- newsletter

- TAX INSIDER

Health savings accounts can save taxpayers money

Now that the medical expense deduction is limited to expenses that exceed 10% of adjusted gross income, health savings accounts may be the way to go.

Please note: This item is from our archives and was published in 2019. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Average tax refund rises 11%; total filings decline

Prop. regs. issued on new qualified tips deduction

IRS releases FAQs on qualified overtime pay deduction under H.R. 1

Health savings accounts (HSAs) have become more popular in recent years as a tax-saving device. High-deductible health insurance plans with HSAs are intended to reduce rising health insurance premiums. Also, the accounts allow qualifying medical expenses to be paid pretax. Medical expenses incurred such as co-pays and deductibles with traditional health insurance are itemized deductions subject to the 10% floor on medical expense deduction enacted in the law known as the Tax Cuts and Jobs Act (TCJA), P.L. 115-97. Combined with the higher standard deductions under the TCJA, most people do not have enough medical expenses and other qualifying itemized deductions to exceed the higher standard deduction.

With a qualifying high-deductible health insurance plan, medical expenses are paid through funding to an HSA pretax under an employer and/or HSA contribution deduction.

Monies withdrawn from an HSA not used for qualified medical expenses (listed in IRS Publication 502, Medical and Dental Expenses) are subject to income tax and a 20% penalty tax. The 20% penalty tax does not apply if a person dies, becomes disabled, or is age 65 or older. Note that under Chief Counsel Advice 200927019, the IRS can levy a delinquent taxpayer account under Sec. 6331. Those levies will be subject to the income tax and the 20% penalty, since a levy is not an eligible medical expense. The penalty tax does not apply under the tax levy if the person is age 65 or older, becomes disabled, or dies.

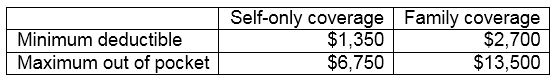

To open an HSA, a person or family must have a qualifying high-deductible health insurance plan. To qualify, a plan for 2019 must meet the following tests as announced in Rev. Proc. 2018-30:

Once the deductible is reached, then the insurance kicks in. For example, with a deductible of $1,350, the insurance company pays a percentage (for example, 90%) after reaching $1,350 in qualifying expenses, until the maximum out of pocket is reached. At that point, the insurance company pays all qualifying medical expenses. There are no co-pays as all qualifying medical expenses are applied to the deductible, compared to co-pays in a traditional plan, which usually are not applied to the deductible.

For 2019, under Rev. Proc. 2018-30, a person can contribute $3,500 for self-coverage or $7,000 for family coverage per year. A person age 55 or over can contribute an additional $1,000 catch-up amount.

For 2020, a plan must meet the following tests announced in Rev. Proc. 2019-25:

For calendar year 2020, a person can contribute $3,550 for self-coverage or $7,100 for family coverage per year. A person age 55 or over can contribute an additional $1,000 catch-up amount under Rev. Proc. 2019-25.

If the employee contributes through an employer plan, the contributions are pretax, and reported on the employee’s Form W-2, Wage and Tax Statement in Box 12 with code W. If the HSA contributions are not done through an employer plan, a person can deduct the HSA contributions on his or her individual income tax return. If funding is done outside an employer plan in part or all, the outside work contributions can be made by the due date of the return without extension for the previous year.

Contributions made pretax are considered employer contributions. Employer contributions, pretax contributions, and post-tax contributions in total cannot exceed the aforementioned limits.

If the person is covered only part of the year by a high-deductible plan, the limit is determined on a monthly basis by determining coverage on the first day of the month under Sec. 223 (b)(1)). IRS Form 8889, Health Savings Accounts (HSA) instructions have a limitation chart and worksheet that should be used for determining the contribution limit. A special rule under Sec. 223(b)(8), known as the last-month rule, states that a person is considered being covered under a high-deductible plan for the whole year if covered on the first day of the last month (usually Dec. 1 for most people), and is thus able to contribute the maximum yearly amount rather than the monthly determination described previously.

However, the deduction for the additional contributions allowed by the last month rule is subject to recapture if the taxpayer fails to be an individual eligible for an HSA during a 13-month testing period starting on the first day of the last month of the year to the end of the following year. If the taxpayer fails to be an individual eligible for an HSA during the testing period, the taxpayer has to increase his or her income by the aggregate amount of all contributions to the health savings account he or she could not have made but for the last month rule.

In addition, the taxpayer would also pay a 10% penalty tax on the amount of contributions included in income under Sec. 223(b)(8)(B). The penalty is calculated and reported on Form 8889, Part III, “Income and Additional Tax for Failure to Maintain HDHP Coverage.” However, the amount of the contributions included in income and related earnings do not have to be withdrawn as they are not considered excess contributions. Withdrawing the amount of the contributions does not avoid the contributions’ being included in income or the 10% tax. However, earnings on the amount are not included in gross income or subject to the 10 percent additional tax, so long as the earnings remain in the HSA or are used for qualified medical expenses. ( Notice 2008-52).

Before using the last day of the month rule, the taxpayer should consider the following during the testing period:

- How likely is the taxpayer going to change jobs during the testing period? Will the taxpayer’s future employer offer HSA plans?

- How likely is the taxpayer to change plans during the year, due to changes in status or a partner’s plan?

- How likely is the taxpayer’s employer to change the available health insurance options during the testing period?

A taxpayer can wait until the due date of the return without extensions (usually April 15) to make a prior year contribution and evaluate the probability of maintaining a health savings plan to the end of the year if using the last month of the year rule. The idea is to save money in a non-HSA and fund the HSA by the due date of the tax return without extension as a prior year contribution. The taxpayer may need to file an extension for his or her income tax return to accomplish this strategy. The payment must be made by the due date to file without extension, but the return reporting the contribution can be filed on extension by Oct. 15.

A person can no longer make health saving plan contributions once the person is eligible for Medicare benefits and actually enrolls in Medicare. Thus, people continuing to work or returning to work when they are enrolled in Medicare are not eligible to make HSA contributions.

Excess contributions are contributions over the maximum contribution amount for a year. They are not deductible. If they are made by the taxpayer’s employer, they are includible in the taxpayer’s income. If excess contributions made by an employer are not included in box 1 of the taxpayer’s Form W-2, the taxpayer must report them as other income on his or her income tax return (see IRS Publication 969, Health Savings Accounts and Other Tax-Favored Plans).

Excess contributions are subject to a 6% excise tax each year until withdrawn. The taxpayer can avoid the excise tax by withdrawing the excess contributions and any earnings related to them by the due date of the return including extensions, and including the earnings related to the withdrawn contributions in other income on his or her tax return. The penalty tax is calculated and reported on Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts.

Most employers have an affiliated financial institution and as part of the plan have a monthly account waiver, in part or all, depending on electronic or paper statements. Some plans have an option to invest in mutual funds and other investments once the account has reached a certain cash balance. Thus, the health savings account becomes part of a person’s retirement plan.

IRS Publication 969 has a summary of the HSA rules and regulations that can be useful to get familiar with health savings accounts. Also, the IRS has issued Notice 2008-59 consisting of questions and answers about HSAs.

Johannes Zonneveld, CPA, is a tax manager at Batchelor, Tillery & Roberts LLP in Raleigh, N.C. To comment on this article or to suggest an idea for another article, please contact senior editor Sally Schreiber at Sally.Schreiber@aicpa-cima.com.