- news

- PRACTICE MANAGEMENT

2023 tax software survey

Related

CPA firm M&A tax issues

Return preparer reliance on third-party tax advice

IRS broadens Tax Pro Account for accounting firms and others

The software that CPA tax preparers use to prepare clients’ income tax returns is one of their most important professional tools. These products vary not only in such basic features as how tax return data is input and displayed but also in their adaptability to the myriad variations in tax clients’ sources of income, deductions and credits, and other pertinent details. CPAs naturally take a keen interest in how performance of the products compares. Consequently, the JofA and The Tax Adviser have annually surveyed AICPA members who prepare tax returns professionally on how their software performed in the most recent return preparation season. We’re pleased once again to present the results of this year’s survey.

The 2023 Tax Software Survey was conducted June 5–23, 2023. Invitations were sent by email to 96,359 AICPA members who had indicated they have a professional interest in taxation. The results reflect answers of 2,685 respondents who said that they prepared tax-year 2022 returns for a fee.

This year, we also asked about respondents’ experience using the IRS’s Practitioner Priority Service (PPS) phone line; those answers are tallied below in the section “Some PPS Improvement Noted.”

PRODUCTS COVERED AND PROFILE OF RESPONDENTS

Respondents could choose from among 13 listed products and write in others. As in other recent years, usage coalesced around seven products, which are the ones reflected in most of this article’s analysis. Here are the percentages of respondents using each of them, in order from the most- to the least-used (and change from 2022 noted for some):

- UltraTax CS, 23.8% (up 3.8 percentage points from 2022);

- Drake Tax, 15.8% (down by 1.3 percentage points);

- Lacerte, 14.8% (up by 1.5 percentage points);

- ProSeries, 10.5% (down by 2.3 percentage points);

- CCH Axcess Tax, 10.1% (up by 1 percentage point);

- CCH ProSystem fx, 9.7% (up by 0.9 percentage point); and

- ATX, 5.8% (down by 0.7 percentage point).

The remaining six products altogether were used by less than 9% of respondents: ProConnect Tax (3.1%), TaxAct Professional (1.8%), GoSystem Tax RS (1.7%), TurboTax (1.1%), TaxWise (0.6%), and TaxSlayer Pro (0.4%). Another 1% of respondents used software other than these 13.

As an indication of a long-term trend of consolidation in the industry, the seven “major” products are produced by four companies: ATX, CCH Axcess Tax, and CCH ProSystem fx by Wolters Kluwer; Lacerte and ProSeries by Intuit Inc.; UltraTax CS by Thomson Reuters; and Drake Tax by Drake Software.

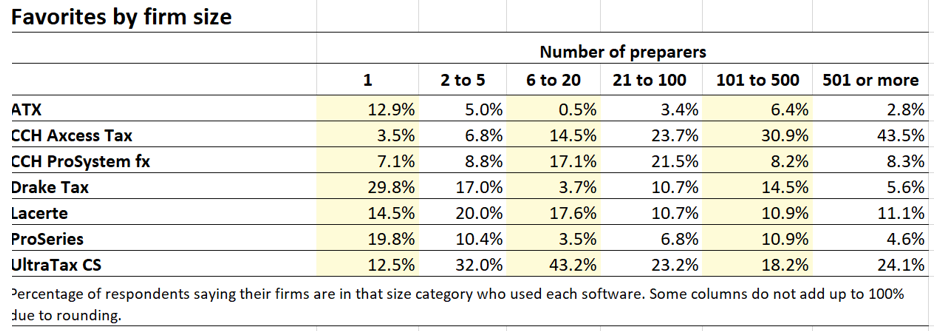

A primary consideration by firms in selecting their software is the size of the firm and the type of returns the firm prepares. Therefore, the survey correlates the seven products by the number of preparers that respondents reported in their firms.

More single-preparer firms (nearly 30%) reported using Drake Tax than any other product. Adding to those Drake users others in firms of two to five preparers who also used Drake Tax equaled 47% of respondents in those combined size ranges. That was the highest percentage in the combined range of up to five preparers, although UltraTax CS’s 32% in the two- to five-preparer range contributed to placing that product not far behind when adding in the single preparers who used it, for a combined 44%.

At the other end of the scale, CCH Axcess Tax came out as a clear favorite among respondents in firms of more than 100 preparers, especially the 43.5% of respondents in firms of more than 500 preparers that used it. When grouped by product and then by size range of firms using each one, some of these preferences appear even more pronounced. Among users of Drake Tax, 87% are in firms of five or fewer preparers. However, CCH Axcess users as a group are not so concentrated; many were in the midrange (e.g., 45% of its users were in firms of between two and 20 preparers), and only 17% were in firms of more than 500 preparers. However, only 4.5% of respondents of all major products were in this category of largest firms.

