- newsletter

- TAX INSIDER

Using transfer pricing to blunt the effects of tariffs

Understanding the interrelationship of transfer pricing and tariffs is key to mitigating the effect of those levies on earnings.

Related

Deductibility of transaction costs incurred by an indirectly acquired entity

IRS issues guidance on treaty application to reverse foreign hybrids

Practical tax issues related to qualified reopenings

In our global economy, even a tariff of less than 10% can have a significant impact on the supply chains that cross national borders. Blanket tariffs of 10% and “reciprocal” tariffs of well over 25% can significantly impact the financial conditions of corporations and drastically alter global commerce. While the implementation of higher U.S. tariffs on over 60 countries has been delayed, the financial and tax implications have been top-of-mind for executives and are a key source of concern on earnings calls.

CPAs are responsible for assisting businesses with the various financial and tax implications of tariffs, and the recent tariffs announced on steel and aluminum products and countries such as Canada, Mexico, and China have become a crucial consideration for U.S. businesses.

The relationship between tariffs and transfer pricing

Tariffs and transfer pricing are closely interrelated. For tax purposes, the transfer price from a seller to a related buyer determines the allocation of profit between those related entities; the reasonableness of the transfer price is frequently tested by comparing the U.S. distributor’s income against similarly situated distributors. That tax-developed transfer price often becomes the customs importation value to which the tariff percentage is applied. That tariff amount becomes a current expense or cost of goods sold (COGS) that reduces the reported income of the U.S. distributor, possibly requiring a reduced transfer price to satisfy transfer pricing rules. That post-importation adjustment may also require a changed importation value.

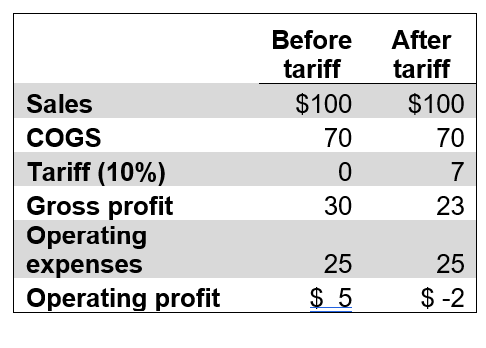

Illustration of the impact of tariffs: It may be helpful to consider a simple example to illustrate the impact of a new tariff on intercompany transactions. As seen in the table “Impact of Tariff With No Passthrough to Customer,” all else being equal, adding a 10% tariff borne by a distributor and not pushed through to its customers can push the distributor from a profit position to a loss.

Impact of tariff with no passthrough to customer

Post-importation adjustments may require administrative procedures to achieve the duty and tax refunds that follow from the reduced transfer price/import value. If the taxpayer sets its customs importation value under the transaction-value method, a downward transfer price adjustment for tax purposes will also require a downward customs valuation adjustment. Importers have various options to report transfer pricing adjustments to U.S. Customs and Border Protection (CBP), the Reconciliation Program being the most efficient. However, importers may also make a voluntary “prior disclosure” to CBP to report a post-importation price adjustment and request a refund of duties due to the lower valuation.

Under U.S. transfer pricing rules, an upward transfer pricing adjustment to the U.S. related-party income produces a downward adjustment to the income of the other transacting related party. The taxpayer can request the IRS to endeavor under the tax treaty to achieve a downward adjustment to the income of the related party; however, the other tax authority may decline to reduce the double taxation caused by the tariffs imposed by the U.S. government.

Many multinational corporations are now considering taking actions to reduce or eliminate the impact of the proposed tariffs. These actions include:

- Price increases to pass the impact to customers: An importer can pass the economic impact of a tariff to its customers through a price increase. However, competing products not subject to the same level of tariffs may make it difficult for importers to do so.

- Increased inventory: Some importers have accelerated purchases of products for delivery before the effective date of any new tariffs; this is only a temporary solution.

- Exclusions and reevaluations of product classification: Some importers have previously sought tariff exclusions through the U.S. Trade Representative or by reevaluating classifying the imported goods to a classification not impacted by tariffs.

- Supply chain changes or discontinuance: Companies that have more flexibility may attempt to change suppliers or move supply chains to avoid the impact of tariffs. Other companies may stop selling goods made unprofitable by the tariffs.

- Allocating tariff risk between related parties: Exposure to tariffs can be understood and interpreted, similar to other risk factors such as currency fluctuation. Transfer pricing rules allow related parties to allocate the risk of tariffs between the parties. Allocation of tariff risk does not eliminate the tariff impact, but it may facilitate transfer pricing compliance and reduce the overall tariff amount.

Other tax considerations

In addition to transfer pricing, tariffs can also impact inventory costs with various financial and tax accounting implications. The treatment between the two sets of books depends on what is included as part of inventory and what is not. It is recommended that reviewing a business’s current book and tax cost allocations can help mitigate large, unexpected book-to-tax differences, which can lead to underpayment penalties on tax returns.

Companies and practitioners should also review their current tax inventory cost flow method, since tariffs are generally treated as part of COGS, which impacts taxable income. For example, adopting or modifying the LIFO cost flow method can increase the COGS, which can, in turn, reduce taxable income. However, there is a compliance cost related to LIFO that taxpayers should take into consideration before adopting this inventory method.

As it appears that tariffs are likely to be considered over this year and possibly over the next several years, tax professionals should be aware of the transfer pricing and other tax and financial implications of them.

— Steven Wrappe, J.D., LL.M., is managing director with Grant Thornton Advisors LLC, and Reema Patel, CPA, is senior manager–Tax Policy & Advocacy with the AICPA, both in Washington, D.C. To comment on this article or to suggest an idea for another article, contact Paul Bonner at Paul.Bonner@aicpa-cima.com.