- newsletter

- TAX INSIDER

Smart tax strategies for lottery winners

Did a client finally hit their lucky number? Here’s why you should convince them to elect installment payments over the lump-sum option if they win millions in the lottery.

Please note: This item is from our archives and was published in 2022. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Using I bonds for education savings

Lottery fever remains at a high level lately, thanks in part to jackpots that sometimes exceed $1 billion, including the $1.334 billion Mega Millions winning ticket sold in July to individuals in Illinois, who claimed the prize via an anonymous partnership. They opted for the lump-sum amount.

While those winners chose the lump sum, if a newly wealthy winner comes to you for advice about how to receive the windfall, we strongly recommend carefully evaluating the installment option before claiming the prize.

Installment vs. lump sum

Most lottery winners elect the lump-sum option, and their reasons for making this choice are often erroneous. Many believe that installment payouts stop if the winner dies. This is not true. Or they fear the state and/or lottery commission could go bankrupt before they are fully paid out. This is highly unlikely since the installment obligation is backed up by a “laddered” bond portfolio. Other concerns include higher tax rates and/or high inflation in the future — which are valid concerns that should be factored into the analysis.

Taking the lump-sum option on a multimillion-dollar prize is usually a poor decision, partly because winners will take a permanent net-present-value haircut of 30% or more on their payout, plus pay 100% of the tax in the first year of winning.

To explain further, the advertised winning amount is the pretax payout over several decades, often 30 years. By patiently waiting for their annual installments, the winner(s) will receive the full advertised winnings. By electing a lump sum, on the other hand, there will be a time-value-of-money discount, which generally falls in the mid-30% range but can be as high as 39%. (This discount decreases with larger prizes, since a smaller annual return is required to compound the lottery commission’s initial investment and increase to the full prize. Due to the record amount of the recent Mega Millions award, the actual discount rate on the lump-sum payout reportedly dropped to a record low of 17.65%, which may have factored into the Mega Millions jackpot winners’ decision to take the lump sum.)

Besides the time-value-of-money discount rate, a lump-sum payout also results in federal tax of 37% on every dollar over $539,900 (single filers) or $647,850 (joint filers) (in 2022 — plus taxes at graduated rates for the amount below that), plus state taxes in many cases — although some states exempt the winnings. Lottery winnings are considered ordinary taxable income by the IRS. Even if an installment winner sells the future income stream to another party, the sales proceeds are considered ordinary income — not capital gain.

To put the tax difference between installment payments and a lump sum in real numbers, any winner taking installments and receiving $539,900 or more each year (a $36 million or larger prize) will save approximately $53,990 annually due to the federal graduated tax structure (2022 rates).

Over 30 years, this amounts to approximately $1.6 million in projected savings under the current federal rates. If a winner can split the proceeds among multiple family members or close friends, the savings become even greater.

Tax planning strategies

Besides the savings outlined above, the installment option has other advantages. The most significant is the ability to apply long-term tax and investment planning to the winner’s newfound, unexpected wealth. History has shown that without careful planning, winners can lose their entire windfall and possibly be forced to file for bankruptcy just a few years after claiming the winning ticket.

From a state tax perspective, an installment election might allow the winner to change residency and reduce or eliminate state taxation on future installments if the winner lives in a state that taxes the winnings. This planning option will not work for lump-sum recipients. For example, winners in a high-tax state such as New Jersey would have to pay a 10.75% top marginal rate in state taxes alone. If a New Jersey winner chose the annuity, however, he or she would be able to take the first payment at that higher tax rate and then receive the rest of the annuity in a lower-taxed state or one without an individual income tax such as Wyoming, resulting in significant savings.

The installment approach does not eliminate the winner’s ability to accelerate access to all (or a portion) of the future installments. The winner might still access these future payments through private loans or transactions with specialty companies that will purchase all (or a portion) of the deferred installments at a discount (note that not all states allow such sales). This provides the lucky winner with added liquidity in the future — if needed.

Another important advantage of the installment plan over the lump-sum option is that the installment plan reduces the likelihood of family, friends, creditors, or scammers accessing the winnings.

In connection with estate tax planning, one factor that will affect a lottery winner is the value of the lump-sum amount or the net present value of the annuity at the date of death, or the alternative valuation date six months after the date of death. The value of the uncollected installment payments will be determined based on the Sec. 7520 interest rates, which are published monthly. The December 2022 rate is 5.20%, based on Rev. Rul. 2022-22. The lower the discount rate, the higher the annuity value. So, the installment election may result in an estate tax savings if interest rates are higher on the date of death, or a higher estate tax if the Sec. 7520 rate is low at that time.