Similarly, the types of returns prepared tend to correlate to particular products. The survey asked about the percentages of individual and business returns prepared. Individual returns made up a majority of returns for 78% of users of all major products combined; users of ATX, Drake Tax, Lacerte, and ProSeries were above that percentage. Business returns were not a majority for any of the products, but CCH Axcess Tax was highest in that respect at 21.6%, followed by UltraTax CS at 11.5%.

The survey also asked respondents if they selected the software or had input into the decision to use it. The highest percentages of these “deciders” (those who made the decision) were for ATX (95%) and Drake Tax (92%). Only 36.7% of CCH Axcess Tax users decided on that product, although another one-third had some say in the matter.

RATINGS

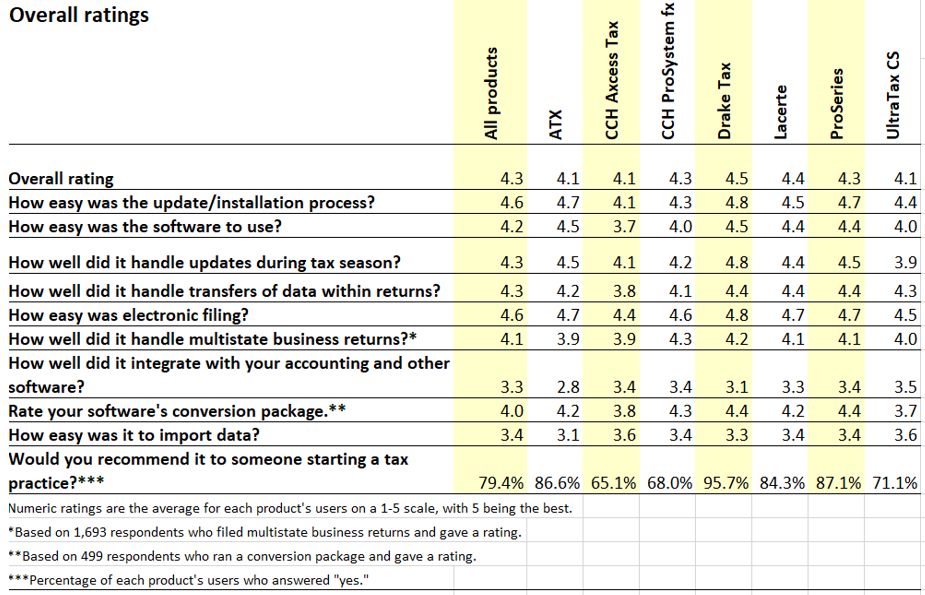

The survey asked users to rate their software by overall performance and by selected parameters. The highest overall rating was the 4.5 (on a scale of 1 to 5, with 5 being the highest) for Drake Tax, followed closely by Lacerte users’ 4.4. Two others, ProSeries and CCH ProSystem fx, scored 4.3, the average for all seven products.

Drake Tax also achieved the highest rating of 4.8 on two performance questions, “How well did it handle updates during tax season?” and “How easy was electronic filing?” Some of the lowest scores across the board were for integrating with accounting and other software and importing data — there were no clear winners here.

In what might be another indication of its suitability for a small firm, 95.7% of Drake Tax users said they would recommend it to someone starting a tax practice. The lowest level of assent to that question was by users of CCH Axcess Tax at 65%, which might be regarded as correlating with that product’s 3.7 rating for ease of use, which was well below the average of 4.2. However, Drake Tax scored lower than the other products in its integration with accounting and other software (3.1), along with ATX (2.8).

