- feature

- TAX ACCOUNTING

Why LIFO, why now?

Related

Digital asset transactions: Broker reporting, amount realized, and basis

Applying updated ASC Topic 740 requirements for the income tax footnote

Income tax purchase accounting considerations for a stock acquisition

TOPICS

Heightened inflation and increased tariffs have created a unique opportunity for taxpayers to adopt the last-in, first-out (LIFO) inventory accounting method. This article explains why acting now can maximize tax benefits, outlines adoption requirements, and highlights key considerations, including the traditional approach and the dollar-value LIFO method, for businesses evaluating a change in their inventory method.

Key takeaways:

- LIFO matches recent inventory costs to current revenues, reducing taxable income during inflationary periods.

- Adoption requires book-tax conformity and filing Form 970, Application to Use LIFO Inventory Method, with the IRS.

- Inflation and tariffs increase LIFO benefits.

- Waiting could mean missing substantial tax savings.

- Taxpayers must consider LIFO recapture, compliance risks, and financial statement effects before adopting.

The LIFO inventory method was introduced in the Internal Revenue Code under the Revenue Act of 1938, P.L. 75-554 (83 Cong. Rec. 5043 (1938)), during a period of rising prices. LIFO was meant to help businesses match current costs with current revenues, reducing inflation-driven tax burdens. Despite the tax-deferral benefits, many taxpayers have historically hesitated to adopt the method due to its complexity and administrative burden. However, when inflation accelerates (such as with implemented or renewed likelihood of tariffs), the combination of it and tariff-driven cost increases makes LIFO adoption more compelling. Because LIFO applies only prospectively, delaying adoption could mean forfeiting significant tax savings tied to today’s inflationary cost environment.

Overview of the LIFO inventory method

The LIFO inventory method assumes the most recently acquired items are sold first. Under LIFO, the cost of goods sold (COGS) tends to reflect current replacement costs, which can significantly reduce taxable income during periods of rising prices. This method contrasts with the first-in, first-out (FIFO) inventory method, which matches older, lower-cost inventory against current revenues. FIFO often results in higher taxable income when inflation occurs. The primary advantage of LIFO is tax deferral: By matching higher costs to current sales, businesses can postpone recognizing income, resulting in improved cash flow and a lower immediate tax liability.

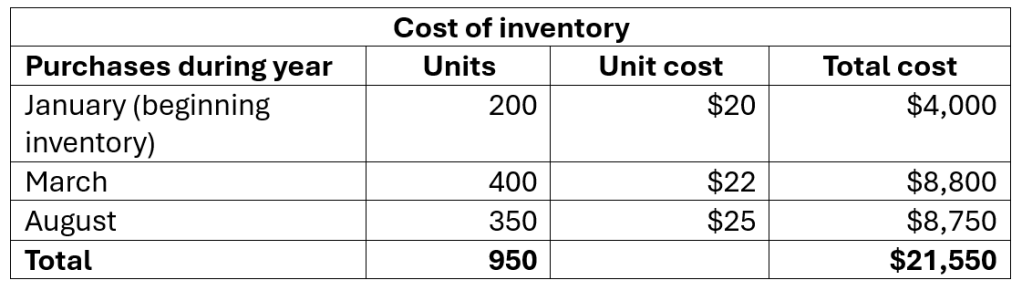

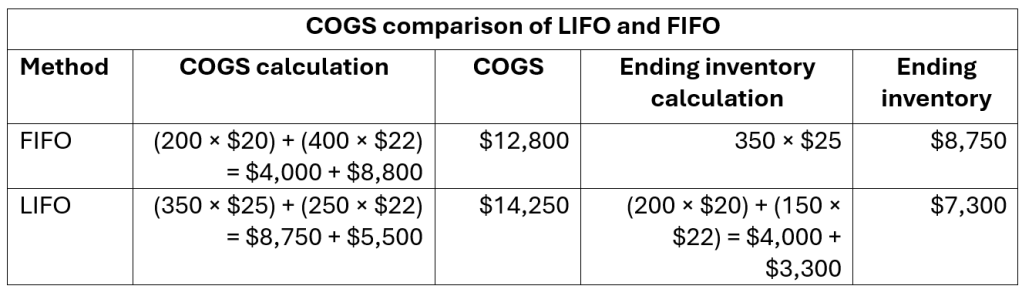

The following example shows the general LIFO cost flow assumption. The “Cost of Inventory” table provides an example wherein a taxpayer experiences rising per-unit costs of inventory, and the “COGS Comparison of LIFO and FIFO” table shows how, under situations of rising per-unit costs of inventory, the COGS computation is higher under LIFO than under FIFO.

