- newsletter

- FOREIGN INCOME & TAXPAYERS

Elections under the new Sec. 987 final regs.

Businesses with foreign branches receive new guidance on adjusting for currency exchange gain or loss.

Related

Navigating safe-harbor rules for solar and wind Sec. 48E facilities

Businesses urge Treasury to destroy BOI data and finalize exemption

IRS generally eliminates 5% safe harbor for determining beginning of construction for wind and solar projects

For taxpayers that have a qualified business unit (QBU) with a functional currency other than the dollar, Sec. 987 provides rules on how to adjust for changes in exchange rates.

On Dec. 10, 2024, Treasury and the IRS released final regulations under Sec. 987 (T.D. 10016, as corrected by 90 Fed. Reg. 5606 (Jan. 17, 2025)). These regulations provide guidance on the determination of taxable income or loss and foreign currency gain or loss of taxpayers with foreign branches and certain foreign disregarded entities.

The final regulations represent the latest step in a more-than-30-year effort by the government to provide a comprehensive set of rules that balance ease of administration and simplification with the objective of creating a mechanism for an appropriate recognition of currency exchange gain or loss that is not susceptible to abuses. Whether these objectives are achieved remains to be seen. However, taxpayers will welcome the enhanced flexibility and optionality the new rules provide.

2024 final regulations

The 2024 final regulations retain the basic approach and structure of the foreign-exchange-exposure-pool (FEEP) method contained in the 2016 final regulations (also known as a “balance sheet approach”) and provide for simplifying elections, including the annual-recognition election (ARE) and the current-rate election (CRE). Under Regs. Sec. 1.987-15, the 2024 final regulations generally apply to tax years beginning after Dec. 31, 2024, and taxpayers can make one, both, or neither of these elections.

With such a multitude of options available and the adoption timelines looming, it is important to understand the mechanics and model out the tax impact (or benefits) of the elections (and combinations thereof) versus cost efficiencies achieved from simplification. The decision as to the preferred approach will largely depend on the nature of a QBU’s business operations, its balance sheet profile, and the currency environment. To help taxpayers understand the key conceptual differences of the various election outcomes, this article provides a brief overview of the default FEEP method and the elections, followed by an illustrative example.

The default FEEP method (no elections made)

Under the FEEP method, the owner of a Sec. 987 QBU determines all items of income, gain, deduction, and loss attributable to the QBU in the QBU’s functional currency and then translates those items into the owner’s functional currency (adjusted to reflect U.S. tax principles). Generally, items of income, gain, deduction, or loss of a Sec. 987 QBU are translated into the functional currency of the QBU owner at the average exchange rate for the year. However, the basis of “historic assets” and deductions for depreciation, depletion, and amortization of such assets are translated at the historic exchange rate.

In addition, the owner of a Sec. 987 QBU must determine the pool of unrecognized Sec. 987 gain or loss based on the annual increase or decrease to the QBU’s balance sheet that is attributable to exchange rate fluctuations. The Sec. 987 gain or loss for each year equals the increase or decrease in the basis of the QBU’s assets (net of liabilities), measured in the owner’s functional currency and adjusted for transfers between the QBU and its owner and for the QBU’s taxable income or loss, as well as certain nondeductible expenses and tax-exempt income items. The basis of historic items is translated at historic exchange rates, while “marked items” are translated at the applicable spot rate. For these purposes, a marked item includes an asset or liability that would generate gain or loss under Sec. 988 if it were held or entered into directly by the owner, as well as Sec. 988 transactions of the Sec. 987 QBU (Regs. Sec. 1.987-1(d)). A historic item is an asset or liability that is not a marked item (i.e., fixed assets).

Under the FEEP method, when a Sec. 987 QBU makes a remittance, a portion of the pooled and deferred Sec. 987 gain or loss is recognized. The recognized amount is determined by reference to the product of the owner’s portion of the Sec. 987 QBU net unrecognized exchange gain or loss, multiplied by the owner’s remittance proportion. The owner’s remittance proportion is equal to the quotient of the amount of remittance divided by the aggregate basis of the Sec. 987 QBU’s gross assets (as reflected on the QBU’s year-end balance sheet), without reduction for remittance (Regs. Sec. 1.987-5(b)).

