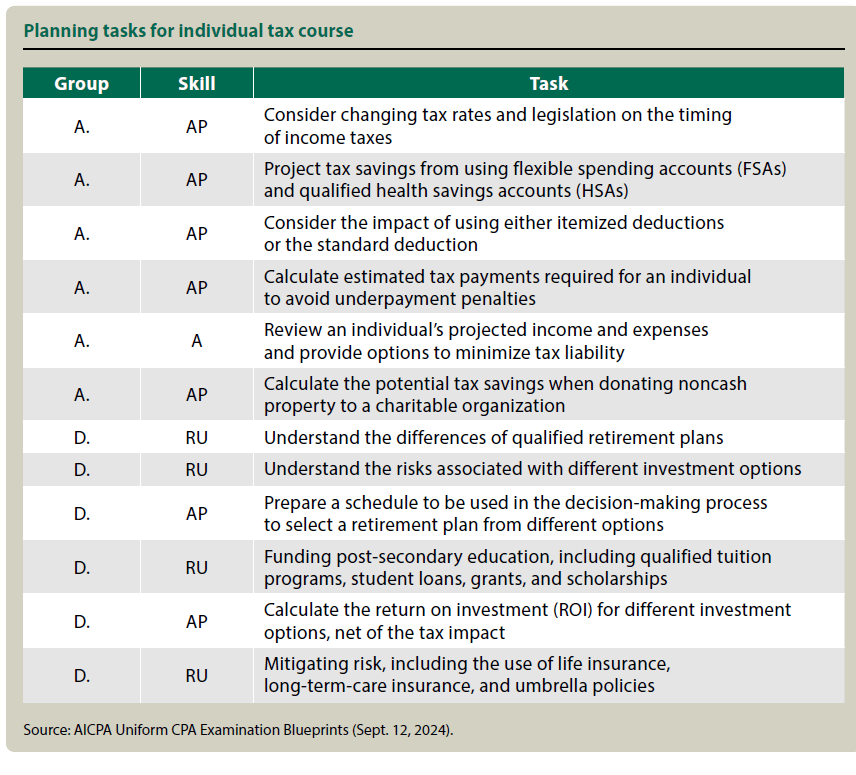

How PFP is assessed on the CPA Exam

The AICPA’s newest version of the exam includes TCP as one of the elective Discipline sections. The most recent blueprint of the CPA Exam combines Area I of the TCP tasks into four groups: (A) Individual compliance and tax planning considerations for gross income, adjusted gross income, taxable income, and estimated taxes; (B) Compliance for passive activity and at–risk loss limitations; (C) Gift taxation compliance and planning; and (D) Personal financial planning for individuals. PFP content is tasked throughout these groups, but the following tasks in the table “Planning Tasks for Individual Tax Course” correspond to topics typically covered in an individual tax course. A full list of the TCP tasks by group can be found in the resource “Learn What to Study for the CPA Exam.” Each task has a required skill level needed for newly licensed CPAs. These skill levels are Evaluation (E), Analysis (A), Application (AP), and Remembering and Understanding (RU).

Group A tasks in this table are tax planning scenarios, and Group D are PFP scenarios.

Students can benefit from learning a systematic process for approaching a planning scenario. Many of the tasks throughout the TCP blueprint include the phrase “given a specific planning scenario” and require either an Application or Analysis skill level.

