- news

- credits against tax

The clean-energy direct-pay election for not-for-profits and governmental entities

Related

Navigating safe-harbor rules for solar and wind Sec. 48E facilities

Businesses urge Treasury to destroy BOI data and finalize exemption

IRS generally eliminates 5% safe harbor for determining beginning of construction for wind and solar projects

As part of the Inflation Reduction Act of 2022, P.L. 117-169, passed in August 2022, hundreds of billions of dollars in governmental funding and costs were allocated to energy and climate initiatives. As part of the legislation, for the first time, tax-exempt organizations, including not-for-profits and governmental agencies, can claim certain energy credits on their federal income tax returns and receive a refund from the federal government even if they have zero federal income tax liability. This ability is due to new Sec. 6417, Elective Payment of Applicable Credits (“direct pay”).

While many in the accounting profession and clean-energy industry have highlighted the direct-pay election under Sec. 6417, a lack of understanding — and fast-approaching deadlines — may cause applicable entities to leave significant cash outlays with the federal government instead of receiving them for their operations.

For tax years beginning after Dec. 31, 2022, the direct-pay election generally must be made by the tax return due date, including extensions of time to file. Proposed regulations clarify that direct pay cannot be made on an amended return. The proposed regulations also do not provide late-filing regulatory relief under Regs. Secs. 301.9100-1 through -3 for direct-pay elections that are not filed timely (Prop. Regs. Sec. 1.6417-2(b)(1)).

For example, if applicable entities were involved in clean-energy initiatives in the 2023 tax year, and the Sec. 6417 direct-pay election is not made on a timely filed 2023 federal income tax return, the clean-energy refundable credit for that year will no longer be available. Under the proposed regulations, there currently appears to be no mechanism for applicable entities to request a refund later.

Some commonly asked questions surrounding the Sec. 6417 direct-pay election are addressed below.

What entities are eligible to make a Sec. 6417 direct-pay election?

Applicable entities that can make a Sec. 6417 direct-pay election include (Sec. 6417(d)(1)):

- Any organization exempt from tax under Sec. 501(a);

- Governments of U.S. territories and political subdivisions thereof;

- States, the District of Columbia, and political subdivisions thereof;

- Agencies and instrumentalities of a state, the District of Columbia, Indian tribal governments, a U.S. territory, or a political subdivision thereof;

- The Tennessee Valley Authority;

- Indian tribal governments and political subdivisions thereof;

- Alaska Native Corporations; and

- Rural electric cooperatives.

What types of production and investment activities would the applicable entity need to be involved in to apply for the Sec. 6417 direct-pay election?

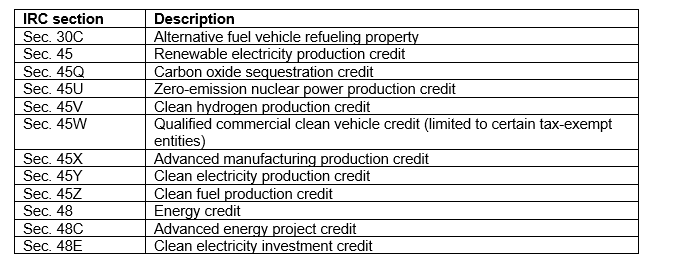

Applicable entities can make the direct-pay election in association with the following credits for investment in clean-energy projects and the production of clean energy (Sec. 6417(b)):

Common investment energy projects by applicable entities include geothermal, energy-storage technology, active solar energy, microgrids, combined heat and power systems, commercial electric vehicles, and electric charging stations. Common clean-energy production projects undertaken by applicable entities include community geothermal wells, wind farms, solar arrays, and energy-storage technology.

Under Sec. 48, applicable entities could receive a federal energy credit as high as 50%, depending on whether certain requirements are met, including if the energy project is located in an energy community, meets the domestic-content requirement, has a maximum net output of less than 1 megawatt, or meets the prevailing wage and apprenticeship requirements. For solar energy and wind projects, applicable entities could receive an additional 10% to 20% if they are located in qualified low-income areas.