Thus, under the FEEP method, Sec. 987 gain or loss reflects currency fluctuations with respect to marked items and is not imputed to historic items that are not subject to Sec. 988.

Current-rate election

A taxpayer may elect to treat all assets and liabilities attributable to a Sec. 987 QBU as marked items by making a CRE under Regs. Sec. 1.987-1(d)(2). When translating the balance sheet items with a CRE, all items will be translated into the owner’s functional currency at the spot rate applicable on the last day of the tax year. When translating the profit-and-loss statement (P&L), all items will be translated into the owner’s functional currency at the yearly average exchange rate for the tax year.

A CRE is anticipated to produce an amount of Sec. 987 gain or loss that may be akin to the amount determined under the 1991 proposed regulations. Since the historical exchange rates are not utilized under CRE, all (marked and historic) assets and liabilities of a Sec. 987 QBU would generate Sec. 987 gain or loss, in conformity with the approach used for financial reporting purposes and the 1991 proposed regulations (56 Fed. Reg. 48457). Gains are recognized, but losses may be suspended (i.e., recognized to the extent of Sec. 987 gain with the same source and character, under a “loss-to-the-extent-of-gain” rule per Regs. Sec. 1.987-11(e)). Generally, the election may increase the pool of net unrecognized Sec. 987 gain or loss, and amounts in the pool may substantially exceed the economic gain or loss due to currency fluctuations (hence, the requirement to limit losses).

Annual-recognition election

Under Regs. Sec. 1.987-5(b)(2), an ARE allows the QBU owner to recognize its net unrecognized Sec. 987 gain or loss with respect to its Sec. 987 QBU on an annual basis (without regard to whether a remittance occurs). As a result, if an ARE is in effect, the remittance proportion is equal to 1. When translating the balance sheet items with an ARE, historic items will be translated at the historic exchange rate, while marked items will be translated at the year-end spot rate. When translating the P&L, all items will be translated into the owner’s functional currency at the yearly average exchange rate for the tax year. Current gains and losses are recognized, but loss suspension rules may apply under certain circumstances. The ARE accelerates the recognition of Sec. 987 gain or loss for marked items.

Election comparison: An example

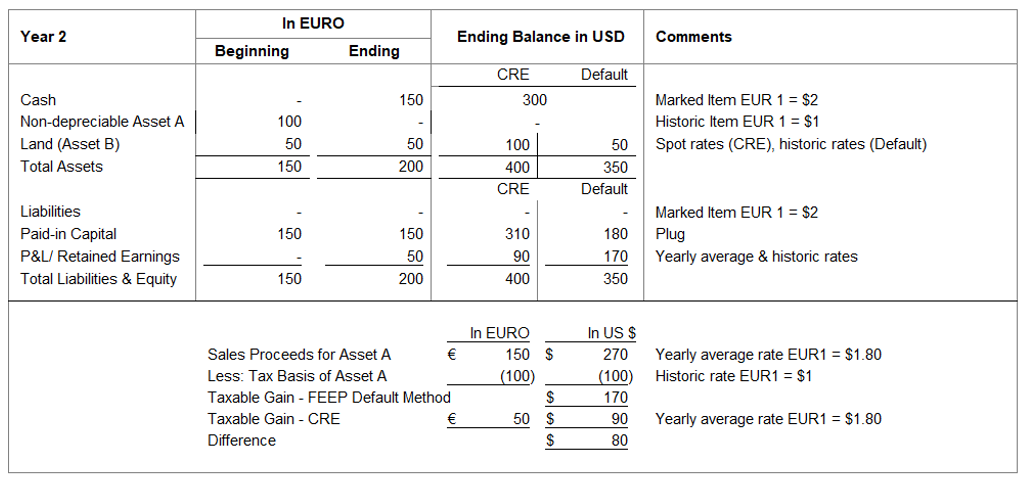

In a simplified example in the table “The FEEP Method,” a U.S. C corporation is a calendar-year taxpayer with the U.S. dollar as its functional currency. The U.S. C corporation owns a Sec. 987 QBU with the euro as its functional currency. At the end of year 1, the Sec. 987 QBU owns a nondepreciable historic asset (Asset A) with a basis of €100 and a parcel of land (Asset B) with a basis of €50. In year 2, the Sec. 987 QBU sells Asset A for €150 and holds the €150 on its balance sheet, together with Asset B in the amount of €50 from year 1. There is no remittance in year 2.