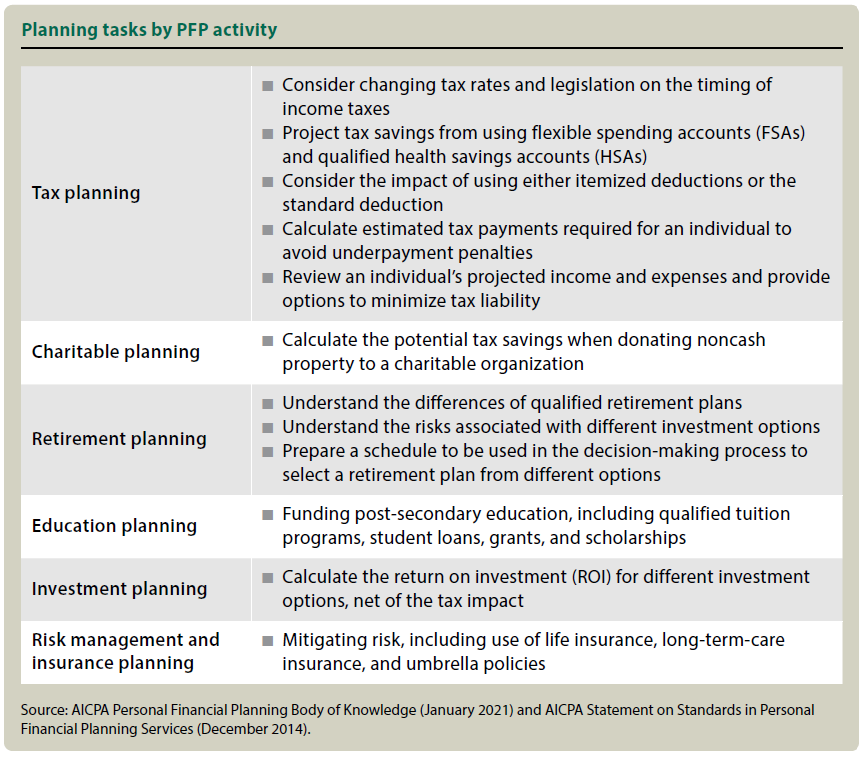

Tax planning is an activity within the scope of PFP services defined in the AICPA Statement on Standards in Personal Financial Planning Services (SSPFPS No. 1). The SSPFPSs provide guidance on the responsibilities of AICPA members when providing PFP services. The nature of PFP services includes planning for cash flow; risk management and insurance; retirement; investment; estate, gift, and wealth transfer; elder planning; charitable; education; and tax (SSPFPS No. 1). Tasks within the TCP blueprint are related to these PFP services in the table “Planning Tasks by PFP Activity.”

PFP Assignment 1: Planning recommendation letter and documentation memorandum

A client letter and file memorandum assignment can prepare individual tax course students for “a specific planning scenario” by applying elements of the PFP process within the SSPFPSs that are relevant to application and analyzing tasks on the CPA Exam.

The elements of the PFP process are (SSPFPS No. 1):

- Identify client goals and objectives;

- Gather and analyze relevant information;

- Consider and apply appropriate planning approaches and methods; and

- Use financial judgment when developing recommendations.

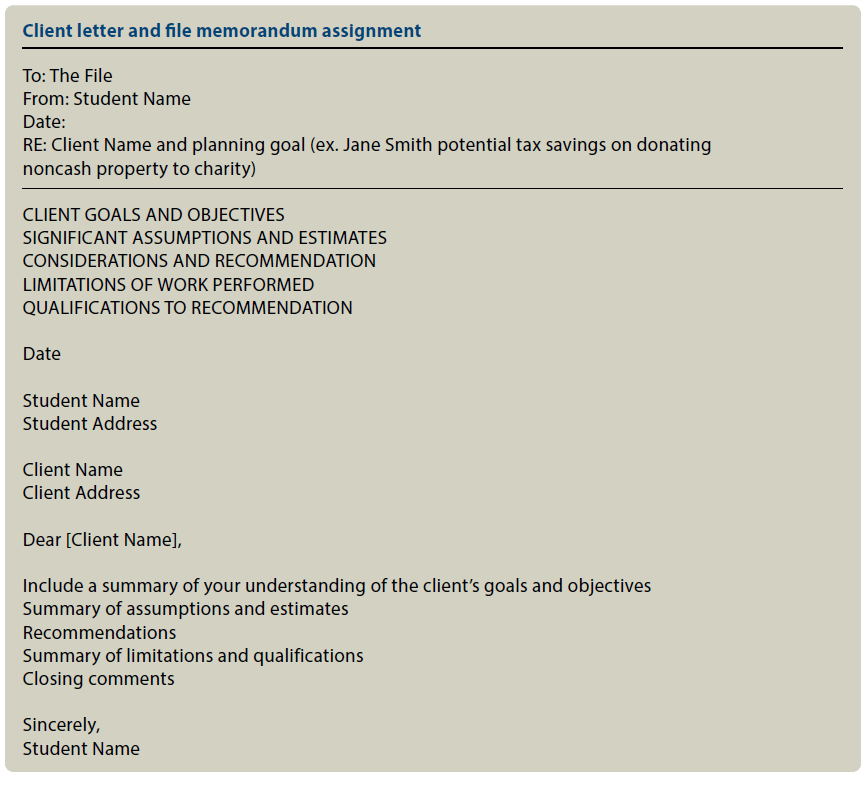

Provide the student with a specific planning scenario, for instance, one within the tasks detailed above in the table “Planning Tasks for Individual Tax Course.” The assignment will focus on analyzing the information, applying a planning method, developing a recommendation, then communicating this recommendation to the client. Prepare students for this assignment with required reading of the SSPFPS paragraphs for developing and communicating information (SSPFPS ¶¶32—35 and ¶¶A16—A20). Additionally, discuss with students the differences between documenting communications for the file versus communications with the client. Though there is not a standard format within the SSPFPSs for documenting communications, one is included here for educational purposes and encompasses the required information to communicate.