TOP LIKES AND DISLIKES

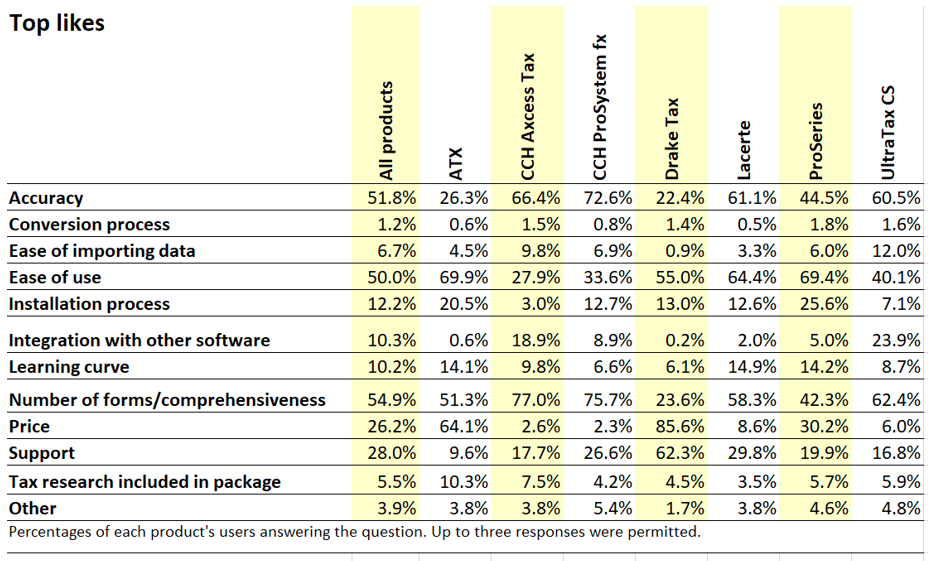

Respondents could choose up to three things from a list of 11 features of what they liked best and liked least about their software (and could write in others).

For all seven products combined, the most esteemed attribute was the software’s number of forms and comprehensiveness (nearly 55%). Here, the winners were CCH Axcess Tax (77%) and CCH ProSystem fx (75.7%), followed by UltraTax CS (62.4%). A related question, not shown in the tables, was whether the software contained all necessary forms. Users of CCH ProSystem fx answered “yes” most often at 90.7%, followed by Drake Tax at 88.2% and UltraTax CS at 86.8%.

Although one might think that software accuracy should be a given, users of CCH ProSystem fx more often picked it as a top like, at 72.6%, against an average of nearly 52%. The highest approval for any feature of any of the products was the 85.6% of Drake Tax users who liked its price, against an average of only 26% for all the products combined.

That dynamic plays out even more starkly in top dislikes, with 56.7% of users of all the products taking aim at the software’s price (but only 5.7% of Drake Tax users). Price antipathy was widespread (a perennial survey finding) but was highest for CCH ProSystem fx (77.5%), followed closely by Lacerte (nearly 77%), and then UltraTax CS (72%). It also figured in a number of write-ins for several products (e.g., “Price × 3”).

Drake Tax also stood out among top likes for its product support (62.3% liked it, as opposed to an average of 28% for all the products). Dislike of support stood at 41.2% for UltraTax CS, 39% for ATX, 34.5% for CCH ProSystem fx, and 31% for CCH Axcess Tax, all above the average of 29%. More findings concerning product support are described below.

Along with accuracy, ease of use might be considered one of the most general traits, and half of users of all the products picked it as a top like. Standouts here were ATX at nearly 70%, followed closely by ProSeries at 69.4%, and then Lacerte at 64.4%. Correspondingly, more respondents than average expressed their appreciation for those three products’ learning curve.

TECHNOLOGY, TRAINING, AND SUPPORT

This year’s survey continued to show a slow but steady trend toward cloud deployment of the software, but 75% of respondents still stated that the software operated from their own hard drive or network rather than on the vendor’s server. In the 2020 survey, that figure was 82%. CCH Axcess Tax users were most likely to use the vendor’s server at 82% but with only UltraTax CS (40%), Lacerte (11.8%) and ProSeries (10%) also reaching percentages in the double digits. Write-in likes and dislikes might provide clues about why. Entries faulting the cloud’s speed, stability, and interruptions showed up more often than appreciation for its convenience.

CCH Axcess Tax users were the most likely to have received training in the software’s use at 63.7%, although they gave that training a lower rating (3.6) than average (3.9). Similarly, nearly half of UltraTax CS users received training, rating it 3.7. Slightly less than half of Drake Tax users (48.7%) were trained and gave it the highest rating at 4.4.

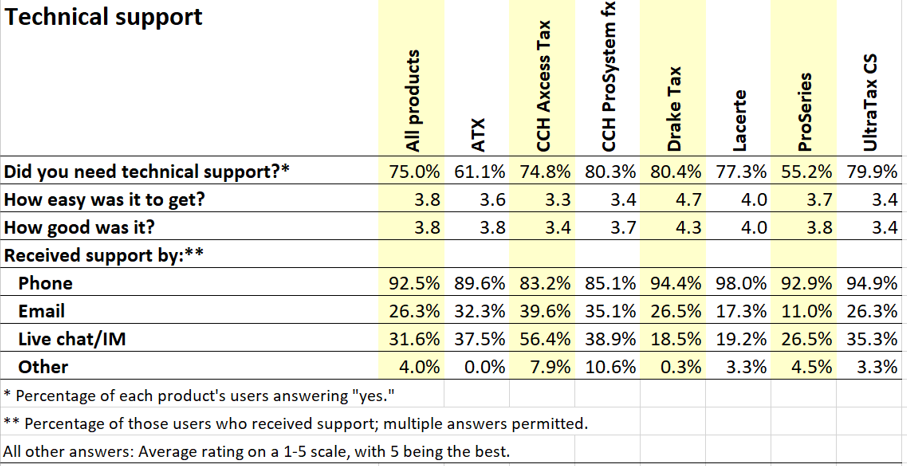

Ease of obtaining technical support was rated more highly than the average of 3.8 by users of Drake Tax (4.7), who also gave the highest rating to its quality (4.3). Lacerte was next with 4.0 for both metrics.