The historic rate for Asset A and Asset B is €1 = $1. The yearly average exchange rate in year 2 is €1 = $1.80. The spot rate on Dec. 31, year 2, is €1 = $2.

The FEEP method

Let’s review the calculation approaches for taxable income and Sec. 987 gain or loss in the alternative election scenarios. The taxable gain on the sale of Asset A is higher under the FEEP method ($170 gain) compared to the result if a CRE is made ($90 gain) because, under the FEEP method, the cost basis of Asset A is translated using the historic rate €1 = $1. Conversely, if a CRE is made, the P&L items (i.e., the net gain of €50) are translated at the annual average exchange rate of €1 = $1.80, resulting in taxable gain from the disposition of Asset A in the amount of $90.

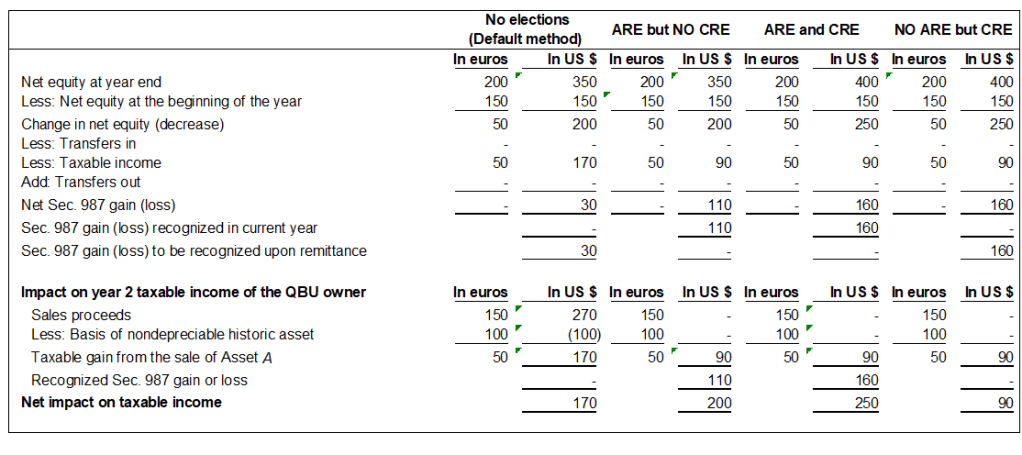

The table “Comparing the Elections” summarizes the differences in determining Sec. 987 gain or loss and the net impact on the taxable income of the QBU owner if (1) no elections are made; (2) only the ARE is made; (3) both the ARE and the CRE are made; or (4) only the CRE is made.

Comparing the elections

As illustrated in this second table, the total amount of taxable income of a Sec. 987 QBU owner ($200) is the same under the default method compared to when an ARE (but not a CRE) is made. However, if an ARE is made, the split between the Sec. 987 component and other operating income ($30 and $170 under the default method, versus $110 and $90 under ARE) and the timing of currency exchange gain or loss recognition changes.

