- news

- TAX PRACTICE MANAGEMENT

2024 tax software survey

Related

Representing taxpayers with IRS identity protection and theft victim assistance

New law, IRS workforce cuts raise red flags for tax season, reports say

Managing tax practices in response to new legislation

When CPA tax preparers gear up for busy season, among their chief concerns is the engine upon which the endeavor runs: their tax preparation software. Afterward, they might take stock of how that software has performed, with an eye to perhaps trying out something else. Thus, the Journal of Accountancy and The Tax Adviser have for years surveyed AICPA member tax preparers on what product they used, how they rate it in various ways, what they liked and disliked about it, and other considerations. We thank those who responded to this year’s survey and are pleased to tally and describe the results in this article.

This year’s data represents the responses of 2,508 CPAs who said they prepared 2023 tax returns for a fee. They were among the 140,401 individuals to whom the survey was sent and who responded June 3–21, 2024.

The AICPA’s Tax Section also surveyed practitioners about IRS service during the most recent preparation season, including respondents’ experience calling the Practitioner Priority Service hotline and their other top concerns of IRS administration (for these results, see “Tax Pros: IRS Improving, but Getting the Right Answer Takes Too Long,” JofA, July 2, 2024).

Products covered

One aspect of tax preparation software’s use that changes only incrementally from year to year is which products are predominantly represented among the survey’s respondents. Usage again this year centered on the seven products that are included in the tables and most of the descriptions that follow. By percentage of respondents using them (with a comparison to the 2023 survey), they were:

- UltraTax CS, 22.6% (down 1.2 percentage points from 2023);

- Lacerte, 16% (up 1.2 points);

- Drake Tax, 15.9% (up 0.1 point);

- CCH Axcess Tax, 12.4% (up 2.3 points);

- ProSeries, 11% (up 0.5 point);

- CCH ProSystem fx, 8.9% (down 0.8 point); and

- ATX, 4.7% (down 1.1 point)

The survey also gave respondents an opportunity to choose six other products: GoSystem Tax RS, ProConnect Tax, TaxACT, TaxSlayer Pro, TaxWise, and TurboTax. None of these were used by more than 3.1% of respondents, and together they accounted for 7.3% of respondents. Another 1.3% of respondents indicated that they used some other product than the 13 named.

The seven “major” products are produced by four companies: (1) ATX, CCH Axcess Tax, and CCH ProSystem fx are products of Wolters Kluwer; (2) Lacerte and ProSeries are by Intuit Inc.; (3) UltraTax CS is a Thomson Reuters product; and (4) Drake Tax is by Drake Software.

Profile of respondents

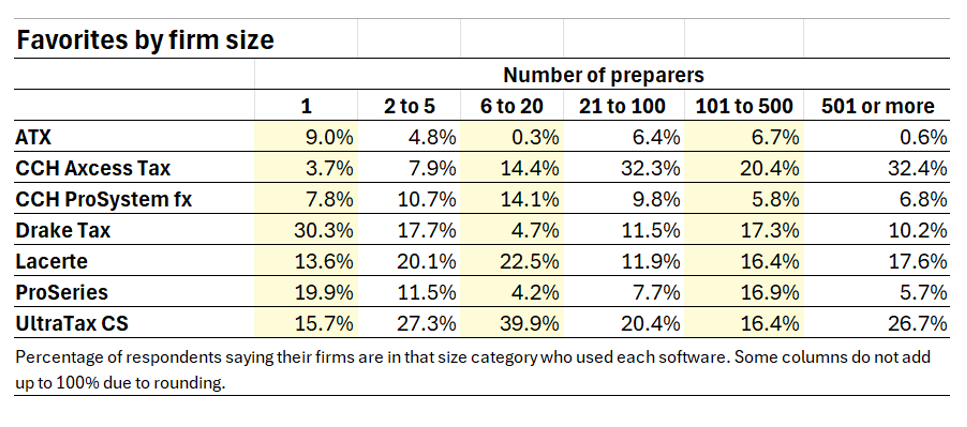

The survey was sent to active AICPA members with a U.S. address who had expressed an interest in taxation and were age 21 or older. The shares of respondents using a particular product tend to correlate to some degree to the number of preparers in the firm in which they work; therefore, the survey also asks about the size of the firm. Those results, tabulated by share of the major products used by each firm size range, are shown in the table “Favorites by Firm Size.”