Learning outcomes

- Demonstrate the ability to analyze and apply relevant tax laws to specific client scenarios.

- Tailor communication style to various audiences, including clients and supervisors.

- Apply the AICPA SSPFPSs and Statements on Standards for Tax Services in the preparation of recommendations.

- Evaluate alternative planning strategies and justify the most appropriate option recommended.

Assignment requirements

Analyze the specific planning scenario provided, consider planning strategies available, and develop an appropriate recommendation for the client. First, document your considerations for the workpaper file, using the memorandum format shown in the sidebar, “Client Letter and File Memorandum Assignment” on the next page. Include specific details and references to resources. Second, and using appropriate client tone and the sidebar’s format, write a letter to your client summarizing your recommendation.

PFP Assignment 2: Tax efficiency of retirement savings options

PFP topics are inherently personal, dealing with real–life financial decisions that individuals face, such as saving for retirement and planning for major life events. Most of the accounting curriculum focuses on businesses, so introducing PFP content into an individual tax course is relatively simple. This personal relevance can make PFP an attractive subject for students, as it allows them to apply classroom knowledge to their own financial lives.

Retirement planning seems to be an exciting personal topic for students and appears in a few TCP tasks (see the table “Planning Tasks by PFP Activity” above). This assignment combines the skills needed for the CPA Exam tasks along with tax considerations, which make it well suited for an individual tax course. Prepare students with an overview of the differences between participating in an employer’s 401(k) and a Roth IRA, including contribution limits, income limits, tax implications, and matching. The resulting deliverable is an interactive schedule, so this assignment is appropriate to do together in a computer lab setting or with students having their laptops in the classroom with access to Microsoft Excel.

Learning outcomes

- Understand the differences of qualified retirement plans.

- Develop an interactive retirement savings schedule to be used in the decision–making process to select a retirement plan from different options.

- Evaluate the impact of employer matching contributions to qualified plans.

- Prioritize savings contributions to maximize growth and optimize tax benefits.

Assignment requirements

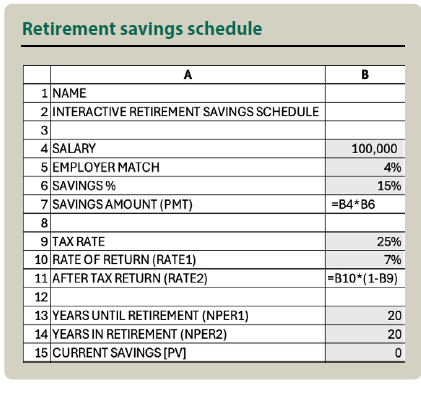

Build an interactive retirement savings schedule with the following variables: tax rate 25%, rate of return 7%, salary $100,000, employer match 4%, years until retirement 20, years in retirement 20, and current savings $0. Using time–value–of–money (TVM) formulas and other Excel functions, set up the schedule to receive variations to these assumptions, such as: differing rates of return, tax rates, employer matching, years until retirement (period of accumulating savings), and years in retirement (period of spending savings).

Step 1: Input your name, title of the schedule, and variables at the top of the Excel spreadsheet. Tint the variable cells in a different color to indicate amounts that can be modified later for calculating varying scenarios.

Step 2: Add rows for calculating amounts, including “amount of savings” and “after–tax return.” Leave these cells without tint to depict a calculated formula within the cell that should not be modified later in varying scenarios; rather, these cells will update automatically. In this scenario, the savings amount results in $15,000 and the after–tax rate of return results in 5.25%. (See the table “Retirement Savings Schedule.”)

