- tax clinic

- procedure & administration

IRS renews corporate tax opportunities with letter rulings

Related

Businesses urge Treasury to destroy BOI data and finalize exemption

Murrin and Zuch provide insight into the limits of taxpayers’ rights

IRS generally eliminates 5% safe harbor for determining beginning of construction for wind and solar projects

Editor: Jessica L. Jeane, J.D.

After a history of limiting access, the IRS reopened the doors to meaningful private letter rulings for corporate reorganizations and spinoffs, reviving opportunities for taxpayer certainty on some of the most complex tax–free transactions. Together with additional guidance in 2024 and early 2025, the agency’s revitalized letter ruling program provides broader access, faster timelines, and dramatically lower user fees for small and midsize businesses. This item provides an overview of the key changes, identifies when a letter ruling is now advisable, and offers practical guidance on using the program in 2025 and beyond.

A new era for corporate letter rulings

For decades, taxpayers seeking certainty in corporate liquidations, reorganizations, spinoffs, and incorporations faced a dwindling set of ruling options from the letter ruling program. By the early 1990s, the IRS curtailed advance rulings for a number of transactions, including those under Secs. 332 and 351 and for certain Sec. 368 acquisitive transactions (see Rev. Proc. 90–56). Then, in the early 2000s, the agency indicated it would not provide a determination in a letter ruling on key elements of a Sec. 355 transaction, specifically: (1) the business–purpose requirement; (2) the device–prohibition requirement (i.e., testing whether a divisive distribution is simply a “bailout” of corporate earnings and profits); and (3) whether a transaction was part of a plan or series of transactions under Sec. 355(e) (see Rev. Proc. 2003–48).

Rev. Proc. 2013–32 further limited determinations with respect to corporate spinoff transactions to address only “significant issues,” i.e., specific issues of the law rather than the general fact patterns of a transaction. See Rev. Proc. 2023–3, Section 3.01(60), which states:

A significant issue is a germane and specific issue of law, provided that a ruling on the issue would not be a comfort ruling, as defined in section 6.11 of Rev. Proc. 2023–1, or the conclusion in such a ruling otherwise would not be essentially free from doubt. An issue is germane if resolution of the issue is necessary to determine an element of the tax treatment of the transaction. An issue is specific if it is the narrowest articulation of the germane issue. A change of circumstances arising after a transaction ordinarily does not present a significant issue with respect to the transaction.

As a result, IRS bulletins added Sec. 355 to the list of other transactions ineligible for full no–gain–or–loss rulings (by then, already including Secs. 332, 351, 368, and 1036), further limiting letter ruling clarity for a range of comprehensive transactions.

However, the tide began to shift with Rev. Procs. 2016–45 and 2017–52. The former broadened ruling availability for certain “significant issues” under Sec. 355, while the latter significantly impacted the letter ruling program by reinstating no–gain–or–loss rulings on Sec. 355 transactions through a pilot program that was later made permanent (although with general exceptions for significant issues of business purpose, device, and plan under Sec. 355(e)). Note that Rev. Proc. 2017–52 permitted both significant–issue rulings and full no–gain–or–loss rulings for Sec. 355 transactions.

Following similar policies, in early 2024, the IRS fundamentally changed course with the issuance of Rev. Proc. 2024–3, by removing the long–standing “no rule” areas for:

- Secs. 332, 351, 368, and 1036. As a consequence, full no-gain-or-loss rulings are available under Secs. 332 (corporate subsidiary liquidation into its corporate owner); 351 (incorporations and contributions to controlled corporations); 368 (corporate reorganizations); and 1036 (certain stock for stock of the same corporation).

- The device test and Sec. 355(e) plan issues for Sec. 355 transactions.

Rev. Proc. 2024–3 also eliminated the significant–issue practice from the letter ruling program. Since then, the IRS resumed ruling on transactions previously excluded, such as statutory mergers under Sec. 368(a)(1)(A) and Sec. 355 transactions involving device and Sec. 355(e) plan issues. Examples include:

- Letter Ruling 202441010 (issued July 5, 2024) included a full no-gain-or-loss ruling under Sec. 368(a)(1)(A), which prior to 2024 would typically not have been eligible for a ruling other than a significant-issue ruling.

- Letter Ruling 202511013 (issued Dec. 6, 2024) included determinations for device and Sec. 355(e) issues under Sec. 355, which are subsumed in the overall full no-gain-or-loss ruling, although they are not specifically addressed in the letter ruling. In general, the full no-gain-or-loss rulings prior to 2024 had specifically excluded determinations on device and Sec. 355(e) plan issues.