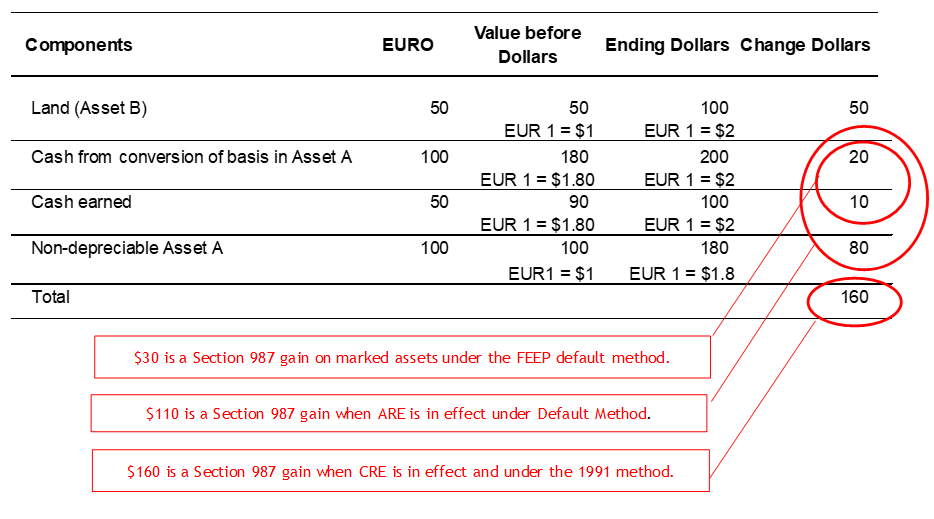

More specifically, the amount of net unrecognized Sec. 987 gain or loss under the default method is $30 (which, as illustrated in the table “A Reconciliation of Sec. 987 Gain or Loss Components,” represents the currency fluctuation on the marked asset, the cash from the sale of Asset A). Such gain would be recognized upon remittance from the QBU to the owner. In contrast, if an ARE is made, the currency gain associated with the marked asset is recognized immediately rather than upon remittance. Under the ARE, there is also $80 more in Sec. 987 gain due to the use of the average rate rather than the historic rate when translating the basis of the sold Asset A for P&L purposes. Under the default method, $80 would be part of the operating income (here, Sec. 1231 gain) rather than Sec. 987 gain. This change in the characterization of income can have a significant impact, particularly from the standpoint of the ultimate applicable tax rates and foreign tax credit position.

If a CRE is made, the pool of net unrecognized Sec. 987 gain or loss increases relative to the pool that would be determined without the CRE ($160 versus $30). This result is similar to the result under the 1991 proposed regulations, which calculate Sec. 987 gain or loss on all assets (rather than only with respect to marked assets). In the absence of an ARE, the CRE would result in $160 of Sec. 987 gain being recognized upon remittance. If both the ARE and CRE are made, the recognition of Sec. 987 gain or loss is accelerated.

A reconciliation of Sec. 987 gain or loss components

Observations

While this example highlights a Sec. 987 gain scenario, it is important to keep in mind that if a CRE is made, recognition of Sec. 987 losses may be suspended. However, under Regs. Sec. 1.987-11(c)(2), if a CRE is in effect, the Sec. 987 loss is not suspended unless the amount of the Sec. 987 loss subject to suspension in the tax year exceeds the lesser of $3 million or 2% of the controlled group’s gross income. This exception could provide a favorable outcome by allowing taxpayers with small QBUs to potentially recognize Sec. 987 losses annually with the CRE in place.

In summary, making a CRE may expose a QBU to currency fluctuations, compared to the default FEEP method or the ARE, particularly if the QBU owns predominantly historic assets. If a QBU predominantly owns marked assets, there may not necessarily be a significant fluctuation in the Sec. 987 computation under the default FEEP method and the CRE. The required tracking of Sec. 987 pools and historic assets may be less burdensome under the ARE than under the default FEEP method. If a taxpayer makes an ARE or CRE, both elections are generally in effect for five tax years; thus, a modeling exercise is recommended prior to any election decision.

Applicability

Under Regs. Sec. 1.987-15, the 2024 final regulations generally apply to tax years beginning after Dec. 31, 2024, as previously noted. Taxpayers have a valuable opportunity to explore whether making the current-rate election and/or the annual-recognition election could optimize a QBU owner’s total tax exposure under Sec. 987.

— Natallia Shapel, CPA, MST, MBA, is a partner, international tax services, and Alison Ray, CPA, MAcc., is an international tax senior manager, both at BDO USA PC in New York City. To comment on this article or to suggest an idea for another article, contact Paul Bonner at Paul.Bonner@aicpa-cima.com.