As the table shows, 30% of sole practitioners surveyed used Drake Tax. At the other end of the scale, nearly one-third of respondents in the largest firms, those of more than 500 preparers, used CCH Axcess Tax.

Not shown are users of each product by percentage of each firm size category; looked at this way, nearly three-quarters of Drake users were in firms of five or fewer preparers. A concentration of ATX users in the smallest firms also stands out: 44% of ATX users were sole practitioners, and another 29% were in firms of two to five preparers.

Ratings

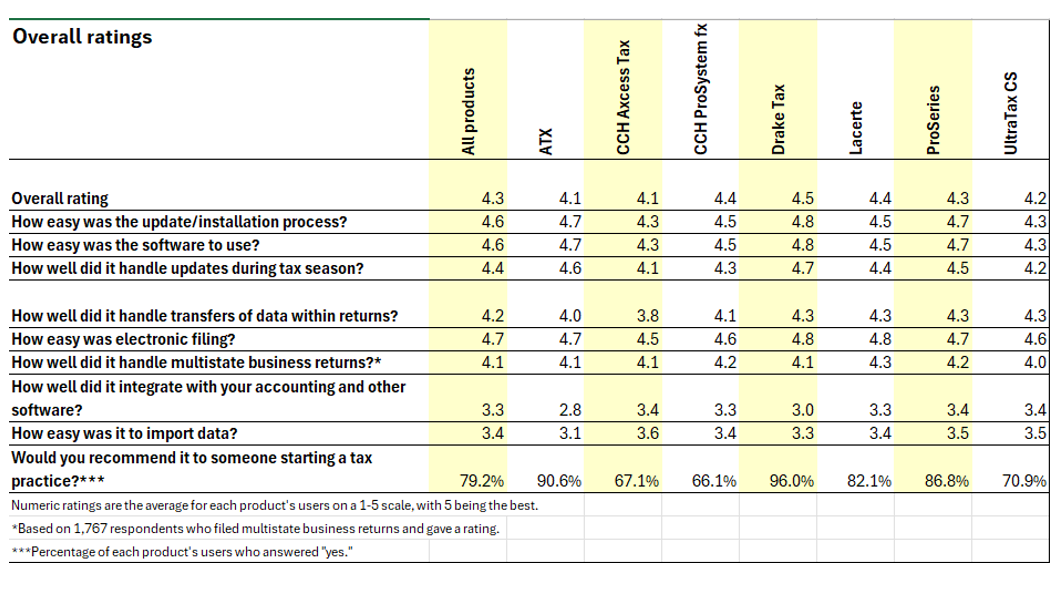

The survey asked users to give an overall rating to their software on a scale of 1 to 5, with 5 being the best (see the table “Overall Ratings”). These do not deviate much from the average 4.3 for all major products, although Drake Tax led this year (and last) at 4.5, followed by Lacerte and CCH ProSystem fx at 4.4 each.

Also see the same table for ratings of how well the software performed in various ways. Drake users gave a 4.8 to ease of use, efiling, and update and installation. Lacerte also garnered a 4.8 for efiling ease. None of the products rated very highly for integration with users’ accounting and other software, and here ATX received the lowest marks of any product for any of these questions, 2.8, with Drake judged a 3.

Responses to how well the software handled multistate business returns — likely a complicated task in many cases — clustered closely around the average of 4.1, but Lacerte edged out the others at 4.3. Similarly, CCH Axcess Tax edged out the others for ease of importing data at 3.6, amid generally lower ratings for the products as a whole regarding this chore.

Updates during tax season are often a source of consternation among preparers, as software developers fix bugs or, sometimes, adapt on the fly to new (and untimely) federal or state provisions or guidance. Ratings here were again best for Drake Tax at 4.7, against an average for all products of 4.4.