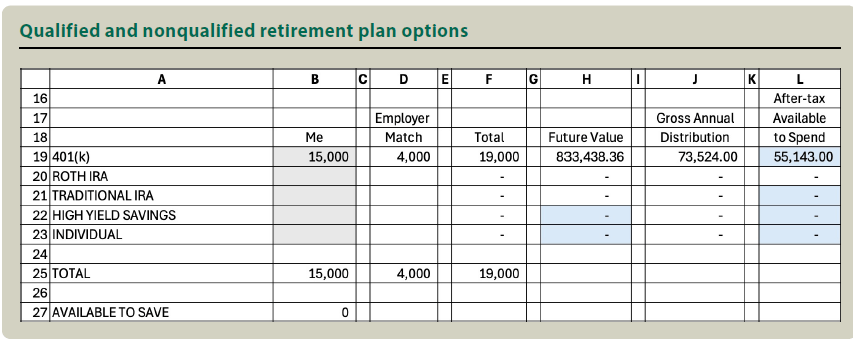

Step 3: List three qualified retirement plan options in Column A, including 401(k), Roth IRA, and traditional IRA. Include nonqualified options as well, such as a high–yield savings account and an individual taxable investment account. Column headings for this analysis should be: “Me,” “Employer Match,” “Total,” “Future Value,” “Gross Annual Distribution,” and “After–tax Available to Spend.” Tint the “Me” column cells to indicate amounts that can be modified later for varying scenarios. Total columns B, D, and F using the SUM function. (See the table “Qualified and Nonqualified Retirement Plan Options.”)

Step 4: Set up the formulas for each of the other five columns, starting with the scenario to save all $15,000 into a 401(k) with an employer match. The gray boxes under the “Me” column will be input in each varying scenario, and if they do not add up to the total amount in B25, there are additional amounts to save or take away until the resulting amount “Available to Save” is equal to zero. The results of this formula should be equal to the savings amount in B7 minus the total in B25. Use the following syntax to compute:

Employer match: The percentage of salary the employer agrees to contribute to your 401(k). No other type of account in this schedule will receive a possible employer match. Using the Excel MIN (minimum) function, calculate the total amount the employer will contribute by multiplying the match percentage (4%) times at least the minimum amount contributed by “Me,” but not to exceed the maximum promised by the employer ($4,000). The MIN function is MIN (B19, (B4*B5)). This will result in a zero match if the employee does not contribute.

Total: The total amount of annual payments into savings vehicles, including both employee and employer contributions. Use the SUM function to add both contributions together for each row, for example, SUM(B19:D19).

Future value: Future value of the accumulation of saving $15,000 into a 401(k) along with the employer match (PMT = $19,000 in F19) for the years until retirement (NPER1 = 20), assuming a rate of return (RATE1 = 7%) and a present value of current savings ([PV] = $0). The future value function is FV(RATE, NPER, PMT, [PV], [TYPE]). Set the TYPE to 1, indicating the payments start at the beginning of the 20–year period. Note the cells with a blue tint indicate nonqualified savings vehicles that grow subject to annual taxes, so the after–tax rate of return (RATE2=5.25%) should be used to accumulate these balances.

Gross annual distribution: The decumulation of the total future value represents the annual amount possible to withdraw from the account during the period of retirement (NPER2 = 20), assuming a rate of return (RATE1 = 7%) and a present value of the nest egg accumulated in the Future Value column (H19). The PMT function is PMT(RATE, NPER, PV, [FV], [TYPE]). Set the TYPE to 1, indicating the payments start at the beginning of the 20–year period. Note these results are the distributions before applying taxes.

After–tax available to spend: The amount of gross annual distribution net of taxes withheld. The cells with a blue tint have some element of tax consequences due to the type of account the money is coming out of. The result is equal to the gross distribution in Column J times 1 minus the tax rate (25%). Since Roth IRA distributions are not taxable, the amount after tax available to spend will be equal to the gross annual distribution.

Step 5: Vary the allocation of $15,000 to other accounts by either splitting it up between different options or saving into one at a time. Also, consider contributing at least the minimum to the 401(k) to receive the match and spread the remaining amount to other options. Note limitations on IRA accounts; for instance, the maximum contribution limit in 2025 is $7,000 for individuals under the age of 50 and $8,000 for those over 50. Additionally, Roth IRAs have an income limitation. In 2025, single individuals can make a full $7,000 contribution if they earn less than $150,000.

Students will begin to see that not all savings options are the same, especially when employers are contributing to retirement savings. The schedule above does not consider inflation or varying tax rates in the accumulation vs. decumulation phase. Additionally, the rate of return above represents an unchanging risk profile throughout the entire 40 years. This is a great opportunity to explain to students that adjusting risk assumptions will impact the rate of return and generally advise clients to reduce risk the closer they are to retirement age and while spending the funds, which may result in lower rates of return during the period of retirement.

Contributors

Brianne C. Smith, CPA/ABV/PFS, Ph.D., is an assistant professor of accounting in the School of Accountancy at Auburn University at Montgomery, Ala., and managing member of Brianne CPA, also in Montgomery. Annette Nellen, Esq., CPA, CGMA, is a professor and director of the graduate tax program (MST) in the Department of Accounting and Finance at San José State University in San José, Calif., and is a past chair of the AICPA Tax Executive Committee. For more information about this column, contact thetaxadviser@aicpa.org.