These significant policy changes have rebalanced the certainty taxpayers can obtain through letter rulings versus solely relying on legal opinions, while signaling the Service’s deeper commitment to taxpayer service and administrative efficiency. With clearer guidance now available on complex reorganizations and other corporate transactions, the letter ruling process is again a viable, and increasingly practical, option for many corporate taxpayers.

When is it worth obtaining a letter ruling?

The letter ruling program promotes both voluntary compliance of taxpayers as well as consistent administration from the agency. Although binding on the IRS only as to the requesting taxpayer, the rulings clarify agency positions of taxability relating to specifically described facts and, critically, provide valuable insights into the agency’s logic on positions where the courts and regulations may be unclear. The IRS publishes a list of revenue procedures to use in applying for a letter ruling (see, in particular, Rev. Proc. 2025–1, Appendix F). For example, in addition to completing the generally applicable checklists and statements required by Rev. Proc. 2025–1, a request for a ruling regarding a particular corporate transaction would also include referencing the following:

- Rev. Proc. 90-52 for a Sec. 332 liquidation;

- Rev. Proc. 83-59 for a Sec. 351 incorporation or transfer to a controlled corporation;

- Rev. Proc. 2017-52 and Rev. Proc. 2024-24 for a Sec. 355 spinoff;

- Rev. Proc. 81-60 for a Sec. 368(a)(1)(E) recapitalization; and

- Rev. Proc. 86-42 for reorganizations under Secs. 368(a)(1)(A), 368(a)(2)(D), 368(a)(1)(B), 368(a)(1)(C), 368(a)(1)(D), 368(a)(2)(E), and 368(a)(1)(F).

The Code extends nonrecognition treatment for certain corporate transactions, including liquidations under Sec. 332, incorporations and contributions to controlled corporations under Sec. 351, corporate reorganizations under Sec. 368, and divisive distributions under Sec. 355. While the legislative, regulatory, and judicial rules for compliance are myriad, the consequences of a misstep in any corporate transaction can result in significant tax exposure for both the corporation and its shareholders. Between step–transaction concerns, ownership shifts, integration of intangibles, and evolving business lines, even well–planned restructurings often include gray areas that invite IRS scrutiny.

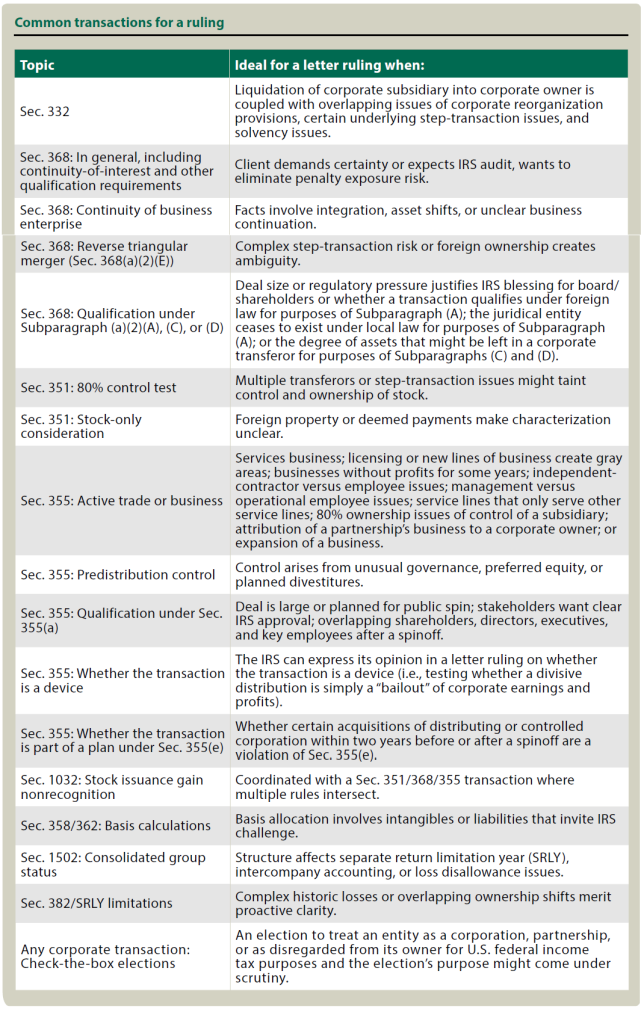

With the expanded letter ruling program now in place, tax professionals and in–house counsel have a refreshed opportunity to secure certainty, especially when a legal opinion alone may be insufficient. The chart “Common Transactions for a Ruling” on pages 33-34 provides a practical list of fact patterns that may justify seeking a ruling.

