- newsletter

- TAX INSIDER

Why small business owners should have a qualified retirement plan

Find out how small business owners can maximize their qualified business income deduction under the new tax law by setting up a qualified retirement plan.

Please note: This item is from our archives and was published in 2018. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

If and when to borrow from a qualified retirement plan

Qualified equity grants: A welcome alternative for startup companies

The benefits of establishing and maintaining a tax-qualified retirement plan have always been substantial. While not all qualified plans are designed in the same manner, they all share the following attributes:

- Contributions the employer makes to the plan are immediately tax deductible;

- Earnings accumulate within the plan on a tax-deferred basis;

- Plan assets are protected from the employer’s and individual plan participants’ creditors, with few exceptions;

- Plan participants do not recognize taxable income until funds are distributed from the plan;

- Taxable income can be further delayed by rolling over the proceeds of a plan distribution to an individual retirement account (IRA); and

- Employees are provided with an attractive employee benefit, thereby promoting recruitment and retention.

The new tax law commonly known as the Tax Cuts and Jobs Act (TCJA), P.L. 115-97, enacted in late December 2017, adds (albeit indirectly) a potentially valuable new attribute to this list. Because qualified retirement plan contributions lower the taxable income of business owners of passthrough entities (sole proprietorships, partnerships, S corporations, and LLCs), increasing contributions can qualify business owners for additional tax deductions under the TCJA that they would not otherwise have been eligible to receive. Before getting into the details, here is a brief primer on qualified retirement plans.

What is a qualified retirement plan?

There are two main types of qualified retirement plans: defined contribution plans and defined benefit plans.

Defined contribution plans

Defined contribution plans are designed to provide employees with a specified contribution amount each year. The terms of the plan determine how each employee becomes eligible for a share of the contribution and how that contribution is then allocated among those eligible employees. An employee’s interest in the plan is expressed as an account balance.

Each year, an employee’s defined contribution account is credited with his or her annual contribution and then either credited or debited with his or her investment earnings within the plan. An employee’s retirement benefit in a defined contribution plan is determined simply by the contributions to the employee’s account and the account’s investment performance.

The different types of defined contribution plans include:

- Profit sharing plans: The employer has discretion as to the amount, if any, of the annual employer contribution to the plan. Many employers use “new comparability” profit sharing plans, which generally allow the employer to place each participant in his or her own allocation group. This allows employers to allocate each allocation group (and therefore, each employee) anywhere from zero to $55,000, providing the plan passes the requisite nondiscrimination tests for the year.

- 401(k) plans: This popular plan allows employees to defer taxation on a portion of their compensation by electing to contribute that portion of their compensation to a qualified plan. An employer can add a 401(k) component to supplement its profit sharing, or “employer funded” plan. In 2018, a participant in a 401(k) plan may contribute as much as $18,500 per year in annual contributions, which is increased to $24,500 per year through “catch-up” 401(k) contributions if the participant is age 50 or older by Dec. 31, 2018. When combined with a profit sharing plan, each employee would have an effective annual limit of $55,000 (or $61,000 if they are 50 or older).

Defined benefit plans

In contrast to defined contribution plans, defined benefit plans provide employees with a guaranteed benefit to be paid out of the plan at retirement. Rather than expressing the employee’s interest in the plan as an account balance, the employee’s interest in a defined benefit plan generally is expressed as a monthly annuity beginning on the employee’s retirement age and payable for life. While an employee’s account balance in a defined contribution plan fluctuates with actual investment earnings, the investment risk of a defined benefit plan falls solely on the employer.

Many small businesses establish defined benefit plans to take advantage of the much larger tax-deductible contributions than are available under defined contribution plans. This is because the limits in a defined benefit plan are expressed as annuities beginning on the employee’s retirement age and payable for life. For example, an individual age 62 who has participated in a defined benefit plan for 10 years is eligible for a maximum annuity of $18,333 per month. Using the prescribed IRS conversion factors, that equates to a maximum accumulation in excess of $2.8 million, or over $200,000 per year in tax-deductible contributions. The individual could then roll over the resulting accumulation to an IRA on a tax-deferred basis.

