- newsletter

- TAX INSIDER

Pillar 2: Time for US multinational enterprises to act

Large U.S. multinationals can take steps now to assess the potential impact of the global top-up corporate tax system that appears on the verge of being implemented.

Related

Deductibility of transaction costs incurred by an indirectly acquired entity

IRS issues guidance on treaty application to reverse foreign hybrids

Practical tax issues related to qualified reopenings

The recent enactment of Pillar 2 minimum tax legislation in South Korea and the unanimous adoption of the European Union’s (EU’s) Pillar 2 directive, both in December 2022, should make U.S. multinational enterprises (MNEs) take note. Additionally, recent administrative guidance from the Organisation for Economic Co-operation and Development (OECD) issued in February 2023 may be especially useful for U.S. MNEs subject to global intangible low-taxed income (GILTI) and Subpart F inclusions.

With certain exceptions, Pillar 2 sets out a global top-up taxation system that ensures large MNEs pay a minimum effective tax rate of 15% in the jurisdictions in which they operate. Based on the OECD’s latest calculations, the global minimum tax rules are estimated to result in annual global revenue gains of around $220 billion, or 9% of global corporate income tax revenue.

Although the United States has not yet enacted legislation implementing Pillar 2, other OECD members have committed to enact legislation during 2023 that generally would take effect beginning in 2024. Large MNEs with operations in any jurisdiction that adopts the rules will likely be subject to the minimum tax provisions regardless of whether the United States fully adopts its own Pillar 2 legislation. This article discusses the general principles of Pillar 2 and highlights actions that U.S. MNEs should consider taking now to assess the potential impact of Pillar 2.

Recent developments

In December 2022, South Korea enacted new global minimum tax rules, and the EU unanimously adopted a directive to implement Pillar 2. Other countries have indicated that they plan to adopt Pillar 2 rules this year, including Australia, Canada, India, Japan, and the United Kingdom.

The Pillar 2 rules generally would take effect for accounting periods commencing on or after Dec. 31, 2023, and Jan. 1, 2024, for the EU and South Korea, respectively. Although MNEs have until the end of the current calendar year before any Pillar 2 legislation takes effect, there may be financial statement disclosure requirements in 2023 for applicable MNEs. As a result, preparing for the new rules in the coming months may entail a considerable degree of complexity.

Pillar 2 goals and scope

The Pillar 2 initiative aims to create a global framework that achieves a level of tax equity by ensuring that large MNEs pay a minimum of 15% corporate tax on the income generated in the jurisdictions in which they operate, unless an exception applies.

The Pillar 2 rules apply to MNEs with annual consolidated revenue of more than €750 million ($827 million) (in at least two of the prior four years). Certain industries and entities — including investment funds and real estate investment vehicles that are the ultimate parent entity (UPE), pension funds, government entities, not-for-profits, and international organizations — are excluded.

The Pillar 2 rules apply to the UPE of a group and all its constituent entities (CEs); however, there is a specific de minimis rule that may allow certain CEs that make an election to avoid the top-up tax if: (1) the CE’s average revenue for the jurisdiction is under €10 million, and (2) the CE’s average profit is under €1 million. Both these requirements apply to the current and two preceding fiscal years.

General mechanics

The Pillar 2 rules require MNEs to compute the effective tax rate (ETR) under Pillar 2 principles on a jurisdiction-by-jurisdiction basis. A charging provision would apply if the ETR is below 15% in a jurisdiction and the source jurisdiction does not bring an MNE’s ETR up to 15% using a qualified domestic minimum top-up tax.

Income inclusion rule: The primary charging provision is the income inclusion rule, which requires the UPE or parent entity to pay a top-up tax on its allocable share of income on any low-tax CEs in instances when there is a direct or indirect ownership interest. Application of this rule would mean that if a wholly owned CE of an MNE had an ETR of 8%, for example, then the UPE would be required to pay an additional top-up tax of 7% on its share of the profits.

When it comes to the top-up tax, a top-down approach generally applies. If the UPE’s jurisdiction has not adopted the Pillar 2 rules or is not required to apply an income inclusion rule, then the next parent entity (the intermediate parent entity) in the chain of ownership would generally be subject to a top-up tax under the income inclusion rule.

Undertaxed payments rule: While the income inclusion rule takes precedence when allocating any top-up tax, a secondary charging mechanism applies when an income inclusion rule does not fully cover the top-up tax or no jurisdictions in the ownership chain have adopted the Pillar 2 rules to apply an income inclusion rule. This backstop rule, the undertaxed payments rule, is applied by either denying a deduction or applying a top-up tax that results in the CE’s having additional cash tax expenses that equate to the proportionate top-up tax.