Beyond the direct benefit to individual taxpayers, the expanded letter ruling program has a ripple effect: It enhances transparency and improves how the tax community understands complex corporate transactions. When the IRS issues a full ruling, especially one addressing formerly off–limits areas such as Sec. 368(a)(1)(A), the published letter ruling most often includes a detailed factual background, legal framework, and representations. These serve as a road map for others navigating similar restructurings.

For example, the previously mentioned ruling in Letter Ruling 202441010 offers rare visibility into the IRS’s current standards for a statutory merger qualifying under Sec. 368(a)(1)(A). Without a letter ruling on the provision, taxpayers would be in the dark as to how the nearly four–decades–old Rev. Proc. 86–42 requirements would apply.

To further support taxpayer access, the IRS has continued modernizing its submission procedures:

- Rev. Proc. 2024-24 updated the required checklist for Sec. 355 submissions, streamlining how taxpayers should represent the facts and organize their ruling requests;

- Rev. Proc. 2025-1 introduced broader access to reduced user fees; and

- The IRS has released draft reporting forms (including proposed Form 7216, Multi-Year Reporting Related to Section 355 Transactions) to improve monitoring of post-spin compliance under Sec. 355.

Enhanced accessibility to the letter ruling program

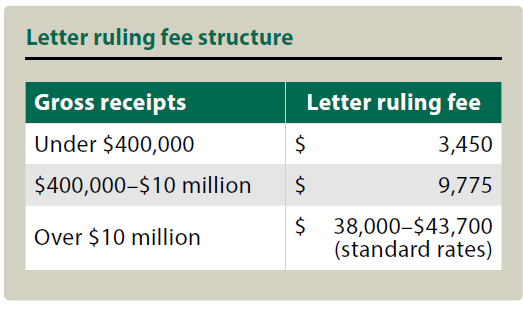

In complex transactions, timelines and costs often impede proper evaluation of risk and planning for alternative strategies. Many small and medium–size businesses lack the financial resources or internal knowledge enjoyed by larger corporations to fully map the options available, much less gain assurance on the tax consequences. It is not surprising that most letter rulings issued under Sec. 355 appear to represent larger corporations or those that file as a consolidated group.

Historically, the fees for obtaining a letter ruling — often exceeding $30,000 — are prohibitively expensive and would keep many, if not most, small and midsize companies on the sidelines. Under Rev. Proc. 2025–1, the IRS significantly expanded eligibility for reduced user fees by increasing the upper ends of the gross income bracket from $1 million to $10 million. For a more thorough discussion regarding the benefits of reduced user fees, see Baker Tilly Advisory Group LP’s comments in response to Notice 2024–38, available at “Accounting Firm Requests Streamlined Spinoff Guidance,” Tax Notes (July 30, 2024).

The current fee structure is as shown in the table “Letter Ruling Fee Structure.”

Fast-track letter ruling procedures

After an initial pilot program (Rev. Proc. 2022–10), the fast–track letter ruling revenue procedure was made permanent under Rev. Proc. 2023–26. This program aims to issue a letter ruling regarding a corporate transaction in 12 weeks, significantly shorter than the 180 days for a typical ruling. Fast–track rulings require some additional front–end work from requesters, including a detailed presubmission conference with the IRS, a draft of the ruling, and prompter responses on information requests (typically seven business days). While not limited to Sec. 355 transactions, the fast track is best suited to deals with a known closing date or other critical deadline.

Separate from the fast–track letter ruling procedures, expedited rulings may be granted at the agency’s discretion for transactions needing priority processing (e.g., imminent initial public offerings or restructurings tied to financing covenants).

In conclusion, these cumulative changes — substantive, procedural, and administrative — signal a coordinated effort by the IRS to restore trust in its corporate letter ruling program while supporting the practical needs of modern taxpayers.

Editor

Jessica L. Jeane, J.D., is director of tax policy, national tax, with Baker Tilly in McLean, Va.

For additional information about these items, contact Jeane at Jessica.Jeane@bakertilly.com.

Contributors are members of or associated with Baker Tilly.

Baker Tilly US, LLP, and Baker Tilly Advisory Group, LP, and its subsidiary entities provide professional services through an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable laws, regulations, and professional standards. Baker Tilly US, LLP, is a licensed independent CPA firm that provides attest services to clients. Baker Tilly Advisory Group, LP, and its subsidiary entities provide tax and business advisory services to their clients. Baker Tilly Advisory Group, LP, and its subsidiary entities are not licensed CPA firms.