An illustration

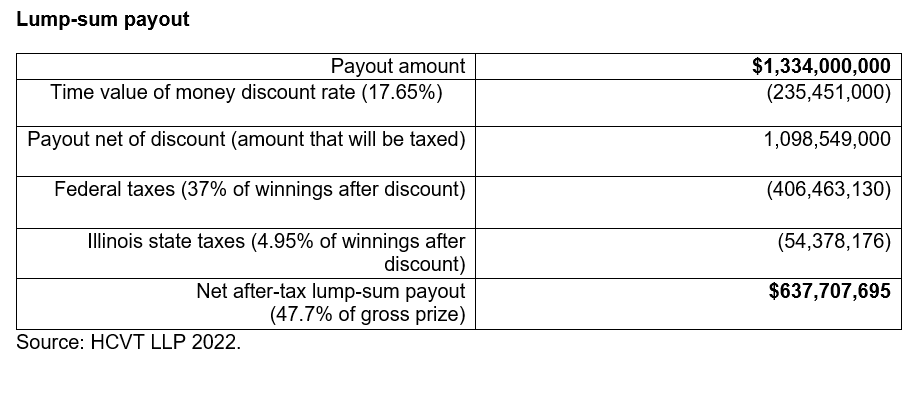

To compare the lump-sum and installment payouts, consider the choice the recent Mega Millions winners faced between the two payout options. Because they ultimately decided to opt for a lump-sum payment of the $1.334 billion prize, their net after-tax amount was $637,707,695 (47.7% of the gross prize), as calculated in the table “Lump-Sum Payout.”

(Note: While the winners’ actual initial lump-sum reward was about $780.5 million, they will owe additional taxes when their tax return is filed, bringing their net after-tax amount to $637,707,695.)

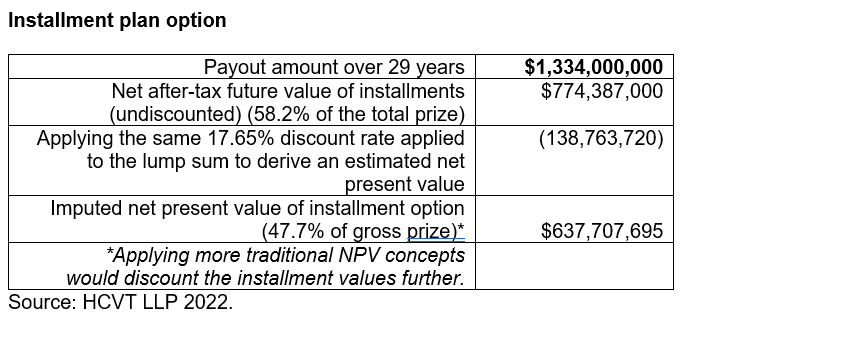

In contrast, if the Mega Millions winners had decided to opt for the installment payout plan, the prize would be paid annually over 29 years. The winners would generally get an initial payment of $20,078,614 (before tax) at the time of claiming the prize, plus a first installment of $21,082,545 (before tax) in the year of claiming the winnings. Each future payment would increase by 5%.

As can be seen in the table “Installment Plan Option,” the imputed net present value of the installment option is the same as the net after-tax lump-sum payout: Both are $637,707,695. But in the case of the installment plan, the after-tax amounts do not reflect the annual graduated rate benefits previously discussed or the potential tax savings that the winners could achieve annually with high-level tax planning when taking installments. Note, too, that the actual discount rate to be used in estimating the present value of the installment payout is subjective and will be driven primarily by the anticipated inflation rate over the payout period.

Although current inflation has risen dramatically lately, the Federal Reserve Bank of Cleveland recently issued a 10-year inflation projection of 2.45% and a 30-year inflation prediction of 2.5%. Therefore the 5% increase in the annual payouts appears to be a fair return, although a skilled investment manager may be able to outpace that rate.

The bottom line

In the end, for prizes in excess of $5 million (simply because of the size of the prize), the annuity ends up being the better option for most winners. The ability to perform multiyear tax planning, to relocate to a low-tax state, to spread the income over 29 years, and to secure a minimum 5% return for 29 years are all reasons to evaluate installments.

That being said, the lump-sum option may be more attractive for those who:

- Believe future tax rates will be higher than today;

- Believe they can consistently earn more than 5% on their net winnings;

- Are older and less concerned with generational wealth transfers;

- Prefer to have access to a large pool of money in the first year; and/or

- Believe inflation and investment returns will be high in the future.

Deciding whether to claim the lump-sum or the installment option requires a complex analysis and will be driven by numerous factors that will be weighed differently by each winner (or group of winners). Needless to say, lottery winners’ lives will become very complex very quickly, and they will need expert advice for many years — particularly in the year they claim the prize. Don’t let your clients make the wrong moves when it comes to this life-altering stroke of luck.

— Blake Christian, CPA, MBT, is a tax partner, and Peter Oliveira is an intern in the Park City, Utah, office of HCVT LLP. To comment on this article or to suggest an idea for another article, contact Dave Strausfeld at David.Strausfeld@aicpa-cima.com.