Under Sec. 45W, commercial clean vehicles provide a maximum federal income tax credit of $7,500, or $40,000 if the gross vehicle weight is 14,000 pounds or greater (Sec. 45W(b)(4)).

Under the Sec. 30C credit for alternative fuel vehicle refueling property, the maximum credit for a charging station that is depreciable property is 30% of the costs if the prevailing wage and apprenticeship requirements are met, not to exceed $100,000 per station (Secs. 30C(a), (b), and (g)).

Example: Assume a calendar-year-end not-for-profit entity placed in service a large commercial solar panel that would generate 250 kilowatts of electricity in the 2023 tax year. The cost is estimated to be $750,000. Provided that the total expenses are deemed eligible costs for the Sec. 48 energy credit and the total maximum net output is less than 1 megawatt, the not-for-profit could generate a federal tax credit (refund) of $225,000, or 30% of the cost. The applicable rate is 30% because the project was not located in an energy community and did not meet the domestic-content requirement.

The timing of when the credit can be claimed is generally based on the tax year in which the project was placed in service. Therefore, applicable entities should closely review clean-energy projects placed in service in the 2023 tax year before filing their 2023 federal income tax returns.

If the applicable entity receives other federal or state funding or grants for the energy project, do they reduce the amount that can be claimed with a Sec. 6417 direct-pay election?

Tax-exempt income, including income from certain grants and forgivable loans, used to purchase, construct, reconstruct, or otherwise acquire investment-related credit property, is included in the property’s basis when determining the applicable credit. Investment-related credit property is defined as alternative fuel vehicle refueling property (Sec. 30C), qualified commercial clean vehicle property (Sec. 45W), energy property (Sec. 48), an advanced energy project (Sec. 48C), and clean electricity investment property (Sec. 48E) (Prop. Regs. Sec. 1.6417-2(c)(3)).

One potential limitation to an investment credit with respect to tax-exempt income used to fund the energy project is that the total grant, forgivable loan, or other income exempt from taxation plus the federal income tax credit determined cannot exceed the total costs of the investment-related credit property. If the combination of tax-exempt funding and the applicable federal credit exceeds the project’s total costs, then the applicable federal credit amount is reduced (id.).

Example: School District A receives a tax-exempt grant for $300,000 from the U.S. Environmental Protection Agency to purchase an electric school bus. A purchased the electric school bus for $400,000, consisting of the grant and $100,000 of A’s unrestricted funds. A’s basis in the school bus is $400,000, and A’s commercial clean vehicle credit is $40,000. Since the amount of the grant plus the commercial clean vehicle credit ($300,000 + $40,000) is less than the total cost of the electric school bus ($400,000), the commercial clean vehicle credit will not be reduced.

Certain credits can be reduced to the extent they are financed with tax-exempt debt. For example, the renewable electricity production and energy tax credits can be reduced by up to 15% if the project is financed with tax-exempt debt (Secs. 45(b)(3) and 48(a)(4)).

How do applicable entities make a Sec. 6417 direct-pay election?

A direct-pay election must be made on an annual income tax return, which is defined as:

- For any taxpayer normally required to file an annual tax return with the IRS, such annual return;

- For any taxpayer that is not normally required to file an annual tax return with the IRS (such as taxpayers located in the U.S. territories), the return they would be required to file if they were located in the United States, or, if no such return is required (such as in the case of state, District of Columbia, local, or Indian tribal governmental entities), the Form 990-T, Exempt Organization Business Income Tax Return; and

- For short-tax-year filers, the short-year tax return (Prop. Regs. Sec. 1.6417-1(b)).

