- newsletter

- TAX INSIDER

Disregarded-payment-loss rules: How multinationals should prepare

New final regulations pose significant implications for possible income inclusions by U.S. corporations with foreign disregarded entities.

Related

Navigating safe-harbor rules for solar and wind Sec. 48E facilities

Businesses urge Treasury to destroy BOI data and finalize exemption

IRS generally eliminates 5% safe harbor for determining beginning of construction for wind and solar projects

Treasury and the IRS on Jan. 10, 2025, released final regulations regarding dual-consolidated-loss (DCL) and disregarded-payment-loss (DPL) rules (T.D. 10026). These finalize proposed regulations issued on Aug. 7, 2024 (REG-105128-23). While released concurrently, the DPL rules operate separately from the DCL rules and apply to different scenarios. This article focuses on the DPL rules.

Given the regulations’ broad scope, multinational organizations should take steps to proactively assess their potential impact.

After providing some background information, this article discusses the DPL rules and illustrates them with several examples.

DPL rules

Broadly, the DPL rules are aimed at preventing situations whereby a foreign disregarded entity (foreign DRE) (or a foreign branch or partnership, in certain instances) owned by a U.S. corporate taxpayer makes certain disregarded payments to its U.S. owner (or to another foreign DRE resident in a third jurisdiction) and those payments reduce the foreign taxable income of the foreign DRE.

When the DPL rules are triggered, the U.S. taxpayer can be required to recognize taxable income potentially up to the entire amount of the disregarded payment. Thus, the DPL rules can result in an otherwise disregarded payment becoming regarded and being included when computing the U.S. corporate taxpayer’s taxable income.

Disregarded payment entities and DPE owners

The DPL rules apply to domestic corporations (including dual-resident corporations), referred to as disregarded-payment-entity owners, or DPE owners, that directly or indirectly own an interest in a disregarded payment entity (DPE).

For this purpose, a DPE includes a foreign DRE, a foreign branch, and an entity treated as a foreign partnership for U.S. tax purposes, provided in each case that the DPE owner directly or indirectly owns interests in it. A DPE is also defined to include the DPE owner itself if it is a dual resident. In the context of DREs, the DPL rules notably apply without regard to whether classification as a DRE is obtained by election or pursuant to the default-entity-classification rules.

Disregarded payment income and loss

To compute whether a DPE has disregarded payment income (DPI) or a DPL, it is first required to determine its “items of income” and “items of deduction.”

An item is considered an item of income if all of the following three criteria are met (Regs. Sec. 1.1503(d)-1(d)(5)(ii)(D)):

- Under the relevant foreign tax law, the DPE includes the item in income;

- The payment, accrual, or other transaction giving rise to the item is disregarded for U.S. tax purposes as a transaction between a DRE and its tax owner, or between DREs with the same tax owner; and

- If the payment, accrual, or other transaction were regarded for U.S. tax purposes, it would be interest, a structured payment, or a royalty (within the meaning of Regs. Sec. 1.267A-5(a)(12), (b)(5)(ii), or (a)(16), respectively).

Similarly, an item is considered an item of deduction if all of the following criteria are met (Regs. Sec. 1.1503(d)-1(d)(5)(ii)(C)):

- Under the relevant foreign tax law, the DPE is allowed a deduction;

- The payment, accrual, or other transaction giving rise to the item is disregarded for U.S. tax purposes as a transaction between a DRE and its tax owner or between DREs with the same tax owner; and

- If the payment, accrual, or other transaction were regarded for U.S. tax purposes, it would be interest, a structured payment, or a royalty.

Items of deduction can also include certain deductions with respect to equity (including deemed equity) allowed to the entity in a tax year (e.g., a notional interest deduction) or a deduction for an imputed interest payment with respect to a debt instrument (such as an interest-free loan).

A DPE has DPI if the sum of the items of income exceeds the sum of the items of deduction. Conversely, a DPE has a DPL if the sum of its items of deduction exceeds the sum of its items of income (subject to a de minimis rule discussed below).

In computing the above, a DPE owner takes into account the DPI or DPL of each DPE for each foreign tax year that ends with or within its U.S. tax year.

DPL inclusion amount

Once it has been established whether the DPE has DPI or a DPL, the impact to the DPE owner can be determined.

To the extent that the DPE has a DPL and a “triggering event” occurs (discussed below), the DPE owner is required to include an amount equal to the DPL inclusion in its gross income. Thus, as noted earlier, the DPL rules can result in an otherwise disregarded payment becoming regarded and included in the DPE owner’s gross income.

A DPL inclusion amount, in this context, is an amount equal to the DPL. The DPL inclusion amount is reduced (but not below zero) to the extent of the balance in the DPL cumulative register of the DPE (explained further below), provided certain certification requirements are met.