Sold during year: 600 units

Ending Inventory: 350 units

With a growing inflation rate and consistent or rising levels of inventory, the longer a taxpayer uses LIFO, the more benefits accumulate — similar to staying invested in a diversified stock portfolio. Some years may yield modest savings, others significant, but the overall trend favors long-term tax deferral for taxpayers.

How the dollar-value method simplifies LIFO

Dollar-value LIFO (see Regs. Sec. 1.472‑8) is an inventory accounting method that simplifies the traditional specific‑goods LIFO approach by valuing inventory in terms of dollars rather than physical units. Instead of tracking increases or decreases in quantities of individual items, the dollar‑value method groups items into “pools” and measures inventory changes based on the total dollar value of those pools. This approach reduces the administrative complexity that arises when a company carries many different products or frequently changes product lines.

The dollar‑value LIFO method requires that inventory be measured at base‑year prices, which represent the cost levels in the year a taxpayer adopts the LIFO method. By restating current‑year inventory at base‑year prices, taxpayers can identify true increases in quantity, distinguishing them from mere price changes (i.e., inflation). Any increase in the dollar value of inventory at base‑year prices is treated as a new LIFO layer; decreases reduce or eliminate previous layers.

The dollar-value method delivers comparable tax benefits to the specific-goods method with far less administrative effort. The dollar-value method is widely accepted and supported by Regs. Sec. 1.472‑8, making it audit-defensible and practical for businesses with large, diverse inventories. Many taxpayers previously using the specific-goods method of LIFO have converted to the dollar-value method for efficiency and compliance, as it achieves the primary LIFO tax advantage while reducing complexity and risk. (See “Dollar-Value LIFO Method Adoption Requirements” below.)

Book-tax conformity rules

Under Sec. 472(c), taxpayers electing LIFO for tax purposes must also use LIFO for financial reporting. This book-tax conformity requirement means that once a company adopts LIFO for tax, it must be reflected in the company’s financial statements prepared under U.S. GAAP before the company provides reports or statements of income, profit, or loss to any shareholders, members, banks, beneficiaries, or other credit holders. Taxpayers that issue financial statements using any other method prior to adopting and reflecting LIFO on their financial statements risk forfeiting significant tax benefits.

Assessing LIFO benefits

LIFO tax benefits are amplified when there are significant increases in inflation (e.g., resulting from an increase in tariffs on imported goods) and inventory levels stay consistent or increase over time. As a result, the inventory values calculated under LIFO reflect highly inflated costs, increasing COGS deductions and deferring taxable income. These conditions make it a favorable time for taxpayers considering LIFO adoption.

Taxpayers can benefit from LIFO even without direct tariff costs. Under the dollar‑value LIFO method outlined in Regs. Sec. 1.472‑8, the inventory price index computation (IPIC) method allows taxpayers to measure inflation using an external government‑published price index, such as the Producer Price Index (PPI) or the Consumer Price Index (CPI), instead of relying on their own internal inventory cost changes. To apply the IPIC method, a business groups its inventory into the appropriate PPI or CPI categories, obtains the published index values for the category that corresponds to the month ending closest to its tax year end, and compares the current‑year index to the base‑year index to determine an inflation factor. That factor is then used to restate ending inventory to base‑year dollars and compute any LIFO increments or decrements. Because inflation is tied to broad economic price movements, taxpayers can generate LIFO benefits even when their own purchase prices do not rise. The election to use the IPIC method must be made with a timely filed tax return, and the taxpayer must state whether PPI or CPI is chosen. Once made, the election generally applies to all dollar‑value LIFO pools and cannot be revoked without IRS consent. Based on data from the Bureau of Labor Statistics — specifically, Table 6 of the detailed PPI report for December 2025 — the table “Comparison of the Average Producer Price Index (PPI) to the 2025 Percentage for Common Commodities” highlights the drastic effects that inflation can have during periods when significant tariffs are imposed.