Asked if they would recommend their software to someone starting a tax practice, Drake Tax and ATX again gleaned significant affirmation, with 96% and nearly 91%, respectively, of their users saying yes. This might be seen as concomitant with their prevalence among the smallest and lone-preparer firms, assuming a new practice most likely would be small.

Top likes and dislikes

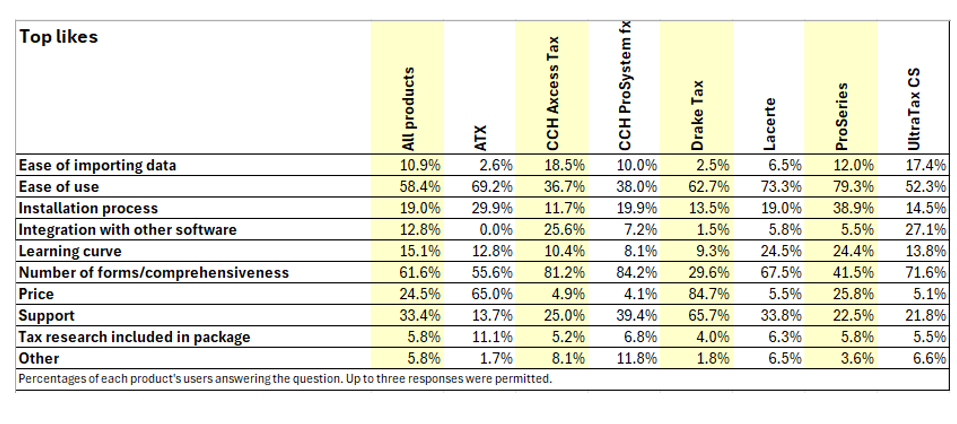

The survey also asked users to select up to three things they liked best and most disliked from a list of nine traits, and they could write in others. By percentage of all attributes picked for each product, some clear grounds for approval emerged, in some cases supporting or clarifying the overall ratings (see the table “Top Likes”). For example, while ProSeries users’ ratings for ease of use were not the highest among the products (although close), nearly 80% of its top likes were for ease of use, more than any other product regarding that characteristic. Lacerte’s ease of use was also highly prized at 73% of its likes.

Write-in likes ran the gamut, but many are (generally less colorful) variants of this Lacerte user’s expression of the virtue of familiarity: “Been using it for 34 years — too old to change.”

The second-highest frequency of approval was for CCH ProSystem fx’s number of forms and comprehensiveness at 84.2% (followed closely by CCH Axcess Tax at 81.2%). The highest of all, however, was the 84.7% approval for Drake Tax’s price, which stands out even more starkly in the next table, “Top Dislikes.”

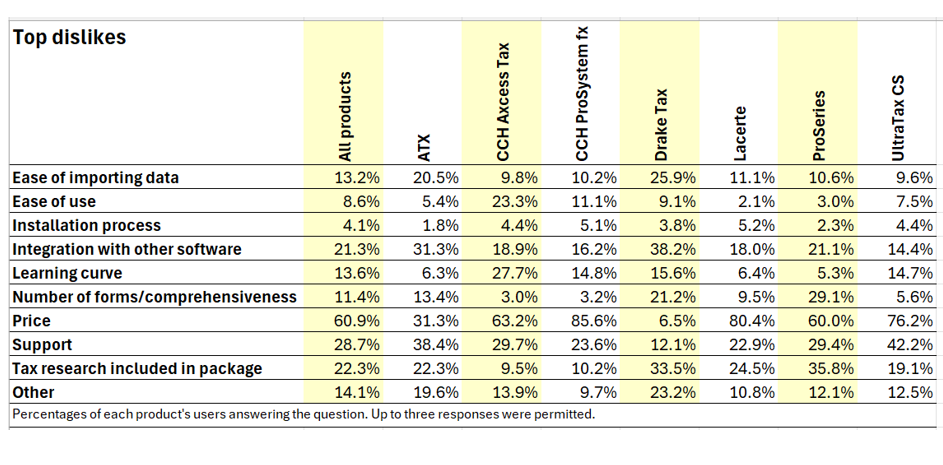

Here, price was the most disliked attribute by far at nearly 61% for all products combined. Sticker shock was most acute among users of CCH ProSystem fx at 85.6%, followed by Lacerte at 80.4%.