When a DPE owner has a DPL inclusion, the DPE owner is also required to establish a “suspended deduction” in an amount equal to the DPL inclusion amount. The suspended deduction is treated as if it were a “reconstituted net operating loss” that becomes deductible to the extent of DPI derived in the tax year in which the suspended deduction is established, or in subsequent tax years (as measured by the DPE’s DPL cumulative register), provided, again, that certain certification requirements are met.

The balance in the DPE’s DPL cumulative register is computed by (Regs. Sec. 1.1503(d)-1(d)(2)(iii)):

- Adding the entity’s DPI amount for the foreign tax year; and

- After determining the DPL inclusion amount for the year, subtracting the amount of the cumulative register balance that is used up either in computing the DPL inclusion or the suspended deduction amount.

An illustrative example of the application of these rules is set out below.

Triggering event

As noted above, a DPL inclusion occurs when the DPE has a DPL and when a triggering event occurs. A triggering event includes either of the following two situations (Regs. Sec. 1.1503(d)-1(d)(3)):

- There is a “foreign use” of the DPL. For this purpose, foreign use is determined largely by following the principles set out in existing DCL rules. Thus, for example, a foreign use of a DPL occurs if, under foreign tax law, any portion of the foreign-law deduction taken into account in computing the DPL is made available (including by reason of a foreign consolidation or similar regime, or a sale, merger, or similar transaction) to offset an item of income that, for U.S. tax purposes, is an item of a foreign corporation, but only when such foreign corporation is related to the owner of the DPE. A deemed ordering rule also applies when the losses or deductions are made available under the laws of a foreign country that would only partly constitute a foreign use.

- There is a failure by the DPE owner to comply with certain certification requirements. Broadly, these require the DPE owner to include certification statements with its U.S. tax returns, including certifications attached to the tax return for the year in which a DPE has a DPL, as well as certifications attached to tax returns for tax years during the certification period (defined as including the foreign tax year in which the DPL occurred; any prior foreign tax years; and, generally, the 60-month period following the foreign tax year in which the DPL is incurred).

Additional rules

Certain key items to note when assessing the potential impact of the DPL rules include:

- The DPL rules apply to tax years of DPE owners beginning on or after Jan. 1, 2026.

- Royalties paid or accrued pursuant to a license agreement entered into before Aug. 6, 2024, are not taken into account when determining the amount of DPI or DPL. Notably, however, when the terms of such an agreement are significantly modified, this carveout ceases to apply (see Regs. Sec. 1.1503(d)-1(d)(5)(ii)(F)).

- A de minimis rule may apply pursuant to which a DPE will not be considered to have a DPL when both of the following two conditions are met (Regs. Sec. 1.1503(d)-1(d)(6)(vii)):

- The items that compose the DPL are incurred in connection with the conduct of an active trade or business carried on by the DPE. For purposes of the active trade or business determination, the rules set out at Regs. Sec. 1.367(a)-2(d)(5) broadly apply.

- The amount of the DPL is less than the lesser of $3 million or 10% of the aggregate amount of all the items of the DPE for the foreign tax year for which, under the relevant foreign tax law, the DPE is allowed a deduction. For this purpose, the items of the DPE may include items that are regarded for both U.S. and foreign tax purposes, or foreign-law items that, if regarded for U.S. tax purposes, would not be treated as interest, a structured payment, or a royalty.

DPL inclusion examples

As an example of the computation of the DPL inclusion as well as the DPL cumulative register and suspended deduction, consider the following:

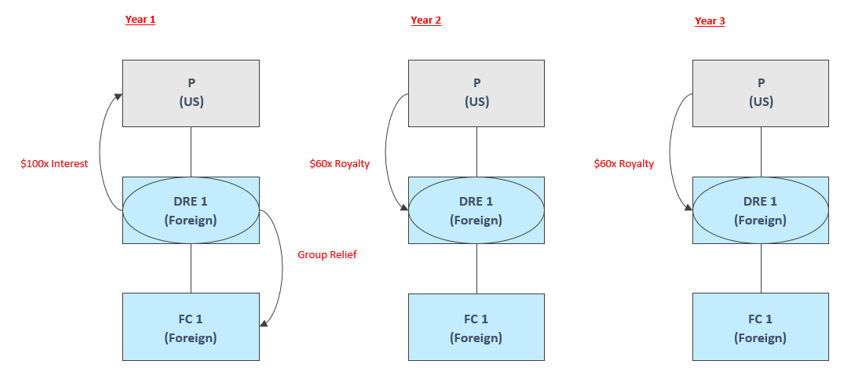

Example: P, a U.S. corporation, owns DRE 1, and DRE 1 wholly owns FC 1, a foreign corporation. In year 1, DRE 1 pays P $100x of interest. For U.S. tax purposes, this payment is disregarded. However, under DRE 1′s country tax law, the $100x interest is allowed as a deduction. Further, through a group relief regime in DRE 1′s country, the $100x deduction is made available to offset income of FC 1. In each of years 2 and 3, P makes a $60x royalty payment to DRE 1, which is disregarded for U.S. tax purposes but regarded under the foreign tax law (see the diagram “DPL Inclusion”).