Computations required: General steps

While specific details of Pillar 2 legislation are still unavailable for most jurisdictions as of the date this article was drafted, the OECD Pillar 2 report published in December 2021 sets out the model rules and basis for the Pillar 2 computation, which has been approved by 140 countries that are members of the OECD’s Inclusive Framework. The model rules must be adopted into the domestic laws of each jurisdiction and, once adopted, will be the basis for assessing the impact of the rules in each CE jurisdiction.

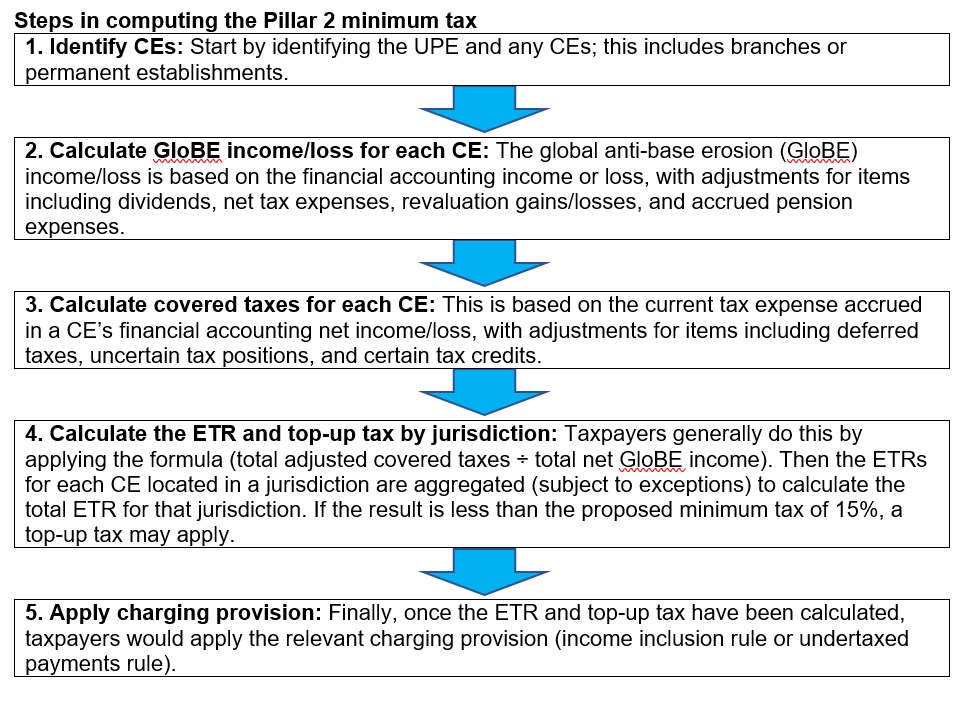

The model rules set out the general steps shown in the graphic “Steps in Computing the Pillar 2 Minimum Tax,” below.

Proposed safe harbors and transitional rules

In December 2022, the OECD released further guidance on safe harbors that have been proposed for the Pillar 2 rules. The guidance includes a transitional country-by-country reporting safe harbor, which effectively allows MNEs to exclude from the scope of Pillar 2 an MNE’s lower-risk jurisdictions in the initial years, thereby providing relief to MNEs regarding their compliance obligations as they implement the rules. The guidance also provides a framework for developing a permanent simplified calculation safe harbor, which aims to allow an MNE to either (1) reduce the number of computations or adjustments required under the rules or (2) perform alternative simplified income, revenue, and tax calculations.

While MNEs welcome the transitional and proposed permanent safe-harbor rules, some analysis will be required to determine which jurisdictions qualify as lower-risk and assess the broader impact on the overall group, as well as consider the effect of introducing an additional data source (country-by-country reporting) to review.

February 2023 administrative guidance for US MNEs

In February 2023, the OECD released temporary administrative guidance under Article 4.3.2(c) of the GloBE rules that will be welcome news for U.S. multinationals impacted by Pillar 2. The administrative guidance indicates that the current U.S. GILTI regime is considered a blended controlled foreign corporation (CFC) tax regime. As such, GILTI taxes may generally be creditable against GloBE top-up taxes, subject to a prescribed allocation methodology. The effect of the allocation methodology is to first allocate taxes to comparatively low-tax jurisdictions with higher income in meeting the minimum 15% test. The salient components of the administrative guidance, and why this may be welcome news for U.S. MNEs — as well as some important caveats — are discussed below.