Timing matters. Because LIFO adoption is applied prospectively on a cut-off basis, prior inventory remains under the old method. Taxpayers are not allowed a Sec. 481(a) adjustment to retroactively apply LIFO to pre-adoption inventory. To capture the LIFO tax benefit of inflation and tariff-driven costs, adoption must occur in the current year.

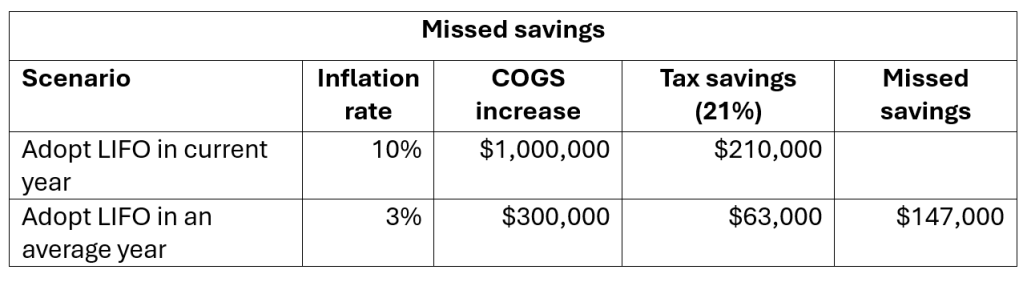

The table “Missed Savings” provides a hypothetical illustration of the potential missed tax savings from waiting to adopt dollar-value LIFO:

Inventory assumptions: $10 million of ending inventory costs under FIFO.

Inflation assumptions: 10% in current year (including 2% attributable to tariffs), 3% average annual inflation.

Dollar-value LIFO method adoption requirements

For tax purposes, adoption requires filing Form 970 with the timely filed tax return and applying LIFO to all inventory for which LIFO is to be used. Form 970 should describe all LIFO submethods adopted, including whether the taxpayer will use internal inventory cost changes or the external IPIC method to compute inflation. Additionally, if a taxpayer is already using a LIFO method other than the dollar-value IPIC method, they can switch to the IPIC method by filing Form 3115, Application for Change in Accounting Method.

The IRS requires adequate LIFO records for all periods the method is used. Failure to maintain comprehensive documentation (including detailed LIFO calculations) can result in the disallowance or termination of the LIFO election (see Rev. Proc. 79-23). Therefore, preparing and retaining complete LIFO calculation records annually is critical to ensure compliance and readiness for an IRS examination.

For financial reporting, businesses must apply the LIFO method consistently to inventory accounting under U.S. GAAP and disclose the method in the notes to the financial statements.

Because LIFO rules and procedures are complex, many businesses choose to outsource the initial implementation and the ongoing annual calculations to inventory accounting specialists. These professionals have established processes and expertise in LIFO compliance, ensuring accurate calculations and proper documentation.

Other considerations before adopting

Deflation: If tariff costs decline, taxpayers could face deflation, partially reversing the initial LIFO benefit. LIFO should be viewed as a long-term strategy, focusing on cumulative tax deferral rather than short-term fluctuations.

Terminating LIFO: To discontinue LIFO, taxpayers must file Form 3115 to elect a new inventory method. Automatic changes are generally unavailable until the method has been used for five years (Rev. Proc. 2015-13, §5.01(1)(f)). The accumulated LIFO reserve is reversed through a Sec. 481(a) adjustment, typically spread over four years.

LIFO recapture: Taxpayers must include in income the difference between LIFO and FIFO values when triggering events occur, such as conversions from a C corporation to an S corporation, asset sales, or certain mergers. They should model potential recapture scenarios before adopting LIFO, to avoid unexpected tax liabilities.

Financial statement impact: LIFO often reduces reported earnings and inventory values, which may affect loan covenants or investor perception. Amendments to loan covenants or additional disclosures on financial statements can be made to address the impacts.

Prompt action necessary

Taxpayers should evaluate inventory trends and promptly consult advisers to determine whether adopting LIFO is advantageous. Action must occur before issuing financial statements and filing tax returns. Missing a window can mean forfeiting significant benefits tied to current inflation and a peak in tariffs.

— Cindy Houser, CPA, is a principal in CliftonLarsonAllen LLP’s Federal Tax Strategies team in Irvine, Calif. To comment on this article or to suggest an idea for another article, contact Paul Bonner at Paul.Bonner@aicpa-cima.com.