DPL inclusion

In this scenario, P is considered the DPE owner and DRE 1 a DPE. In year 1, DRE 1 has a DPL of $100x for the interest paid to P. Because the deduction by DRE 1 is made available to offset the income of FC 1 pursuant to the group relief regime, this constitutes a foreign use, and thus a triggering event occurs. As a result, in year 1, P must include $100x in gross income. That amount is treated as ordinary interest income, with the source and character determined as if P had received the interest payment from a wholly owned foreign corporation. P also establishes a suspended deduction of $100x related to this year 1 DPL inclusion amount.

In year 2, DRE 1 has DPI of $60x. P is allowed a $60x deduction with respect to the suspended deduction, resulting in $40x remaining suspended. In year 3, DRE 1 has DPI of $60x. P is permitted a $40x deduction, the balance of the suspended deduction (see the table “DPL Cumulative Register”).

DPL cumulative register

The facts in the above example are relatively common. Examples of additional intercompany transaction scenarios routinely seen in practice that could be subject to the DPL rules include the following:

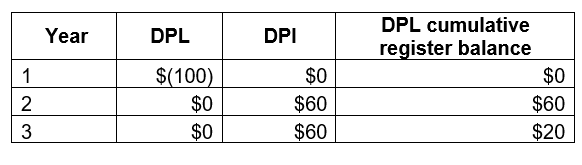

- Payment of royalties by a foreign DRE to its DPE owner for the use of intellectual property to generate active income from third-party customers. In such a scenario, the otherwise disregarded royalty paid from the foreign DRE to the DPE owner could give rise to a DPL inclusion (see the diagram “Payment of IP Royalties”).

Payment of IP royalties

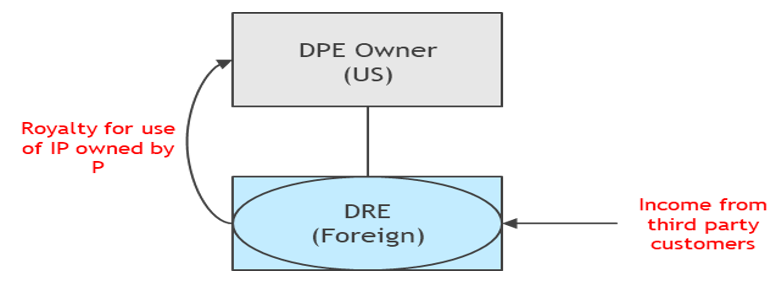

- Payments of interest by a foreign DRE to its DPE owner, when the DPE owner holds a third-party loan and has lent the proceeds from the third-party loan to the foreign DRE. In such a scenario, the otherwise disregarded interest paid from the foreign DRE to the DPE owner could give rise to a DPL inclusion and be included in computing taxable income of the DPE owner (see the diagram “Interest Payment”).

Interest payment

Proactive steps

Given the potentially significant — and adverse — consequences of the DPL rules, multinational organizations should take steps to evaluate their potential impact. Recommended steps include the following:

- Step 1: Identify whether the multinational group includes a DPE owner and whether there are any DPEs.

- Step 2: Evaluate whether the DPE has DPI or a DPL through computing the items of income and items of deduction. Consideration of the application of non-U.S. anti-hybrid rules is required here (see Secs. 245A(e), 267A, and 1503(d)).

- Step 3: Assess whether the de minimis exception could apply.

- Step 4: Assess whether there has been a triggering event.

- Step 5: Determine the DPL inclusion amount. This will include a computation of the DPL cumulative register and suspended deduction.

- Step 6: Assess whether restructuring steps could be undertaken to mitigate the potential DPL inclusion amount.

Significant potential consequences

Because the DPL rules can result in an otherwise disregarded payment becoming regarded and included within gross income, their potential consequences are significant. The rules can apply to a number of common fact patterns, including taxpayers with significant flows of interest and royalties between and among foreign DREs. U.S. corporate taxpayers should take steps to evaluate the potential implications they face under the DPL regulations.

— Sebastian Biddlecombe, ACA, CTA, E.A.; Shaiq Ibrahim, CPA, E.A.; and Anke Krueger, LL.M., are all with BDO USA in New York. To comment on this article or to suggest an idea for another article, contact Paul Bonner at Paul.Bonner@aicpa-cima.com.