In recent years, many employers have chosen to forgo traditional defined benefit plans in favor of “hybrid” cash balance plans. Cash balance plans are subject to the same funding requirements, operations, and benefit limitations of traditional defined benefit plans, but look and feel in many ways like a defined contribution plan. Benefits are expressed as an account balance, much like defined contribution plans, but with a guaranteed fixed rate of interest and not subject to market fluctuations.

The true state-of-the-art plan design for owners of small businesses with staff employees is a cash balance plan coupled with a new comparability 401(k)/profit sharing plan. This approach allows the owner to benefit from the higher deduction limits provided by the cash balance plan while retaining the added flexibility of a defined contribution plan.

What does all this have to do with the new qualified business income deduction?

Generally, the new qualified business income (QBI) deduction (Sec. 199A) allows business owners of passthrough entities to reduce their taxable income by up to 20% of the entity’s profits. However, there is a catch: Owners of specified service trades or businesses do not benefit from this deduction if their taxable income exceeds a certain threshold. A “specified service trade or business” is defined as any business involving the performance of services in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its employees or owners, or that consist of investing and investment management, trading, or dealing in securities, partnership interests, or commodities.

Specifically, a married owner of a specified service business receives only a partial deduction if the owner’s taxable income exceeds $315,000 but is less than $415,000 ($157,500 and $207,500 if single or married and filing separately), and receives no deduction if the married owner’s taxable income is $415,000 ($207,500 if single or married filing separately) or more.

Significantly, the owner of a specified service business may reduce his or her taxable income by making contributions to a qualified retirement plan to maximize his or her QBI deduction.

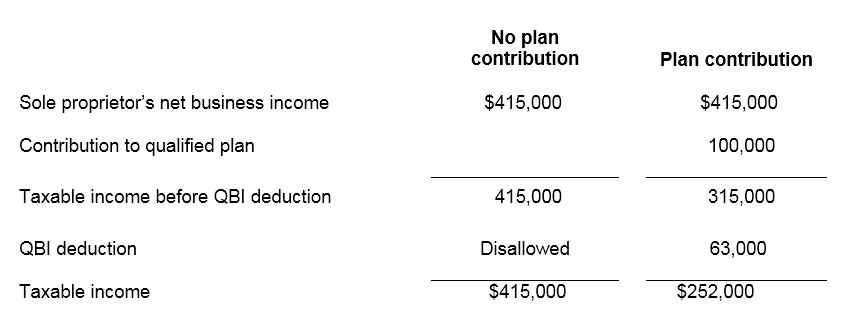

Consider the following example of a sole proprietor in a specified service business with no employees (assume for simplicity that any nonbusiness income will be offset by the taxpayer’s deductions):

A $100,000 contribution to a qualified retirement plan reduces this business owner’s current taxable income by $163,000. That results in a federal and state income tax reduction of approximately $59,000. Stated differently, under these facts, the qualified plan contribution generates an outsized income tax shield of nearly 60%. While taxes on the $100,000 plan contribution technically are deferred and still payable on withdrawal at retirement, the taxes saved due to the QBI deduction represent actual dollars in the business owner’s pocket.

While this example seems straightforward, the QBI deduction rules are extremely complex and will depend on each taxpayer’s personal circumstances.

Qualified plan contribution does double duty

Qualified retirement plans have always been a great deal for owners of small businesses and a great way for small businesses to attract and retain employees. The TCJA adds one more potentially powerful reason for owners of passthrough entities to establish a new plan or enhance their existing one. The contribution in this case essentially does double duty: It results in a tax deferral on the amount contributed and enables a QBI deduction that generates a permanent annual tax savings to the owner.

Mark Hamilton, J.D., LL.M., is an attorney and partner and Alexander Nahoum, EA, FCA, MAAA, is an actuary at Danziger & Markhoff LLP in White Plains, N.Y. To comment on this article or to suggest an idea for another article, please contact Sally Schreiber, senior editor, at Sally.Schreiber@aicpa-cima.com.