- newsletter

- TAX INSIDER

Maximizing the QBI deduction with UBIA property

Taxpayers should increase the unadjusted basis of Sec. 199A qualified property immediately after acquisition to achieve this result.

Please note: This item is from our archives and was published in 2019. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

New Schedule 1-A for tips, OT, car loans, and senior deductions published

Average tax refund rises 11%; total filings decline

Prop. regs. issued on new qualified tips deduction

The 20% Sec. 199A qualified business income (QBI) deduction is designed to provide some tax relief to owners of passthrough entities. However, the QBI deduction rules impose several limitations, most notably on high-income owners. These owners may be subject to a limitation on the QBI deduction based on the entity’s Form W-2 wages paid to employees and its unadjusted basis immediately after acquisition (UBIA) of qualified property. Their QBI deduction may also be subject to limitation if their trade or business is a specified service trade or business (SSTB).

Therefore, it is important to understand the components behind these two QBI deduction limitations, particularly the UBIA of qualified property. This will be especially important for high-income taxpayers who own nonspecified service businesses that pay little or no Form W-2 wages, such as some rental real estate businesses.

This article examines the calculation of the UBIA of qualified property; offers guidance on special situations such as like-kind exchanges and the Sec. 754 election; and presents planning opportunities to maximize the UBIA of qualified property, thus maximizing the QBI deduction for qualifying taxpayers.

QBI deduction limitation rules

Under Sec. 199A(b)(2), a taxpayer’s QBI deduction is determined to be the lesser of:

(1) 20% of QBI, or

(2) the greater of

(a) 50% of Form W-2 wages, or

(b) 25% of Form W-2 wages, plus 2.5% of the UBIA of qualified property.

Lower-income taxpayers are not typically subject to the Form W-2 wages and UBIA of qualified property limitation when calculating their QBI deduction. These limitations are phased in over $50,000 range (single and head of household) or $100,000 range (married filing jointly) for individuals with 2019 taxable income before the QBI deduction and net capital gain above $160,700 (single and head of household) and $321,400 (married filing jointly). Therefore, the phase-in of these limitations is complete for individuals with 2019 taxable income above $210,700 (single and head of household) and $421,400 (married filing jointly).

Furthermore, individuals with 2019 taxable income above $210,700 (single and head of household) and $421,400 (married filing jointly) are not eligible for the QBI deduction on income derived from a specified service trade or business (SSTB). SSTBs include those in the fields of health; law; accounting; actuarial science; performing arts; consulting; athletics; financial services; brokerage services; investing and investment management; trading; dealing in securities, partnership interests, or commodities; and any business where the principal asset of the trade or business is the reputation or skill of one or more owners or employees.

UBIA of qualified property

Under Sec. 199A(b)(6), the UBIA of qualified property generally equals the cost of tangible property subject to depreciation that satisfies all of the following criteria:

- The property is both held by and available for use in the trade or business at the close of the tax year;

- The property is used at any point during the tax year in the production of the trade or business’s QBI; and

- The property’s depreciable period for UBIA of qualified property purposes has not ended before the close of the taxpayer’s tax year.

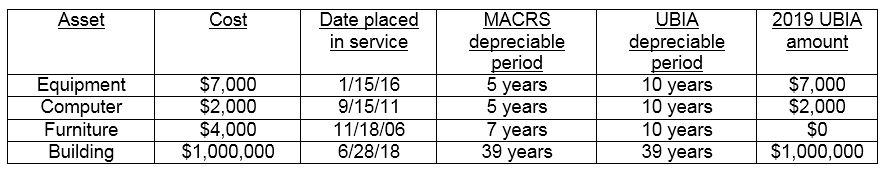

For purposes of the third criterion, the property’s depreciable period is either 10 years after the property is placed in service, or the last day of the last full year of the property’s normal Sec. 168(c) depreciable period, whichever is later.

This example illustrates that an asset with a five- or seven-year depreciable life under the modified accelerated cost recovery system (MACRS) has a depreciable life of 10 years for UBIA of qualified property purposes, while a building has a depreciable life of 39 years for both MACRS and UBIA purposes.

As the example above illustrates with the computer, it is possible to have an asset that is fully depreciated under MACRS but is still included as part of UBIA. However, as shown with the furniture, once the 10-year window has expired, the asset is no longer included in UBIA, even if it is still being used by the business.

It is also worth noting that the UBIA amount is typically the asset’s original basis. The UBIA amount does not take into account any annual depreciation expense, including bonus depreciation expense, or Sec. 179 expense. Additions or improvements to property are treated as separate items of property when placed in service.

The allocation of UBIA of qualified property among partners or shareholders depends on the entity type. The final QBI regulations provide that partnerships allocate UBIA of qualified property among partners based on how the partnership would allocate book depreciation under Regs. Sec. 1.704-1(b)(2)(iv)(g) on the last day of the tax year. In contrast, S corporations allocate UBIA of qualified property based on each shareholder’s shares held at the end of the tax year. Note that, like the other items of QBI, UBIA of qualified property must be disclosed on each owner’s Schedule K-1. An owner’s UBIA of qualified property is considered to be zero if not identified on Schedule K-1.

An antiabuse rule listed in the final Sec. 199A regulations prevents an entity from artificially inflating its UBIA of qualified property by purchasing property and then soon disposing of it after barely using it. Any property that is acquired within 60 days of the end of the tax year and disposed of within 120 days, and also not used for at least 45 days before disposition, will not be considered to be qualified property, unless the taxpayer can demonstrate that the principal purpose of the acquisition and disposition was other than to increase the QBI deduction.