Telephone was still the decidedly preferred method of getting support, although live chat/instant messaging gained ground overall at 31.6%, another slow but steady upward trend and notably relied upon by 56.4% of CCH Axcess Tax users.

SOME PPS IMPROVEMENT NOTED

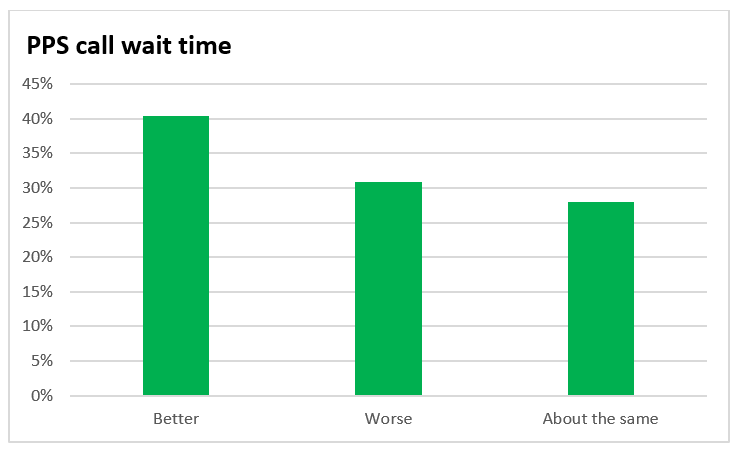

This year’s survey also sought to gauge respondents’ perception of a reported improvement for the 2023 income tax filing season in the IRS’s operation of its PPS dedicated help hotline. In January, Kenneth Corbin, the IRS’s commissioner of the Wage and Investment Division and its taxpayer experience officer, told a gathering of enrolled agents that current wait time for a PPS operator to answer was less than 10 minutes (see “Wait times for practitioner phone line reduced, IRS official says,” JofA, Feb. 3, 2023). While hardly instantaneous, that was markedly speedier than the average 25-minute wait time during fiscal 2022 reported by National Taxpayer Advocate Erin Collins in her 2022 Annual Report to Congress. And that represented the hold time only for the 16% of PPS calls attempted that ever reached an operator at all (see “National taxpayer advocate: IRS in better shape now than a year ago,” JofA, Jan. 12, 2023).

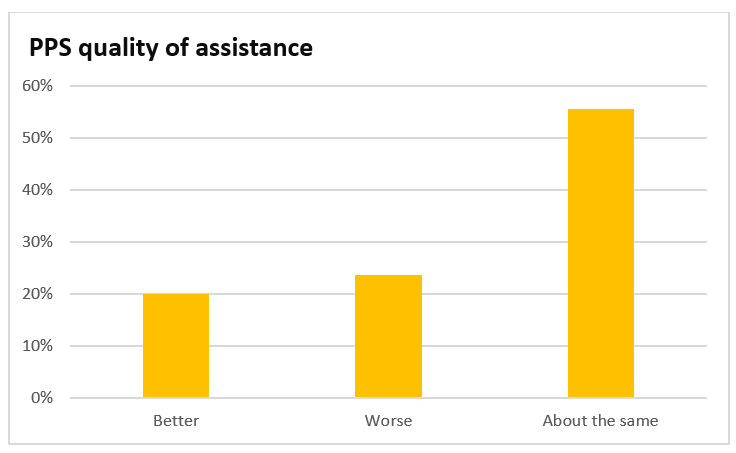

The survey’s findings generally bore out the reported wait time improvement but found no clear improvement in the quality of assistance on the PPS line. In his January speech, Corbin credited the swifter call pickup on the hiring of thousands of new customer service representatives.

Specifically, the survey asked whether, while preparing 2022 returns, respondents called the PPS line. The 1,266 who said they did were then asked how their wait time compared with that of any PPS calls they had made in previous years — better, worse, or about the same. More than 40% said it was better, 30.8% said it was worse, and 28% said it was about the same. Another 1% had not made any calls in previous years.

The survey then asked how the quality of assistance respondents received from PPS compared with any PPS assistance received in previous years. Of the 99% of respondents who had prior-year calls to compare it to 55.6% rated it about the same; 23.5% said it was worse. Only 20% said it was better.