Mechanism for GILTI allocation

The administrative guidance indicates that a U.S. MNE can generally start with the allocable blended CFC tax that can be taken from the U.S. federal income tax return. Importantly, this is the net GILTI tax liability paid after applying potential net operating losses (NOLs), the foreign tax credit, and the applicable Sec. 250 deduction. For example, taxpayers in an NOL position would not have any GILTI tax to allocate under these administrative rules and should examine how the remaining provisions of Pillar 2 should apply to them.

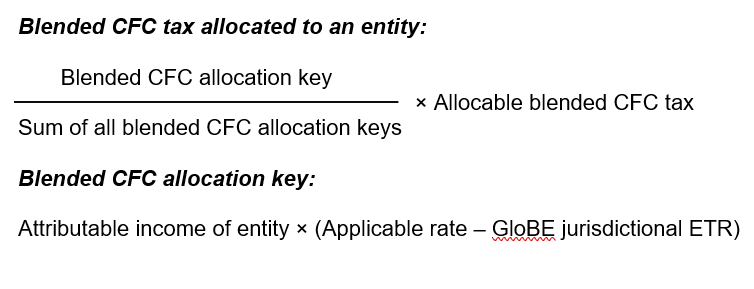

To determine a CE’s attributable income, the formulas below provide guidance for MNEs with a blended CFC regime. Taxpayers first start with the blended CFC allocation key. For U.S. MNEs, the GILTI applicable rate is currently 13.125%. The income jurisdictional ETR is generally the effective rate in a jurisdiction, computed without regard to any covered taxes under a CFC tax regime. The blended CFC allocation key for that CE is zero when the GloBE jurisdictional ETR is at least equal to the minimum rate. This typically results in no GILTI tax being allocated to the CE (since the denominator would be zero in determining how much GILTI tax should be allocated to that CE).

The administrative guidance provides a helpful example that outlines a hypothetical MNE group with a UPE in a jurisdiction (modeled after the United States). In the example, the MNE group does business in three jurisdictions with different jurisdictional ETRs for GloBE purposes. The example sets out how the simplified allocation rules work and how the blended tax may be properly allocated to each CFC.

The administrative guidance also addresses how blended CFC allocation rules interact with qualified domestic minimum top-up taxes. The guidance indicates that a jurisdiction’s qualified domestic minimum top-up tax would generally apply before the blended CFC allocation rules. Because taxes attributable to the GILTI and Subpart F inclusions are not considered covered taxes, the OECD believes that top-up taxes are likely to be creditable. However, this point has not been explicitly addressed by Congress or Treasury.

Timing of administrative guidance

The interim blended allocation rules are applicable for fiscal years beginning on or before Dec. 31, 2025, and excluding any fiscal years that end after June 30, 2027. Although the current U.S. administration proposed legislation in 2021 to amend the GILTI rules so that they would apply on a country-by-country basis, those proposed changes have yet to move forward, and it remains to be seen whether there will be any change in U.S. tax law before 2024. The application of these blended allocation rules after their planned June 30, 2027, sunset date is still being determined.

Next steps for US MNEs

For large U.S. MNEs within the scope of the rules, the time to begin preparing for the impact of Pillar 2 is now. It is also the time to revisit the Pillar 2 rules and assess their possible impact on an applicable MNE’s ETR and the overall Pillar 2 reporting and compliance requirements.

The key actions that large U.S. MNEs should consider now include:

- Assessing potential future financial statement disclosure requirements;

- Understanding the impact of the administrative guidance and the related allocation methodologies for GILTI and Subpart F;

- Undertaking an initial impact assessment to assess the potential ETR and cash tax impact and the future cost for financial statement and tax return compliance;

- Developing a road map to implement necessary systems, processes, and controls to ensure the organization can address future compliance and tax reporting requirements; and

- Assessing the benefit of restructuring to address any increased ETR or cash tax cost and the benefit of realigning the corporate and operating structure to reduce additional compliance costs.

Companies may have new opportunities to minimize tax and compliance costs through restructuring or other tax planning. The full impact of Pillar 2 on large U.S. MNEs is not yet known and will require thoughtful planning, even while future U.S. tax legislation remains uncertain.

— Matthew Williams, CTA (Chartered Tax Adviser), is an international tax principal with BDO US LLP in New York; David Little, CPA, J.D., is an international tax partner with BDO US LLP in Atlanta; and Dillon McDaniel, J.D., is an international tax associate with BDO US LLP in Atlanta. To comment on this article or to suggest an idea for another article, contact Dave Strausfeld at David.Strausfeld@aicpa-cima.com.