Like-kind exchanges, involuntary conversions, and other nonrecognition transactions

The UBIA of qualified property acquired in a like-kind exchange or involuntary conversion is the same as the UBIA of the relinquished property, decreased by excess boot, or increased by the amount of money paid or the fair market value (FMV) of non-like-kind property relinquished. Excess boot is the amount of money or the FMV of other property the taxpayer received in the exchange over the amount of appreciation in the relinquished property. Appreciation for this purpose is the property’s FMV at the exchange date over the FMV at the acquisition date.

A transferee’s UBIA of qualified property received in a Sec. 168(i)(7)(B) nonrecognition transaction, such as a Sec. 721 contribution of property to a partnership in exchange for a partnership interest, equals the transferor’s UBIA in the property, either decreased by the amount of money received by the transferor, or increased by the amount of money paid by the transferee in the transaction.

An anti-abuse rule states that property acquired in a like-kind exchange, involuntary conversion, or Sec. 168(i)(7) nonrecognition transaction with the principal purpose of increasing UBIA is considered to have a UBIA equal to the basis determined under other applicable Code sections.

The placed in service date for UBIA property received in a like-kind exchange, involuntary conversion, or any Sec.168(i)(7)(B) nonrecognition transaction typically defaults to the placed in service date of the relinquished property. However, any acquired UBIA that exceeds the relinquished property’s UBIA is treated as a separate item of property that is placed in service on the date acquired in the transaction.

In this example, a taxpayer that enters into a like-kind exchange transfers a building and cash in exchange for a parking garage. The adjusted basis of the parking garage is a carryover of the adjusted basis of the building, increased by the cash relinquished. The UBIA of the parking garage received ($1.7 million) is higher than the UBIA of the building surrendered ($1.2 million). Therefore, for UBIA purposes only, the parking garage is treated as two separate assets with different placed in service dates.

Sec. 754 election for partnerships

A partnership may make a Sec. 754 election, under which an adjustment is required (under Secs. 734 or 743) to the basis of the partnership’s assets with respect to a transferee partner, upon the transfer of a partner’s interest or the distribution of partnership property.

The final Sec. 199A regulations provide that an excess Sec. 743(b) basis adjustment pursuant to a Sec. 754 election is included in the UBIA of qualified property. A Sec. 743(b) basis adjustment may be made following a sale or exchange of a partnership interest or the death of a partner. An excess Sec. 743(b) basis adjustment is the Sec. 743(b) adjustment calculated as if the adjusted basis of all of the partnership’s property equals the property’s UBIA. The absolute value of excess Sec. 743(b) basis adjustment cannot exceed the absolute value of the total Sec. 743(b) basis adjustment. No UBIA adjustment is made for a Sec. 734(b) basis adjustment following a partner’s redemption.

The preamble to the final Sec, 199A regulations states that Treasury is still studying the Sec. 754 election’s impact on UBIA and requests additional comments. In practice, it is difficult to determine the excess Sec. 743(b) basis adjustment if adequate records are not maintained to determine the property’s UBIA on the date of the Sec. 754 election.

Planning opportunities

One planning opportunity to maximize the UBIA of qualified property is to not make the Regs. Sec. 1.263(a)-1(f) de minimis safe-harbor election. This annual election allows taxpayers to immediately expense fixed asset purchases up to $2,500 ($5,000 if the taxpayer has an applicable financial statement) per item or invoice rather than capitalizing and depreciating those acquisitions. Failure to make this election generally results in more fixed assets and, therefore, more UBIA of qualified property. Current preferential bonus depreciation and Sec. 179 expense rules likely mean that taxpayers will still fully deduct those purchases. A downside is that additional resources must be devoted to tracking fixed asset purchases if the de minimis safe-harbor election is not made.

For example, a company that immediately expenses 50 computers purchased for $2,000 each under the de minimis safe-harbor election will forgo $100,000 from its UBIA of qualified property. The company could instead capitalize and depreciate the computer purchases and likely fully deduct the cost by using Sec. 179 expense or bonus depreciation.

An additional planning opportunity relates to the timing of fixed asset purchases. The UBIA of qualified property calculation considers fixed assets owned at the entity’s year end. Therefore, taxpayers subject to the UBIA of qualified property limitation are encouraged to make fixed asset purchases by year end. However, taxpayers should consider the previously mentioned anti-abuse rule related to purchases within 60 days of the tax year end.

Act now to increase the QBI deduction

Practitioners whose client’s QBI deduction is limited based on the UBIA of qualified property should review the QBI deduction regulations carefully and consider these planning opportunities. Now is an opportune time to review fixed asset schedules to identify which assets are still in use and eligible to be included in the UBIA calculation. Practitioners whose clients are subject to the UBIA of qualified property limitation should take advantage of opportunities to maximize the limitation and enjoy the enhanced QBI deduction benefits. They should also look for potential additional guidance on the Sec. 754 election and other UBIA issues.

Alex K. Masciantonio, CPA, is a senior tax manager with Gunnip & Company LLP in Wilmington, Del. Kevin E. Flynn, CPA, Ph.D., and Sean Andre, Ph.D., are associate professors in the accounting department at West Chester University of Pennsylvania. To comment on this article or to suggest an idea for another article, please contact Sally Schreiber, senior editor, at Sally.Schreiber@aicpa-cima.com.