Only 6.5% of dislikes by Drake Tax were for its price. Those users, however, were least fond of its integration with other software at 38.2%, well above the average of 21.3% for all products.

Product support, which will be further examined next, was disliked 28.7% of the time by users of all products combined, but with dislikes well above that average posted by users of UltraTax CS (42.2%) and ATX (38.4%). By the same token, those products’ users seldom picked support as a top like. Conversely, Drake Tax users generally favored their product support, picking it as a top like 65.7% of the time, the highest for any product.

Write-in dislikes were many and varied, but a significant number of respondents underscored their disapproval of the product’s price, such as this one: “Price should count twice.” Difficulties preparing state returns were also a recurrent theme across all products.

Training and support

Of the 1,035 respondents who said they received training from their software provider, the highest ratings of that training were by users of ATX at 4.5, followed by Drake Tax at 4.4 and Lacerte at 4.2.

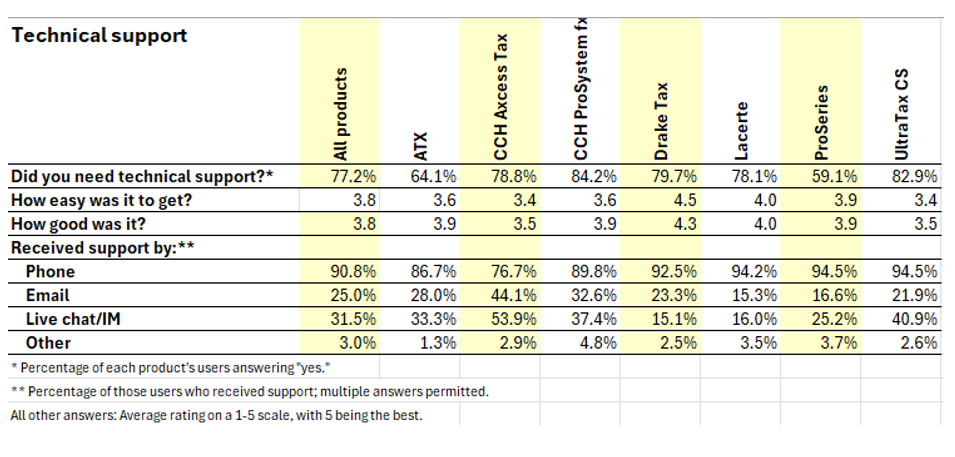

Technical support ratings (see the table “Technical Support”) were most favorable by the nearly 80% of Drake Tax users needing support, who rated its worth at 4.3 and the ease in obtaining it at 4.5, both above the average of 3.8 for both questions.

The telephone remains the preferred method of obtaining tech support, although CCH Axcess Tax users were a good deal more likely than users of other products to avail themselves of email, chat, or instant messaging (and did so more often than last year). The nearly 41% of UltraTax CS users who used chat or IM for support is also an increase over last year.

Preparing to prepare

CPAs looking to assess their own tax preparation software against others and perhaps switch might take these survey results as a starting point. With the advice of a trusted fellow CPA using any other product they are interested in, they might then reach out to a company representative. Often, companies will provide access to a trial or demo version that users can run through its paces with mock returns. Most providers have a variety of pricing plans, in some cases scalable to the number of returns of particular types the preparer will have. While, as mentioned above, many 2023 returns may yet remain on extension, at this point, any switch to a new product can still be made in enough time before — all too soon — the busy season for preparing 2024 returns takes off.

— To comment on this article or to suggest an idea for another article, contact Paul Bonner at Paul.Bonner@aicpa-cima.com.