Again, the direct-pay election must be filed on an original return for the year the credit is being claimed and filed no later than the due date of the return, including extensions. For taxpayers in U.S. territories, the due date for making the election is the due date that would apply if the taxpayer were located in the United States. If a taxpayer is not required to file a federal income tax return, the due date for making the election is generally the 15th day of the fifth month after the applicable tax year end (Prop. Regs. Sec. 1.6417-2(b)(3)). Taxpayers that are not required to file income tax returns could request an automatic paperless six-month extension of time to file. Consideration should be given to applicable entities with fiscal year ends.

Are there any steps to be taken before filing the tax return in which a Sec. 6417 direct-pay election is made?

Applicable entities must engage in the prefiling registration process to make a Sec. 6417 direct-pay election on a federal income tax return. The IRS launched the prefiling registration process to help decrease improper and fraudulent energy credit claims. Applicable entities must complete the prefiling registration process electronically through the IRS electronic portal prior to filing their federal income tax return. By registering, an applicable entity will obtain a registration number that must be reported on the federal income tax return in the tax year the direct-pay election will be effective. The registration number must be renewed if the project is delayed and not placed in service until the following tax year (Temp. Regs. Sec. 1.6417-5T(c)). The IRS recommends registering the energy project at least 120 days before the due date, including extensions, of the federal income tax return that will report the clean-energy credit.

The following information will be required by the applicable entity when registering (Temp. Regs. Sec. 1.6417-5T(b)(5); see also IRS Publication 5884, Inflation Reduction Act (IRA) and CHIPS Act of 2022 (CHIPS) Pre-Filing Registration Tool):

- The applicable entity’s or electing taxpayer’s general information, including its name, address, taxpayer identification number, and type of legal entity.

- Any additional information required by the IRS electronic portal, such as information regarding the taxpayer’s exempt status under Sec. 501(a); that the applicable entity is a political subdivision of a state, the District of Columbia, an Indian tribal government, or a U.S territory; or that the applicable entity is an agency or instrumentality of a state, the District of Columbia, an Indian tribal government, or a U.S. territory.

- The applicable entity’s tax year.

- The type of annual tax return(s) normally filed by the applicable entity or electing taxpayer, or that the applicable entity or electing taxpayer does not normally file an annual tax return with the IRS.

- The type of applicable credit(s) for which the applicable entity or electing taxpayer intends to make an elective payment election.

- For each applicable credit, each applicable credit property that the applicable entity or electing taxpayer intends to use to determine the credit for which the applicable entity or electing taxpayer intends to make an elective payment election.

- For each applicable credit property, any further information required by the IRS electronic portal, such as the:

- Type of applicable credit property;

- Physical location (i.e., address and coordinates (longitude and latitude) of the applicable credit property);

- Any supporting documentation relating to the construction or acquisition of the applicable credit property;

- The beginning-of-construction date and the placed-in-service date of the applicable credit property;

- If an investment-related credit property (as defined in Prop. Regs. Sec. 1.6417-2(c)(3)), the source of funds the taxpayer used to acquire the property; and

- Any other information that the applicable entity or electing taxpayer believes will help the IRS evaluate the registration request.

- The contact person’s name for the applicable entity or electing taxpayer. The contact person is the person whom the IRS may contact if there is an issue with the registration.

- A penalties-of-perjury statement, effective for all information submitted as a complete application, and signed by a person with personal knowledge of the relevant facts authorized to bind the registrant.

- Any other information the IRS deems necessary for purposes of preventing duplication, fraud, improper payments, or excessive payments under this section that is provided in guidance.

— Lynn Mucenski-Keck, CPA, is principal and national lead, Federal Tax Policy, with Withum in New York City. The author thanks Mark Rogers, principal, Business Credits and Incentives, with Eide Bailly LLP in Chicago, for editing this article. Both are members of the AICPA ESG Tax Task Force. To comment on this article or to suggest an idea for another article, contact Paul Bonner at Paul.Bonner@aicpa-cima.com.